Prepare Financial Statements For Non-Reporting Entities Assignment

- Subject Code :

FNSACC414

- Country :

Australia

Part 4: Scenario

To complete this part of the assessment, read the scenario and complete the following task/s.

Scenario: Parternships

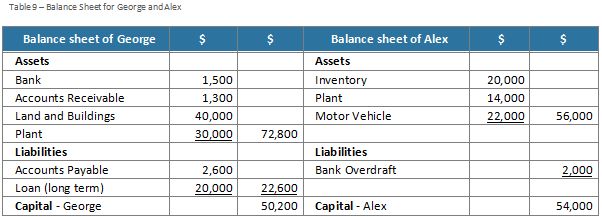

On 1 July 2021, George and Alex agree to amalgamate their businesses to form Central Perk Cafe. The balance sheets of each at the time of the agreement were as follows:

The agreement provided that:

- Georges assets and liabilities will be taken over at book value except:

- Accounts Receivable are expected to realize $1,100

- Land and buildings are to be valued at $45,000

- Alexs assets and liabilities will be taken over at book value except:

- Inventory to be written down by 10%

- Bank overdraft will be paid out prior to entry into the partnership.

- Both partners agreed that their capital would be fixed at $55,000 and any shortfall would be made up by a contribution of cash.

Task:1 Formations

A. General journal entries

As part of preparing financial statements for the formation of a partnership your manager has asked you to prepare general journal entries to record the formation of the partnership.

Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 1A) to complete the task.

B. Balance sheet

As part of preparing financial statements for the formation of a partnership your manager has asked you to prepare a balance sheet of the new partnership.

Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 1B) to complete the task.

Scenario: Parternship operation

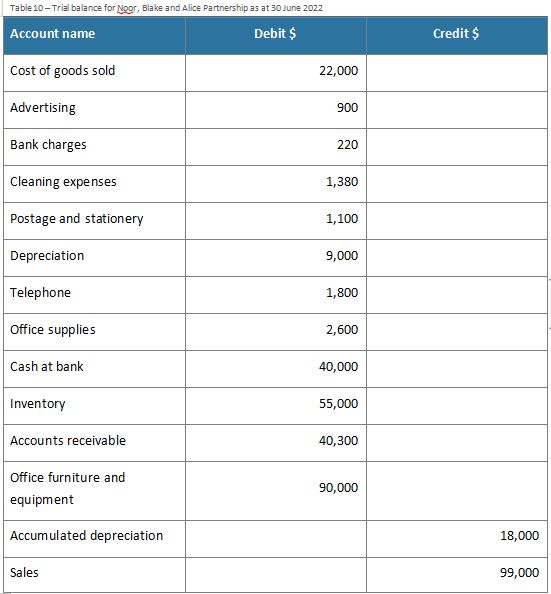

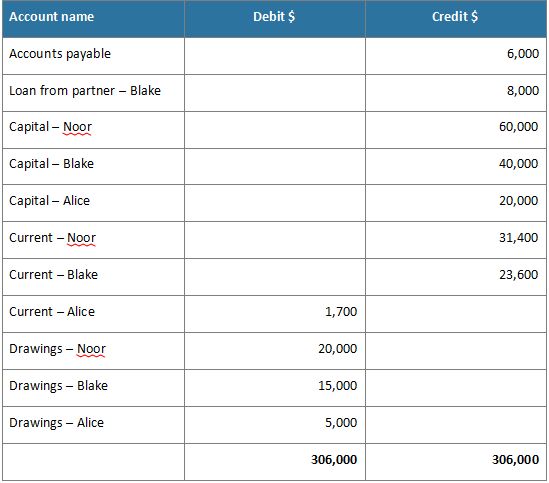

Noor, Blake and Alice share profits and losses in the ratio of 5:4:3. The Trial Balance for the year ending 30 June 2022 before final adjustments was:

Other information:

- Salary due (not paid) to Noor $19,000

- Interest on loan due (not paid) to Blake $2,000

As per the partnership agreement, interest on fixed capital is 7% and interest on drawings is 15%. General Journal entries for the end of period adjustments.

statement of performance

A. Journals for end of period adjustments

You are required to complete general journal entries to record the end of period adjustments.

Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 2A) to complete the task.

B. Income statement

You are required to complete an income statement for the year ending 30 June 2022. Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 2B) to complete the task.

Task 3: statement of financial position

A. Profit and loss appropriation account

You are now required to complete the profit and loss appropriation account.

Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 3A) to complete the task.

B. Current accounts for each partner

You are now required to complete the current accounts for each partner.

Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 3B) to complete the task.

C. Balance sheet as at 30 June 2022

You are now required to complete a balance sheet as at 30 June 2022.

Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 3C) to complete the task.

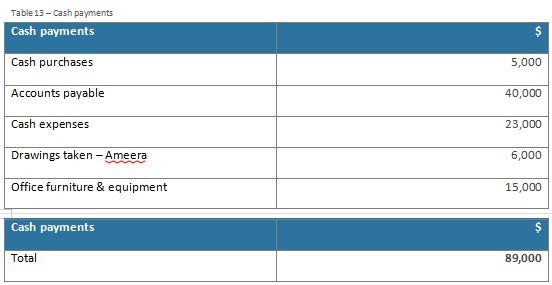

Task4: cash flow statement

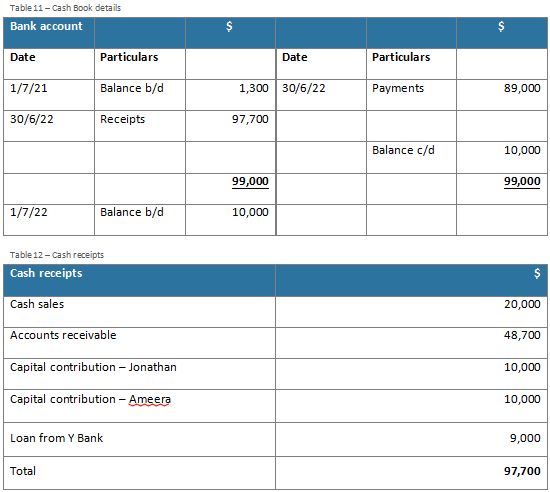

From the following Cash Book details you are required to prepare the Partnership Cash flow statement for Jonathan and Ameera.

Use the template in FNSACC414_AE_Sk2of3_Appx_ExcelTemplates2.xlsx (Part 2 Task 4) to complete the task.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank