FNSACC414 Financial Ratio Assignment

- Subject Code :

FNSACC414

- Country :

Australia

Part 2: Scenario

To complete this part of the assessment, read the scenario and complete the following task/s.

Scenario: Financial ratio

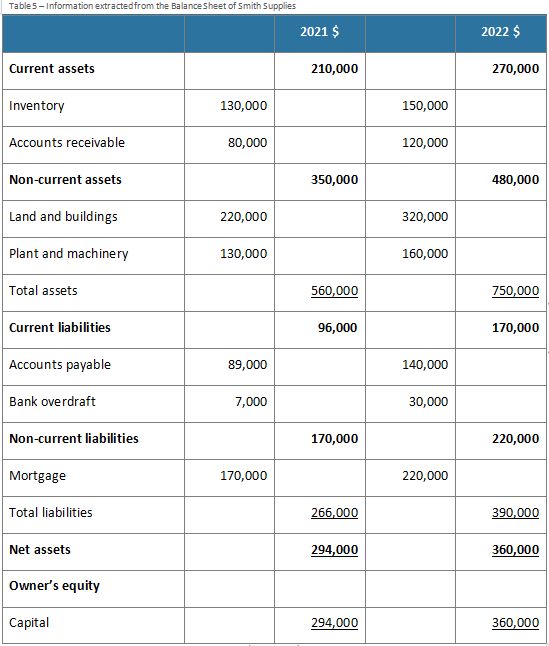

The following information has been extracted from the Balance Sheet of Smith Supplies, for 2021 and 2022:

Additional information for the year ended 30 June 2022:

- Sales (all credit) $705,000

- Gross profit $145,000

- Net profit $ 70,000

- Drawings $ 4,000

Task:1 Calculate Ratio

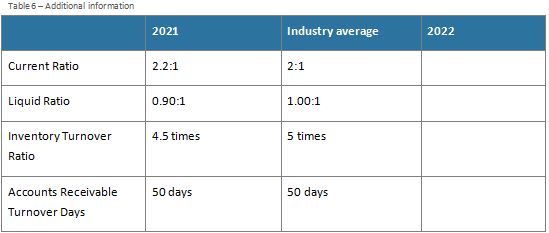

The following table lists the results for 2021 and industry average ratios.

Using this information, you are required to calculate the ratios for 2022. When you have calculated all 4 ratios, complete the 2022 column in the table above.

- Current ratio

- Liquid ratio

- Inventory turnover ratio

- Accounts receivable turnover days

Report on financial performance

You need to obtain verification and authorization from your manager, Yasmeen, before you are able to send your report to Smith's Supplies. Send an email to Yasmeen requesting verification and authorization of your report. Your report should outline the financial performance of Smith Supplies. The report needs to use clear language and logical structure to present the financial information.

Your report must:

- outline Smith Supplies financial position in relation to:

- liquidity (short terms)

- efficiency (stock control and credit management)

- include at least 2 possible causes of change in the current ratio

- suggest at least 2 possible actions for the inventory ratio that could be taken to improve Smiths position

- comment on Smiths position for:

- the liquidity ratio in relation to the Industry average

- the efficiency ratio in relation to Smiths prior year (2021).

Financial performance Report

- outline Smith Supplies financial position in relation to:

- liquidity (short terms)

- efficiency (stock control and credit management)

- Outline at least 2 possible causes of change in the current ratio

- Suggest at least 2 possible actions for the inventory ratio that could be taken to improve Smiths position

- Comment on Smiths position for:

- the liquidity ratio in relation to the Industry average

- the efficiency ratio in relation to Smiths prior year (2021).

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank