Examine The Performance Of Telstra Assignment

- Country :

Australia

Question 1

To examine the performance of Telstra, information from Statement of Profit and Loss from financial statement section has to be taken. In financial statement, Balance sheet with assets and liabilities as its main component represents financial position of the company and Statement of profit and loss represents the financial performance. Profit and loss statement contains revenue and expenses portion which helps to determine what turnover company has earned during the year and expenses incurred by it to get that turnover. Net income at end of the statement represents the income left over all the expenses for the shareholder. It also represents Earning per share (both basic and diluted) to further make shareholder informed about their earning throughout the year for each share held by them.

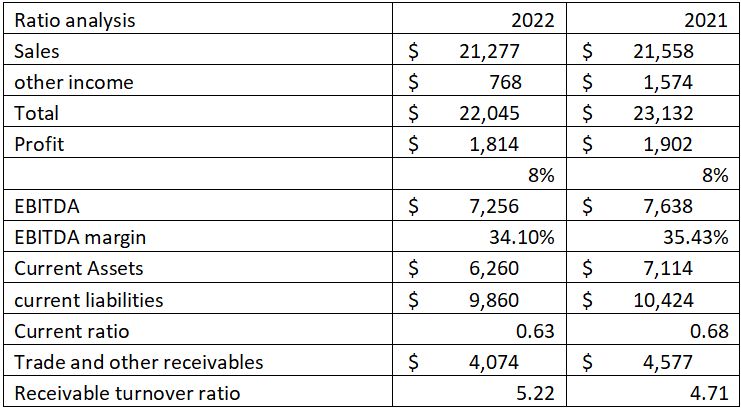

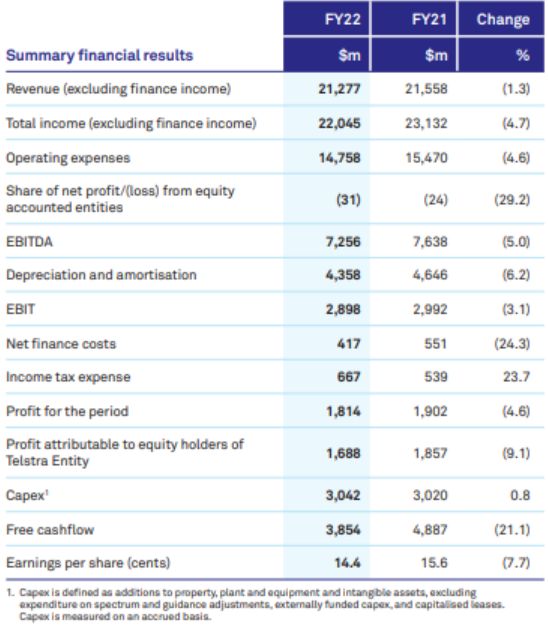

Telstra performance in year 2022 declined as comparison to year 2021. Its turnover is year 2022 is $22045 m only while it was $23132 m in year 2021. Thus, there has been declination in performance in year 2022 by 5% on turnover. Also, EPS has declined from 15.6 cents to 14.4 cents. However, profit margin is more or less same at 8% in both the year. It can be thus said that company has not performed well rather than just established its position as it was in previous year.

To reach out at reasonable conclusion about the performance of Telstra, further analysis on its previous 5 years performance, ratio analysis, competitor status or performance by competitor in the same industry would be required. Few ratio analysis has been carried out from the information available , it represents that Telstra has liquidity crunch as it might not be able to meet its current liabilities in future represented by current ratio. EBITDA margin has declined from 35% to 34.1% which indicates decline in performance . Furthermore, receivable days has almost doubled in these years. However, to arrive at reasonable conclusion, further data from previous years and its ongoing business strategy would be beneficial.

For future performance, company may decline its performance as evident from trend from 2021 to 2022 and it can be concluded that Telstra company performance has declined in year 2022.

Question 2

From MD&A in Telstras Annual report, information with respect to main achievements of company briefing on the strategy adopted to reach the achievement, challenges faced can be gained. Information of T22 strategy and its scorecard and T25 strategy and score card followed by material risk that company is facing is also shared in these pages. Company is evolving its strategy to new era of T25 strategy which involves risk like climate change, network risk, cyber-attacks, regulatory compliances, stakeholder expectations, geopolitical environment and its risk. So, management discussion and analysis provides information on ongoing strategy at company along with description on what risk it is facing and what would be its steps to cover those risk. Information on company segment wise performance is also available in this segment of report.

Financial year achievement per shareholder wise, customer wise, network wise, gives an overall insight on performance of company. A snapshot from annual report below helps understanding and evaluating financial performance of company. This shows company has declined in its performance this year.

Question 3

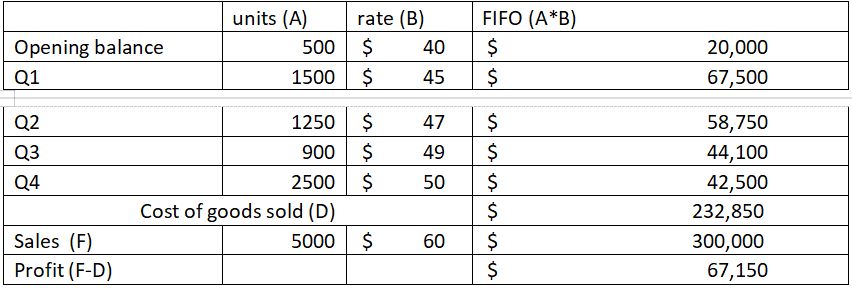

Calculation of profit under FIFO method:

For Q4 cost of goods sold under FIFO method,

Units covered till Q 3 = 500+1500+1250+900 = 4150

So, units sold from Q4 = 5000-4150 = 850

COGS for Q4 goods sold = 850*50 = $42500

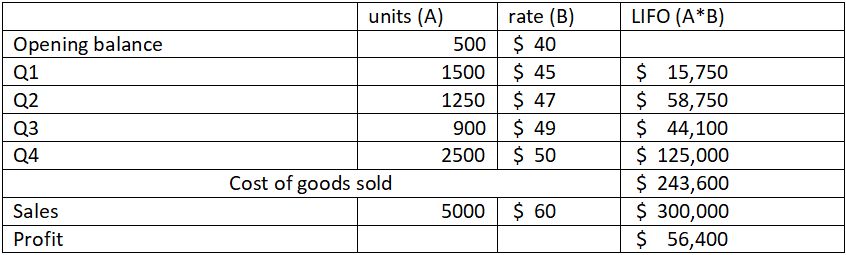

In LIFO, last in goods are sold at first. So, calculation of goods sold has been done for goods received in Quarter 4. Only 350 ( 5000-4650) quantity of goods are sold from quarter 1 purchased goods. Hence, COGS for 350 goods in Q1 has been taken at $15750 at the rate of $45 per unit.

Question 4

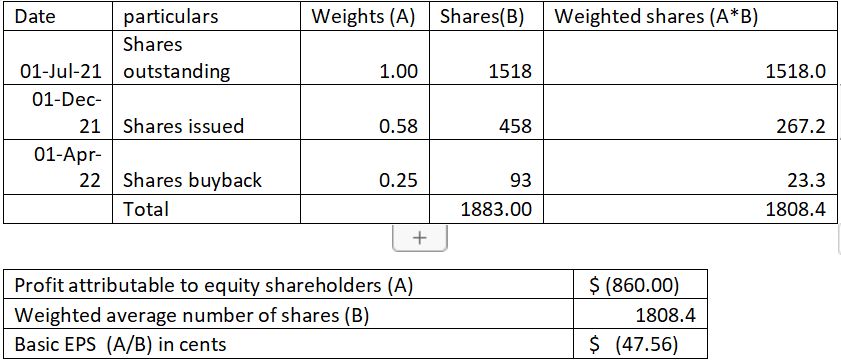

Computation of basic EPS

Calculation of weighted average number of shares

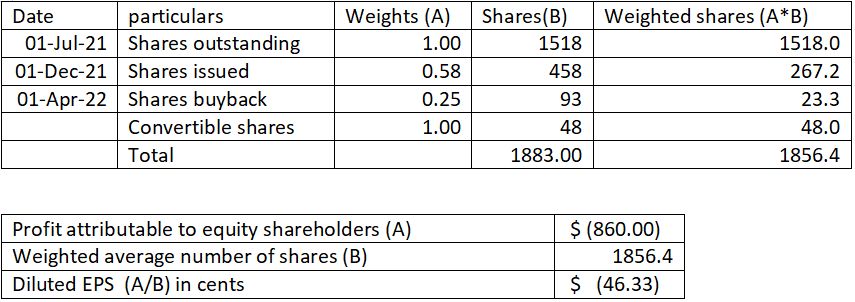

Diluted EPS

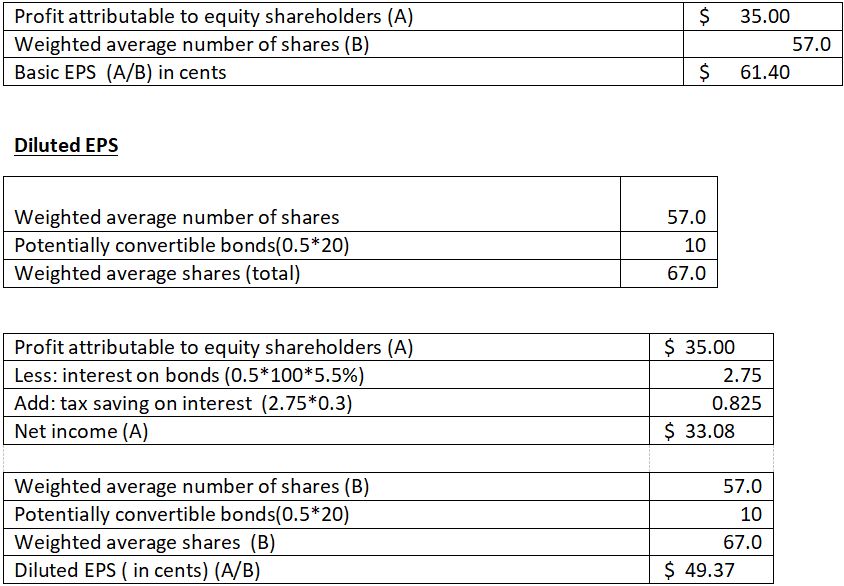

Question 5

Basic EPS

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank