BSBFIN501 Financial management Policy and Procedures Assignment

- Subject Code :

BSBFIN501

- University :

King Edward VII College Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

United Kingdom

King Edward VII College Budget Policy and Procedures

Purpose of the Policy

King Edward VII College will operate in a financially sustainable manner balancing revenue and expenditure.

Our financial planning process are as follows:

- Financial objectives set for each year.

- Budgets set for each year.

Procedures

Budgets are set for each applicable department. Budgets are based on expected sales and expenses. Budgets will be set by the finance team. Each manager must review their budget and may contact the finance team for any revisions. They must present a clear argument for any changes.

A contingency amount is usually included in each budget to account for unexpected costs. Managers are expected to inform their team of the budget and to provide them with the required resources and systems so as to fulfill their roles. Generally this will include regular meetings to monitor the budget. Team members are expected to report all expenses to managers by providing receipts and so on.

Budgets should be monitored by each Manager every month using our accounting system, Xero, to make sure expenses are on track. Where changes are required, the finance team may be contacted to discuss this. This should also include where contingency amounts need to be varied. Each manager must review their budget amount versus actual amount at the end of the reporting period. Variances of up to 5% over budget are acceptable. Differences between actual and budgeted amounts must be described, as well as justifications for such.

Purpose of the Policy

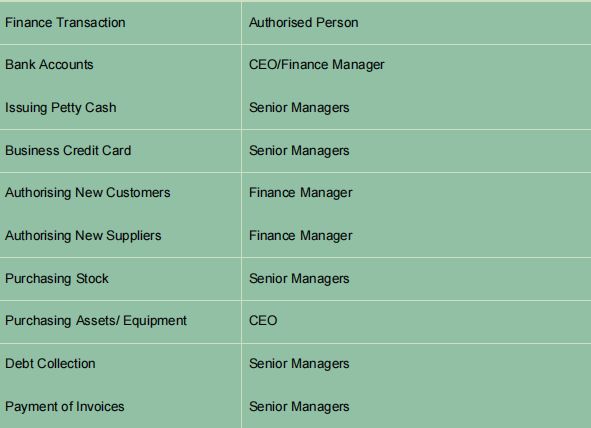

All finance transactions as noted in this policy are to be authorised by the noted authorised person prior to the transaction being undertaken.

This policy is to be read in conjunction with other specific finance policies where relevant.

Procedures

Prior to any of the following finance transactions being undertaken, the authorising person noted must authorise the transaction.

Where additional policy is noted, this policy must also be adhered to when undertaking the finance transaction.

Petty Cash Policy

Purpose of the Policy

Petty cash should be used to pay for small business expenses up to $100 where payments through accounts payable or credit card are not justified or appropriate

Issuing Petty Cash

Petty cash vouchers must be completed before any cash is taken from the petty cash float. Only up to $100 can be disbursed at any one time.

All petty cash vouchers issued must be approved by a Senior Manager.

Once the petty cash is spent, a receipt or invoice should be attached to the voucher and returned to petty cash with any balance of monies unspent All completed vouchers must have the following details included:

- Issue date of voucher;

- Name of person who issued the voucher;

- Amount of monies disbursed;

- Details of expense;

- Invoice or receipt

- Signature of approval person

Reconciling Petty Cash

Petty cash float is to be reconciled at least monthly. This is the responsibility of {insert relevant job title here}

All petty cash expenditure must be entered into the financial system once the petty cash has been reconciled.

The balance of monies and vouchers must equal the petty cash float amount before reimbursement can be made. Reimbursement of petty cash will be authorised by a Senior Manager.

Use of Business Credit Card Policy

Purpose of the Policy

This policy provides guidelines for the issue and use of business credit cards.

Procedures

An employee will only be issued a credit card once the Credit Card Authorisation Form has been completed.

The business credit card can only be used for travel, authorised entertainment and purchases of small value expenses or equipment up to the value of $500.

No cash advances are to be taken using the business credit card unless authorised by the Finance Manager.

Where a business credit card is lost or stolen, the owner of this card is to notify the Finance Manager, who is responsible for notifying the issuing agency and ensuring the card is cancelled. The business credit card is not to be used for personal expenses.

All holders of business credit cards are required to reconcile the monthly credit card statement to the expense form, attach all receipts for payments made on the credit card and have the expense statement authorised by the Finance Manager.

Upon completion and authorisation of the monthly expense statement, these documents are to be forwarded to the Finance Manager for payment of the credit card statement.

All business credit cards are to be returned to the business when the person is requested to by the Finance Manager or where they are no longer an employee of the business.

New Supplier Policy

Purpose

All new suppliers to the business must be reviewed and accepted in accordance with this policy to ensure that the supplier service is aligned with the business objectives.

Procedures

Choosing a New Supplier

A new supplier must provide our business with quality products, great service, competitive pricing and efficient delivery.

The following information table must be completed prior to agreeing to services Supplier Selection Background Information Business Name of Supplier:

Location of Supplier:

- Products/Services provided by supplier: (Attach a list if necessary)

- Name of business owner/ sales representative:

- For how many years has the supplier been trading?

Appointment of Supplier

The appointment of a new supplier will be authorised by the Finance Manager.

All relevant details of the supplier will be entered into the financial system by Administration Assistance once approval is obtained from the Finance Manager.

The Finance Manager will review information entered into the financial system and independently verify the bank account or other payment details of the supplier to ensure payments made are to the correct supplier

Supplier Payment Terms

All purchases from suppliers must be supported by a purchase order.

Payment terms for all suppliers must be reviewed by {Insert relevant job title here} every {Insert timing of review here, recommended at least once a year}. Following this review each supplier must be approached to seek improved payment terms by Finance Manager.

All supplier payment terms must be a minimum of 30 days.

Any variation to the above must be authorised by Finance Manager.

All supplier payments are to be reviewed once a quarter to ensure that payment terms are adhered to. For payments made to any suppliers earlier or later than the agreed terms. The Finance Manager will prepare a report that details the reasons why payment terms have not been adhered to.

This report will be reviewed and authorised by the CEO.

Notes on budget:

- No contingency amount factored into the original budget.

- Monthly monitoring missed on three occasions.

- Staff report difficulty in understanding how to monitor budgets.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank