AA3F8 Audit & Assurance Assignment

- Subject Code :

AA3F8

- Country :

Australia

Introduction/Abstract.

Bloomsbury Publishing Limited is a global British publisher of fiction and nonfiction. It was founded on 26 September 1986 by Nigel Newton, 36 years ago. Sir Richard Lambert (non-executive chairman) and Nigel Newton (chief executive) are key figures.

The company is a component of the FTSE SmallCap Index. The headquarters of Bloomsbury are located in Bloomsbury, a district of the London Borough of Camden. It has a US publishing office in New York City, an India publishing office in New Delhi, an Australia sales office in Sydney's central business district, and additional UK publishing offices, including in Oxford. The majority of the company's growth over the past two decades can be attributed to J. K. Rowling's Harry Potter series and, since 2008, to the expansion of its academic and professional publishing division.

In both 2013 and 2014, the Bloomsbury Academic & Professional division received the Bookseller Industry Award for Academic, Educational & Professional Publisher of the Year.

The paper is research around the audit parameters ISA 315 (R) Identifying and Assessing the Risks of Material Misstatement which deals defining the operating activities , materiality along with the risk and responses along with the corporate governance (Alstad, and Helle, 2023).

Main body with appropriate headings.

1) Operating Activities

The publishing house main operating activity was Publishing works of excellence and originality in multiple formats. Along with this it ensured to deal in the following activities as well the following below :-

- Intensive concentration on digital academic and professional publishing

- Acquisition of rights from authors, illustrators, and other proprietors of intellectual property

- Innovatively leveraging existing intellectual property rights through publication

- Managing licencing agreements for Bloomsbury's vast backlist

- Providing publishers and third-party organisations with publishing services

- Internationalor global presence

- Strategic acquisitions in important publishing houses

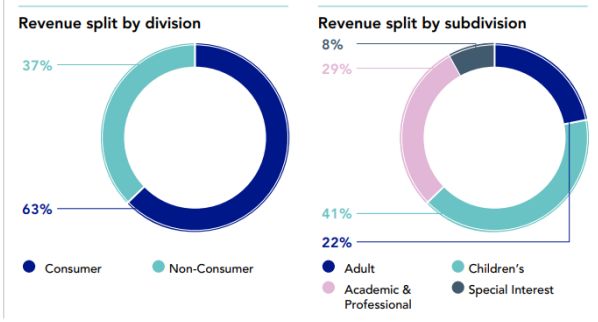

The above activities are further dividend into two division one being the consumer and the other being the Non Consumer and further sub division which spilt into four sector Adult , children , Academic and Professional and the other being the Special Interest.

(Bloomsbury,2023)

2) Materiality

Materiality in auditing refers to the significance of an item, transaction, or discrepancy that could potentially influence the decisions of financial statement users. It is a subjective concept that varies according to the nature, size, and context of the item, as well as the requirements of the users of the financial statement.

The concept of materiality influences the auditor's response to assessed risks in a direct manner. When an auditor identifies a risk during the auditing process, they determine the appropriate response by evaluating the risk's significance and how it has an significant impact on the financial statements, the auditor will likely implement more stringent audit procedures (Khalmurzayevna, Nuritdinovich, and Karimovich, 2023). This is done in order to collect sufficient appropriate audit evidence to reduce the risk of a material misstatement to an acceptable level. In essence, materiality guides the auditor's judgement when assessing risks and determining the audit procedures required to mitigate those risks.

In case of the Bloomsbury the following material misstatement is reported The determination of the overall materiality for the Group financial statements is established at 1,200,000, which is calculated as 5% of the profit before taxes. The materiality threshold for the financial statements of the parent company, when considered as a whole, was established at 985,000, which represents 1% of the total sales.

The determination of the scope of our testing for the audit of the financial statements is based on the application of a distinct threshold known as "performance materiality." Performance materiality is determined by considering the audit materiality and making adjustments based on assessments of the entity risk and the specific risk associated with each audit area, taking into account the internal control environment. In the context of the Group performance, the concept of materiality was established at 840,000, while for the parent business, it was determined to be 689,500. Performance materiality can be decreased to a lower degree in some situations, such as for related party transactions and Directors' remuneration, where deemed appropriate.

We reached a consensus with the Audit Committee to disclose any found errors above 60,000 in our report. Errors that fall below a certain level would also be communicated to the relevant party if, in our capacity as auditors, we believe that disclosure is necessary based on qualitative considerations.

The audit scope included the following audit procedure which encompassed 92% of the Group's income, 96% of the Group's profit before tax, and 96% of the Group's total assets.

The Group audit team conducted comprehensive processes on both components and the Parent Company. Specialists were employed under the guidance and oversight of the Group audit team. The majority of the audit work conducted was primarily focused on substantive procedures.

3) Risk & Response

The company has identified the key risk under 10 pointers

- Market

- Importance of digital publishing

- Acquisitions

- Title acquisition

- Information and technology systems

- Financial valuations

- Intellectual property

- Reliance on key counterparties and supply chain resilience

- Talent management

- Legal and compliance

- Reputation

- Cost Inflation

(Bloomsbury,2023)

Out of the ten key risks the increase in the change risk were seen in Reliance on keycounterparties; supply chain resilience was major as the occurrence of important counterparties' failure or the disruption of key counterparty relationships. The potential failure of important counterparties could lead to a substantial interruption in the business activities of the Group, resulting in decreased levels of trading and revenues. The Group's capacity to fulfil customer demand for print products is contingent upon the punctual provision of supplies from our printing partners. The availability of raw materials, such as paper pulp, and the ongoing disruption in the global supply chain may have an impact on this. The potential disruption of essential business partnerships may have a significant influence on prospective opportunities within the publishing industry. The Other Key audit matters included Acquisitions as the potential to yield a return on investment that is lower than initially anticipated. Inadequate purchases have the potential to lead to impairment charges, and the Board is regularly provided with reports on post-acquisition performance, which include an evaluation of any deviations from the anticipated return on investment. The other risk which is taken care is the commercial viability, however the company ensures that the Financial forecasts are typically generated in advance of an acquisition with the aim of projecting the potential commercial viability of the venture. There are established editorial rules and policies that serve as a framework for making acquisition selections.

4) Corporate Governance

The Corporate Governance was very well and systematically implemented in the Bloomsbury Publishing it established a board which plays a crucial role in establishing the Company's purpose and values, as well as overseeing the organisational culture. The Board is responsible for establishing suitable risk management and internal control systems, as well as determining the Company's risk appetite. Specific issues are designated for the approval of the Board, while others are assigned to Board Committees or the Company's Executive Committee, as deemed suitable. The incorporation of the corporate governance in the company led to the possible positive outcomes for the following company The annual and interim results and associated announcements were done post board approval. It keeps a strong check on the viability statement and the going concern assessment. Frequent updates regarding the actions implemented by the organisation to address the potential risks associated with Cyber Security, as well as to establish sufficient controls for information governance were taken. The internal controls policies of the Group and its associated risk management framework are utilised to evaluate the extent and efficiency of these aspects. The subsequent section provides a more detailed explanation of the approach taken towards these issues, including an examination of the primary hazards involved. Additionally, this section outlines the strategies employed to manage and mitigate each individual risk. The Audit report of the company specifically states that the Committee determined the risk management and internal control mechanisms in place for Bloomsbury, including all subsidiaries within the Group, are sufficient. No substantial internal control vulnerabilities were discovered that posed challenges to the Group in accomplishing its objective. Further, the effectiveness of the external audit process was evaluated by the Committee, which expressed satisfaction with the comprehensiveness, guidance, and results of the audit. When developing its perspective, the Committee took into account several factors. These included evaluating the calibre of the audit work conducted and the subsequent findings. Additionally, the Committee assessed the extent of the External Auditor's activities and whether they allocated adequate resources to fulfil their agreed-upon programme. Furthermore, the Committee considered the External Auditor's independence and objectivity, which was verified through a letter specifically directed to the Committee.

Conclusion

The report provides insight about concept of materiality to the auditors risk assessment along with the material rationale and identifying the financial statements. The report streamlines the risk and response and identify the assessment of the risk of material misstatement and how the company has responded to the risk plan of action. The report also explains the implementation and evaluation of the corporate governance practices and redefining the audit risk practices.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank