Airline Risk Management and Fuel Hedging Strategies AVM4026

- Subject Code :

AVM4026

Part A

1. Evaluating the Qantas CFO's Perspective in the Video

In general, various hedging strategies can be employed by airlines to protect their bottom lines due to oil price fluctuation. For medium-sized airline companies, hedging can protect against unpredictable fluctuations in fuel prices. Based on the Qantas CFO, ahedging strategy is in place, and forthe next six months to June, the oil exposure has hedged to 90%, which means that in theshort term, the Qantas group has not been impacted in the fuel price and it is not same for the airlines competitors, (i.e., the competitors are facing issues at the moment) (Aviation, 2022). Apart from decreasing the impact of unstable fuel prices on their bottom line, their approach lets Qantas in managing the budget and forecast better (Murugan, 2024). It is also evaluated that byhedging amajor portion of oil exposure, the airline is possibly decreasing the financial risks, and in the industry, it is maintaining a competitive advantage. The CAPA news confirmed that Qantas Domestic, Qantas Loyalty, and Jetstar Domestic are performing well and in a stable market, they have high operating margins. They have disciplined their cost and continued to carefully manage their capacity for meeting the demand. Moreover, through ahedging strategy, the airline has secured the advantages of lower fuel prices (Aviation, 2016).

Before adopting ahedging strategy, medium-sized companies must check their risk tolerance and financial capabilities and be sure that it is appropriate and effective for them. Thus, the Qantas CFO clarifies the significance of thehedging strategy for reducing the risks of fuel price fluctuation risks. And, financial stability, size of the company, market condition are essential factors to be considered for determining if hedging is suitable for medium-sized airline companies or not.

2. Insights and Jet Fuel Hedging

By analyzing the jet fuel price-based trends, it is possible to detect the patterns and fluctuations, which can help to implement hedging strategies at better timing. The jet fuel price index can also forecast the expected fuel prices in the future, and the highly effective hedging instruments that can be used. From the Qantas CFOs video, it is found that, if there is a steady increase in the fuel prices as they continue to this year end, then there are chances that Qantas airways can recover through its higher fuel prices. For example, 200 index value shows price doubling from the year 2000 (Jet fuel Price Monitor, 2024).

3. Risks of Hedging Jet Fuel Prices and Hedging Strategy Design

The CFO stated that, there is a need for strong underlying demand and relatively stable and rational capacity, so that, when the market opens and when the border restrictions are removed due to COVID-19 lockdown, a strong leisure demand is expected in international as well as in domestic markets. Also, the airline has shown strong recovery in leisure and corporate travel, which makes the airline optimistic that the group is placed well for recovering the fuel cost by considering the current levels at the moment. It is expected to see strong transformation as all the domestics markets are opening. After COVID, all the staff are back to work, which increases resilience and agility for responding to various demands. The half year retention payment is provided at the end of 2023 when the conditions are met for rewarding the employees. Further, the operational and executive staff are effective for taking the airline to the next final phase of the recovery.

Identified Risks Linked to Jet Fuel Hedging

- There will be significant losses if there is decrease in the fuel prices.

- There will be opportunity cost for failing to participate in the potential price decreases.

For managing the risks linked to jet fuel price exposure, companies like Qantas Airways can implement a comprehensive risk management strategy that includes diversification of hedging instruments and regularly reviewing and adjusting their hedging positions based on market conditions. They can also consider using financial derivatives to hedge against fuel price fluctuations more effectively.

The aim of hedging strategy is to decrease the risks linked with jet fuel price exposure, where fuel prices stay stable and provide a level of certainty.

Hedging Strategy Design

- Enter into contracts for locking the future purchases of the fuel prices at a particular level and position it well

- Consider options for safeguarding against unpredictable fluctuations in jet fuel price ('Hedging strategies using futures and options,' 2024)

- Mitigate the impact of price fluctuations

- Monitor market trends carefully

- Accordingly adjust the positions

Part B

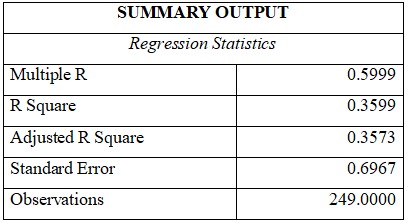

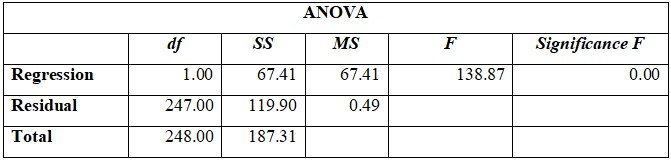

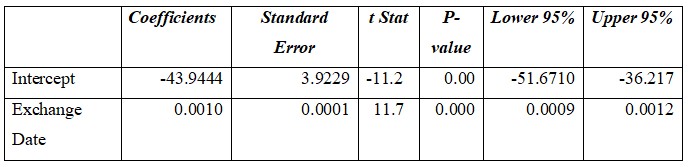

a) In this part, the provided excel file will be analyzed that contains Kerosene type Jet fuels weekly prices, and this is accomplished with the help of regression model on Microsoft Excel. The regression result of this analysis is tabulated below.

From the above result, it is noted that the r squared value is 0.35, which indicates 35% of variance in explaining the independent variables by the dependent variables. The p-value of this model is 0.00, which indicates that the created model is a good fit model for this price prediction. And, the coefficient table shows the coefficients value for this prediction as -43.944, which indicates that the hedge ratio is -43.944 and it denotes that -43% of fuel consumption must be hedged with the help of ULSD futures for decreasing the risk.

b) For addressing the needs of the airlines fuel hedging dated from 5th of July 2024 till 27th of September 2024, a hedging strategy of futures-based can be implemented. The following outlines a structured strategy for the analysis:

Hedging Strategy Outline:

1. Fuel Exposure:

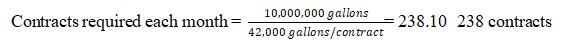

- Monthly, ten million gallons of jet fuel is consumed by the airline.

2. Assumption of Futures Contract:

- New York Harbor ULSD (Ultra-Low Sulfur Diesel) Futures is assumed to be the preferred futures contract that CME exchange listed, which is commonly utilized to hedge the prices of jet fuel.

- 42,000 gallons of fuel is represented for each futures contract.

3. Timeline of Hedging:

- Opening Positions: Each months first week (for instance, July 5 to 7).

- Closing Positions: prior to the relevant contract expires during months last week (for instance, July 28).

4. Prices of the Contract and Assumptions in Calculation:

- For jet fuel, assume spot and futures prices depending on the ULSD historical prices.

- In July, the example spot price equals to $2.75 per gallon, and in September equals to $2.90 per gallon.

- For July, the futures contract price equals to $2.80/gallon, and for September equals to $2.95/gallon.

- Transaction costs and margin requirements must be ignored for simplicity.

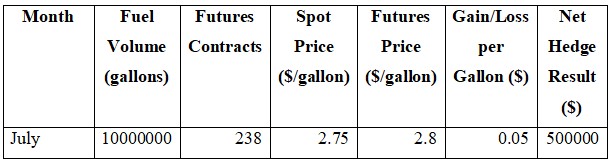

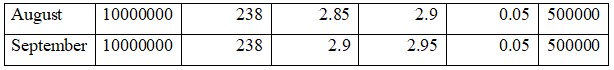

Hedging Calculations Table

With hedging strategy, each month continuously $500,000 was generated because of favourable price movements, and futures contracts helps to get financial buffer against the increasing prices of fuel. Hence, futures contracts must be utilized by the CEO for hedging the fuel exposure.

c) Airline's Fuel Hedging Strategys Critique

For the Melbourne-based airline, the proposed futures-based hedging strategy can effectively mitigate fuel price volatility. However, the following are some of the issues, and potential alternatives:

1) Fuel hedging is avoided by the American Airlines, because of reduced flexibility and unnecessary costs, and di, Further, volatile fuel prices, the airlines face difficulty to accurately predict the market trends.

2) Jet fuel costs might not correlate will with crude oil or futures benchmarks, and results in basis risk, which can decrease the effectiveness of airline hedges.

3) Fuel hedging increases accounting and operational burdens on airlines, so they must work on maintaining liquidity for margin calls, consuming cash kept for other business activities, and potentially result in unrealized losses, investor perceptions, and negative impact on financial performance.

Alternative approaches proposed are as follows:

1.The airline must ensure to go with a selective or opportunistic hedging all fuel exposure, as it increases flexibility and decreases the cost of hedging.

2.Though call options are expensive, use them for discarding the need for margin collateral, as it can help the airlines that is financially tight.

3.The airline can work on improving its efficiency by working on fuel-efficiency initiatives and alternative energy solutions, and for reducing the exposure, collaborate with suppliers on joint hedging strategies.

It is concluded that the proposed futures-based strategy gives a safety net; however, it costs trade-offs. Highly balanced approach must be used and combine financial instruments with operational efficiency strategies can better support the airline to navigate the volatile markets. Successful strategy cannot be guaranteed for the airlines, so it needs a multi-layered risk management framework that is highly flexible.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank