HI5001 Accounting For Business Decisions Assignment

- Subject Code :

HI5001

- Country :

Australia

Question 1 (10 marks)

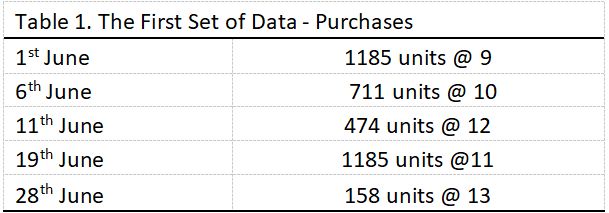

The accounting department of MNO Limited (MNO) provides two sets of data for June. The first data relates to the purchase, and the second data relates to the sales.

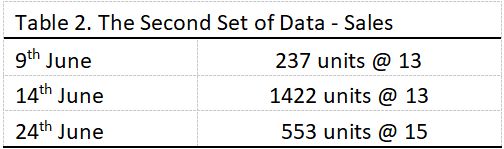

The following data relates to the sales:

Required:

Based on the above information, calculate the following for the month of June 20X0:

- Cost of goods sold (COGS)(4 Marks)

- Cost of closing inventory(3 Marks)

- The gross profit(3 Marks)

Question 2 (10 marks)

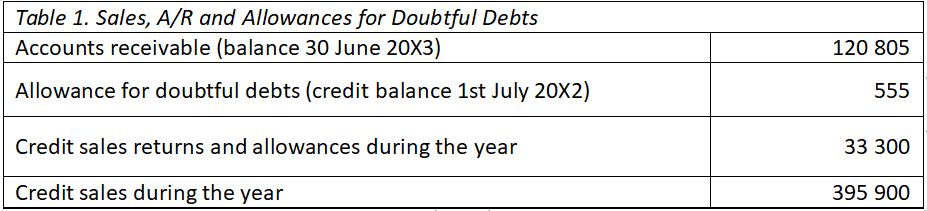

Credit Sales refer to therevenue earned by a company from its products or services, where the customer paid using credit rather than cash. JKL Limited (JKL) sells its products on credit. The table below presents the information relating to the selected accounts.

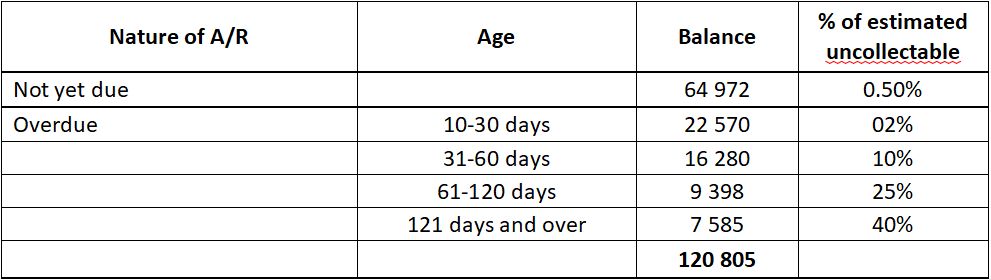

In the past, the companys yearly bad debt expense had been estimated at 2% of net credit sales revenue. It was decided to compare the current method with an ageing of the accounts receivable method. The following analysis was obtained with respect to the accounts receivable.

Required:

- Prepare journal entries to adjust the Allowance for Doubtful Debts at 30 June 20X9 using the net credit sales method.(3 marks)

- Prepare journal entries to adjust the Allowance for Doubtful Debts at 30 June 20X9 using the ageing of accounts receivable method.(3 marks)

- Determine the balance in the Allowance for Doubtful Debts account under the net credit sales method.(2 marks)

- Determine the balance in the Allowance for Doubtful Debts account under the ageing of accounts receivable method.(2 marks)

Question 3 (10 marks)

On 1st January 20X1, WWW Limited (WWW) purchased new machinery for $210 560. WWW paid some directly attributable cost to bring this machinery into working condition. In particular, WWW paid the freight cost of $3 580 and the installation cost of $4 843. This machine is expected to have a useful life of ten years with a residual value of $2 106. The pattern of economic benefits from using this machinery is constant. Therefore, it is decided that the straight-line depreciation method will be used. Ignore GST.

Required:

- Determine the cost of the machine (4 marks)

- Assuming that year ends on 30 June, record the journal entry of depreciation expenses on 30 June 20X3 (3 marks)

- Calculate the accumulated depreciation balance at the end of the fourth year(3 marks)

Question 4(10 marks)

Table 1 presents the information extracted from the accounting records and bank statement of GHI Limited (GHI) at 30 June 20X3.

Required:

- Prepare the bank reconciliation statement at 30 June, 2010 disclosing the closing balance of cash at the bank. (5 marks)

- Assume the same data as above, but assume further that the closing balance of the bank account shown on the bank statement is $1 575 Dr., i.e., the bank account is overdrawn). Prepare the bank reconciliation statement at 30 June, 20X3 disclosing the closing balance of cash at the bank. (5 marks)

Question 5 (10 marks)

You have performed the processes involved in the SAP S/4HANA Procurement and Fulfilment (recall your SAP ERP assessment). Briefly describe these processes. Is there any theoretical linkage between the fulfilment process and the procurement process? Finally, what challenges did you face in completing SAP ERP Assessment? Note: Your responses will be verified using your SAP ERP account details.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank