31855 v1 Demonstrate And Apply Knowledge Of Financial Services Legislation, Good Conduct, Professionalism Assessment

- Subject Code :

31855-v1

- University :

Professional IQ College Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

Australia

Task 4 (US 31855 PC 3.1)

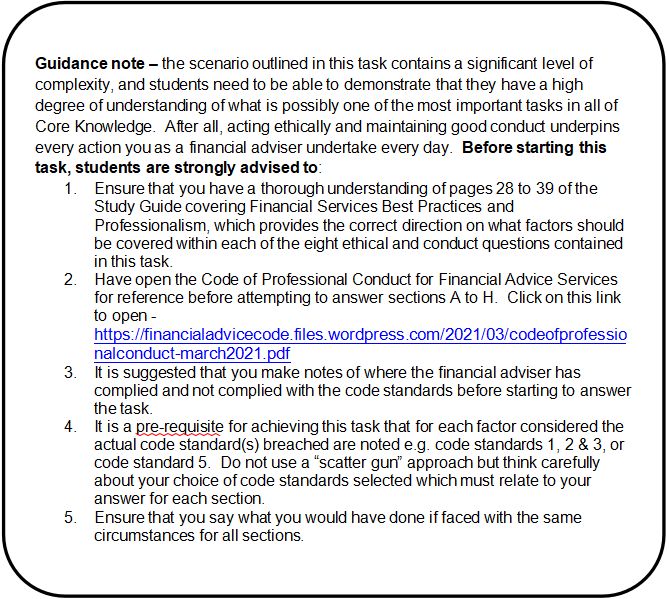

PLEASE READ THE GUIDANCE NOTE BELOW BEFORE ANSWERING THIS TASK

The purpose of this assessment task is to demonstrate how you apply best practice and professionalism when providing services to clients.

Read the scenario below, then:

Comment on each of the ethical considerations below (for example, explain the ethical consideration)

- Explain where you believe this adviser has met or not met the obligation. You will need to reference relevant Code Standards and legislation/regulations in your answer.

- Describe the good and ethical practice you would apply if this was your interaction with this client:

Answers to 1 & 2 above must be given under each heading for a-h, and not as a separate essay- Adopting best practice processes

- Maintaining confidentiality

- Meeting duty of care

- Adopting non-discriminatory practices

- Making full disclosure of remuneration and fees and other conflicts of interest that may influence any recommendation where required

- Acting in good faith

- Remaining within your field of competence

- Managing client information to meet appropriate standards

Scenario

You are a Financial Adviser, giving advice under another entitys license. You sell personal (life and health) and general insurances. You are studying the investment strand but have not yet completed all of the requirements. It is your intention to add KiwiSaver investments to your list of products and services in six months once you have completed all your assessments and can demonstrate meeting your obligations under Code Standards 6-8.

Huia and Joey are referred to you by an accountant. You have a good relationship with the accountant and have received a large number of very good referrals from him in the past. Joey works for the accountant as a manager. In the first meeting, Huia and Joey explain that they would like to discuss a comprehensive financial plan including saving, debt repayment, personal insurance, general insurance and KiwiSaver. They own a home with a mortgage and 2 cars. They have two young children. They want to make sure they have all the protection they need for the future.

Huia and Joey meet up with you in your office. All your work in progress files are on your desk. You hurriedly put them into a drawer, as you dont want them to see any other client information. Your computer screen is not locked, as you thought you had a recent data breach, and were checking your malware at the time Huia and Joey came into the office.

You complete the correct disclosures and data collection procedures for Huia and Joey and explain your fees in general, saying you receive commissions. You tell them that you are currently qualified to advise them on personal and fire and general insurances only.

You mention that you mostly sell ABC product for personal insurances and XYZ product for fire and general because they both have excellent claims payout and very good financial strength ratings. You say that, even though you prefer those insurers, you are able to look at a wide range of insurances and so, you are really an independent adviser.

During the discussion, Joey mentions he has had mild depression but has never seen any specialists nor been on medication. He says he just gets unhappy sometimes and takes the odd day off work to de-stress. While doing your analysis later, you find that your preferred product suppliers are very good on price, a key consideration for Huia and Joey, and excellent in terms of policy wordings. The only issue you have is that the personal insurance company has strong exclusions for mental health. You want to get a better idea on how bad the depression is, so you ring the accountant and talk about how many days Joey has had off and how this has affected his work. He states that it is really fine; he works very hard and so deserves flexibility at times when he feels overwhelmed. You decide to recommend your preferred product suppliers in your Statement of Advice.

You meet again with Huia and Joey. The presentation goes well and they accept all your recommendations. They sign up all of the documentation. When Joey asks about the depression thing, you ask them if it is recorded on their doctors records. They say no, so you say dont worry about it.

When completing the forms for the fire and general insurance, you note that they dont have an alarm system or any garaging for the cars right now but Huia and Joey say they intend to put up a double garage and install alarms in the next 12 months. So you tell them to put down that they have both the garage and an alarm system as long as they promise to do it as soon as they can.

Everything goes through the insurers OK. The personal insurer accepts the personal insurance applications as clean skin risks. The fire and general insurance applications are accepted as good risks.

You receive your commission from both companies and a free trip to Fiji for hitting your sales targets with one of the providers.

After 6 months Joey calls and says they are very happy and can you please now talk to them about KiwiSaver. You have started but have not completed the investment strand of the qualification but you say yes and help them implement a KiwiSaver scheme investment. You think that as you are going to complete the strand in 2-3 months anyway so it will be fine.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank