AFE_7_IFM International Financial Management for Business

- Subject Code :

AFE-7-IFM

Seven Stars

All firms want to invest in projects that are expected to yield a return greater than their cost of capital.

For the chief financial officer (CFO) of a company, the procedure for determining where to invest is a

three-step process. The first step is finding the expected return (Internal Rate of Return) on the projects

in which the firm may be interested. The second step is the determination of the firm's cost of capital.

The final step is selecting those securities or projects whose expected return is greater than the firm's

cost of capital. In reality neither of the first two steps precedes the other as the CFO may calculate the

firm's cost of capital on an annual, a semi-annual, or even a quarterly basis, depending on changes in

the capital markets. The calculated cost of capital may then be compared to the expected returns of the

various capital projects available.

History of Seven Stars

Seven Stars (SS) was founded in 1980 by John as a manufacturer of quality chocolate. As with most

food companies established in the United Kingdom in that period, SS started as a modest manufacturer

of a single product that was sold locally. Later, if successful, those firms expanded their sales efforts to

regional, national, and sometimes even to international areas.

Seven Stars was one of the successful companies. John's first product was a chocolate bar that sold for

twenty pence. The bar, known as the Seven Stars Bar, soon became famous for its quality and fine taste.

John expanded production to meet the rising demand for the Seven Stars Bar, but growth never exceeded

cash available to pay for the expansion. Two of the basic tenets on which John founded and ran SS were

to make a quality chocolate bar and not to go into debt. These tenets were considered almost sacrosanct,

and John believed they were the reasons for his success while many other food companies failed.

By the year 2000 when John turned the reins of his company over to his son, William, SS had grown

into a respected and well-known 40-million regional chocolate firm. It had survived intense

competition, according to John, because the firm still produced a quality product and, above all, had no

debt. William followed the principles laid down by his father, and in the next 10 years SS grew to a

national firm with 700 million in sales. Although SS had purchased a confectionery firm, over 90

percent of the sales were from chocolate . Significantly only 5 percent of the firm's capital structure was

in long-term debt, the debt needed to purchase the confectionery firm.

In 2014, when William's son Alex became president of SS, the family still owned all the shares of the

firm and the board of directors was made up entirely of family members. However, in 2016 the company

was forced into going public because of two circumstances. The first was the need to raise cash to pay

estate taxes following the death of William. The second came from the increasing awareness that the

firm needed to modernise its plants to compete with other food companies, which were slowly taking

market share from SS with better quality products and higher profits from their automated, modern

equipment.

By the early 2020 the firm had completed its modernisation, which improved the quality of its products

and reduced operating expenses. However, the firm was totally dependent on the chocolate and

confectionery business and its managers were beginning to realise that diversification into other lines

of the food business might be necessary for SS to survive in the increasingly competitive business

environment. In addition, some family members were beginning to question the financial practices of

the firm and the effects those practices had on the share price. They noticed that throughout the 1990s,

many of the old-line family food businesses were purchased by larger publicly held firms run by

managers who were not majority shareholders of the firm. More importantly they noticed that the

returns on the shares sold seemed much higher than the returns they were receiving from their shares.

During the early 2010s, SS did expand into the pasta business through the purchase of three family-

owned firms and by 2020 had a 20 percent market share of the 1.4 billion UK pasta business. Thepurchase of these businesses was financed through two bond issues. Long-term debt, however, was never more than 20 percent of total assets.

James Wilson

James Wilson, the chief financial officer (CFO) of SS, was hired in 2018 with specific instructions to

improve the return on the financial resources of the firm. James's background included four years as the

cash manager of a large corporation with sales in excess of 10 billion. He was a graduate of an MBA

programme that is nationally known for its emphasis on financial management. James saw the job as

CFO of SS as an outstanding opportunity to affect the financial decision making of a firm in transition

from family ownership to one that was becoming a multibillion pound, publicly held firm.

This Monday morning, James had just walked into his office at 7:30 am to find a note stuck on his

computer's monitor to call Alex, the CEO of Seven Stars . Alex, however, was making a real effort to

bring SS into the modern era, insisting that many of the top executives attend financial seminars

sponsored by the Top Business School. James had suggested the seminars to Alex as a vehicle to help

these executives understand some of the changes he thought were necessary to improve Seven Stars '

financial performance.

James called Alex, who asked him to come up to his office. In the next 30 minutes James learned that

SS was considering the purchase of Treehouse Foods, a pasta producer with annual sales in excess of

800 million, for 400 million. Before a decision could be made, Alex wanted the answers to three

financial questions from James. First, what was the expected return from this proposed purchase?

Second, what was Seven Stars' cost of capital? Finally, what was James's recommendation on how the

purchase could be financed?

Financial Information

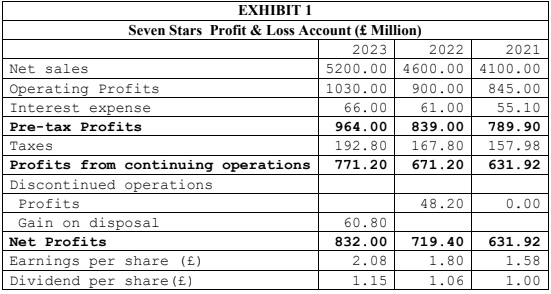

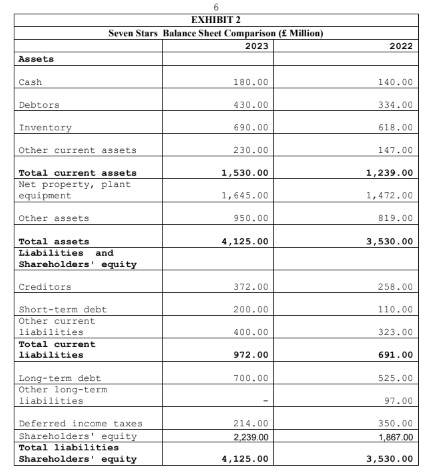

James reviewed the SS financial data. (See Exhibits 1 and 2.) The average outstanding balance of short-

term, interest-bearing debt in 2023 was 200 million and the weighted average interest rate was 6.0 percent. Domestic borrowing under lines of credit and commercial paper was used to fund seasonal working capital requirements and provide interim financing for business acquisitions. Maximum short-term borrowings at any month were 250 million.

SS had two long-term, AA+ rated bonds outstanding. The first was a 6.00 percent sinking fund

debenture due in 12 years. This debenture is traded on the London Stock Exchange priced at 105.0

which results in yield to maturity of 5.43 percent per annum. Of the original 650 million issue, 200

million is still outstanding. The second issue was for 500 million and had a coupon interest rate of 5.5

percent. The entire issue was sold in 2021 in a private placement to two life insurance companies, and

the issue will mature in 2051. James then called SS's investment banker and learned that the banker was

highly confident that Seven Stars could issue up to 400 million of new debt at the current return on

SS's outstanding long-term debt.

Like many other family-controlled but publicly held businesses, SS has two classes of ordinary shares:

Ordinary Shares and Class B shares. The Ordinary Shares have one vote per share and the Class B

shares (held or controlled by family members) have 10 votes per share. However, the Ordinary Shares,

voting separately as a class, are entitled to elect one-sixth of the board of directors. With respect to

dividend rights, the ordinary shares are entitled to cash dividends that are 10 percent higher than those

declared and paid on the Class B Shares. There are a total of 340 million shares of ordinary shares and

60 million of Class B Shares outstanding. The current price of both the ordinary shares and Class B

Shares is 2250 pence and their beta is 1.3. The ordinary shares and Class B Shares generally vote

together without regard to class on matters submitted to shareholders.

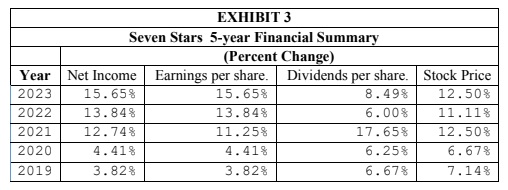

The growth rate of net income, earnings per share, dividends, and ordinary share prices are given in

Exhibit 3. The increase in the stock price have averaged about 9.95 percent a year over the last five

years. Some of this growth rate is the result of an aggressive repurchase of the firm's ordinary shares.

Over the past five years the firm has repurchased over 20 million ordinary shares (virtually all

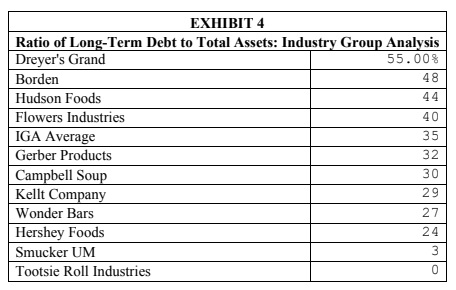

repurchases were made in 2019 and 2020). Finally, James looked up the capitalisation ratio for other

firms in the food industry. (See Exhibit 4.) As he expected, Seven Stars Bar had a much lower debt ratio

than almost all other companies in the industry group.

James wrote down the additional information that he thought he needed before starting to work. The

current Treasury bill rate was 4.0 percent and the return on the FT all share index has averaged 12

percent over the past 5 years. The current corporate tax rate is 20 percent. The beta for Treehouse Food

was 1.5 with debt accounting for 40 percent of the market value of the firms capital. The yield to

maturity for the debt was 6.5 percent per annum, slightly higher than that for the Seven Stars.

Questions requiring answers:

- What is Seven Stars's capital structure? List all the assumptions made underlying your

calculations providing the rationale based on capital structure theories and practices. - What is Seven Stars's before-tax cost of long-term debt and cost of equity? List all the assumptions made underlying your calculations providing the rationale based on capital market theories and practices. Use the Dividend Growth Model (DGM) and the Capital Asset Pricing Model (CAPM) in calculating the cost of equity.

- Calculate the cost of capital for Seven Stars using weighted average cost of capital of debt and equity, and Miller and Modigliani proposition incorporating corporate tax. Explain, which of the cost of equities calculated in question 2 (using the DGM or the CAPM) is used? Why the capital asset pricing model is not used to estimate the firms cost of capital directly?

- If Seven Stars uses book value rather than market value to determine its capital structure, explain the impact of the cost of capital on its capital budgeting decisions?

- Why using the book value or the market value of the firm's capital in the determination of the cost of capital is considered superior? Explain.

- James apparently believes that Seven Stars's cost of capital can be used as the hurdle rate for the required return to evaluate the acquisition of Treehouse Foods. Under what conditions, if any, is this appropriate?

- How can the firm raise 400 million for the acquisition without changing the present capital structure?

- Assume that the expected net income of Seven Stars in 2024 is 700 million, how would you suggest that the firm finance the acquisition? Explain the advantages and disadvantages of share repurchase instead of cash dividend payments.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank