FBL 5030 Accounting Assignment

- Subject Code :

FBL-5030

- University :

Edith Cowan University Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

Australia

Requirements

- This a group project. The maximum number of members in a group is five.

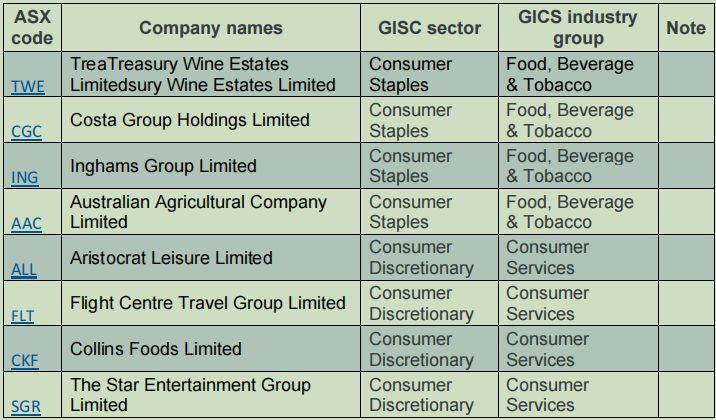

- In your group, select one company and analyse the latest five-year performance of the company.

- Download the company financial data from DatAnalysis (also known as Morning Star) for your analysis. The data shall include items from balance sheet, income statement, cash flow statements, and relevant financial ratios for the latest six years. You will need to download 1 year extra to be able to run a five-year analysis.

- You can find a guideline to download the data from DatAnalysis at the end this document.

- You are encouraged to analyse the company beyond the reported financial figures. It is advisable, but not limited, to look for further information on IBIS World (from IBIS https://ecu.au.libguides.com/ibisworld), the companys annual reports, and other credible sources including the companys official website.

Detailed instructions

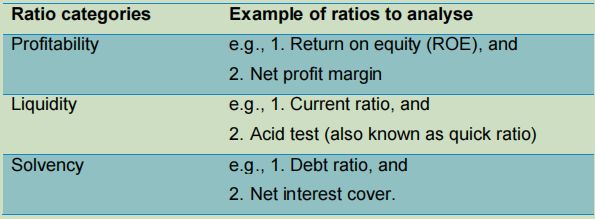

- For the latest five-year period of your chosen company, assess the companys profitability, liquidity, and solvency. The table below summarises some of the relevant ratios for each ratio category.

Note: Each ratio does not sit in a vacuum. One ratio interlinks with other ratios of different categories. Therefore, you need to draw in more than 2 ratios in each category to provide substantive reasons and discussions. Industry average and competitors data also form a good platform to put your discussion into perspective. For example, a large difference between current ratio and quick ratio can be explained by an inventory build-up.

Note: Each ratio does not sit in a vacuum. One ratio interlinks with other ratios of different categories. Therefore, you need to draw in more than 2 ratios in each category to provide substantive reasons and discussions. Industry average and competitors data also form a good platform to put your discussion into perspective. For example, a large difference between current ratio and quick ratio can be explained by an inventory build-up.

This can be confirmed by looking at inventory turnover (in days) which is longer compared to its competitors or the industry average. In that case, it could mean the company has difficulties to attract customers, which can also explain why it provides a longer credit term (receivable turnover ratio in days).

In some cases, you will need to manually calculate other ratios to provide substantive reasons and discussions for the trend captured in a published ratio. For example, a steady increase in revenue over a five-year period can be explained by a rapid expansion of the company. However, revenue per store indicates a negative growth which can be detrimental for the company (as can be inferred from Dick Smith case). This revenue per store is a ratio that is not readily available and will need to be calculated manually, and it is dependent on the availability of the data. Some companies disclose the number of stores (outlets) they have in their annual reports. - Present your analyses as a professional report for a group of potential investors. Charts and tables are encouraged. Your report should have the following sections.

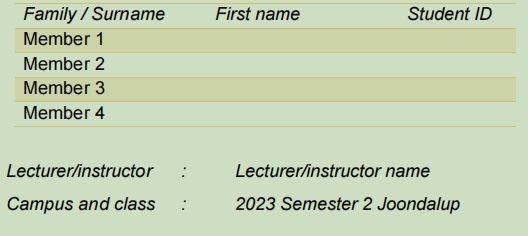

2.1. A cover sheet which clearly identify all group members, class/campus, and your lecturers name. See example below.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank