ACG510 Risk Based Audit & Assurance Assignment

- Subject Code :

ACG510

- University :

Charles Sturt University Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

Australia

QUESTION 1

15 marks

You are the audit manager assigned to the audit of Seagreen Pharmaceuticals Pty. Ltd. (SP) a wholly owned subsidiary of Universal Pharmaceuticals Inc. (UP), a company listed on the New York Stock Exchange. SP was established in 2006 to provide UP with access to the Australian and South East Asian markets. Since establishment SP have found trading conditions difficult.

The audit evidence obtained, and final review of this evidence suggests that unless SP receives a significant cash flow injection or trading conditions improve, it will be bankrupt within three months.

You have approached the CEO of SP with your concerns and he has indicated that there is nothing for you to worry about. The companys owners have guaranteed financial support of the company for as long as it takes to establish a market presence.

Required:

- Evaluate the impact of the parent companys support on your assessment of the going concern at SP. (4 marks)

- What further evidence will you require to assess the appropriateness of going concern at SP? (4 marks)

- Explain the reason for assessing the probability that any company will continue as a going concern. (7 marks)

QUESTION 2

15 marks

One Stop Supplies Pty Ltd is a single-store retailer that sells a variety of tools, garden supplies, lumber, small appliances, and electrical fixtures to the public, although about half of One Stop Supplies sales are to construction contractors on account.

Retail customers pay for merchandise by cash or credit card at cash registers when merchandise is purchased. A contractor may purchase merchandise on account, if approved by the credit manager based only on the managers familiarity with the contractors reputation. After credit is approved, the sales associate files a pre-numbered charge form with the accounts receivable supervisor to set up the receivable.

The accounts receivable supervisor independently verifies the pricing and other details on the charge form by reference to a management-authorised price list, corrects any errors, prepares the invoice, and supervises a part-time employee who mails the invoice to the contractor. The accounts receivable supervisor electronically posts the details of the invoice in the accounts receivable subsidiary ledger; simultaneously, the transactions details are transmitted to the bookkeeper. The accounts receivable supervisor also prepares a monthly computer-generated accounts receivable subsidiary ledger without a reconciliation with the accounts receivable control account, and a monthly report of overdue accounts.

The cash receipts functions are performed by the cashier, who also supervises the cash register clerks. The cashier opens the mail, compares each cheque with the enclosed remittance advice, stamps each cheque for deposit only, and lists cheques for deposit. The cashier then gives the remittance advices to the bookkeeper for recording. The cashier deposits the cheques daily, separate from the daily deposit of cash register receipts. The cashier retains the verified deposit slips to assist in reconciling the monthly bank statements, but forwards to the bookkeeper a copy of the daily cash register summary. The cashier does not have access to the journals or ledgers.

The bookkeeper receives the details of transactions from the accounts receivable supervisor and the cashier for journalising and positing to the general ledger. After recording the remittance advices received from the cashier, the bookkeeper electronically transmits the remittance information to the accounts receivable supervisor for subsidiary ledger updating. The bookkeeper sends monthly statements to contractors with unpaid balances upon receipt of the monthly report of overdue balances from the accounts receivable supervisor. The bookkeeper authorises the accounts receivable supervisor to write off accounts as uncollectible when six months have passed since the initial overdue notice was sent. At this time, the credit manager is notified by the bookkeeper not to grant additional credit to that contractor.

Required:

Describe five internal control weaknesses in One Stop Supplies internal control for the cash receipts and billing functions. Explain why each is a weakness

QUESTION 3

15 marks

Buggsy Ltd is a mattress manufacturer that achieved a net profit before income tax of $1 842 000 for the year ended 30 June 2021.

You have identified the following matters from your audit work:

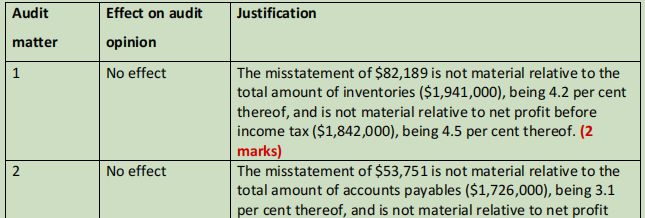

- Buggsy Ltds inventory amounted to $1,941,000 at 30 June 2021. To move some of its old stock, in July 2021 the company sold 25 per cent of its finished goods inventories held at 30 June 2021 for $82,189 below their original cost. Management has indicated that as the sales occurred after 30 June 2021, it believes that the value of finished goods at that date should remain at cost. The remainder of the inventory has only been purchased recently and is in great demand.

- Buggsy Ltds accounts payable at 30 June 2021 amounted to $1,726,000. Subsequent payments testing revealed that in July 2021, invoices totalling $53,751 were paid that related to June 2017 purchases of inventories. The relevant invoices were omitted from the balance of accounts payables at 30 June 2021. Management has indicated that it does not intend to adjust the financial report in relation to this issue.

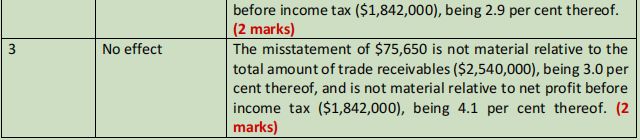

- Buggsy Ltds accounts receivable balance at 30 June 2021 amounted to $2 540 000. Your testing has revealed that the accountant used an incorrect exchange rate to translate overseas debtors at 30 June 2021. As a result, the balance of the accounts receivable account was overstated by $75,650. Again, management has indicated that it does not intend to adjust the financial report in relation to this issue.

Required:

- Explain the two circumstances under which a modified audit opinion is issued and explain the three different types of modified opinions. (6 marks)

- Explain whether the issues arising from your audit work (matters 1 to 3 above) will individually have any effect on your audit opinion. Justify your answer, using calculations. (6 marks)

- Identify the type of audit opinion that you will include in your audit report for Buggsy Ltd for the year ended 30 June 2021. Justify your answer. (3 marks)

QUESTION 4

15 marks

Part A

8 marks

Wagga Sports Club (WSC) is an indoor community sporting facility in the heart of Wagga Wagga.

WSC has recently been acquired and the new management committee of the club is keen to provide environmentally friendly facilities to its members. WSC is committed to protecting the natural environment and enhancing the economic sustainability for future generations. As a result the management committee has hired Jacqui Bowen, the environmental and sustainability expert at your audit firm to check its current energy use patterns for two months based on its internal records, and physically inspect the premises to identify factors that affect energy usage. Jacqui is to report the results of her testing to the management committee, so that they can consider areas where energy use may be reduced.

Required

- Referring to the relevant Australian auditing pronouncement, describe the level of assurance that Jacqui can provide on this engagement. (4 marks)

Part B

7 marks

Your audit client Georgie Green has recently implemented a business to business (B2B) electronic commerce system. Alex Matthews, the audit senior has stated that she would like to be able to determine the reliance that can be placed on the internal controls. However, she has limited knowledge of how, in such an IT environment, you can test controls sufficiently to justify relying on them.

Required

Explain to Alex the audit implications of the B2B e-commerce system. Identify the computer assisted audit techniques (CAATs) that might be appropriate to aid the testing of the controls, highlighting any strengths and weaknesses of the CAATs that you discuss.

SOLUTIONS

Question 1

- For the guarantee to positively impact on assessment of going concern, evidence of its existence must be obtained, and an evaluation of the guarantees legal enforce ability undertaken. The capacity of UP to provide financial support to SP must be also assessed but given its a parent company, rather than a government or bank, there may be insufficient evidence available to do that.

- additional audit procedures: (1 mark for each up to a max of 4)

- Review after balance date events

- analyse the latest interim financial report, cash flow and profit forecasts

- read the minutes of directors meetings for references to financial difficulties

- review the terms of venture and loan agreements

- request information from the entitys solicitors

- consider the effect of unfilled customer orders

- An imminent business failure may influence:

- the appropriateness of the presentations of the final report, i.e. whether the assets and liabilities should be valued at fair value or at liquidation values, or (2 marks)

- may motivate management misrepresentation to hide the failure by misstating amounts in the accounts and financial report (2 marks)

- In addition, liquidation increases the possibility that the auditor will have to defend the quality of the audit in court and so will want to be sure that the audit program and working papers are watertight. (3 marks)

Question 2

Answer (1 mark for identifying the weakness and 2 marks for explaining why it is a weakness = 3 marks for each weakness)

Any five of the following weaknesses:

Weakness 1: Inappropriate procedures for credit approval.

- The credit manager approves credit to contractors based on the credit managers familiarity with the contractors reputation.

- Credit is approved on an ad-hoc basis, without any credit check with an external party such as a credit rating agency, or the contractors bank.

- Furthermore, no reference is made to the contractors credit limit or past payment record. (The credit manager should have read only access to the account receivable subsidiary ledger.)

- Inappropriate credit approval procedures could result in the extension of credit to high-risk customers, and consequently, a high level of bad debts.

- Furthermore, the credit manager may receive kickbacks in return for approving credit to uncreditworthy customers. The credit manager could also approve credit for uncreditworthy relatives or friends.

Weakness 2: Inadequate segregation of duties regarding the accounts receivable supervisor.

- The accounts receivable supervisor verifies details on the charge forms, and corrects any errors (including pricing errors), and prepares invoices. There is no independent manual or computer check of the details on the corrected charge form before the invoice is prepared.

- The accounts receivable supervisor could fraudulently alter details on the charge forms prepared by the sales associate and use these altered details to prepare the invoice.

- Therefore, the accounts receivable supervisor could lower prices charged to customers in return for kickbacks, or lower prices relatives and friends.

Weakness 3: No use of control totals to compare charge forms and invoices.

- There is no control to ensure that the daily total of the dollar amount of the charge forms reconcile with the daily total value of invoices prepared. (Any difference between the control total relating to the charge forms and the control total relating to the invoices should be explained by error corrections, which should have been independently verified. See Weakness 2.)

- Therefore, any illegitimate discrepancies between the charge forms and invoices (due to error or fraud), are not identified, followed up, and corrected.

- The reconciliation of control total of the charge forms and the invoices should be performed by an independent person, other than the accounts receivable supervisor and the sales associate.

Weakness 4: No reconciliation of accounts receivable subsidiary ledger with control account.

- There is no reconciliation of the accounts receivable subsidiary ledger with the accounts receivable control account to ensure that the sum of the subsidiary ledger account balances reconciles with balance of the control account.

- The reconciliation of subsidiary ledger and the control account should be performed by an independent person, other than the accounts receivable supervisor.

- Therefore, any discrepancies between the subsidiary ledger and the control account (due to error or fraud), are not identified, followed up, and corrected.

- The accounts receivable supervisor could post unauthorised credits to the accounts of particular customers/debtors, in return for kickbacks. For example, credits for returned goods, where goods were not returned, credits for payments, where payments were not made, credits for bad debt write-offs, where the write off was not approved.

- In addition to reconciling the sum of the subsidiary ledger account balances with the balance of the control account, there should be a reconciliation of sum of the payments posted to individual accounts in the subsidiary ledger on a particular day with the amount banked on that day (or the previous day), a reconciliation of the sum of the amounts written off from individual accounts in the subsidiary ledger on a particular day with the total amount of bad debts approved for write off.

Weakness 5: The accounts receivable supervisor can influence whether a particular contractor is granted additional credit, or whether a particular account is approved for write off as bad.

- The accounts receivable supervisor can influence whether a particular contractor is granted additional credit, by incorrectly omitting the contractors account from the monthly report of overdue accounts submitted to the bookkeeper (in return for a kickback, or as a favour for a friend or relative). In these circumstances, the bookkeeper will not notify the credit manager not to grant additional credit to the contractor (and the bookkeeper will not authorise the account to be written off).

- The accounts receivable supervisor can also influence whether a particular account is approved for write off as bad, by incorrectly including collectable accounts in the monthly report of overdue accounts submitted to the bookkeeper (in return for kickback, or as a favour for a friend or relative). In these circumstances, the bookkeeper will authorise the account to be written off.

Weakness 6: Inadequate segregation of duties regarding the cashier (No. 1).

- The cashier opens the mail, lists the enclosed cheques for deposit, and deposits the cheques.

- There is no independent check of the completeness of the cheques deposited in Everyday Supplies bank account.

- The cashier could misappropriate a cheque by not including the cheque in the list of cheques for deposit, not passing the remittance advice to the bookkeeper, and depositing the cheque into the cashiers own bank account. Alternatively, the cashier could misappropriate a cheque, and replace the cheque with subsequent cheque(s) received from another customer and replace the subsequent cheque(s) with the next cheque(s) received from another customer etcetera (i.e. lapping). In these circumstances the cashier would delay listing the misappropriated cheque for deposit, and delay passing the remittance advice relating to misappropriated cheque to the bookkeeper.

Weakness 7: Inadequate segregation of duties regarding the cashier (No. 2).

- The cashier performs the monthly bank reconciliation and deposits the cheques and cash into Everyday Supplies bank account. Furthermore, the cashier retains the verified deposit slips. ,/li>

- There is no independent check of the handling of cheque receipts, and their deposit into Everyday Supplies bank account. The bank reconciliation should be performed by an independent person, other than the cashier and bookkeeper.

Weakness 8: Automatic write-off of accounts receivable six months overdue.

- The bookkeeper automatically authorizes accounts receivable to be written off six months after they are first listed in the monthly report of overdue accounts.

- There is no investigation of the reasons why the account is overdue. The contractor concerned should be contacted by Everyday Supplies and asked to explain. Everyday Supplies may need to follow up/investigate the explanation. For example, the contractor may explain that payment was made six months ago. Further investigation may reveal that the cheque was misappropriated by the cashier. (See Weakness 6.)

- This criteria for writing off accounts is too inflexible/rigid. There is no analysis of the collect ability of the account receivable.

Weakness 9: Credit manager notified of overdue accounts receivable six months after they become overdue.

- The bookkeeper notifies the credit manager not to grant additional credit to a contractor when the bookkeeper authorises the write off of the contractors debt, six months after the debt was first listed in the monthly report of overdue accounts.

- During this six-month period after the contractor was first reported as being overdue, the credit manager may approve additional credit for the contractor.

- The granting of additional credit to customers with overdue accounts receivable is likely to exacerbate bad debt problems. (No additional credit should be granted to contractors with overdue accounts receivable.)

Weakness 10: The bookkeeper can influence whether a particular contractor is granted additional credit.

- The bookkeeper can influence whether a particular contractor is granted additional credit, by incorrectly failing to notify the credit manager that the bookkeeper has authorised the write off of the contractors account (in return for a kickback, or as a favour for a friend or relative).

- The failure of the bookkeeper to notify the credit manager is likely to result in the extension of additional credit to uncreditworthy customers and increase bad debt problems.

Weakness 11: Inadequate segregation of duties regarding the bookkeeper.

- The bookkeeper authorizes the write off of bad debts and records journal entries (including bad debt write offs) and maintains the general ledger.

- There is no independent authorization of the write off of bad debts, by higher level management.

- The bookkeeper could authorize the write off of accounts receivable for contractors in return for kickbacks, or as favour for relatives and friends.

Question 3

- The audit opinion will be qualified.

While the individual matters would not have an effect on the audit opinion, the aggregate misstatement of the three matters results in an overstatement of net profit before income tax in the amount of $211,590. Therefore, net profit before income tax is materially misstated (2 marks) (11.5 per cent of net profit before income tax of $1,842,000), but the misstatement is not pervasive to the whole financial report. (1 mark)

Question 4

Part A

- Jacqui has been hired to identify current energy use patterns of PRC based on a review of its internal records. She is not required to evaluate the identified energy use patterns of the club or to give any opinion; she is only required to use her expertise for evidence collection and report on her factual findings. Her report will be restricted to the members of PRC. Thus, this is an agreed-upon procedures engagement for which guidance is provided in ASRS 4400 (ISRS 4400). It is outlined in the standards that for such engagements no opinion is expressed, and consequently no assurance is provided. (4 marks)

- Jacqui should collect the following key information (this list is not exhaustive): (1 mark each)

- records of gas and electricity usage for the two-month period selected

- details of the clubs facilities, such as the size of the building, open and covered areas, office area, sitting area, kitchen, bathrooms, internal and external playing surfaces, ceiling height of indoor sports facilities, type of roof, exhaust fans, ventilation and landscaping

- number and size of windows, and whether these are installed with blinds and awnings

- type of heating and cooling facilities and hot water system

- automatic doors, if any, to ensure doors are not left ajar for effective heating and cooling

- type and extent of insulation

- source of energygas and/or electricity

- lightingtypes of globes (normal or low-energy), automatic light sensors, if any, extent of natural lighting in indoor playing area

- number of club members and extent of their use of the clubs facilities.

Part B

Audit implications of business-to-business (B2B) e-commerce systems include: (1 mark each up to 4)

- ensuring that access to the system is limited (a key internal control)

- ensuring that data transmitted is accurate and complete

- fewer source documents in hard copy form (lack of audit trail)

- transactions often authorized by controls within the system, suggesting heavy reliance on controls

- many of the above factors increase the potential for fraud

- often, reliance on third parties (such as B2B e-commerce hubs) to ensure transaction security and processing continuity

- substantive audit procedures often inefficient, causing auditors to implement controloriented strategies.

Computer-assisted auditing techniques include: (1 mark each up 3)

- integrated test facilities, which enable the auditor to create fictitious entities (e.g. suppliers). Can be used to test controls, such as passwords, by processing test transactions. Weaknesses include need to ensure that the test data is appropriately excluded from the system

- test data approaches, which involve using a simulated data set that contains valid and invalid items to test system accuracy. Weaknesses include time required to create data sets and the potential inability to test all relevant conditions or controls

- embedded audit modules, which are programs written by the auditor to perform audit procedures while applications are operating. These allow auditors to select data samples at any time and are useful for assuring the integrity of real-time systems such as would be encountered in a B2B e-commerce environment, but they require high levels of time, effort and resources to build and maintain.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank