MAF707 Investments & Portfolio Management

- Subject Code :

MAF707

Assignment Task

General Information

Generative Asset Management (GAM), an Australian asset manager committed to sustainability, has hired you as an Equity Analyst. Your task is to construct efficient portfolios for clients seeking exposure to Australian stocks listed on page 3 of this document, with a focus on sustainability principles.

Recall Portfolio B is a dynamic portfolio you are managing as part of Assessment 1. The selected stocks for this portfolio (Portfolio B) are:

- AGL Energy Ltd

- BHP Group Ltd

- Commonwealth Bank of Australia

- CSL Ltd

- Fortescue Metals Group Ltd

- Coles Group Ltd

- Telstra Corp Ltd

- Transurban Group

- Woolworths Ltd

- Woodside Energy Group

The analysis period spans from 21 March 2019 to 21 March 2024, using daily returns in

continuously compounded form (Check the price data I have downloaded for you from

Refinitive Workspace) .

Hints: How to generate continuously compounded returns ....

Using daily returns in continuously compounded form involves transforming the raw

price data of assets into a format that represents the logarithmic rate of return. This

form of return is continuous and is particularly useful for portfolio modelling.You can

generate continuously compounded returns for individual assets from 21 March 2019 to

21 March 2024 using given prices and follow these steps:

Steps for Generating Daily Continuously Compounded Return

1. Use Price Data : Using the price data provided in the Assignment folder for each

asset from 21 March 2019 to 21 March 2024. Ensure that the data is organized in chronological order.

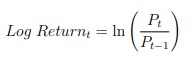

2. Calculate Logarithmic Returns: In a new column next to your price data, calculate

the logarithmic return for each day using the formula:

Replace Pt with the price of the asset at time t, and Pt?1 with the price of the asset

at the previous time period.

You will use =ln(current price/yesterdays price) in the formula window as I

explained in the class using the example optimisation Excel Spread Sheet (see Seminar

2.6 on CloudDeaakin for this file).

3. Apply the Formula: Apply the formula for each day in the dataset to calculate the logarithmic return.

4. Repeat for Each Asset: Repeat steps 2-3 for each asset in your dataset. Make sure to adjust cell references accordingly for each asset.

5. Format Data: Format your data as needed for clarity and readability. You may want to label columns and format dates appropriately.

6. Analysis: Once you have calculated the continuously compounded returns for all assets, now you are ready to gnerate the excess return for each asset on a daily basisi by generating the deviation of each daily return from the average return for the entire sampleperiod . We assume that the average return you generate for the sample period is a good measure for proxiying the expected return of each asset for your portfolio analysis.

Question 1: Australian Investment Environemnt ( 7 Marks)

In light of our focus on the 10 selected assets within the Australian equity market, we

will provide an outlook that integrates ESG (Environmental, Social, and Governance)

factors alongside traditional economic indicators. This comprehensive approach allows

us to assess both financial performance and sustainability considerations.

To begin, you we will evaluate the sustainability performance of the selected stocks and

industries within the Australian equity market using the Bloomberg output and D&B

Hoovers industry analysis. In addition, by conducting your own research and reading

widely, you will conduct a thorough analysis of each assets as well as the broader industry it belongs to. Environmental Social Governace (ESG) metrics, including carbon

footprint, social responsibility initiatives, and governance practices (py may consult the

latest annual report of the company by going to its web page). By examining these factors, we aim to gauge the long-term viability and resilience of these investments in the

face of evolving market dynamics and societal expectations.

Furthermore, you analysis will extend beyond individual stocks to encompass broader

economic trends and implications. We will also pay attention the the the sustainability

performance of the Australian economy as a whole, considering factors such as environmental regulations, social welfare policies, and corporate governance standards aimed at

enabling the climate rik-proofing of the Australian economy, with the capacity

to manage key emerging risks. This macro-level perspective will provide valuable insights

into the overall sustainability landscape of the macro-market envioronment within which

our selected ten assets operate. Ultimately, our goal is to deliver a holistic assessment that

integrates financial performance with ESG considerations, enabling informed investment

decisions that align with both our clients financial objectives and their commitment to

responsible investing.

[500 words = 7 marks]

Question 2: Portfolio Management (16 Marks)

Part I: Preliminary Analysis

- Generate daily continuously compounded returns for 10 assets.

- Compute essential statistical measures.

- Analyze correlation.

- Generate the equally weighted portfolio consisting of these ten assets.

- Evaluate portfolio performance measures including the traditional measures for the

equally weighted portfolio (e.g., Sharpe and Treynor ratios).

Part II Generate efficient frontiers using the Markowitz optimization method under two

scenarios regarding short-sale assumptions:

Scenario 1: Short Sales Not Permitted

- tilize continuously compounded return data from 21 March 2019 to 21 March

2024. - Construct efficient frontiers for target returns ranging from 2% to 25%, with

1% increments. - Report instances of infeasibility where convergence is not achieved.

- Tabulate annualized target expected returns and standard deviations for feasible portfolios along with traditional portfolio evaluation measures such as

Sharpe and Treynor ratios (Table 1). - Generate an efficient frontier graph (Graph 1) with Expected Returns on the

y-axis and standard deviations on the x-axis, using optimized portfolios from

Table 1.

2. Scenario 2: Short Sales Permitted

- Repeat the above process with short-sales allowed by deleting the constraint

that forced all weights to be positive in Scebario 1. - Tabulate annualized target returns and standard deviations for feasible portfolios along with traditional portfolio evaluation measures such as Sharpe and

Treynor ratios (Table 2). - Generate an efficient frontier graph (Graph 2) with Expected Returns on the

y-axis and standard deviations on the x-axis, using optimized portfolios from

Table 2.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank