FNSACC321 - Process financial transactions and extract interim reports

- Subject Code :

FNSACC321-Process-financial-transactions-and-extract-interim-reports

- University :

TAFE NSW Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

Australia

Submission 1

Part 1: Scenario

Scenario: Prepare and process invoices

Welcome to Azure Beach Accountants and Financial Services (ABAFS). You work in the accounting department of this company.

You have been asked to help prepare an invoice for one of your clients, ABC Stores, who sells props for school stage productions. One of their customers, ABC Grammar, has ordered some products for their end-of-year stage recital. You have been provided with the delivery docket (source document) for the transaction, but you need to prepare the associated tax invoice. Note that the tax invoice is needed by ABC Grammar before they can make the payment to ABC Stores. Task 1: Prepare an invoice

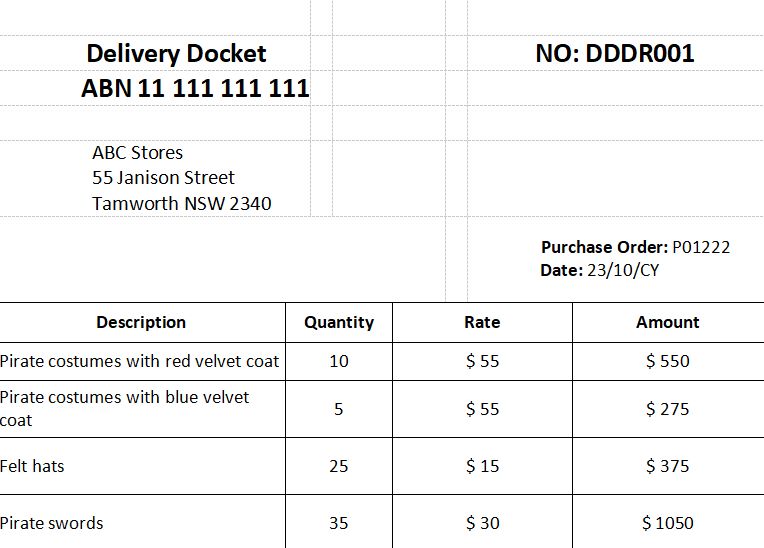

To begin, you must first review the delivery docket in Table 2 for the supply of props to ABC Grammar. This will give you a good overview of the clients stock and costs.

Table 2 Delivery docket for ABC Grammar

Based on the information in the delivery docket as the source document as well as the guidelines in the Accounting requirements and financial reporting policy, you are to fill out the invoice template FNSACC321_Sk2of2_Part1_Task1.xlsx, contained in the folder FNSACC321_AE_Sk2of2_Appx_Part1.zip.

The invoice template represents the invoice that needs to be sent to the client ABC Grammar in order to request for payment for the stage props.

Once you complete the invoice template in excel, ensure that you re-check it against the docket for any inconsistences, that is, make sure that the information recorded in the invoice is the same that supplied on the docket in Table 2.

Task 2: File and store an invoice

Now that you have successfully entered in the correct information into the tax invoice for ABC Grammar, a client of ABAFS, you can practice your learning by answering some general knowledge questions. You will need to refer to the Document filing and retention policy to help support your answers.

You can use the one entry box provided to enter answers for all the questions. Each answer should be no more than 30 words

- How are invoices and supporting documentation filed for audit purposes?

- What is the timeframe for retaining invoices and supporting documentation?

Part 2: Scenario

Scenario: Prepare and process journal entries

You should now have a good understanding of how to read delivery dockets and complete the corresponding tax invoices. You should also be more across the Document filing and retention policy.

In this next step of your learning journey, you will prepare and process journal entries for your client ABC Stores. Doing so will help ABC Stores maintain a good track record of their account.

In order to prepare the journals for your client you need to review section 1 of the appendix document FNSACC321_AE_Sk2of2_Appx_ReceiptsJournal .

For Section 1, start off with the Chart of Accounts, and then move onto the tax invoices and adjustment notes, receipts, cheque butts as well as the internal memorandum. Note that the information contained in the appendix document is mainly screenshots of many different businesses tax invoices that depict various examples of information contained in the invoices and other financial documents.

Once you review the various financial documents in the appendix, you need to determine which of the following three journal types they will need to be entered into. These are:

- Sales journal

- General journal

- Cash receipt journal

Task 1: Prepare the journals

The first step in preparing the journals is ensuring that all of the journals adhere to the organisational guidelines contained in the Accounting requirements and financial reporting policy, and then filling out the appropriate journal templates contained in the folder FNSACC321_AE_Sk2of2_Appx_Part2.zip.

This zipped folder will contain 3 excel templates for completing a sales journal, general journal and cash receipt journal for your client ABC Stores.

Task 2: Organisational policies and procedures regarding journals

Now that you have successfully created the journals for your client, you can practice your learning by answering some questions about the organisational policies and procedures regarding journals. You will need to refer to the Document filing and retention policy to help support your answers.

You can use the one entry box provided to enter answers for all the questions. Each answer should be no more than 30 words.

- What is the organisations timeframe for processing journals and finalising monthly accounts?

- After you complete and approve the journal, what is the next authorisation level prior to processing?

- Why are specialised journals created? List the 5 key types of specialised journals.

Task 3: Identify special journal entries

In tasks 1 and 2, you have prepared journal entries and identified organisational requirements related to journals. In this next task, you will need to review some sample scenarios related to special journal entries.

This will give ABC company a good outline of what makes up a good scenario and what makes up a bad one and will show them that you understand what makes a good one vs a bad one. Once you have reviewed all of the available scenarios, you can provide your answer in the space provided under each scenario.

Scenario 1:

A sole trader Blake, operating company ABC has some business losses, and as a result does not have enough money to pay for a supplier. As a result, he invests an additional $ 100,000 on 28 March 202X.

On June 202X, Blake also contributes his new car to the company. He just bought this car a week ago at $ 40,000, but due to the company needs, he decides to transfer the car ownership to the company.

Which special journal entry will Blakes contribution be added under?

Complete the special journal entry in the general journal using the templates provided in FNSACC321_AE_Sk2of2_Appx_Part2.zip.

Scenario 2:

On 28 March 202X, ABC company wrote off Blakes account that had a balance of $800. However, on 12 June, Blake paid the $800 amount that the company had previously written off.

Which special journal entry will this transaction sit under?

Prepare the general journal entry using the templates provided in FNSACC321_AE_Sk2of2_Appx_Part2.zip.

Scenario 3:

Imagine that Blake paid $2000 for some new stationery for his company. Therefore, he should debit the Stationery expense account by $2000 (increasing it) and credit the cash account by $2000 (decreasing it).

However, they made an error and debited the Postage expense account instead. How can this error be corrected?

Prepare the correcting general entry using the templates provided in FNSACC321_AE_Sk2of2_Appx_Part2.zip.

Scenario 4:

Imagine that Blakes company provided services to a client but is yet to receive the agreed payment of $66,000 (inclusive of GST) for their services. After months of contacting the client, Blake is unsuccessful in receiving the payments. How should this payment of $66,000 be entered in Blakes journals?

Using the templates provided in FNSACC321_AE_Sk2of2_Appx_Part2.zip:

- record the general journal entry to re-establish the debt

- record the receipt of the funds.

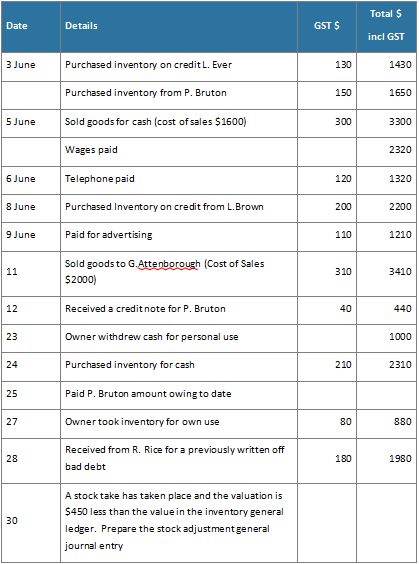

Task 4: Prepare general journal entries

You have recently commenced working of Azure Beach Accountants and Financial Services have been allocated your first client, Beachside Office Supplies. You have received the following information for the month of June, 20X3 and have been requested to prepare the general journal entries for all transactions Using the templates provided in FNSACC321_AE_Sk2of2_Appx_Part2.zip. Beachside use a perpetual inventory system.

Table 3 Transactional information

End of Submission 1

You have now completed this submission point. Submit the evidence for this submission point and then await assessor feedback before moving onto the next section.

Submission 2

Part 3: Scenario

Scenario: Check ledger accounts

Now that you have prepared the journals for your client, you need to check a series of ledger accounts for your client and identify any inaccuracies. This is a task that you may have to do quite frequently in the real world.

Before you can begin to prepare the journals for the client, you need to review section 2 of the appendix document FNSACC321_AE_Sk2of2_Appx_ReceiptsJournal . This link will contain a series of trial balances and journals that will guide you for when you need to create your own for ABC company, a client of ABAFS.

Section 2 contains a series of ledger accounts that have been created based on the trial balance dated 1st May 20X1 as well as the journal entries in section 2 of the appendix document. These journal entries are as follows:

- General journal

- Sales journal

- Purchases journal

- Cash receipts journal

- Cash payments journal

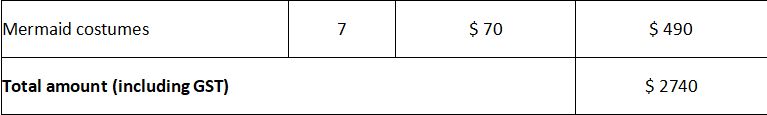

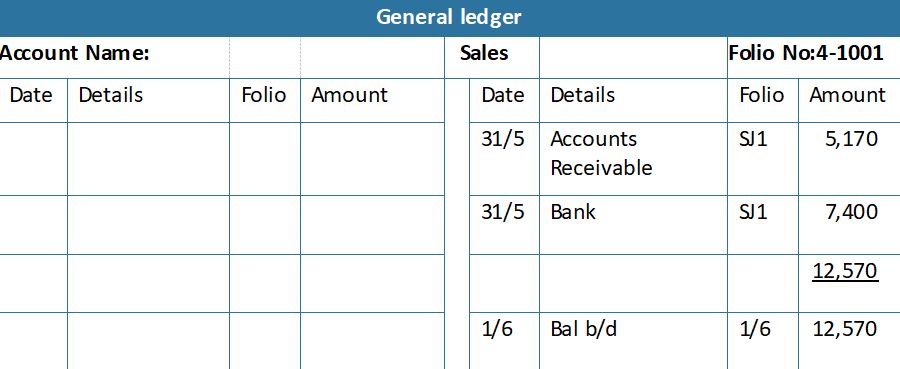

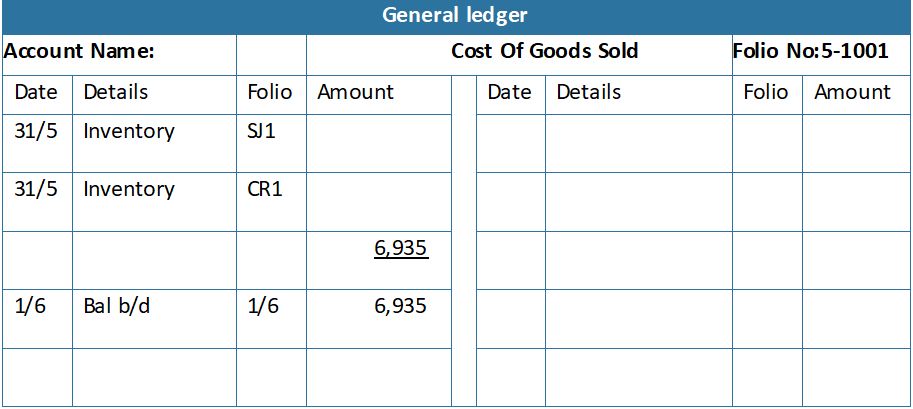

Task 1: Review and correct the general ledger account entries

Here are a series of general ledger accounts based on the journal entries in section 2 of the appendix document. You need to review the journal entries against the information provided in these general ledger tables because you will need to make a note of the errors (if any), and then document this in the space provided under each table.

Also refer to the Accounting requirements and financial reporting policy, to analyse the potential errors in the provided general ledgers.

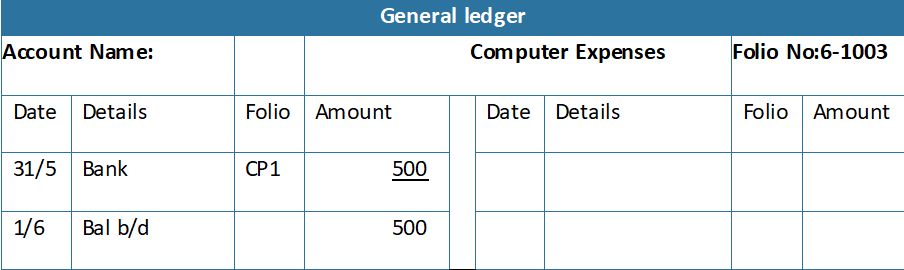

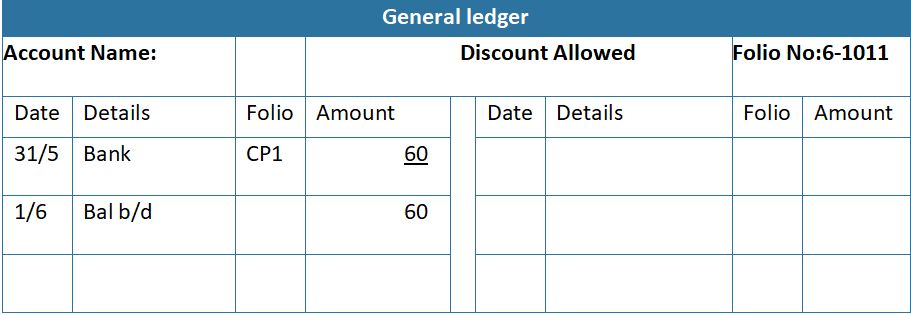

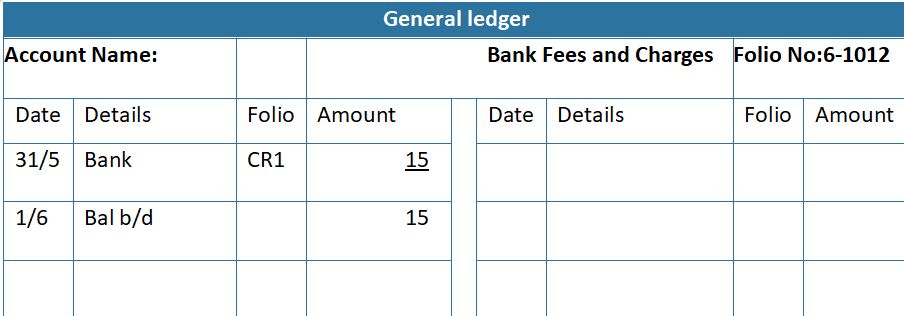

Table 4 General ledge

Table 5 General ledger

Table 6 General ledger

Table 7 General ledge

Table 8 General ledger

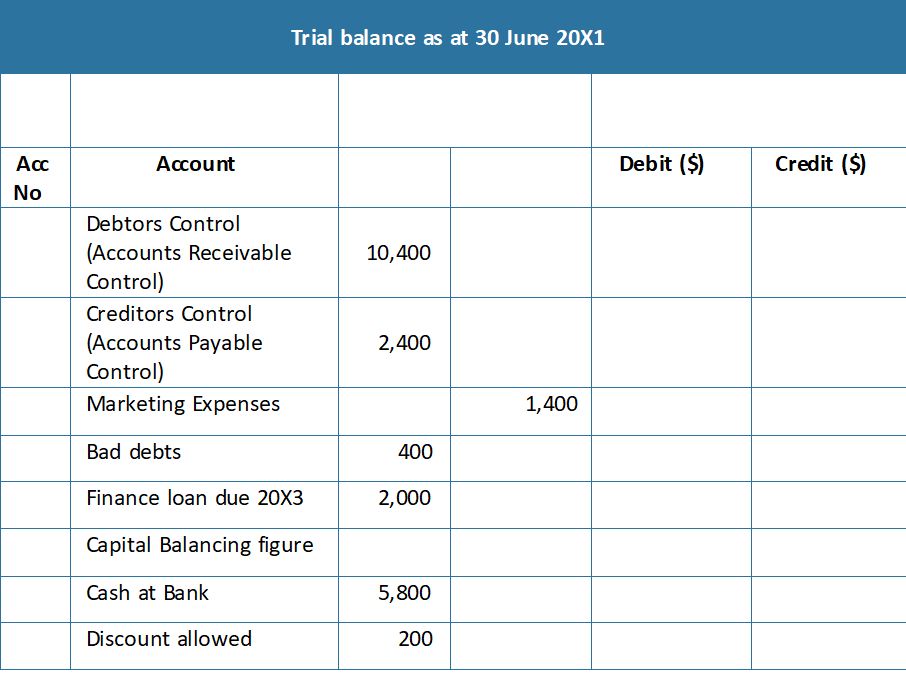

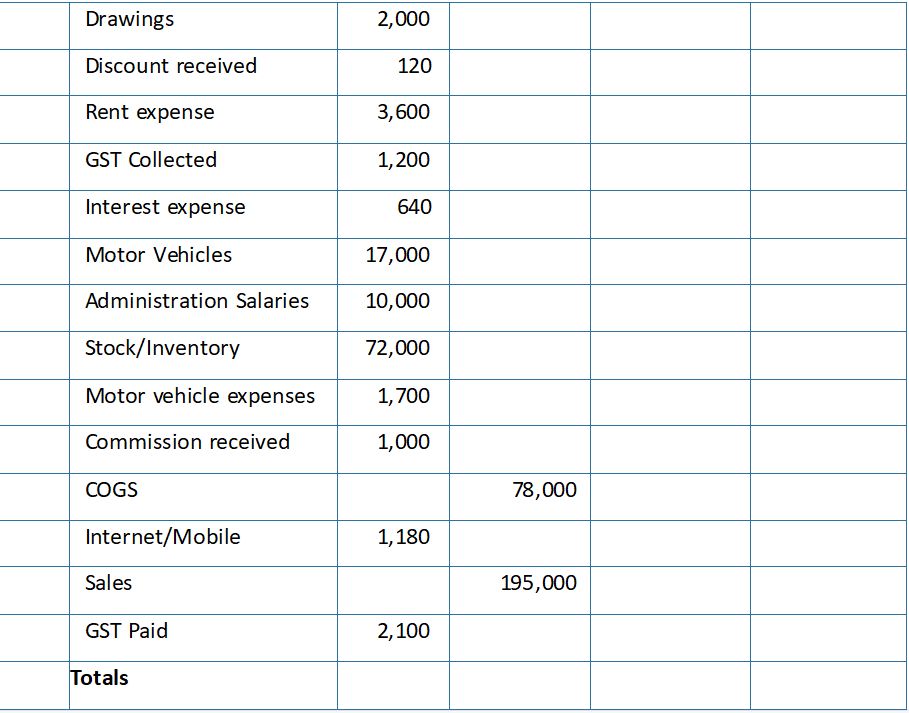

Task 2: Extract and prepare trial balance

Now that all of the ledgers have been corrected, your next task is to extract and prepare a trial balance for your client ABC Stores. The trial balance will help your client to understand which details are in credit and which are in debit.

In order to prepare the trial balance, you again need to review section 2 of the appendix document FNSACC321_AE_Sk2of2_Appx_ReceiptsJournal.

Use the template FNSACC321_Sk2of2_Part3_Task2.xlsx, contained in the folder FNSACC321_AE_Sk2of2_Appx_Part3.zip to write down your Trial Balance preparations for ABC Stores.

Part 4: Scenario

Scenario: Prepare interim reports

After checking the ledger accounts for your client, you now need to finalise the trial balances and extract the corresponding interim reports.

Task 1: Re-construct a trial balance

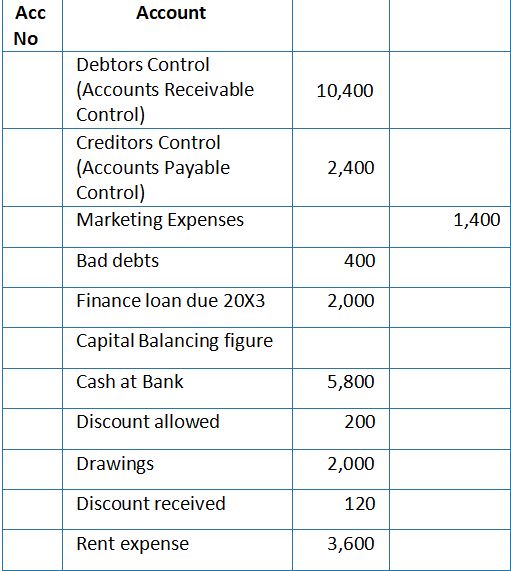

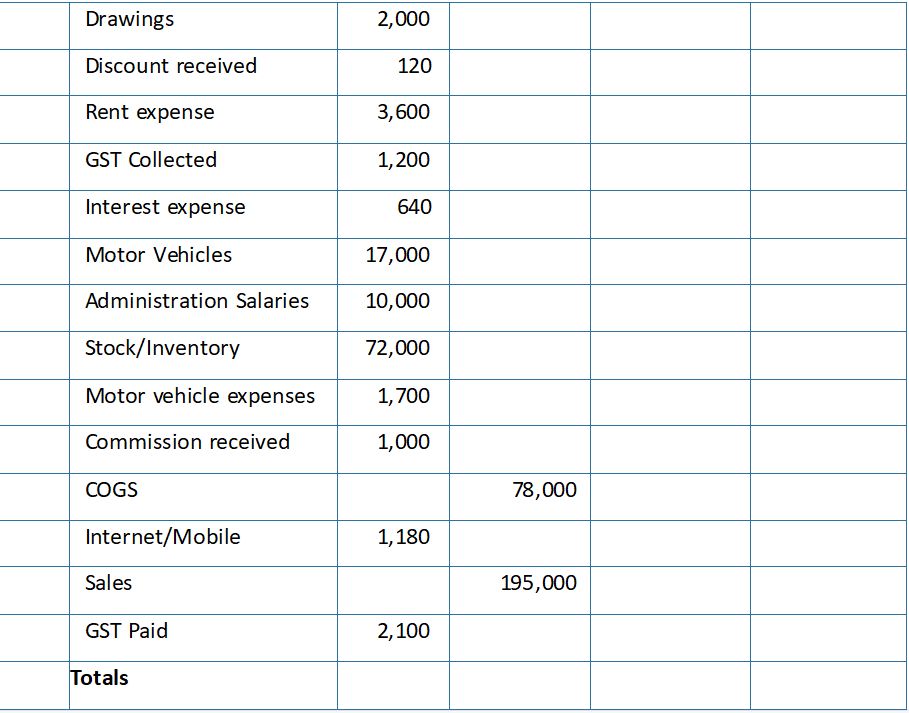

To begin, review the list of account balances in Table 9 Note that there is an account balance in Debit (Dr) or Credit (Cr), there will be no mention of this.

You need to take into consideration that Debit (Dr) accounts are Assets and expenses and that Credit (Cr) accounts are Income, Liabilities and Owners Equity. Based on this consideration, you need to re-construct a trial balance from the supplied list of values with the residual value being the Owners equity. Note that the general purpose of producing a trial balance is to ensure that the debits equal the credits in a companys bookkeeping system

Use the template FNSACC321_Sk2of2_Part4_Task1.xlsx, contained in the folder FNSACC321_AE_Sk2of2_Appx_Part4.zip to complete this task.

Table 9 Account balances

Table 10 Account balances

Task 2: Re-construct a trial balance

Great job so far! Now you need to answer some questions to demonstrate your knowledge and understanding about re-constructing trial balances.

You will need to refer to the Document filing and retention policy to help support your answers. You can use the one entry box provided to enter answers for all the questions. Each answer should be no more than 30 words.

- In order to finalise the trial balance and interim reports in accordance with organisational and regulatory requirements, where will you file these reports?

- Identify the industry-accepted accounting naming conventions, processes and procedures that you will have used to complete this task?

End of Submission 2

You have now completed this submission point. Submit the evidence for this submission point and then await assessor feedback before moving onto the next section.

Submission 3

Part 5: Scenario

Scenario: Banking

Now that youve demonstrated your knowledge and skills in analysing financial documents and checking inaccuracies in general ledgers, the intent of this section is to test your knowledge about banking policies and procedures in regard to various tasks completed by your client.

To complete this part of the assessment, you need to refer to the Bank account policy.

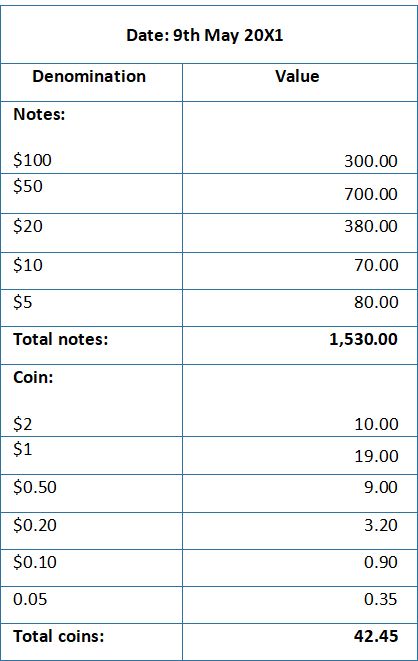

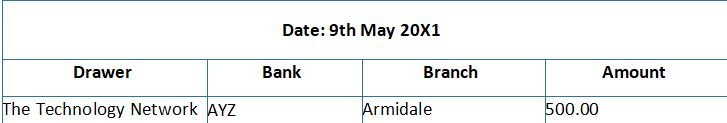

The relevant bank account details are as follows:

Account name: Azure Beach Finance and Accounting Services

BSB: 024 442

Account Number: 654987

Table 12 Cheque details for deposit

Task 2: Organisational policies and procedures regarding banking

Now that you have successfully created a bank deposit slip for your client, you can practice your learning by answering some questions about the organisational policies and procedures regarding banking. You will need to refer to the Bank account policy to help support your answers.

You can use the one entry box provided to enter answers for all the questions. Each answer should be no more than 50 words.

- What proof of lodgement will you need to keep for a bank deposit?

- You have been asked by your supervisor to bank funds for the week as the employee responsible for banking is away. What steps will you take to determine the organisational policy and industry requirements for banking and apply these to bank funds in a safe and secure manner?

- What action needs to be taken in case some entries on the bank statement do not show up in the associated cash journal?

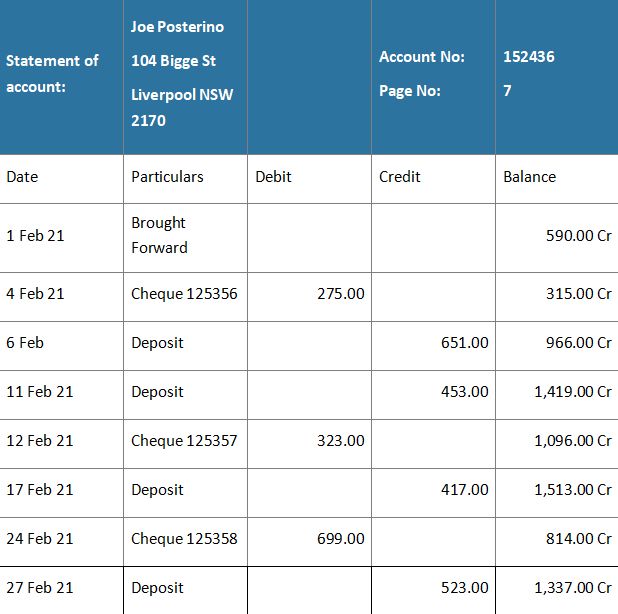

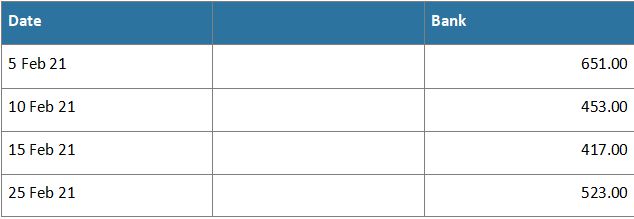

Task 3: Prepare a bank reconciliation

One more task that you may need to complete for your clients is preparing a bank reconciliation. Banking reconciliation is an important part of internal control of cash as it ensures the accuracy of both the bank statement and the businesss cash records.

Table 13 (Bank statement)

Table 14 (Cash receipts journal)

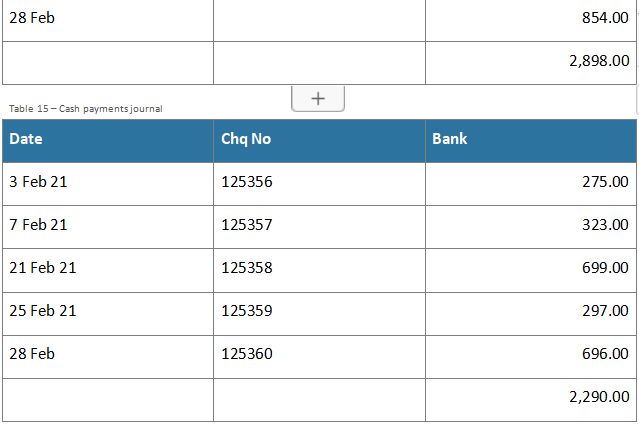

Table 15 (Cash payments journal)

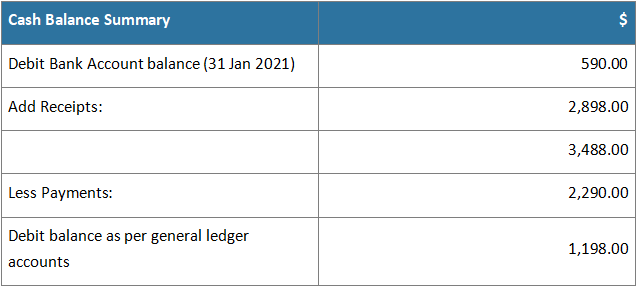

Table 16 (Cash balance summary) represent transactions for one of your clients, a sole trader, Mr. Joe Posterino.

After reviewing their bank statement, cash receipts journal, cash payments journal as well as cash balance summary, you need to prepare a bank reconciliation for them.

Use the template FNSACC321_Sk2of2_Part5_Task3.xlsx, contained in the folder FNSACC321_AE_Sk2of2_Appx_Part5.zip to prepare the reconciliation.

Table 13 Bank statement

Table 14 Cash receipts journal

Table 15 Cash payments journal

Table 16 Cash balance summary

Part 6: Scenario

Scenario: Petty cash

Great work! Youve made it to the final part of this assessment.

So far, as an accountant for Azure Beach Accountants and Financial Services, you have created tax invoices, processed journal entries, checked ledgers for inaccuracies, prepared trial balances, and also finalised bank deposits and reconciliations.

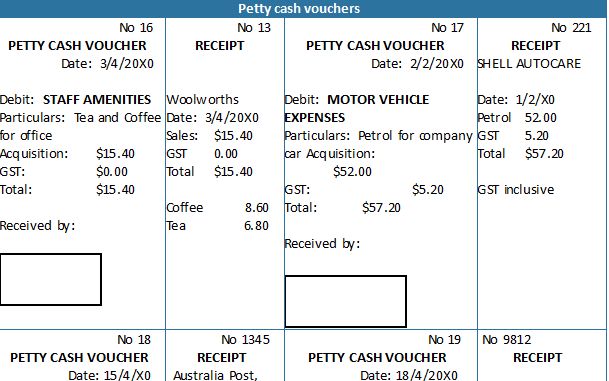

In this last part of the assessment, you need to examine and assess the various petty cash vouchers and receipts for your client because this will ensure that funds are being used appropriately and there is no internal fraud.

1: Prepare petty cash

Review the petty cash vouchers and receipts in Table 17.

The claims have been provided to you on 28th April 20X0 by a colleague Dale Hurst. You are to use 30 April 20X0 as the date of validation of the vouchers.

Refer to the Petty cash policy to help identify whether these should be Approved or Not approved.

Make a note of your answer (Approved/Not approved) in the blank box provided under each voucher information.

Table 17 Petty cash vouchers and receipts

Task 2: Prepare the petty cash book

Now that you have successfully identified the petty cash vouchers as Approved/Not approved, you can practice your learning by answering some questions about the organisational policies and procedures regarding petty cash.

You will need to refer to the Petty cash policy to help support your answers. You can use the one entry box provided to enter answers for all the questions. Your answer should be a maximum of 100 words.

According to organisational policies:

- Who authorises the reimbursement of petty cash?

- What are some guidelines around issuing of petty cash?

- How is petty cash reconciled?