Private Equity Investment Analysis: Operational Scenarios, Financing Structures, and Profitability Scenarios

1. Operational Scenarios

Your profitability analysis should be based on three operational scenarios:

1. Baseline (without operational improvements). This scenario will assume that the financial

sponsor will not take any major managerial decision to improve the profitability/growth of

the company.

2. With OperationalImprovements. This scenario will assume a range of reasonable

improvements to the management of the company.

3. Major Stress. This scenario is designed to test the resilience of your investment to a

significant negative systemic shock (High interest rates and slow growth in construction).

Specifically, you should assume that the current level of interest rates (4.35% in March

2024) will persists until the end of 2025. Interest Rates in this scenario are only expected

drop 0.50% in 2026 and an additional 0.50% in 2027. This rates scenario will have a

negative impact on construction. You are to consider the impact of the high interest rates

and slow construction growth on the operation and growth of the company. Please show

your assumptions in the major stress scenario

Your Operational Improvements and Major Stress scenarios should affect both sales growth and

the cost structure of the company.

In the worksheet Questions, you should explain your philosophy for the various scenarios.

2. Financing Costs

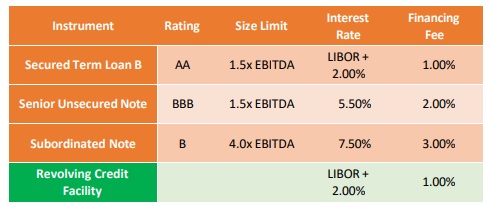

After consulting with your capital markets division, you estimate that the PE fund could finance

the deal with a combination of the following sources of funds:

The maximum size for all forms of external financing is measured as a multiple of the LTM

EBITDA of the target company. For sake of simplicity, you can assume that all sources of debt

have maturity of 10 years (outside your modelling horizon). The term loan has 5% annual

mandatory repayment.

The Revolving credit facility is not to be used for financing the deal. It will be activated only in

case of bankruptcy

Loan covenants restrict the PE fund to maintain at least 10% equity in the company.

The company should also close every year with at least $75m in cash. This is a minimum

amount considered necessary to safely run the company.

3. Financing Structures

You should propose two different deal structures to your client:

1. One where the amount of equity and debt used to finance the deal are chosen to

maximize the profitability for the Private Equity fund (measured with a 5 years IRR)

under the scenario with operational improvements.

2. One where the amount of equity and debt used to finance the deal are chosen to ensure

the survivability of the company under a major stress scenario (see paragraph 5 below

for a description of the scenarios). [If your company does not default under the

structure 1, your structure number 2 should be the same as the previous one]

For sake of this analysis bankruptcyis defined as a situation where the model needs to

borrow from the revolving credit facility.

4. Alternative Value Creation

Your boss is eager to show your PE client a variety of value creation strategies. Specifically, he

wants you to test:

- The profitability of strategy where, under your operational improvements scenario

(and financing structure 1) you extract as much extraordinary dividends as possible in

the first 5 years of the deal. You should still respect the minimum cash requirements. - The profitability of a multiple expansion strategy where, under your operational improvements scenario (and financing structure 1) you assume the possibility of increasing the exit multiple above the level of the entry multiple

Both the Exit Multiple for the Multiple Expansion scenario (Profitability Scenario 5) and the

extraordinary dividends (Profitability Scenario 6) inputs should be recorded in the

Profitability worksheet.

5. Profitability

The 6 Profitability Scenarios measured with the IRR assuming exit in year 5 will be recorded in

the Profitability Scenarios table in the TS worksheet. Each scenario reflects the following

circumstances:

- Baseline Scenario and Financing Structure 1

- Operational Improvements scenario and Financing Structure 1

- Operational Improvements scenario and Financing Structure 2

- Major Stress scenario and Financing Structure 2

- Operational Improvements scenario and Financing Structure 1 plus multiple expansion.

- OperationalImprovements scenario and Financing Structure 1 plus dividends.

6. Data and Timeline

Financial data can be found in FactSet. Instruction on how to access the data can be found in the videos of the guided valuation exercises. The knowledge necessary to complete the assignment will be covered in the subject, with the theoretical aspects analysed in class and the technical components (including how to use the excel models and how to access information in FactSet) explored in the valuation exercises. Specifically:

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank