FNSTPB402 Establish and maintain payroll systems Case Study

- Subject Code :

FNSTPB402

- University :

AIBT Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

Australia

Part B: Knowledge test

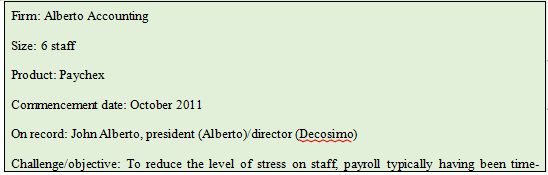

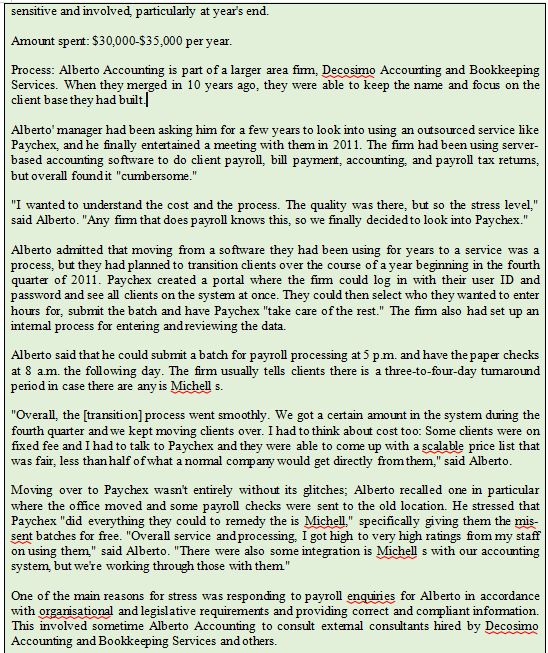

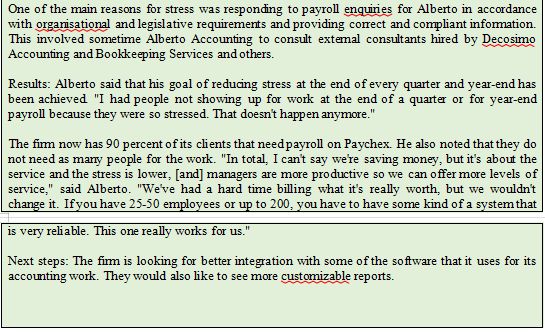

1.11.Read the following case-study and answer the given below questions:

Questions:

1.11a. Provide your comments how Alberto is handle payroll enquiries in 50-100 words.

1.11b. Why is it necessary for Alberto to respond to payroll enquiries? Answer in 50-100 words.

1.11c. What Alberto has to consider providing information in accordance with organizational and legislative requirements? How they have handled this area so far? Answer in 50-100 words.

1.11d. Who and why Alberto referred enquiries outside area of responsibility or knowledge? Write answer in 30-50 words.

1.11e. One of the steps for Alberto is to provide additional information or complete follow-up action within designated timelines in accordance with organisational policy and procedures? What are the benefits to Alberto if they follow this step thoroughly? List any four (4).

1.12 The Bargain Store pays their employees once a month. The payroll register shows a gross salary expense of $40 000 for the month of June. PAYG amounts withheld total $6 000 and health fund contributions to be deducted from employees pay total $1 500.

The store is liable for payroll tax of 6%, and compulsory superannuation for employees of 9.50% of the total salary expense.

Make a general journal entry to record and pay the stores monthly payroll expense and other amounts due on 30 June and an entry on 16 July to pay all payroll deductions withheld and any other amounts owing.

1.13 Answer the following:

- As defined in Fair Work Act 2009, what information must be kept in employee records? Identify and list any eight (8).

- Under Superannuation guarantee (administration) act 2002, what records must be kept and retained by the employers? Write your answer in 100-150 words.

- As per corporation law 2001, who long must a company keep its financial records.

- What records must be kept in order to assess your fringe benefits tax (FBT) liability? Write your answer in 50-100 words.

1.14 List the steps required to be implemented to enter payroll information in MYOB.

1.15 When preparing a payroll data, errors in payroll calculation are inevitable. List and explain any five (5) most common payroll errors that can occur in 100-150 words.

1.16 Identify and explain the payroll procedure that needs to be followed to prepare and process payroll. Write your answer in 200-250 words.

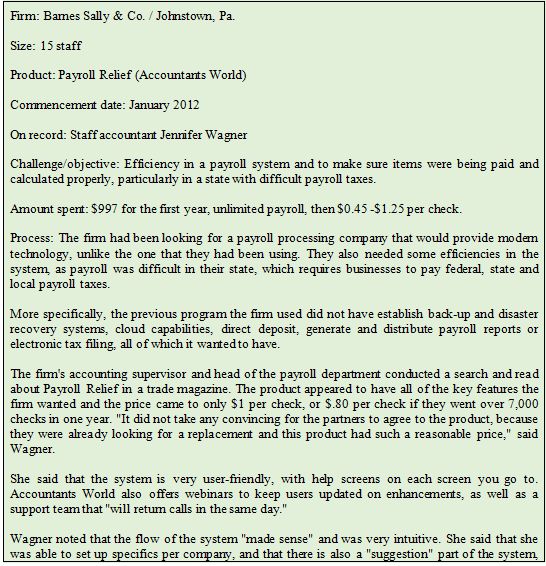

1.17 Read the following case-study and answer the given below questions:

Questions:

1.17a Explain why Barnes Saly & Co. / Johnstown, Pa. must consider maintaining all information and record keeping relating to payroll function in accordance with relevant legislation and regulations? Write in 30-50 words.

1.17b Explain in 50-100 words the process to prepare end of month reconciliation report to comply with relevant legislation requirements.

1.17c What Barnes Saly & Co. / Johnstown, Pa. should consider updating records and systems in line with salary reviews and other changes in employment status. Write single sentence for this answer.

1.17d What documents are required to be included in the disaster recovery plan? Explain in 150-200 words.

1.17e Please mention the steps Barnes Saly & Co. / Johnstown may take to generate and distribute payroll reports in line with organizational policy? Write answer in 30-50 words.

1.18 Under the fair work act 2009, what are the obligations of employer in order to make deductions and what deductions should be made from employees pay? Explain in 100-150 words.

1.19 Why is it required to reconcile the accounts for the payrolls? Explain in 100-150 words.

1.20 As per the organizational requirements it is mandatory to acquire authorization of payroll and payment of salaries. Why is it required to do so? Explain in 50-100 words.

1.21 As per the organizational policies and procedures, the preparation of the payrolls must be completed in given time frame. Why is it required to do so? Explain in 50-100 words.

1.22 Mr Aydin is responsible for processing AYMAs payroll. Mr Aydin has some queries regarding end of year tasks:

- How/when should Mr Aydin process payroll data for staff ceasing employment in December?

- How and when should Mr Aydin a process payroll data for staff to be hired or rehired in the new year

You are required to answer the in 50-100 words.

1.23 Answer the following:

- To what payees can an Individual non-business use PAYG payment summary for making payments? Mention any six (6).

- For what type of amounts withheld from payments, payment summaries cannot be used? Mention any eight (8).

1.24 For a tax sales of invoice more than $1,000, What are requirements of ATO in terms of ABN number. List any seven (7).

1.25 Declaration of tax file number is required so that payers can work out the tax amount that is required to be withheld from payments. What requirements does an ATO have for employers in terms of Tax file number (TFN) declaration? Explain in 150-200 words.

1.26 What are the existing ATO requirements in terms of employment declaration? Explain in 50-100 words and list any five (5) employee declaration forms.

1.27 Betty is a registered tax (financial) adviser and has several clients, one of which is Crunchy munch, a large ice-cream retailing franchise. Betty has an ownership interest in Crunchy munch. Betty is approached by Ice Cold, a rival ice-cream retailing franchise, to provide tax (financial) advice services. Identify the code of professional conduct applicable and related Tax Practitioners Board (TPB) requirements. Write answer in 100-150 words.

1.28 What requirements must be fulfilled to be registered as a BAS agent as following:

- Registering as an individual BAS agent

- Registering as a company or partnership BAS agent

Explain in 200-250 words.

1.29 Answer the following:

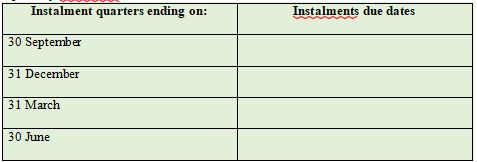

- Under subdivision A of A New Tax System (Pay as You Go) Act 1999, what information must be given to the commissioner if you are liable to pay an instalment for the period? Write your answer in 50-80 words.

- Under Privacy act principle 12, when can an APP entity give access to personal information of an individual? Write your answer in 50-100 words.

1.30 Answer the following:

- What does an employment termination payment (ETP) include? Write your answer in 50-70 words.

- How are employment termination payments (ETP) taxed? Write your answer in 30-100 words.

- If you do not pay the minimum amount of super guarantee (SG) for your employee into the correct fund by the due date, how will you calculate super guarantee charge (SGC) you need to pay? Write your answer in 30-50 words.

1.31 Explain in 150-200 words, the key features of computerized payroll systems and manual payroll system.

1.32 What policies and procedures affect the payroll system of the organization taking into consideration the structure of authority in the organization? Identify and explain any five (5) in 200-250 words.

Resources and equipment required to complete assessment activity1(Part B)

Assessment must be conducted in a safe environment where evidence gathered demonstrates consistent performance of typical activities experienced in the bookkeeping field of work and include access to:

- office equipment, technology, software and consumables required to establish and maintain a payroll system, including:

- workplace reference materials, such as procedural manuals and organizational policy

- actual or simulated payroll data.

- Computer

- Internet

- MS Word

- Printer or e-printer

- Adobe acrobat/reader

- Learning management system i.e. Moodle

- MYOB

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank