Accountancy & Financial Management-I ACC101

- Subject Code :

ACC101

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: I

Subject: Accountancy & Financial Management- I

Q-1. From the following of ABC and XYZ item value closing stock on 31-3-2004 applying (a) FIFO to ABC (b) Weighted average to XYZ.

|

ABC |

XYZ |

|

|

Stocks (kgs) 0n 1-3-2004 |

2000 @ Rs. 28 |

4,000 @ Rs. 13 |

|

Purchases (kgs) |

||

|

(i) On 11-3-2004 |

1,800 @ Rs. 27 |

2,500 @ Rs. 14 |

|

(ii) On 21-32004 |

1,700 @ Rs. 25 |

2,000 @ Rs. 18 |

|

Sales (kgs) |

||

|

(i) On 6-3-2004 |

1,300 |

2,500 |

|

(ii) On 15-3-2004 |

1,400 |

2,000 |

|

(iii) On 18-3-2004 |

700 |

1,300 |

|

(iv) On 29-3-2004 |

1,100 |

1,700 |

Q-2. Vinayakas Trial Balance as on 31stMarch 2004 is as follows:

|

Particulars |

Dr. Rs. |

Cr. Rs. |

Particulars |

Dr. Rs. |

Cr. Rs. |

||

|

Opening Stock: |

Printing & stationery |

5,200 |

|||||

|

Raw Material |

2,50,000 |

Bank Charges |

2,500 |

||||

|

Work-in-Progress |

80,000 |

Traveling Expenses |

10,000 |

||||

|

Finished Goods |

2,20,000 |

Discount |

3,300 |

||||

|

Purchases |

2,15,000 |

Sales return |

11,000 |

||||

|

Building |

1,50,000 |

Advertisement |

5,500 |

||||

|

Plant & Machinery |

3,60,000 |

Sales |

7,80,000 |

||||

|

Furniture |

40,000 |

Capital- |

8,50,000 |

||||

|

Trade Mark |

30,000 |

Sundry Creditors |

52,000 |

||||

|

Wages |

83,000 |

Sundry debtors |

82,500 |

||||

|

Factory Taxes |

4,000 |

Discount |

2,500 |

||||

|

Motive Power |

9,000 |

Miscellaneous Expenses |

5,500 |

||||

|

Factory Insurance |

5,000 |

Bills Payable |

34,000 |

||||

|

Salary to office staff |

11,000 |

Bills Receivable |

16,000 |

||||

|

Office Rent |

10,500 |

Corporation bank |

98,000 |

||||

|

Carriage Inward |

2,500 |

Cash on hand |

9,000 |

||||

|

17,18,500 |

17,18,500 |

||||||

|

Adjustments: |

|||||||

|

(1) Closing stock: |

Rs. |

||||||

|

Raw Materials |

85,000 |

||||||

|

Work-in-Progress |

30,000 |

||||||

|

Finished Goods |

2, 05,000 |

||||||

- Factorytaxes prepaid 2,000.

- Depreciation:Furniture 10%

Plant & machinery 15% Trade Mark 20%

Building 5%

Please prepare manufacturing, Trading and Profit & Loss Account for the financial year 2003-04 and Balance Sheet as on 31-3-2004.

Q-3. Apana Bazaar has three Departments X, Y, and Z Please the profit and loss accounts for the year 2003 from the following figures:

|

Particulars |

X Rs. |

Y Rs. |

Z Rs. |

|

Opening Stock on 1stJanuary 2003 |

40,000 |

50,000 |

55,000 |

|

Purchases |

1,00,000 |

1,50,000 |

1,60,000 |

|

Sales |

1,20,000 |

1,80,000 |

2,00,000 |

|

Closing Stock on 31stDecember, 2003 |

80,000 |

90,000 |

1,10,000 |

The following expenses were recorded:

|

Rs. |

|

|

Rent & Taxes |

24,000 |

|

General Expenses |

36,000 |

|

Salesmans Salary |

18,000 |

|

Commission received |

1,00,000 |

The following expenses were recorded:

Salesmans Salary and Rent and Taxes equally.

General expenses in the ratio of 2: 3: 4 to X, Y, and Z respectively. Commission received on the basis of sales.

Q-4. The Car Mart company purchases a motor car from Autoriders Company on a hire purchase agreement on January 1, 2001, paying cash Rs. 10,000 and agreeing to pay further three installments of Rs. 10,000 each on 31stDecember each year. The cash price of the car is Rs. 37,250 and the Autoriders Company charges interest at 5% p.a. The Car Mart company writes off 10% p.a. as depreciation on the reducing installments system. Compute the amount of yearly depreciation.

Question:

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: I Subject: Tally

- Summarizethe steps for installation of

- Explainin detail vouchers and types of vouchers in

- Discussutility of F11 and F12

- Discussadvantage and disadvantages of accounting in Computerized

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank Semester: II Subject: BFSI

Questions:

- Explainthe importance of Role Banking

- Explainthe Types of

- Explainthe Types of Commercial Bank

- Explainthe Importance of Financial

- Explainthe Types of Machine

- Explainthe Distinguish Between Artificial Intelligence & Machine

- Explainthe Importance of Role in

- Explainthe Function of Commercial

- Explainthe Types of

- Writea Short Notes of CBS

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank Semester: II Subject: AFM

Q.1)

A retail trader asks you to prepare accounts of his business for the year ended 31stDecember, 2017. On investigation, you find that from time to time cash been paid into Banking Account and cheques thereon have been drawn for business and private purpose.

From the following information obtained from the records, prepare Profit & Loss Account for the year ending on 31stDecember, 2017 and Balance Sheet as on 31stDecember, 2017. Any difference in the cash book may be treated as drawings for personal use.

|

Particulars |

? |

|

Cash received from the Debtors and paid into Bank |

32,500 |

|

Dividend received on Personal Account paid into Bank |

300 |

|

Payments to Creditors out of the Bank |

28,300 |

|

Private Payments out of Bank |

4,200 |

|

Cash Sales |

45,000 |

|

Cash Purchases |

29,500 |

|

Direct Expenses of business |

6,000 |

|

Other Expenses |

4,190 |

The Assets and Liabilities of business at the beginning and the end were as under

|

Particulars |

Opening Balance ? |

Closing Balance ? |

|

Stock |

6,000 |

4,300 |

|

Motor |

7,500 |

? |

|

Trade Debtors |

4,200 |

6,000 |

|

Cash on hand |

90 |

100 |

|

Cash at Bank |

1,500 |

1,800 |

|

Trade Creditors |

5,900 |

6,500 |

Depreciation at twenty per cent per annum is to be provided on Motor Van

Expenses outstanding in respect of Motor van amount to ? 300. Expenses included in other expenses consists of expenses : in respect of Motor Van amounting to ? 900 and personal payments of Proprietor amounting to ? 150 paid to Tailor and ? 200 paid to Grocer.

Q.2)

Shri. HJ maintains his books on the Single Entry System and furnishes the following details to you for the year 2018:

|

Particulars |

1.1.2018 ? |

31.12.2018 ? |

|

Fixed Assets |

20,000 |

25,000 |

|

Debtors |

25,000 |

40,000 |

|

Creditors |

15,000 |

20,000 |

|

Stock |

10,000 |

15,000 |

|

Cash at Bank |

5,000 |

8,000 |

The other information relating to the year 2018 is as follows

|

Particulars |

? |

|

Receipts from Debtors |

2,50,000 |

|

Payment to Creditors |

2,00,000 |

|

Discounts earned |

5,000 |

|

Bad Debts |

7,000 |

|

Expenses paid |

30,000 |

|

Drawings of Shri. HJ |

6,000 |

|

Cash Sales |

5,000 |

|

Cash Purchases |

11,000 |

|

Purchase Returns |

26,000 |

You are required to prepare the Profit & Loss Account for the year 2018 and a Balance Sheet as at 31stDecember, 2018 after making the following adjustments

- DepreciationFixed Assets at 10 per cent of the Balance as at 31stDecember, 2018

- Providefor outstanding liabilities for expenses of ? 5,000

- Providea Reserve for Bad Debts of ? 2,500

Q.3)

Shri Engineer who keeps his books by single entry gives you the following information for the year 2018.

|

Receipts |

? |

Payment |

? |

|

To Balance at Bank |

4,350 |

By Engineers Drawings |

7,520 |

|

To Sundry Debtors |

38,400 |

By Trade Creditors |

27,100 |

|

To Bills and Receivable realised |

12,000 |

By Bills payable |

9,300 |

|

To commission Received |

1,500 |

By wages |

12,000 |

|

To cash sales |

8,600 |

By Salaries |

6,500 |

|

To Balance c/d |

3,350 |

By Rent and taxes |

4,400 |

|

By Insurance |

800 |

||

|

By Carriage |

250 |

||

|

By Advertising |

330 |

||

|

68,200 |

68,200 |

Particulars of outer asset and liabilities

|

Particulars |

1.1.2018 ? |

31.12.2018 ? |

|

Stocks on Hand |

18,700 |

23,400 |

|

Debtors |

12,000 |

14,000 |

|

Creditors |

9,000 |

1,500 |

|

Bills receivables |

4,000 |

5,000 |

|

Bills Payable |

1,000 |

200 |

|

Furniture |

600 |

600 |

|

Building |

12,000 |

12,000 |

A reserve of Rs. 1,450 is required for doubtful debts and depreciation at 5% is to be written off Building and Furniture. Rs. 3,000 are outstanding for the wages and Rs. 1,200 for salaries. Insurance has been prepaid to the extent of Rs. 250. Legal Expenses are outstanding to the extent of Rs. 700.

Prepare final accounts

Q.4)

Mr. Ramji supplies you the following information:

|

Particulars |

1.4.2017 Rs |

31.12.2018 Rs |

|

Sundry Debtors |

90,000 |

1,05,000 |

|

Stock |

75,000 |

85,000 |

|

Sundry Creditors |

55,000 |

60,000 |

|

Furniture |

20,000 |

? |

|

Machinery |

1,75,000 |

? |

Summary of cash transaction for the year 2017-18:

|

Receipts |

Rs |

Payments |

Rs |

|

Opening Balance |

5,000 |

Creditors |

1,75,000 |

|

Cash Sales |

55,000 |

Wages |

80,000 |

|

Received from Debtors |

3,90,000 |

Salaries |

75,000 |

|

Loan from Raj@ 10% p.a. |

Expenses |

30,000 |

|

|

On 1.10.2017 |

50,000 |

Drawings Income Tax Machinery Purchased on 1.10.2017 Closing Balance |

45,000 |

|

15,000 |

|||

|

50,000 |

|||

|

30,000 |

|||

|

5,00,000 |

5,00,000 |

Discount allowed were Rs. 6,000 and discounts received Rs 5,000. Bad debts written off were Rs. 4,000. Depreciation is to be provided on furniture @ 5% p.pa. and on machinery @ 10%p.a.

Expenses include payment of Rs. 1,000 which relates to 2017-18. Wages outstanding Rs. 7,500. Prepare Trading and Profit and Loss Account of Mr. Ramji for the year ended 31stMarch ,2018 and Balance Sheet as on that date.

Questions:

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

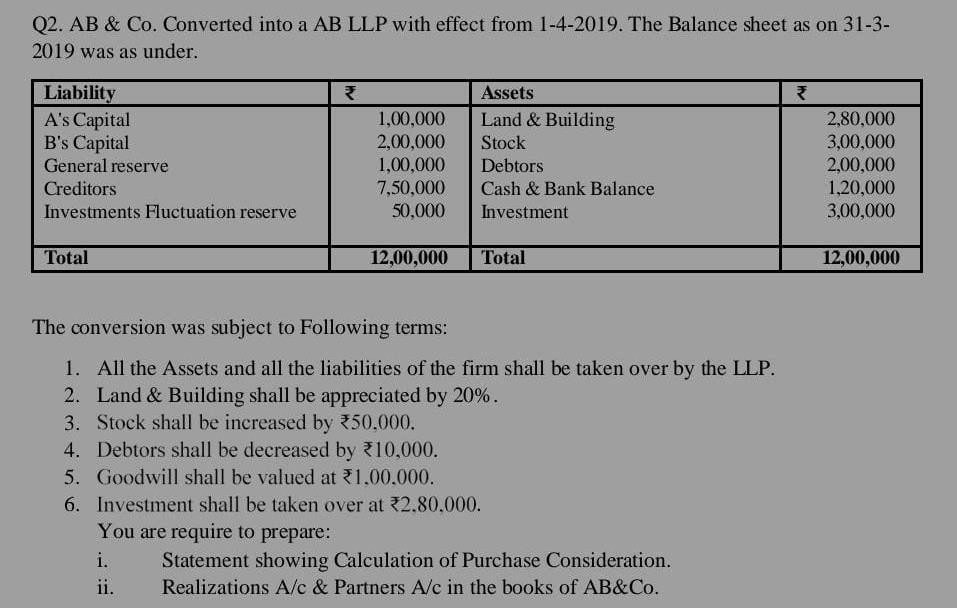

ATKT Question Bank Semester: III Subject: AFM

- Whatis Partnership Deed? Explain it's

- Whatis Piecemeal Distribution of Cash? Explain it's order of payment?

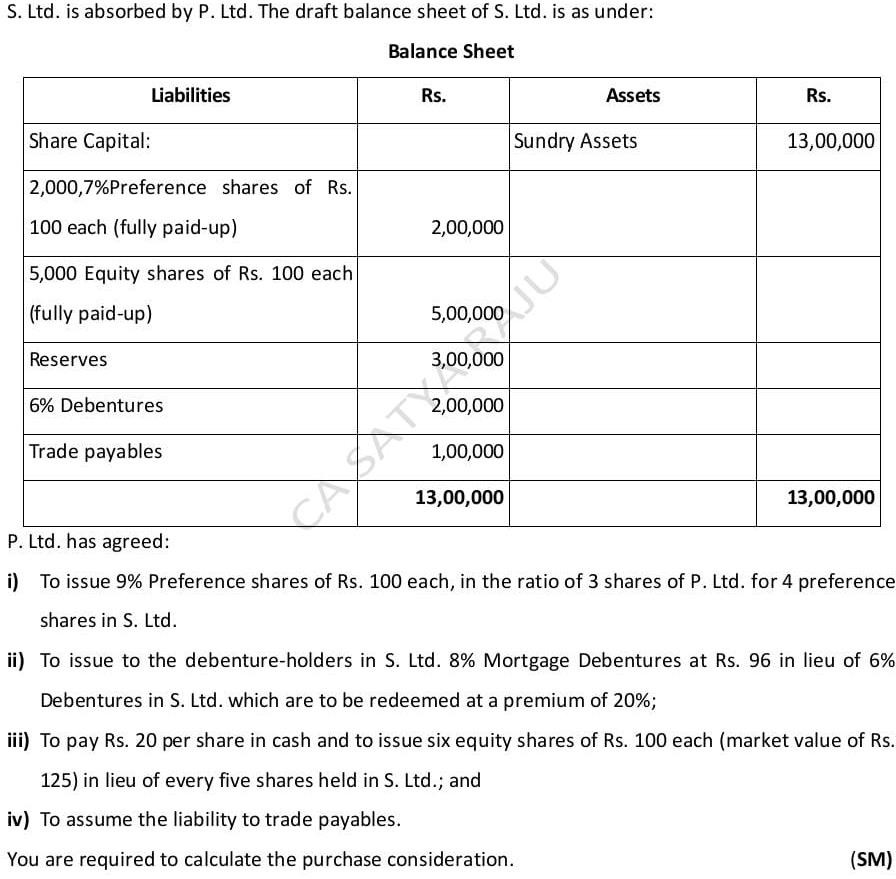

- Whatis Amalgamation? Explain various methods of Calculation of Purchase Consideration?

- Whatis difference between Conversion of Firm into Ltd. Company & Amalgamation of Firms?

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: III

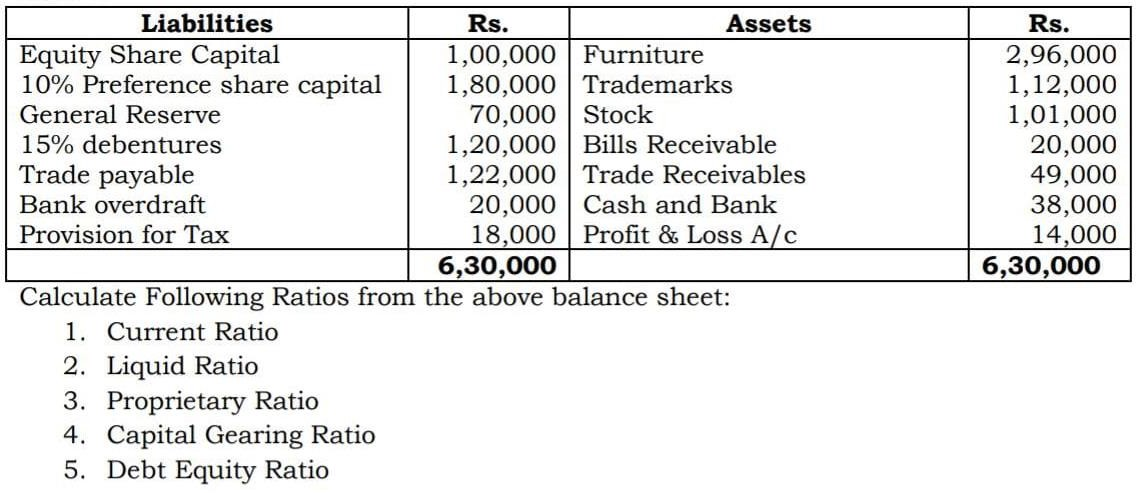

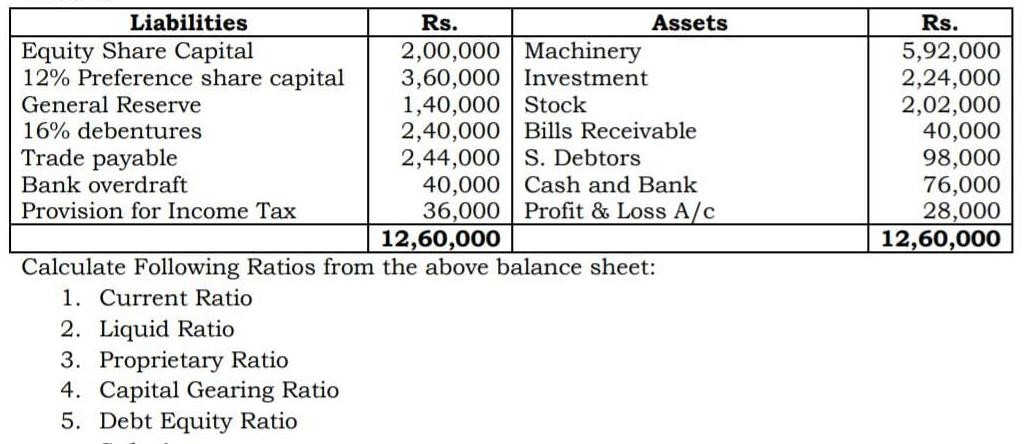

Subject: Management Accounting

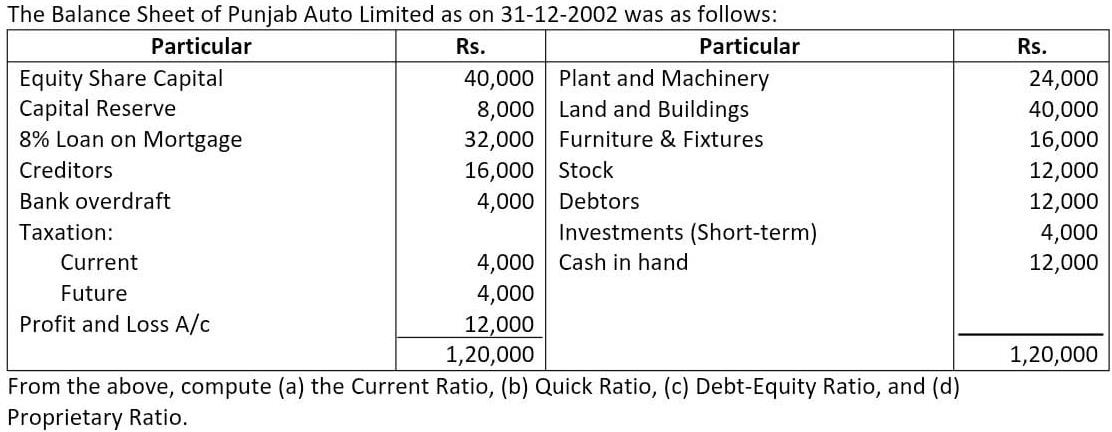

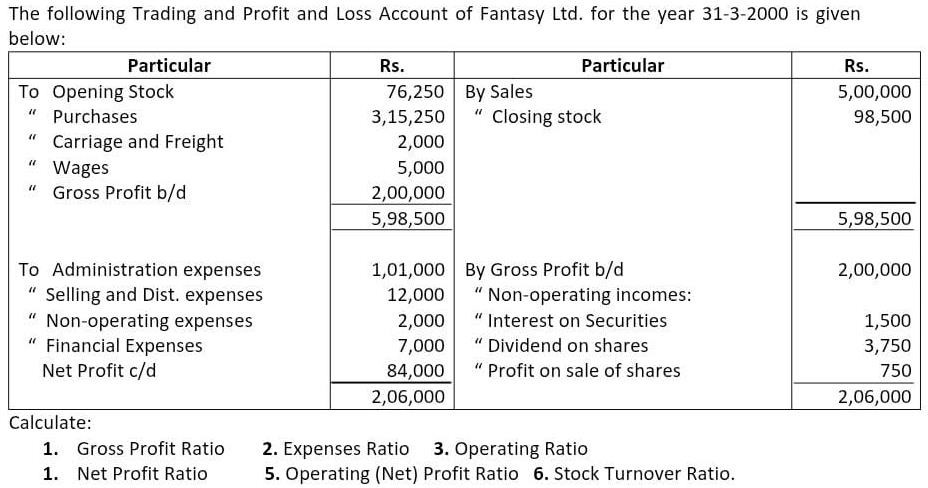

Q.1)

Q.2)

Q.3)

Q.4)

Q.5)

Q.6)

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank Semester: Subject:

Questions:

1.

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: IV Subject: Auditing

Questions:

- Explaintype of error

- Explainadvantages of audit

- ExplainTypes of Audit

- Whatdo You mean by audit program explain it's advantages

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: IV

Subject: Accountancy & Financial Management- IV

Q.1)

Pass necessary Journal entries in the books of N of Nashik based on AS 11

A machine was imported on 20thJanuary 2021, from Jackie Chan of China for US $ 2,00,000. The payment for the same was made as follows.

US $ 1,50,000 on 27thFebruary 2021 US $ 50,000 on 15thMarch 2021

The Exchange rate for $ 1 was as follows On 20thJanuary 2021 Rs 47.00

On 27thFebruary 2021 Rs 46.50

On 15thMarch 2021 Rs 48.00

Nia follows financial year as accounting year.

Q.2)

ABC Ltd. was incorporated on 1.5.2019 to take over the business of DEF and Co. from 1.1.2019. The summarized Profit and Loss Account as given by ABC Ltd. for the year ending 31.12.2019 is as under: Summarized Profit and Loss Account

|

Particulars |

?` |

Particulars |

? |

||

|

To |

Rent and Taxes |

90,000 |

By By |

Gross Profit Interest on Investment |

10,64,000 |

|

To |

Salaries including managers salary of Rs 85,000 |

3,31,000 |

36,000 |

||

|

To |

Carriage Outwards |

14,000 |

|||

|

To |

Printing and Stationery |

18,000 |

|||

|

To |

Interest on Debentures |

25,000 |

|||

|

To |

Sales Commission |

30,800 |

|||

|

To |

Bad Debts (related to sales) |

91,000 |

|||

|

To |

Underwriting Commission |

26,000 |

|||

|

To |

Preliminary Expenses |

28,000 |

|||

|

To |

Audit Fees |

45,000 |

|||

|

To |

Loss on Sale of Investments |

11,200 |

|||

|

To |

Net Profit |

3,90,000 |

|||

|

11,00,000 |

11,00,000 |

||||

Prepare a Statement showing allocation of expenses and calculations of pre- incorporation and post- incorporation profits after considering the following information:

- P.ratio was constant throughout the year.

- Salesfor January and October were 1 times the average monthly sales while sales for December were twice the average monthly sales.

- BadDebts are shown after adjusting a recovery of 7,000 of Bad Debt for a sale made in July,

2019.

- Managerssalary was increased by 2,000 p.m. from 1.5.2019.

- Allinvestments were sold in April,

- Theentire audit fees relates to the

Q.3)

The following is the balance sheet of Suhas Mobiles Ltd. on the date of redemption of preference shares:

|

Liabilities |

Amt |

Assets |

Amt |

|

Share Capital: |

Fixed assets |

10,50,000 |

|

|

Equity share Capital (` 10 each) |

4,00,000 |

Investments (FV ` 2,37,500) |

2,00,000 |

|

Preference Share Capital (` 100 each, partly paid) |

1,00,000 |

||

|

Preference Share Capital (` 100 each, fully paid) |

2,00,000 |

Bank |

1,00,000 |

|

Capital Redemption Reserve |

1,00,000 |

Other current assets |

1,50,000 |

|

Securities premium A/c |

5,000 |

||

|

Profit and Loss A/c |

2,95,000 |

||

|

Current liabilities |

4,00,000 |

||

|

15,00,000 |

15,00,000 |

To redeem preference shares following resolution is passed:

- Preferenceshares are to be redeemed at a premium of 20%.

- Investmentsare to be sold at a loss of 5%.

- 5,000Equity shares of ` 10 each are to be issued at par for the purpose of redemption of preference

Pass journal entries to record the above transactions assuming that all the necessary formalities are fulfilled. Prepare balance sheet after redemption of preference shares.

Q.4)

Enron Ltd. gave notice of its intention to redeem its outstanding Rs. 6,00,000 8?bentures at Rs. 103 and offered the holders the following options.

- 10%Preference Shares of 20 each at Rs. 25.

- 9?bentures at 96.

- Tohave their holdings redeemed for

- Theholders of 1,80,000 debentures accepted proposal

- Theholders of 2,40,000 debentures accepted proposal

- Theremaining debenture holders accepted proposal Pass necessary journal entries in the books of Enron Ltd.

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: V Subject: Financial Accounting

Questions:

- Explainvarious Provisions of Companies Act 2013 for preparation of Company Final

- Distinguishbetween Internal & External Reconstruction?

- WriteConditions of Buyback of

- Whatis Underwriting of Shares? Explain various types of

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank Semester: V Subject: Tax

Q.1)

Mr. X earns the following income during the financial year 2023-24 Salary: ?12,00,000

House Rent Income: ?2,40,000 Bank Interest: ?20,000

Life Insurance Premium Paid: ?50,000

Compute his taxable income and tax liability for AY 2024-25 (Assume applicable tax rates).

Q.2)

Mr. X owns a house property that is let out for ?25,000 per month. The municipal taxes paid are ?15,000 per annum. Calculate the Net Annual Value (NAV) and Income from House Property after deductions under Section 24.

Q.3)

Dr. B, a medical professional, provides the following details for the financial year 2023-24: Consultation fees received: ?18,00,000

Rent paid for clinic: ?2,40,000 Salary to staff: ?3,60,000

Depreciation on medical equipment: ?1,00,000 Purchase of medical books: ?50,000

Professional tax paid: ?10,000

Interest on loan for clinic: ?60,000 Compute taxable income from profession .

Q.4)

XYZ & Co. (a partnership firm) provides the following details for FY 2023-24:

Income Details:

Business Income (after all expenses except depreciation): ?15,00,000 Depreciation as per books: ?1,20,000

Depreciation as per Income Tax Act: ?1,50,000

Interest on Partners Capital (Allowed by Partnership Deed): ?2,00,000 Salary to Partners (Allowed as per Deed): ?3,60,000

Compute the total income of the firm .

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank Semester: V Subject: CA

Q.1)

Following details are furnished by K.K Ltd of expenses incurred during the year ended 31stMarch 2023.

|

Particulars |

Amount |

|

Direct Wages Purchases of Raw Materials Factory Rent Cost of Catalogues Sundry Expenses Depreciation on Plant and Machinery Opening Stock of Raw Materials Repairs to Office furniture Carriage outwards Interest on Loans Closing Stock of Raw Materials Distribution of Free Samples Audit Fees Demonstration Expenses Furniture lost by Fire Indirect Materials Office Salaries Store keepers Salary Depreciation on Office Expenses Commission on Sales Direct Expenses Material Handling Charges Furniture Purchased |

1,10,000 2,40,000 35,000 17,100 18,500 19,000 25,000 12,500 25,650 12,700 15,000 13,775 11,500 13,300 8,000 26,000 27,500 9,000 10,000 15,675 90,000 11,000 1,40,000 |

Other Information:

- Stockof finished goods at the end 500 units to be valued at cost of

- Numberof units sold during the year were

- Profit desiredon sales is 20%.

Prepare Cost Sheet showing the various elements of cost both in total and per unit and also find out the total profit and per unit profit.

Q.2)

Prepare a statement showing closing stock on the basis of FIFO & Weighted Average Method

|

Date 2022 |

Purchases (Kg) |

Rate (Rs) |

Sales (Kg) |

|

March 1 4 5 10 18 23 29 31 |

600 --- 300 --- 200 --- 400 --- |

4.00 --- 3.80 --- 4.20 --- 4.40 --- |

-- 300 --- 200 --- 400 --- 300 |

Out of purchases March 5, 50 kgs were returned to the supplier on March 8. Out of Sales on March 23, a customer returned 20 kgs on March 26.

Q.3)

The following data is available from the financial accounts of a firm for the year ended 31stDecember 2022.

|

Particulars |

Amount |

|

Material Consumed Direct Wages Factory Expenses Administration Expenses Selling and Distribution Expenses Bad Debts Written off Loss on Sale of Investments Interest and Dividend received Sales (1,20,000 Units) Closing Stock (40,000 Units) Work in Progress 31-12 -22 |

5,20,000 2,40,000 3,60,000 5,00,000 9,60,000 40,000 30,000 1,20,000 19,20,000 4,00,000 1,60,000 |

The following information was revealed by the cost accounts:

- DirectMaterials consumption was Rs 5,70,000

- FactoryOverheads were taken at 20% on Prime Cost

- Administrationexpenses have been taken at Rs 4 per unit of

- Sellingand Distribution Expenses were taken at Rs 50 per unit sold. Prepare:

- Statementof Cost and Profit

- FinancialProfit and Loss Account

- Statementof

- Statementof Cost and Profit

Q.4)

The Zee company is divided into four departments: A,B and C are production departments and S is a service department. The actual costs for a period are as follows: 15 marks

|

Particulars |

Rs. |

Particulars |

Rs. |

|

Rent |

20,000 |

Fire Insurance (Stock) |

5,000 |

|

Repairs to Plant |

8,000 |

Power |

7,000 |

|

Depreciation of Plant |

5,500 |

Light |

1,000 |

|

Supervision |

25,000 |

Employers Insurance Liability |

2,500 |

The following information are available in respect of the four departments:

|

Particulars |

Departments |

|||

|

A |

B |

C |

D |

|

|

Area (Sq. Feet) |

150 |

110 |

90 |

50 |

|

Number of Employees |

20 |

15 |

10 |

15 |

|

Horsepower of Machines |

80 |

50 |

20 |

- |

|

Total Wages (Rs.) |

60,000 |

40,000 |

30,000 |

20,000 |

|

Value of Plant (Rs.) |

2,40,000 |

1,80,000 |

1,20,000 |

60,000 |

|

Value of Stock (Rs.) |

1,50,000 |

90,000 |

60,000 |

- |

|

Light points (Nos.) |

40 |

30 |

20 |

10 |

Apportion the costs of the various departments by the most equitable method.

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: VI Subject: Cost Accounting

Q.1)

From the following particulars you are required to calculate Fixed Cost

Profit Volume Ratio Break even sales

Sales to earn Profit of 6,00,000 Margin of Safety of the year 2012.

|

Particulars |

2012 (Rs) |

2013 (Rs) |

|

Total Cost |

12,96,000 |

18,72,000 |

|

Sales |

14,40,000 |

21,60,000 |

Q.2)

From the following, calculate materials cost variance, Materials Price variance and Material Usage Variance:

|

Material |

Standard |

Actual |

||

|

Units |

Price Per Unit |

Units |

Price Per Unit |

|

|

A |

600 |

Rs. 3 |

640 |

Rs. 4.00 |

|

B |

800 |

Rs. 5 |

960 |

Rs. 4.50 |

|

C |

1,000 |

Rs. 4 |

840 |

Rs. 5.00 |

Q.3)

Survey Ltd. provides you the following information for the month of January, 2019 about its processes per unit of the product.

|

Particulars |

Down ? |

Middle ? |

Up ? |

|

Basic raw Material introduced in units |

20,000 |

4,200 |

3,740 |

|

Cost of Basic Raw Material in units ? |

24 |

26 |

32 |

|

Labour Charges ? |

3,33,100 |

2,83,300 |

2,34,400 |

|

Sundry Material ? |

1,66,100 |

1,10,500 |

99,800 |

|

Factory Overhead ? |

1,92,000 |

1,17,480 |

97,920 |

|

Normal Loss % of the total no. of units input |

3% |

5% |

7% |

|

Scrap Value per unit ? |

12 |

15 |

21 |

|

Output Transferred to next process % |

70% |

60% |

- |

|

Output sold at the end of the process |

30% |

40% |

100% |

|

Selling price per unit of output sold ? |

65 |

85 |

110 |

Prepare Process Accounts.

Q.4)

Calculate a fare per passenger-km of CSR transport CO. from the following information for a Mini bus:

- Lengthof route: 30 km one way

- Purchaseprice 4,00,000

- Partof above cost met by loan, annual interest of which is 10,000 p.a.

- Otherannual charges:

Insurance Rs. 15,000 Garage rent Rs. 9,000 Road tax Rs. 3,000

Repairs & maintenance Rs. 15,000 Admin charges Rs. 5,000

- Running exp: drivers & conductors Salary Rs. 5000 p.m., repairs & replacement of tyres & tubes 3600 p.a., diesel & oil per km Rs.5

- Effective life of Vehicle is estimated at 5 years at the end of which it will have a scrap value of Rs.10,000.

- Minibushas 20 seats & is planned to make six, two-way trips for 25 days/pm Provide profit @ 20% on total revenue.

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

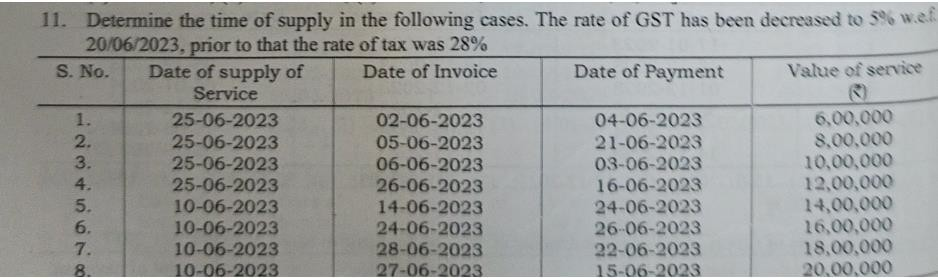

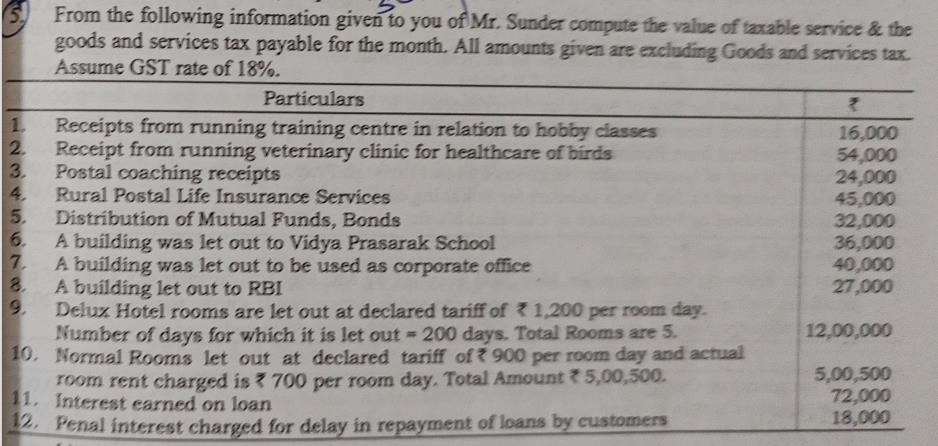

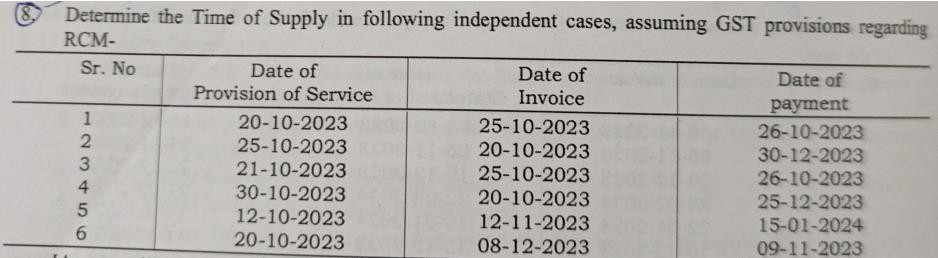

Semester: VI Subject: Indirect Tax

Q.1)

Q.2)

Q.3)

Q.4)

Q.5)

Thakur College of Science and Commerce Department of Accountancy

2024- 25

C.E. I

ATKT Question Bank

Semester: VI Subject: Financial Accounting

Q.1)

Q.2)

Q.3)

Q.4)