25705 Financial Modelling and Analysis Assessment

- Subject Code :

25705

- Country :

Australia

Instructions

Please access the Stock Allocation - Autumn 2023.xlsx spreadsheet to get the details of the stocks assigned to you (Main, Bench1 and Bench2) based on your Student ID.

- Dataset1 | For all three stocks, please download daily data (Price, Cvol, Open, High, Low) from Factset from 31 December 2004 to 31 December 2022. Seminar 1 in-class activity shows how to do this.

- Dataset2 | For your all three stocks and the S&P/ASX200 (XJO-ASX), download weekly prices from 31 December 2017 to 31 December 2022.

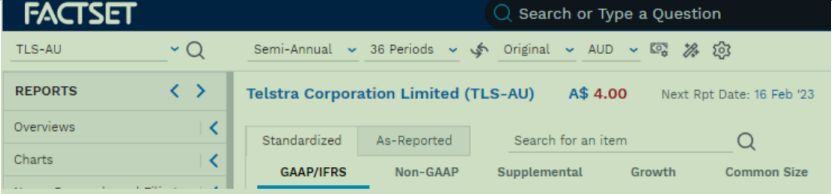

- Dataset3 | For your Main stock, also download half-yearly Income Statement from June 2005 to December 2022 (36 periods)

Report Format

- Please submit your report in PDF format and your workings in an Excel spreadsheet.

- The report should include your answers and conclusions, as well as the tables and charts you judge relevant.

- Please create a cover page for the report, containing subject number and name, report title, student name, ID, and UTS email.

- All text should be 1.5 lines space with 12-size font.

- The page limit is 10-A4 pages, excluding the cover and the reference list. Any materials beyond the page limit will not be considered.

- Please name the report by including your Student ID number after the original file name (e.g., 25705 Case Study 13333333.pdf)

- The spreadsheet should contain all calculations and be formatted appropriately:

- One worksheet per Dataset (Dataset1, Dataset2, Dataset3)

- One worksheet per question. Each labelled Q1, Q2, etc.

- Input and calculation formats should be clearly identified

- Calculations should be transparent and show proficiency in Excel

- Hard-coded values are only appropriate for inputs or for outputs of Data Analysis steps. Please clearly specify if you have used any Data Analysis steps in your calculation.

- Please name the spreadsheet by including your Student ID number after the original file name (e.g., 25705 Case Study 13333333.xlsx)

Descriptive Statistics and Visual Analysis

Q1. [2 marks]

For each of the three stocks you have been assigned, please use Dataset1 to:

- Calculate daily returns and daily volatility (using the high/low measure).

- Compute the descriptive statistics for returns, volatility, and volume for the entire period.

- Compare results across stocks and comment on your findings

Correlations

Q2. [2 marks]

For each of the 3 stocks, please use Dataset1 to:

- Compute the correlations across returns, volatility, and volume.

- Compare results across stocks and comment on your findings.

Q3. [2 marks]

Please use Dataset1 to:

Compute the correlations of returns across each pair of the three stocks:

- Main Bench1

- Main Bench2

- Bench1 Bench2

- Use a scatter plot chart to illustrate the correlations between each pair.

- Compare results and comment on your findings.

- Which of the two benchmark stocks provides more diversification benefits?

Hypothesis Testing

Q4. [2 marks]

A colleague asks you to corroborate whether the difference in average returns for the Main stock and the Bench1 stock is statistically significant at the 1% level. Using Dataset1, please:

- Formulate the null and alternative hypotheses,

- Specify if you need to perform a one or a two-tail test, and

- Run a hypothesis test at the 1% level of significance and provide your conclusion.

Q5. [2 marks]

A colleague asks you to corroborate whether the difference in average volatility for the Main stock and the Bench2 stock is statistically significant at the 1% level. Using Dataset1, please:

- Formulate the null and alternative hypotheses,

- Specify if you need to perform a one or a two-tail test, and

- Run a hypothesis test at the 1% level of significance and provide your conclusion.

Forecasting Volatility

Q6. [2 marks]

Using Dataset1, please forecast daily volatility for your stock using an estimation period going from 1 January 2005 to 30 June 2022 and a hold-out period going from 1 July 2022 to 31 December 2022. Implement the SES method to forecast volatility using an initial ? defined by you. Use the estimation period volatility data and Excels Solver determine the optimal ?.

Simple Linear Regression

Q7. [2 marks]

Using Dataset2, please:

- For each of the three stocks (Main, Bench1 and Bench2), estimate Beta (measure of systematic risk) for:

- The 2018-2019 period

- The 2021-2022 period

- Report and discuss your main findings.

Multiple Linear Regression

Q8. [2 marks]

Using half-yearly Sales as reported in the Income Statement (Dataset3), please:

- Build two alternative multiple regression models you believe will have explanatory power over your Main stock Revenue/Sales. You can source these independent variables from Factset or from other sources. The difference between the two models could be just one independent variable:

- Use the first 32 periods as training, and the last 4 periods as test data.

- Please report and discuss your main findings.

Q9.[4 marks]

Quality of writing and presentation

- Sentences should be clearly connected and coherent. The sentences should flow logically from point to point. Written expressions should be clear, complete, and grammatically correct.

- Chart formatting should be clear, only showing the information that is requested in each question. Make sure labels, series and numbers do not overlap.