ACC330 Business taxation Case Study

- Subject Code :

ACC330

- University :

International College of Management Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

Australia

Assessment instructions

Assessment overview

This is an individual assessment that aims to enable the student to demonstrate their understanding of company tax liabilities, dividends and franking credits. This assessment assists in the development of research skills to achieve the intended learning outcomes.

Task description

This task presents a case study, wherein the student is provided with a setting where he/she is working as a tax accountant at a medium sized accounting firm, and a client requests that the student examines and analyses various business taxation scenarios for that clients business. The student also conducts a critical analysis of that business, with reference to relevant tax laws and literature.

Students will then provide their client with two pieces of work; case A & case B. Student can answer any questions the client may have regarding the solutions and recommendations the student has prepared.

In their recommendations to the client, the student is required to answer the following three questions, which include four complex calculations.

Task A - CASE 1

Baby Hub Pty Ltd (Baby Hub) is an Australian company. It conducts a business selling childrens toys.

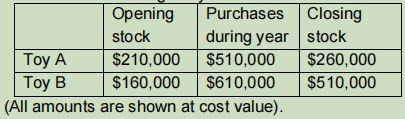

Details of stock during the year were as follows: (All amounts are shown at cost value).

Sales during the year were $700,000 (Toy A) and $350,000 (Toy B). Of the sales, $150,000 represented invoices issued in the month of June 2022 for which payment had not been received as at 30 June 2022.

Other income received by Baby Hub for the year included:

- A dividend of $100,000 received from Jumbuck Bank Ltd (an Australian resident public company for tax purposes) franked to 50%.

- An unfranked dividend of $50,000 from Toy Best Ltd (an Australian resident public company for tax purposes)

- Baby Hub also holds 10 units in the Toddler Toy Unit Trust.

Under the terms of the unit trust Baby Hub is entitled to distributions of 10% of the income of the unit trust. The income of the trust estate for the year ended 30 June 2022 was $220,000, and the net income of the trust estate was $200,000.

Salaries for Baby Hub staff for the year were $120,000. Other deductible expenses for the year were $150,000.

Unfortunately, during the year, a child suffers an eye injury whilst playing with Toy B, and Baby Hub is sued as a result. Baby Hub is denying liability, but so far has incurred $25,000 in legal fees. As at 30 June 2022, the lawsuit has not been settled. Due to the bad publicity surrounding Toy B, Baby Hub is now faced with a large volume of stock that is unlikely to be sold.

For the year ending 30 June 2022 Baby Hub Pty Ltd paid a total of $120,000 in instalments of tax (you can assume these were made in equal instalments). Any final payment of tax required for the 2021-22 income year is paid on 31 October 2022.

Assume all figures are GST exclusive.

Required

Question 1

Calculate Baby Hub Pty Ltds income tax liability in respect of the income that it derived in the 2021-2022 year of income (GST calculations are not required). Use the company tax rate 30%. (12 marks)

Question 2

As noted in the facts, Baby Hub has a large quantity of stock of Toy B left on hand. The market value of the stock is now lower than the cost price. Baby Hub seeks your advice as to whether they can revalue the stock at a lower price. Briefly advise Baby Hub whether they are able to revalue the stock and if so, how they can value it.

(3 marks)

Task B CASE 2

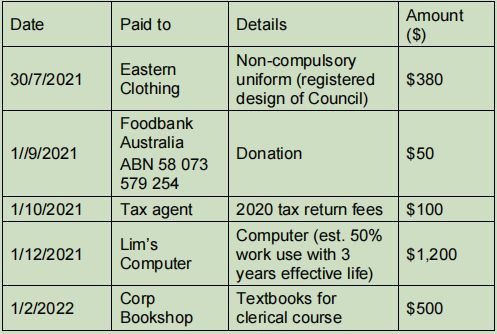

Your client Lucy has attended your office to have her 2022-year tax return prepared. Lucy is 52 years old single resident taxpayer employed by Burwood Council as a clerk. Lucy is also a friend of yours.

She has the following documentation and admits that she is not good at keeping her receipts and invoices:

Payment Summary for the period 1 July 2021 to 30 June 2022 from Burwood Council.

Gross Wages $56,000

Allowances Clothing $400

Tax withholding Deducted $12,000

Various receipts

Other Information

- Lucy estimated total $490 annual train ticket used to travel to and from work.

- Lucy advises you she spent $600 on personal grooming which was essential for her job and insists that she claims this amount.

- Lucy held $200,000 deposit for the whole year in an interestbearing account but insists that she did not receive any interest during the year. Lucy has not supplied any bank statements.

- Lucy sold various shares on 20 June 2022 as follows.

- Apricot Shares (Australian company): purchased in January 1998 for $20,000 and sold for $55,000.

- Pear shares (Italian company): purchased in March 2019 for $7,000 and sold for $5,000.

- Cherry shares (Australian company): purchased in May 2022 for $9,000 and sold for $14,000.

Required

- Calculate taxable income for Lucy. You are required to explain all income & deduction details with section numbers and/or cases in your explanations (6 marks).

- Advise Lucy on the CGT consequences of the share sales. You must provide all methods available for her and choose the best method to minimise Lucys net capital gains (6 marks).

- As the Tax Agent, how would you handle the stance your client has taken in points 2 and 3 above, refer to the Code of Conduct from Tax Practitioners Board, include the principle involved and the action to take in each situation? (3 marks)

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank