Accounting : Financial Statements Assignment

- Country :

Australia

The assessment has discussion questions as well as numerical questions. Part A of the assessment comprising of the theoretical discussion questions. In answering discussion questions, there will be marks for formatting and referencing. Proper references are required in answering the discussion questions. Harvard-style referencing is recommended for the discussion questions. Part B of the assessment is based on short questions and answers. Part C of the assessment has numerical questions. Please provide complete workings, and notes, and adopt the proper formats in answering the questions.

In solving the numerical questions, please show all calculations and adopt the proper formats for the financial statements.

PART AScenario Question 1

10 Marks

Golden Battery World sells several types of batteries for vehicles, power supplies, and solar- powered systems. It maintains its inventory records manually, keeping a separate card for each type of battery that is stocked and sold in-store. Every time a battery is purchased or sold, the card for that battery type is adjusted. Once a year, staff count the inventory of batteries and compare the amount with the cards. Appropriate alterations are made for differences between the inventory on hand and the cards. Graham Wood is in charge of the shop, and he has decided that it is time to install a computer?based system. He has heard that there are two ways to account for inventory, but he is not sure which method he has been using and which method to use if he computerizes the inventory records. You are an accounting student working part-time in the shop, so Graham approaches you for help.

Question:

- Explain the main differences between the two methods of accounting for inventory and how each method works.

- Which method of inventory has Golden Battery World been using?

- Which inventory method would you recommend when the computerized accounting system is installed, and why?

Scenario Question 2

15 Marks

Refer to the latest financial report of Harvey Norman Limited on its website https://www.harveynormanholdings.com.au/pages/reports-announcements and answer the following questions.

- Harvey Norman is one of Australias major retail organisations. After reviewing the financial report, what types of different accounting journals, if any, would you expect the company to use? 3 Marks

- From the statement of cash flows, name the journal(s) or journal summaries in which you would expect to find the following transactions recorded. 4 Marks

- Cash receipts from customers

- Cash paid to suppliers and employees

- Dividends paid

- Payments for plant and equipment

- From the financial statements and notes in relation to revenues and expenses, name the journal(s) or journal summaries in which you would expect to find the following transactions recorded. 4 Marks

- Depreciation and amortisation expenses

- Employee benefits expense

- Financial services fees revenue

- Lease and occupancy expenses

- In general journal format, provide entries that could be made by the company to account for all of the items in (2) and (3) above. 4 Marks

PartB Discussion Questions

- Holy Circus Ltd has been developing specialized computer software for its own use. At the end of the reporting period, the company spent $250 000 on the project. The final date for full implementation of the software is scheduled to be in 6 months time. However, the management accountant believes that the project will not be ready on time and that the company will have to acquire a commercial package instead, which will not be as efficient as the specialized software, but will be better than having no operational software at all. Others in the software department agree with her. In the financial statements, how should Holy Circus Ltd account for the development costs of $250 000? Why? 5 Marks

- A statement of cash flows is of limited use as a business needs to know if it will have sufficient cash to support its planned future activities. Discuss the merit of this statement focusing on both the purpose and limitations of a statement of cash flows.5 Marks

Part C

Numeric Questions

Question No 1

35 Marks

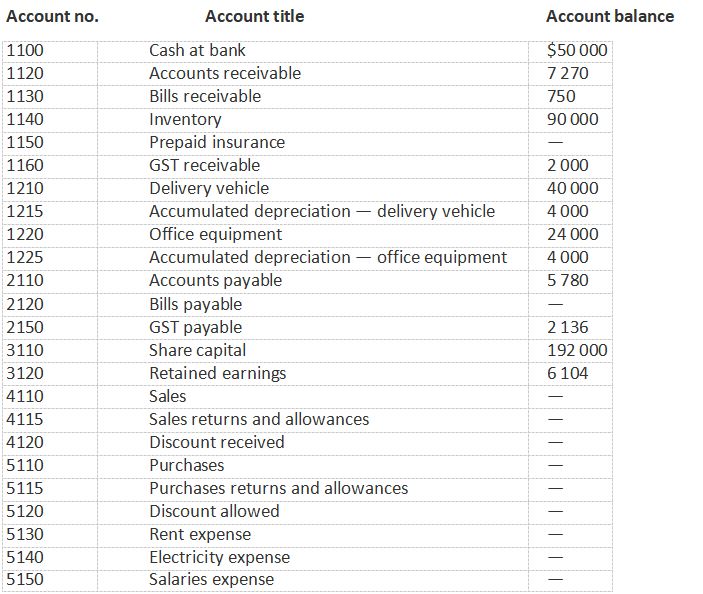

The post-closing trial balance of Raechell Delivery Services Ltd as at 1 November 2022 contained the following normal balances.

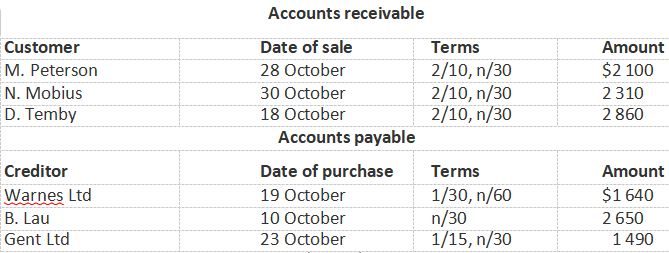

Subsidiary ledger balances at 31 October 2022 were as follows.

Transactions for the month of November 2022 were as follows.

Nov. 1 Bought inventory from B. Lau on credit, $2400 plus GST; terms n/30. Purchased 1 years insurance cover for $900 plus GST, EFT no. 400.

- Inventory sold to N. Mobius last month was returned. Issued an adjustment note for the amount of $110 (including GST).Received a cheque from M. Peterson to cover the sale made on 28 October.

- Paid Gent Ltd EFT no. 401 for purchase of 23 October.Purchased inventory from Warnes Ltd on credit, $2400 plus GST; terms 1/10, n/60.

- Issued EFT no. 402 for $1650 to B. Lau on account, and issued a 60-day 10% bill payable for the balance due on the purchase of 10 October.

- Paid November rent of premises $540 plus GST, EFT no. 403. Paid Warnes Ltd for the purchase of 19 October, EFT no. 404.

- Sold inventory on account to M. Menz, $4500 plus GST; terms 2/10, n/30.Received cash for the issue of additional share capital, $30 000 (GST-free).

- Received electronic funds transfer for $1430 from D. Temby in part payment of the sale made on 18 October, together with a bill receivable for the balance due.>

- Sold merchandise to M. Peterson on account, $4800 plus GST; terms 2/10, n/30.

- Purchased goods on credit from Gent Ltd, $3960; terms 1/15, n/30 (including GST).

- Paid fortnightly salaries by EFT no. 405, $1200.Cash sales from 1 November to 14 November, $9200 plus GST.

- Sold goods to D. Temby on account, $4650 plus GST; terms 2/10, n/30. Received an adjustment note from Gent Ltd for $77 for defective goods returned (includes GST).Forwarded cheque no. 406 to ATO to cover GST owing from previous month,$1500.

- M. Menz forwarded an electronic funds transfer for $1320 on account; no discount was allowed.

- Purchased goods for cash. Issued EFT no. 407 for $5400 plus GST. Received an electronic funds transfer from M. Peterson for $660 and a promissory note (bill receivable) for the balance of his account; no discount was allowed.

- D. Temby forwarded an electronic funds transfer for the goods sold on 18 November.

- Paid Gent Ltd for the purchase made on 13 November, cheque no. 408.

- Paid fortnightly salaries with EFT no. 409, $1200 (GST-free).

- Electricity account paid by EFT no. 410, $210 plus GST.

- Cash sales from 15 November to 30 November, $9000 plus GST. Purchased inventory on credit from Gent Ltd, $3630; terms 1/15, n/30 (includes GST).

Required

Record the November transactions (round amounts to the nearest dollar) in appropriate special journals and the general journal.

Question No 2

30 Marks

New Era Bookbinders Pty Ltd commenced business on 1 July 2022. On 5 July 2022 spent $165 000 (GST inclusive) on industrial printing and binding machinery, payable in two equal instalments on 1 August and 1 November 2022. They incurred $4950 (GST inclusive) in transport costs to deliver the machinery to the business premises and a further $5000 (plus GST) in electrical wiring and installation before the machinery could be used for production. These expenses were paid in cash. The supplier informed management that the machinery has a productive capacity of 600 000 hours. It is estimated the residual value would be $10 000 in scrap metal at the end of the machinery useful life.

On 30 August 2022, the business purchased a second-hand truck for $38 500 (GST inclusive) for deliveries incurring a $1050 stamp duty fee (GST does not apply). Four new tyres were fitted at a cost of $1320 (GST inclusive) to be road-worthy and a signwriter was paid to wrap the business logo design across the truck body for $935 (GST inclusive). The truck was expected to have a useful life of 5 years and a residual value of $5000.

On 1 March 2026, the trucks head gasket blew, causing the engine to seize up. A new engine was purchased at a cost of $19 800 (GST inclusive) which was installed for $3300 (GST inclusive). Management believes this will provide an additional 4 more years to the existing life of the truck. The residual value remains unchanged.

The company has adopted the units-of-production method of depreciation for the printing and binding machinery and the diminishing balance method for the truck. The end of its reporting period is 30 June.

Required

- Prepare general journal entries to record the transactions and the depreciation adjustments necessary for the year ended 30 June 2023 if production totaled 74 000 hours. Show narrations and all workings. (Round to nearest whole dollar)

- Justify the value you recognized as the cost of the second-hand truck purchased on 30 August 2022 by referring to the IAS 16/AASB 116 compliance requirements.

- Prepare the journal entries to record the new engine and identify the cost to be recorded for the value of the truck in the financial statements for 30 June 2026.