Global StrategicImmersionProject (GSIP)

Global StrategicImmersionProject (GSIP)

A Business Proposal for Bunnings Expansion to Canada

Table of Contents

The Company Chosen: Bunnings Group

Key Strategic Issues in Canada

Strategic Goals for Bunnings in Canada

Target Market Segmentation Customer Persona

List of Figures:

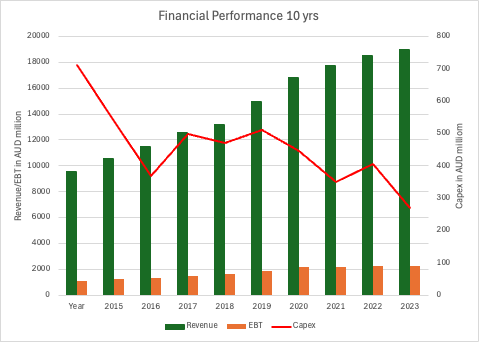

Figure 1:Bunnings historical financial performance

Figure 2:Reasons for choosing Canada

Figure 3:Bunnings strategic challenges in Canada

Figure 4:Bunnings Business Model Canvas - Canada

Figure 5:Porter's Five Forces Framework

Figure 6:Pie analysis for Home Improvement Retailers in ANZ vs Canada

Figure 7:Projected Sales growth for Home Depot, Lowe and Bunnings

Figure 9:Bunnings Canada Market Sizing projections

Figure 10:Bunnings Action Plan based on recommended strategies

Figure 11:Bunnings Projected Income Statement (Canada)

Figure 12:Bunnings Projected Market Share (Canada)

Figure 13:Bunnings Projected ROI (Canada)

List of Tables:

Table 1:PESTEL Analysis for Bunnings

Table2:SWOT Analysis for Bunnings

Table3:Defining the business model in Canada

Table4:Canada Home Improvement Market

Table5:Porters 5 forces for Bunnings in Canada

Table 6:Competitive analysis of Bunnings

Table7:Bunnings comparison with competitors

Table 9:Bunnings current strategy in ANZ

Table 10:Bunnings future strategy for Canada

Table 11:Recommended Strategies Short Term (Year 1-2)

Table 12:Short term risks and mitigation plan

Table 13:Recommended Strategies Medium Term (Year 3-5)

Table 14:Medium term risks and mitigation plan

Table 15:Recommended Strategies Long Term (Year 6+)

Table 16:Long term risks and mitigation plan

Table 17:Balanced Scorecard for Bunnings Expansion into Canada (10-Year Plan)

Table 18:Initial Investment Financials

Table 19:Investment Plan for Canada

List of Exhibits:

Exhibit 1:Canadian Consumer spending habits

Exhibit 2:Canadian per capita disposable income

Exhibit 3:Canadian Home Improvement Market Growth

Exhibit 4:Canada Sustainable Development Goals

Exhibit 5:Bunnings Strategic Framework: Building a Winning Retail Offer

Exhibit 6:2024 Canadian Homeowner Renovation Report

Exhibit 7:Average Income distribution in Canada

Exhibit 8:Bunnings Historical Balance Sheet

Exhibit 9:Bunnings Historical Income Statement

Executive Summary

The report details Bunnings Groups expansion strategy to penetrate Canadas expanding home improvement market. Canada demonstrates significant market potential valued at CAD 50 billion. Its DIY culture along with urbanization and sustainability trends complement Bunnings strengths in affordable pricing, product diversity and customer-focused business models.

Operating under the ownership of Wesfarmers, Bunnings achieved leading market positions in Australia and New Zealand and generated AUD 19 billion in revenue in FY2024. However, its dependence on domestic markets makes international expansion essential for risk reduction and sustained growth. The report further examines Canada's financial conditions along with its competitive and logistical environments before suggesting a strategic step-by-step market entry approach to establish Bunnings as an industry leader while reducing business risks.

Bunnings needs to develop sustainability programs that fit Canadian consumer demands while localizing its products and improving supply chain effectiveness to achieve success. These initiatives will create a dominant market position while meeting Canadas rising demand for sustainable home improvement options.

The Company Chosen: Bunnings Group

Background and Company Overview

Since its establishment in 1886 Bunnings Group has developed into Australia and New Zealand's biggest retailer of home improvement and lifestyle products. Starting as a sawmill company established by the Bunning brothers the business grew into hardware and home improvement sectors earning recognition for its low prices, wide selection of products and quality customer service. Since Wesfarmers acquired Bunnings in 1994, the company has strengthened its leadership in the market by operating 381 stores throughout Australia and New Zealand. The company employs about 53,000 people serving consumers ranging from DIY enthusiasts, professional tradespeople, and large industrial customers. Bunnings has established itself as a socially responsible brand by building a reputation beyond retail through community engagement and support for sustainability initiatives and local projects.

Core Principles:

- Best Prices:Bunnings maintains low prices throughout their operations to support lasting customer relationships. The company implements a Lowest Prices Are Just the Beginning pricing strategy to provide affordable products while maintaining high quality standards. Bunnings maintains competitive pricing throughout all product categories through its bulk purchasing power and efficient supply chain management together with its private-label brands.

- Extensive Product Coverage:Bunnings provides both DIY enthusiasts and professional tradespeople with its wide-ranging selection of products for home improvement, gardening, and lifestyle needs. The store provides everything from hardware and tools to appliances and outdoor furniture along with sustainable home solutions transforming it into a complete destination for renovation and home improvement.

- Exceptional Customer Service:Bunnings delivers exceptional customer service through its customer-first approach which includes educational in-store workshops along with expert guidance and individualized support. Staff with specialized training guide customers through choosing products and managing DIY projects as well as home improvement plans. The company builds community connections by offering hands-on demonstrations together with kids' DIY workshops and specialized trade services which ensures shoppers have an interactive and uninterrupted experience.

Sustainability Achievements and Goals:

Bunnings is dedicated to environmental sustainability, ethical sourcing, and human rights, with a commitment to achieving 100% renewable electricity by 2025 and net zero Scope 1 and 2 emissions by 2030. Currently, over 80% of Bunnings network is powered by renewable energy, with New Zealands operations already at 100%. The company has installed over 150 solar PV systems in Australian stores, supplying up to 30% of each stores energy needs, and implemented LED lighting, reducing energy use by 30% per store. Bunnings also promotes a circular economy by minimizing waste, optimizing packaging, and supporting recycling programs, including the Soft Plastic Recycling Scheme in New Zealand and B-cycle battery recycling, which has collected over 550 tonnes of batteries (Bunnings, 2024).

In ethical sourcing, Bunnings ensures 99% of its timber comes from certified low-risk plantations and upholds zero tolerance for illegal logging. The company conducted 1,170+ supplier risk assessments and 590+ independent audits in 2024 to uphold labor rights and supply chain transparency. It also provides grievance mechanisms like the Your Voice, Worker Helpline to safeguard factory workers. As a signatory to the United Nations Global Compact Network, Bunnings continues to drive sustainable retail practices, reinforcing its commitment to climate action, ethical business, and responsible resource management (Bunnings, 2024).

Financial Highlights (FY2024):

- Revenue:AUD 19 billion (2.3% year-on-year growth).

- Net Earnings:AUD 2.2 billion (0.9% year-on-year growth).

- Return on Capital Employed (R12):2%

- Drivers of Growth:Increased demand for DIY solutions, expanded online offerings, and product diversification.

Figure1:Bunnings historical financial performance

The Country Chosen: Canada

Figure2:Reasons for choosing Canada

Canada has a thriving CAD 50 billion home improvement market which is expected to grow at the rate of 3.1% over the next few years. With declining interest rates, home renovations in Canada are driven by both personal preferences and investment value, with 63% of homeowners aiming to tailor their homes to their tastes while boosting property value. Nearly half (49%) are actively planning or executing renovations, with average renovation costs reaching $19,000almost double the $10,000 reported in 2019. While 57% rely on cash or personal savings, 49% have a structured budget in place, and 80?el confident in managing costs and timelines. Despite rising expenses, 60% of homeowners prefer renovating over selling. However, 75% have made compromises, such as cutting discretionary spending or sacrificing leisure time. Sustainability remains a priority, with 59% willing to pay more for eco-friendly upgrades and 73% interested in integrating smart, energy-efficient technology (CIBC, 2024).

Main Drivers of growth:

- Interest in Personalization and Property Value: Sixty-three percent of Canadian homeowners invest in home improvements because they want to create personalized spaces that will also boost their property value. Homeowners maintain their renovation investments because they aim to boost property value while achieving personalized living spaces.

- Rising Expenditures on Renovations: The average renovation cost has grown to $19,000 which is nearly double the cost from past years and Canadians are now spending more on home improvement projects. Expanding homeowner interest in renovation spending impacts market growth substantially since renovations serve both aesthetic and functional needs.

- Focus on Sustainability and Smart Technology: More than 59% of Canadians show readiness to invest extra money into home renovations that enhance environmental sustainability. Energy-efficient and smart technologies attract the interest of 73% of homeowners who want to integrate these features into their renovation projects which boosts the demand for sustainable and advanced technological solutions.

- DIY Culture and Increasing Homeownership: The strong DIY culture combined with rising homeownership numbers leads to steady market demand for home improvement products and services. Forty-nine percent of homeowners are currently planning or working on renovations.

- Preference for Renovation over Selling: Due to high real estate prices and market unpredictability, 60% of Canadians choose home renovations over selling resulting in increased demand for home upgrades.

Although established players like Home Depot, Lowe and other local players have a strong presence in the Canadian home improvement retail market, Bunnings has a strong potential to create a name for itself.

- Mapping to Bunnings Core Competencies:Canadian market concentrates on quality, affordable, and environmentally friendly solutions, which are also core competencies of Bunnings. Sixty-two percent of Canadians show a willingness to pay a premium of 20% or more on sustainable produced goods and services (Deloitte 2024).

- Economic Stability:Canada is an economically strong country with a lot of disposable income and a healthy median income housing market. Canadas disposable income grew by 4% in 2024 resulting in more Canadians now engaging in home improvement projects. See exhibit for Canadian spending and disposable income trends.

- Favourable Trade Policies:The commercial relationship between Canada and Australia stands strong and multifaceted with growing investment flows and service trade exchanges. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) solidifies their partnership by enabling reduced tariffs on Australian imports. The 2023 trade figures show that Canada and Australia conducted bilateral trade worth CAD 4.5 billion while observing remarkable growth in service exports from both nations.

- Oligopolistic Market:The fragmented Canadian home improvement market creates a significant business opportunity for Bunnings to succeed by implementing customer-focused approaches and customized products. Even though Home Depot and Lowe's maintain dominance in the market they still leave enough room for an emerging competitor who can secure market share through thorough product availability combined with affordable prices and superior customer service. The growing customer demand for sustainable products and smart home solutions complements Bunnings' sustainability efforts and provides opportunities for market differentiation against established competitors.

Key Strategic Issues in Canada

Figure3:Bunnings strategic challenges in Canada

- Competitive Landscape

Issue:The Canadian home improvement market sees Home Depot and Lowe's as dominant forces because of their significant market shares at 28.1% and 20.4% thanks to established supply chains and robust brand loyalty.

Mitigation Plan:Bunnings can establish its market identity by leveraging its exceptional customer service capabilities alongside its competitive pricing strategy and robust sustainability commitment. Bunnings can establish a unique market position by concentrating its efforts on key business areas to challenge the dominance of major players. This is evident from their dominance in the domestic market where it is a household name when it comes to home improvement and lifestyle retailer.

- Logistical Challenges

Issue: Bunnings faces significant supply chain and infrastructure challenges throughout Canada due to varying climate conditions which affect product availability, store operations, and logistics. Floods, heatwaves, wildfires, heavy rainfall, landslides and harsh winters pose threats to timely delivery and operational stability.

Mitigation Plan: Bunnings needs to implement region-specific strategies which will help maintain operations and please customers while addressing environmental challenges. In Ontario Bunnings will use flood-resistant store designs and energy-efficient cooling systems while providing urban products including reflective roofing and rainwater harvesting solutions. Alberta will need fire-resistant stores and drought-resistant products together with active community wildfire preparedness programs to protect against wildfire threats. The implementation of reinforced infrastructure with strong foundations and adaptive inventory planning together with resilient logistics networks in British Columbia will help lower the impact of both landslides and heavy rainfall. Bunnings must concentrate on energy-efficient insulation products and snow-resistant building materials while improving the winter supply chain in Quebec to overcome high heating costs and supply chain disruptions. Bunnings will maintain operational resilience at its stores and boost long-term growth in Canada through the implementation of these customized solutions.

- Regulatory and Bureaucratic Hurdles

Issue:The Canadian market entry for Bunnings presents a challenge because of complex trade regulations alongside labour and environmental policies which include local content mandates and provincial variations. Different provinces have distinct regulations that create potential operational delays and higher compliance costs if companies do not manage them effectively.

Mitigation Plan: To ensure operational stability Bunnings must successfully navigate through Canadas diverse local regulations. The Ontario Buy Local program represents a type of local content requirement that forces businesses within Ontario to prioritize the purchase of local products. Bunnings can fulfil regulatory requirements and lower compliance expenses through local supplier partnerships. Quebecs French-language labelling requirement under provincial labour laws will necessitate that Bunnings modify its product documentation and labels. Engaging local legal and regulatory specialists in each province will prevent businesses from facing penalties. The stringent environmental regulations in Canada which aim for net-zero emissions by 2050 and a 40?crease in greenhouse gas emissions by 2030 require Bunnings to adopt sustainable business practices. Bunnings can achieve regulatory compliance and strengthen its brand reputation through the adoption of eco-friendly products and alignment with Canadian environmental legislation including CEPA.

- Economic Risks

Issue: The profitability of Bunnings in the Canadian market may face significant challenges due to currency movements between the CAD and AUD in addition to inflationary forces. For instance, in 2022, the exchange rate between the CAD and AUD fluctuated between 0.85 and 0.88, which could lead to higher costs for Bunnings when importing products from Australia. Additionally, Canada's inflation rate that has risen in the past to 6.8% in 2022 which will also have an adverse impact on the pricing strategy.

Mitigation Plan: Bunnings needs to adopt localized pricing methods to maintain competitive prices while adjusting to market conditions to reduce the effects of currency fluctuations and inflation. The pricing strategy requires adjustment according to local economic factors such as inflation rates alongside potential regional promotions to remain competitive. Bunnings needs to initiate currency hedging initiatives to secure beneficial exchange rates which will minimize CAD to AUD volatility and stabilize operational expenses. These strategies will protect business profits during periods of external economic stress.

Strategic Goals for Bunnings in Canada

By entering Canada, Bunnings aims to achieve:

- Market diversification:Bunnings expansion into Canadas AUD 56 billion home improvement market will diversify its revenue streams and reduce its dependency on the Australian market. By capturing even a small portion of this sizable market, Bunnings can tap into growing consumer demand for home renovations, offering a range of products and services. This expansion would allow the company to capitalize on Canada's increasing home improvement expenditures while also positioning itself for long-term growth in a new, lucrative market.

- Sustainability Leadership:Bunnings, by the virtue of its internal sustainability g a significant opportunity to position itself as a sustainability leader in the retail sector by expanding its range of eco-friendly products and reaching its renewable energy targets. By launching initiatives that align with the Canadian Sustainable Development Goals 2024, Bunnings can further reduce its carbon footprint while nt while providing sustainable alternatives. This not only enhances Bunnings' reputation as a forward-thinking retailer but also attracts environmentally conscious customers, reinforcing its position as a leader in home improvement.

- Improved Brand Equity:Bunnings will build a solid reputation in Canada through its exceptional customer service and competitive pricing while engaging with local communities. Bunnings stands to gain customers' trust in Canada through its skilled staff and personalized assistance along with high-quality products at reasonable prices. Through participation in community activities and local projects Bunnings will strengthen its brand while proving its dedication to positively impacting Canadian society. The integration of exceptional service quality with community engagement efforts ensures Bunnings becomes the preferred destination for home improvement shoppers.

Implementation Framework

Bunnings should execute a phased market entry plan by first initiating pilot projects in major urban centres such as Alberta and Ontario due to their strong growth prospects. Building regional distribution centres in strategic locations like British Columbia and Quebec will lead to more efficient supply chain operations and logistics management. Building partnerships with regional vendors and contractors enables adherence to Canadian legal requirements while promoting community connections. Through specialized advertising campaigns that emphasize affordability and sustainable practices while offering excellent customer service coupled with free workshops and events, we will both establish brand loyalty and draw in DIY enthusiasts. By investing in digital platforms for customer communication and real-time inventory management together with predictive analytics businesses will boost customer satisfaction while streamlining supply chain operations.

PESTEL Analysis Canada

|

|

1.Political Stability: Canada is ranked 12thglobally in the world for political stability, which makes it a secure environment for business expansion (World Bank, 2023). 2.Corporate Tax Rate: A competitive tax rate of 26.5%, which promotes business profitability (Government of Canada, 2023). 3.USMCA Agreement: This agreement facilitates trade between the U.S., Mexico, and Canada and streamlines cross border operations (United States Trade Representative, 2023). 4.Green Subsidies: The Canadian government allots $10 billion annually to encourage sustainable activities, which will promote sustainable business practices (Canadian Federal Budget, 2023). 5.Strict Product Regulations: Provides market safety and reliability while adhering to Bunnings quality requirement (Health Canada, 2023). |

|||

|

|

1.High Disposable Income: The average household disposable income is CAD 36,000, reflecting strong purchasing power (OECD, 2023). 2.Growing DIY Market: Projected to reach CAD 55 billion by 2025, highlighting immense growth potential (Statista, 2023). 3.Real Estate Boom: With a homeownership rate of 66.5%, demand for renovation products remains high (CREA, 2023). 4.Affordable Labor: Competitive labour costs, with the median hourly wage at CAD 22 (Statistics Canada, 2023). 5.GDP Growth: Canadas economy has grown up by 3.2% in 2023, demonstrating resilience amid global challenges (IMF, 2023). |

|||

|

|

1.Diverse Population: Immigrants comprise 23% of Canadas population, contributing to varied DIY preferences (Statistics Canada, 2023). 2.DIY Culture: 72% of homeowners will undertake annual renovation projects, boosting demand for home improvement products (HomeStars, 2023). 3.Sustainability Awareness: 78% of Canadians prefer eco-friendly products, creating opportunities for green initiatives (Canadian Sustainability Survey, 2023). 4.Aging Population: In 2030, 23% of Canadians will be over the age of 65, increasing demand for accessible and user-friendly products (Government of Canada, 2023). 5.Seasonal Trends: Harsh winters drive indoor product sales, accounting for 30% of annual sales (Canadian Retail Insights, 2023). |

|||

|

|

1.E-Commerce Growth: Online retail is projected to reach CAD 56 billion by 2025, highlighting the need for a strong digital presence (eMarketer, 2023). 2.Smart Home Market: Estimated to grow to CAD 2.6 billion by 2026, creating demand for innovative tech products (Mordor Intelligence, 2023). 3.Digital Payments: Over 85% of transactions are cashless, making digital payment systems essential (Payments Canada, 2023). 4.AI in Supply Chain: Retailers using AI achieve 20-30?ficiency gains in inventory management (McKinsey & Company, 2023). 5.Sustainable Store Designs: Renewable energy-powered stores can reduce operating costs by 15-20% (Canadian Green Building Council, 2023). |

|||

|

|

1.Harsh Winters: Regions like Ontario experience over 200 cm of snowfall annually, driving demand for heating and insulation products (Environment Canada, 2023). 2.Eco-Friendly Preferences: 90% of Canadians support sustainability initiatives, increasing demand for green products (Canadian Sustainability Survey, 2023). 3.Net-Zero Laws: Businesses must comply with sustainability targets by 2050 (Environment Canada, 2023). 4.Climate Resilience: Seasonal variations require adaptive supply chains to meet fluctuating demand (Canadian Supply Chain Forum, 2023). 5.Renewable Energy: 18.9% of Canadas energy mix comes from renewable sources, presenting opportunities for cost-effective solutions (National Energy Board of Canada, 2023). |

|||

|

. |

1.Employment Laws: Minimum wages range from CAD 15-16 per hour, varying by province (Employment Standards Act, 2023). 2.Consumer Protection: Non-compliance with product safety laws can result in fines up to CAD 1 million (Consumer Product Safety Act, 2023). 3.Building Codes: New stores must adhere to fire and safety regulations, adding costs of CAD 50-100K per location (Canadian Building Code, 2023). 4.Import Tariffs: Duties range from 5-20% on specific goods, requiring careful supplier planning (Canada Border Services Agency, 2023). 5.Quebec Language Laws: French-only labeling is mandatory, posing operational challenges in this province (Quebec Charter of the French Language, 2023). |

|||

Table1:PESTEL Analysis for Bunnings

The PESTEL analysis reveals that the Canadian market holds great potential for Bunnings to broaden its operational reach. Economic expansion alongside technological advancements and rising consumer demand for sustainable solutions serve as primary growth catalysts. The Canadian market presents strategic challenges due to diverse regional laws and strict environmental regulatory requirements. Bunnings' knowledge of environmental solutions along with its focus on customer innovation enables the company to establish leadership in Canada's expanding home improvement industry.

SWOT Analysis Bunnings

|

SWOT - Bunnings |

|

|

|

1.Market Leadership: Bunnings has established itself as trusted brand by controlling over 20% of the Australian home improvement market, (Burgess Rawson, 2022). Strong brand equity provides a competitive advantage when entering into emerging markets. 2.Scalable Business Model:It allows Bunnings to scale, underpinned by operational efficiency and lean inventory management. Large warehouse, neighbourhood store, and trade centre formats ensure flexibility in various markets. 3.Sustainability Initiatives:Industry-leading sustainability goals, like sourcing 100% renewable electricity by 2025 and reducing Scope 3 emissions by 30% by 2030, resonate especially with global and Canadian consumer values (Deloitte, 2024). Similarly, the concern for recycling programs and eco-friendly products finds favor with all environmentally conscious consumers. 4.Community Engagement: Bunnings localized approach, including workshops, fundraising events, and support for community projects, helps build strong community connections (Hirmagazine, 2024). Demonstrated ability to cultivate long-term customer loyalty. 5.Diverse Product Range: It offers a wide range of products, from 'Do It Your Self' tools and gardening to trade-specific supplies, serving different customer bases. |

|

1.Limited International Experience: Bunnings operations are primarily focused in Australia and New Zealand, with limited exposure to competitive North American markets. A lack of familiarity with Canadian regulatory frameworks and consumer behaviour may present initial challenges. 2.Dependence on the Domestic Market:The majority of Bunnings' revenue comes from Australia, making international diversification essential for long-term growth. Economic downturns in the home market could have a significant impact on overall performance. 3.High Competition in E-Commerce:Although Bunnings is expanding its online presence, it trails behind global competitors like Home Depot and Amazon in terms of digital innovation and logistics capabilities. 4.Cultural Adaptation Challenges:Canadianconsumer preferences for bilingual services (English and French) and winter-specific products will require substantial localization efforts |

|

|

1.Canadian Market Expansion:Canadas home improvement market, valued at CAD 36.3 billion, offers significant growth potential (IBISWorld, 2024). The strong DIY culture (with a 73% participation rate) aligns well with Bunnings product offerings and community-focused approach (MadeInCA, 2024). 2.Sustainability as a Differentiator:Canadian consumers increasingly prioritize environmentally friendly products, giving Bunnings a competitive advantage through its robust ESG initiatives. Collaborating with Canadian organizations and government programs focused on green initiatives could further support market entry. 3.Localized Offerings: Gaps in the Canadian market, especially for community-driven and DIY-oriented retailers, present an opportunity for differentiation. Introducing tailored product lines, such as energy-efficient solutions and winter-specific tools, can address regional needs. 4.Technological Integration:Expanding e-commerce capabilities and offering advanced services like augmented reality for DIY tutorials can enhance the customer experience. Developing a seamless omnichannel strategy would help Bunnings compete with established players in the market. 5.Partnerships and Collaborations:Partnering with Canadian suppliers and distributors can streamline supply chains and lower costs. Collaborating with local trade groups could strengthen Bunnings trade services and industry presence |

|

|

1.Intense Competition:Home Depot and Lowes dominate the Canadian market with established supply chains and strong brand recognition. Emerging local competitors could challenge Bunnings and erode its potential market share 2.Regulatory Hurdles:Strict labour and environmental regulations may raise operational challenges and expenses. Compliance with bilingual marketing legislation within provinces, such as Quebec, could create additional challenges. 3.Economic Fluctuations:A rise in the interest rate and inflation could reduce consumer spending on home improvement in Canada. Uncertain global economic conditions may disrupt supply chains and raise operational costs. 4.Cultural Missteps:Failure to effectively localize products or marketing strategies could alienate Canadian customers. Misalignment with Canadian values, such as sustainability and community engagement, could negatively impact brand perception. 5.Supply Chain Risks:Global supply chain disruptions could delay market entry and affect inventory availability. The reliance on international suppliers may raise costs due to tariffs and logistical delays. |

|

Table2:SWOT Analysis for Bunnings

The overall SWOT analysis highlights Bunnings' strong potential to succeed in the Canadian home improvement market by leveraging its scalable business model, sustainability initiatives, and community focus, despite challenges like limited international experience and intense competition

Defining the business

Bunnings business model

Bunnings is an Australian retail chain company specializing in providing a diverse product line of home improvement, lifestyle and gardening products. Owned by Wesfarmers Limited, Bunnings is the leading retailer in this space within Australia as well as New Zealand.

Industry Overview

Bunnings operates in the home improvement and lifestyle products sector, Bunnings provides a wide range of products and services for homeowners, professional tradespeople and DIY enthusiasts. Urbanization, rising homeownership, and the need for sustainable living solutions have all contributed to the industrys expansion (IBISWorld, 2024). Major international players like Home Depot and Lowes, as well as smaller, local retailers will compete with Bunnings.

Customer Segments

Bunnings focuses on both individual consumers and professional tradespeople:

- DIY Solutions:Bunnings offers to the growing DIY sector of the market with a wide variety of product offering supported by workshops, professional advice, and easy-to-use alternatives in support of home improvement projects.

- Trade Services:For the professional, Bunnings will offer specialized products, bulk pricing, and trade-specific services like delivery and account management, therefore fostering loyalty in the trade sector.

Sustainability-Aligned Products

Environmental sustainability is key element in Bunnings product offerings. The company focuses on eco-friendly, energy-efficient, and recyclable products to meet the growing consumer demand for green solutions (Deloitte, 2024). Bunnings always focuses on initiatives like promoting sustainable gardening products and providing waste recycling facilities enhance its ESG credentials.

Core Elements of Bunnings Business Model

- Affordability:Bunnings uses a value-driven pricing strategy. The stores ensure that prices are affordable to customers without sacrificing quality. With its scale and operational efficiency, Bunnings can maintain competitive pricing(Burgess Rawson, 2022).

- Community Engagement:Bunnings does well in community involvement. The company is highly engaged in local activities like do-it-yourself workshops, barbecues, and fundraising for local charities. These activities contribute to reinforcing the brand image and developing customer loyalty. The strategy positions Bunnings as part of the community rather than just a retailer(Hirmagazine, 2024).

- Innovative Retail Formats:Bunnings has different retail formats to meet the various demands of the market:

- Mega-stores: Offering a wide range of products for both consumers and professionals.

- Compact Stores:Suitable for cities where space is at a premium, compact stores have limited product offerings.

- Online Storefronts:Complementing its physical outlets, Bunnings has an efficient e-commerce site. Customers can enjoy various services such as "click-and-collect" (IBISWorld, 2024).

- Localized Offerings:Bunnings adapts its product range and marketing strategies to meet regional and cultural needs. In Australia, for example, the focus is on outdoor and gardening products, reflecting local lifestyles. As Bunnings expands into new markets like Canada, it will likely tailor its offerings to suit regional conditions, such as products designed for harsh winter climates (MadeInCA, 2024).

|

Sector,Category |

Home Improvement / Retail |

|

ProductCategory |

Hardware, Garden Products, Home Improvement Solutions |

|

MarketBoundary |

Canada, focusing on residential and commercial sectors |

|

CustomerSegments |

Residential Customers:Homeowners and DIY enthusiasts looking for home improvement solutions Commercial Customers:Businesses seeking bulk purchases for construction and renovation projects |

|

CustomerNeeds andWants |

Needs:High-quality, reliable home improvement products, competitive pricing, and convenient shopping experience Wants:Wide product range, expert advice, DIY workshops, and sustainable product options |

|

CustomerObjectivefunction |

Minimize home improvement costs, maximize convenience and product quality, enhance home aesthetics and functionality |

|

ProductLaunch Objective |

To establish Bunnings as a leading home improvement retailer in Canada, capturing significant market share and building a strong brand presence |

|

BrandValue |

Reliability, extensive product range, customer-centric service, and cost-efficiency |

|

BrandPositioning |

Position Bunnings as a one-stop shop for all home improvement needs, offering exceptional customer service and value for money |

|

Products |

Hardware tools, garden supplies, home improvement materials, outdoor living products, and DIY project kits |

Table3:Defining the business model in Canada

Business Model Canvas

Figure4:Bunnings Business Model Canvas - Canada

- Customer Segments

The Canadian home improvement market serves various distinct customer groups. DIY home improvement activities are popular among homeowners, as 57% completed at least one or two minor repairs or renovations in 2019. Professional contractors and tradespeople remain essential market participants who need quality materials for construction and remodelling work. The market expands because commercial clients such as facility managers and real estate developers acquire substantial amounts of supplies for their extensive projects.

- Value Propositions

Through its extensive home improvement product selection Bunnings will serve multiple renovation requirements for a wide range of customers. Bunnings will use competitive pricing through an everyday low-price approach to attract customers who watch their spending. Bunnings will strengthen the DIY experience by offering workshops and expert consultations to enable customers to gain the necessary skills for their projects. The promotion of eco-friendly products and sustainable practices shows their strong commitment to sustainability which matches the values of environmentally conscious Canadian consumers.

- Customer Relationships

Bunnings will focus on delivering a personalized shopping experience by training staff to offer tailored advice and assistance to customers. To foster long-term relationships, it will implement loyalty programs that reward repeat shoppers and encourage brand loyalty. Additionally, Bunnings will actively engage with local communities by participating in neighbourhood events and supporting community projects, strengthening its connection with Canadian consumers.

- Channels

Bunnings will deliver personalized service through specialized training for employees who will provide support that matches individual customer needs. Bunnings will build stronger community ties through active participation in local events and backing neighborhood initiatives to solidify enduring relationships with Canadian customers.

- Revenue Streams

Bunnings will expand its Canadian operations through the opening of both small-format and large warehouse-style stores strategically placed across the country. The company will create a powerful e-commerce platform that supports online shopping and home delivery while expanding its physical operations. A user-friendly mobile application will improve customer service by providing DIY resources and product browsing features along with easy purchasing options.

- Key Activities

To achieve projected sale growth, Bunnings will conduct continuous market research that will help understand consumer trends and preferences. Targeted marketing campaigns will be developed to increase brand awareness and draw in customers. Efficient supply chain management will help Bunnings achieve smooth product procurement while ensuring proper storage and distribution for product availability that meets customer demand.

- Key Resources

During its expansion into Canada Bunnings will establish a solid supplier network through partnerships with local and international suppliers to guarantee a steady supply of quality products. A strong logistics infrastructure consisting of efficient distribution centers and transportation networks will be needed to manage inventory levels and facilitate prompt deliveries.

- Key Partnerships

Bunnings will expand its Canadian footprint by forming partnerships with local suppliers to domestically source products while meeting regional regulations and benefiting the local economy. Trade association involvement will maintain the company's knowledge of industry standards and evolving regulations and best practices. Working with technology providers will facilitate the creation and supervision of a unified shopping experience across physical stores and digital platforms that improves customer convenience and operational effectiveness.

- Cost Structure

Bunnings' cost structure in Canada will cover multiple essential areas which include operational costs such as maintenance work alongside utilities expenses and employee salaries. Marketing expenses will fund advertising initiatives, public relations efforts and promotional activities that aim to increase brand visibility. Supply chain expenses which cover inventory management, warehousing and logistics operations will determine the effectiveness of product distribution and availability throughout the market.

|

Metric |

Value (CAD) |

Source |

|

Market Size (2021) |

$50 Billion |

Statista |

|

Number of Home Improvement Companies |

2,269 |

Made in CA |

|

Employment in the Sector |

88,879 |

Made in CA |

Table4:Canada Home Improvement Market

Porters five forces framework

Figure5:Porter's Five Forces Framework

|

Threat of New Entrants (Moderate) 1.Barriers to Entry:The Canadian home improvement market is a capital-intensive business at the entrance level, as the company has to build its distribution networks, access premium retail locations, and create brand awareness. Still, there are regions where underserved markets exist, and those could lower entry barriers for such a well-resourced player as Bunnings. 2.Regulatory Challenges:Market entry may be delayed due to strict Canadian regulations concerning environmental sustainability, worker safety, and building codes. Regarding adhering to regulations and acquiring permits, challenges could be very well expected-especially among international players who are not so familiar with local laws. 3.Local Competition:Existing players like Home Depot and Lowes have long-standing customer loyalty and government relationships. While this creates a competitive hurdle, Bunnings can differentiate itself by emphasizing localized product offerings, competitive pricing, and superior customer service. |

|

|

Threat of Substitutes (Moderate to High) 1.Online Marketplaces:E-commerce giants like Amazon and local online retailers offer competitive pricing and convenience, posing a significant threat to traditional brick-and-mortar home improvement stores. Bunnings must develop a strong omnichannel strategy to counteract this substitution threat. 2.DIY Alternatives:Canadian consumers are using smaller hardware stores and community initiatives more and more for their DIY needs. This threat can be minimized if Bunnings offers unique in-store experiences, workshops on DIYs, and exclusive products that the smaller stores cannot offer. 3.Professional Services:Contractors and professional installation services occasionally use retail stores. Many bypass the retail channel and deal direct with suppliers. Bunnings could actively pursue relationships with contractors to secure this market segment. |

|

|

Bargaining Power of Suppliers (Moderate) 1.Supplier Concentration:The Canadian market depends on a consolidated supplier base for hardware, tools, and materials. This reduces the bargaining power of Bunnings from the major suppliers. However, the development of long-term relationships with local suppliers can ensure quality consistency and reduce reliance on global suppliers. 2.Dependence on Imports:A large percentage of home improvement products sold in Canada are imported. Fluctuations in currency and disruption to supply chains may affect price and availability, increasing the power of suppliers. This can be mitigated by Bunnings through investment in local manufacturing and procurement. 3.Supplier Relationships:Suppliers prefer established players with higher volumes of orders. Bunnings needs to use its Australian network to negotiate favourable terms in Canada. |

|

|

Bargaining Power of Buyers (High) 1.Customer Price Sensitivity:Canadian consumers are highly price-sensitive, with a preference for competitive pricing and promotional offers. Even a small price increase can lead to reduced demand, pushing Bunnings to adopt aggressive pricing strategies. 2.Availability of Alternatives:With established competitors like Home Depot and Lowes, and online options, buyers have multiple alternatives, giving them significant leverage. Bunnings can reduce buyer power by offering unique value propositions such as loyalty programs and eco-friendly product lines. 3.Access to Information:Buyers are well-informed and can compare products and prices online, increasing their bargaining power. Transparency and differentiated product offerings are critical for Bunnings to build customer loyalty. |

|

|

Industry Rivalry (High) 1.Competitor Dominance:The Canadian market is dominated by Home Depot and Lowes, which have extensive store networks and strong brand loyalty. This creates intense rivalry, forcing Bunnings to differentiate itself through innovative marketing and unique customer experiences. 2.Market Saturation:The home improvement market is fiercely competitive, with high saturation in urban parts of Canada. The suburban and country areas present relatively unexploited potential that Bunnings will have to avail in their race to the top. 3.Brand Differentiation:The competition highly relies on branding and customer loyalty. Having said that, Bunnings needs to emphasize differential strengths such as strong DIY culture, sustainable products, and superior in-store services to find a niche in this market. |

Table5:Porters 5 forces for Bunnings in Canada

CompetitorAnalysis

The competitive analysis explores Bunnings' potential expansion into the Canadian home improvement market, which is currently distributed with no dominant player. The Canadian market has competition from well-established brands like Home Depot, Lowes, and RONA, each holding a significant share of consumer loyalty. Despite the competitive landscape, there is good opportunity for a strong new entrant. Bunnings, with its market-leading presence in Australia and New Zealand, with strong customer loyalty, sustainable focus, and operational efficiency, have the potential to capture a good market share in Canada. The analysis has examined the current competitive dynamics, Bunnings' strengths, and the areas where the company can differentiate itself and standout to succeed in this new market.

Figure6:Pie analysis for Home Improvement Retailers in ANZ vs Canada

|

Market Leader |

The DIY home improvement market in Australia and New Zealand (ANZ) is led by Bunnings which commands more than 50% of the market share. The company currently operates more than 381 stores throughout ANZ and aims to grow its presence by adding more stores. |

|

Customer Loyalty |

The customer loyalty rate at Bunnings sits around 80%. Its dominance results from competitive pricing alongside a broad selection of products and outstanding customer support. Through DIY workshops and community programs customers have developed stronger trust and brand loyalty. |

|

DIY Destination |

Bunnings offers a wide range of DIY products with over 30,000 different options available in categories such as gardening, building materials and home improvement. The company organizes more than 1,000 workshops each year which draw in thousands of participants. |

|

Sustainability Focus |

Bunnings pledges to obtain products manufactured through sustainable methods. The company aims to achieve 100% sustainable timber by 2025 while its various recycling programs cut down plastic bag usage by more than 2 million units annually. |

|

Fragmented Market |

The home improvement market in Canada remains highly divided as no leading company exists to establish dominance. Home Depot led the market with approximately 30% share and Lowe's followed with 25% market share while RONA controlled about 10%. The fragmented market structure shows there is room for new companies such as Bunnings to enter. |

|

Opportunity for New Entrants |

Bunnings can secure a substantial portion of the Canadian market by capitalizing on its operational efficiency and exceptional customer service capabilities. The Canadian DIY market stands at an estimated CAD 10 billion value which suggests substantial growth opportunities. |

|

Differentiation Potential |

Bunnings can differentiate itself through the sustainable product offerings (e.g., eco-friendly paints), competitive pricing strategies (average price point was lower than competitors by about 15%), and personalized customer experiences through tailored services like project consultations. |

|

Strong Competitive Advantage |

Bunnings maintains a competitive edge through its ability to consistently offer low prices (average savings of approximately 20% compared to competitors) and a diverse product range. This has allowed it to outperform US competitors who have recently faced negative growth. |

|

Operational Efficiency |

By applying operational excellence principles, the company manages to keep its costs low and simultaneously improves customer experience. Bunnings reached an operational efficiency rating of more than 90% through streamlined supply chain processes and inventory management systems that lower expenses and enhance service delivery. |

|

Focus on Sustainability |

Bunnings emphasizes sustainability initiatives that resonate with changing market trends. In 2023, it reported a reduction of carbon emissions by approximately 30% from 2019, aligning with global sustainability goals and consumer preferences towards eco-friendly products. |

|

Innovation and Customer-Centric Approach |

The ongoing development of new products like smart home devices combined with customized services allows Bunnings to successfully address changing consumer requirements. The company's customer-centric initiatives have generated results with satisfaction ratings staying above 85%. |

|

Market Positioning |

Through strategic positioning Bunnings gains substantial market share via effective marketing approaches (2 million social media followers engaged) and community engagement initiatives which build strong brand loyalty. |

Table6:Competitive analysis of Bunnings

Figure7:Projected Sales growth for Home Depot, Lowe and Bunnings

"Post-Covid-19, Bunnings' revenue growth has slowed from high single digits to low single digits, outperforming US peers Home Depot and Lowes, which have slipped into negative growth over the past 12 months." - Sandstone Insights, a leading Australian investment and analysis company

Generic Strategy

Through its differentiation strategy that focuses on sustainability initiatives combined with local engagement efforts and innovative customer experiences Bunnings plans to build a sustainable competitive edge in the Canadian market. The proposed strategy connects with Canadian consumer preferences by focusing on environmental responsibility and community involvement.

The Sustainable Competitive Advantage profile revels the following profile for the Bunnings -

Figure8:Bunnings SCA profile

- Cost Leadership

- Pricing Strategies:The Strategic focus on maintaining the cost leadership is by focusing on strategies like price match guarantee and a commitment to offer products at prices 10% lower than other competitors. The company will focus on having private label items which will allow Bunnings to provide affordable tools, hardware and outdoor living products which are a low-cost alternative to well-known brands. Bunnings will negotiate to have lower prices with suppliers which ensures competitive pricings across the wide range of products.

- Sustainability as a Core Differentiator:

- Carbon-Neutral Operations: Bunnings works towards carbon-neutral operations through the implementation of renewable energy solutions like solar panels and energy-efficient lighting systems. Bunnings plans to achieve 100% renewable electricity use by 2025 and attain net-zero Scope 1 and 2 emissions by 2030 while forming alliances with Canadian energy providers to attract eco-conscious customers and lower operating expenses.

- Eco-Friendly Product Offerings: Energy-efficient appliances, sustainable building materials, and recyclable gardening tools will be incorporated into Bunnings' expanding product range. By forming alliances with local manufacturers and advertising government incentives for eco-friendly products, Bunnings can improve its competitive standing and green reputation.

- Recycling and Waste Reduction Programs:Bunnings is working on establishing recycling services that will handle paint products alongside batteries and garden waste materials. This initiative helps customers dispose of materials responsibly while building strong bonds with people who care about the environment.

- Localized Marketing and Engagement:

- Community-Centric Initiatives:Bunnings plans to offer workshops and community events that cater to Canadian preferences through DIY home improvement projects designed for local needs. Connecting with Canadian communities will be strengthened through partnerships between Bunnings and schools along with community centres and nonprofit organizations.

- Carbon-Neutral Operations: Bunnings works towards carbon-neutral operations through the implementation of renewable energy solutions like solar panels and energy-efficient lighting systems. Bunnings plans to achieve 100% renewable electricity use by 2025 and attain net-zero Scope 1 and 2 emissions by 2030 while forming alliances with Canadian energy providers to attract eco-conscious customers and lower operating expenses.

- Bilingual Marketing:Bunnings will adopt bilingual marketing in English and French throughout Quebec to adhere to local regulations while building consumer trust through sustainable and affordable value messaging.

- Seasonal Promotions:Bunnings will roll out region-specific promotions in response to the Canadian market's seasonality which involves discounts on winter snow-removal tools and spring gardening supplies.

- Innovative Retail Experiences:

- Omnichannel Integration:The e-commerce platform at Bunnings will expand with new features such as click-and-collect service options and virtual DIY tutorials alongside same-day delivery services. By using data analytics to create personalized marketing strategies businesses can target promotions better which improves customer retention rates.

- Store Formats Tailored to Market Needs:Bunnings will establish compact store formats in urban areas like Toronto and Vancouver but will open larger warehouse outlets in suburban locations. Remote regions will host pop-up stores and mobile units, and these will operate during peak seasons to assess market demand.

- Establishing a Unique Value Proposition

- Affordable Sustainability:Bunnings aspires to democratize sustainable shopping by offering eco-friendly products at affordable prices to reach more customers. Bunnings stands apart from its competition because it focuses on serving ordinary market segments while others pursue premium markets.

- Superior Customer Experience: By training staff to handle DIY projects and sustainability issues, customer service quality will reach superior levels. Loyalty programs that benefit customers who purchase eco-friendly products will grow repeat business and strengthen customer loyalty.

- Social Responsibility and Inclusion:Bunnings will start programs to tackle local issues by working on home improvement projects in underserved areas and supporting Indigenous sustainability initiatives. This commitment enhances its social responsibility profile.

By implementing these initiatives, Bunnings can differentiate itself from established competitors like Home Depot and Lowes:

|

Area |

Bunningss Advantage |

Competitors |

|

Sustainability |

Carbon-neutral operations; aggressive focus on eco-friendly products and sustainable practices |

Initiated some efforts but they have less ambitious targets |

|

Community Engagement |

Tailored workshops to satisfy regional-needs and customer preferences; strong local partnerships via various unique initiatives |

Limited localized outreach programs |

|

Localized Products |

Region-specific offerings for winter/urban markets and harsh climates |

Generic products offered to all the regions. |

|

Affordability |

Competitive pricing for sustainable and eco-friendly goods |

Expensive pricing on eco-friendly items |

Table7:Bunnings comparison with competitors

Expected Outcomes

Bunnings should build robust customer loyalty by focusing on sustainability values and community engagement which will attract consumers who base their purchases on environmental and ethical considerations. Bunnings will create a distinct brand identity in Canada by implementing local practices that help the company stand out from competitors while creating brand recognition. By targeting underserved segments through affordable green products and localized outreach Bunnings plans to secure a major share of the 25% home improvement market share which will establish its position as a leading competitor and guarantee its continued growth.

Target Market Sizing and Segmentation

The home improvement market in Canada is a significant sector within the broader construction and renovation industry. Understanding the market's potential can be framed through the concepts of Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM).

In the below diagram, the rationale for the market sizing is based on the following assumptions.

- TAMAs of 2024, the Canadian home Improvement market is valued at AUD 56 billion and projected to grow at a CAGR of 3.1%.

- SAMShort-term store locations will be in Alberta and Ontario, which represent 40% of the market. The long-term plan is to expand to British Columbia and Quebec, which together will represent 75% of the market.

- SOM Bunnings projected market share based on the pilot phase and expansion.

Figure9:Bunnings Canada Market Sizing projections

Customer segments

- Eco-Conscious DIY Home Improver

- Budget-Conscious DIY Enthusiast

- Senior Homeowners

- Tradespeople/ Renovation contractors

Typical Customer personas that define the Market preferences

|

Mark Smith |

|

|

Age/Gender |

45/Male |

|

Location |

Toronto, Ontario |

|

Occupation |

Marketing Manager |

|

Family Status |

Married with 2 children |

|

Income Level |

$90K annual household income |

|

Goals |

Mark's primary goal is to improve his homes energy efficiency while ensuring it remains a cozy and inviting place for his family. He wants to tackle more extensive renovations to increase the value of his home |

|

Challenges |

He often struggles with finding reliable contractors for installations and is wary of the costs associated with professional services. Time constraints due to work commitments make it hard for him to manage multiple projects simultaneously. |

|

Devices |

Smartphone, tablet, laptop |

|

Brand Affiliations |

Home improvement stores, energy-efficient appliance brands, renovation contractors |

|

Psychographic Details: |

|

|

Interests |

Mark enjoys DIY projects, home improvement shows, and gardening. He often spends weekends working on his home and loves to learn about the latest trends in home design and energy efficiency. |

|

Values |

He values quality and durability in products. Sustainability is important to him, so he looks for eco-friendly options when renovating or upgrading his home. |

|

Lifestyle |

Mark leads an active lifestyle. He balances work with family time, often involving his two children in home projects. He believes in maintaining a comfortable and beautiful living space for his family. |

|

Sarah Thompson |

|

|

Age/Gender |

32/Female |

|

Location |

Toronto, Ontario |

|

Occupation |

Marketing Coordinator |

|

Family Status |

Single |

|

Income Level |

$65,000 annual household income |

|

Goals |

Sarah wants to create a cozy and stylish home that feels personal but is also budget-friendly. She aims to make small, affordable improvements to enhance her living space while considering future homeownership. |

|

Challenges |

Limited budget for large renovations, the need for temporary solutions since she is a renter, and balancing work and personal projects. |

|

Devices |

Smartphone, laptop, smart home devices (e.g., smart bulbs, smart plugs) |

|

Brand Affiliations |

Sarah is interested in brands that offer affordable DIY home improvement solutions, temporary fixtures, and smart home products tailored to renters and first-time home buyers. |

|

Psychographic Details: |

|

|

Interests |

DIY home projects, interior design, technology, sustainability, gardening, and cooking |

|

Values |

Affordability, quality, practicality, and environmentally friendly products. She believes in creating a comfortable living space that reflects her personality while being budget-friendly. |

|

Lifestyle |

Sarah lives in a rented apartment with her partner. She enjoys spending weekends working on home improvement projects, attending local markets, and exploring new cafes. She is active on social media, often sharing her DIY projects and tips with friends. |

|

Margaret Johnson |

|

|

Age/Gender |

68/Female |

|

Location |

Calgary, Alberta |

|

Occupation |

Retired |

|

Family Status |

Married with grown children |

|

Income Level |

$75,000 annually (retirement savings and pension) |

|

Goals |

To make her home safe and accessible so she can continue living independently as she ages. She wants to invest in renovations that will allow her to navigate her home easily and maintain her quality of life. |

|

Challenges |

Limited physical strength and mobility lead to difficulties with home maintenance. She struggles to find reliable contractors who understand her specific needs for aging-in-place renovations. |

|

Devices |

Smartphone, tablet |

|

Brand Affiliations |

Relies on trusted contractors and renovation companies for installations and upgrades. |

|

Psychographic Details: |

|

|

Interests |

Gardening, reading mystery novels, participating in local community activities, and spending time with family. |

|

Values |

Safety, independence, quality of life, and maintaining her home. |

|

Lifestyle |

Lives alone in a single-family home. Enjoys a quiet lifestyle with occasional outings to visit family or friends. Prioritizes comfort and accessibility in her home. |

|

Ken Holmes |

|

|

Age/Gender |

32/Male |

|

Location |

Calgary, Alberta |

|

Occupation |

Owns the home improvement business |

|

Family Status |

Married |

|

Income Level |

$75,000 annually |

|

Goals |

To grow his home improvement business by attracting more clients and expanding service offerings; to stay updated on industry trends and tools; to improve his skills through workshops and training. |

|

Challenges |

Finding reliable suppliers for quality materials; managing time effectively between work and personal life; dealing with competition in the crowded home improvement market. |

|

Devices |

Smartphone, tablet, laptop |

|

Brand Affiliations |

|

|

Psychographic Details: |

|

|

Interests |

Home renovation, woodworking, DIY projects, sustainable building practices |

|

Values |

Quality craftsmanship, customer satisfaction, environmental responsibility |

|

Lifestyle |

Active and hands-on, spends weekends working on home improvement projects, enjoys outdoor activities like camping and hiking |

GAP Analysis

Bunnings has established itself as a dominant player in the home improvement sector in Australia and New Zealand through its competitive pricing strategy and extensive product range. With over 50% market share in the DIY segment, it has become synonymous with home improvement shopping in these regions. The company reported solid financial results with revenues reaching approximatelyA$18.97 billionfor the financial year 2024, indicating strong demand despite economic fluctuations. However, to expand successfully into new markets like Canada, Bunnings must adapt its strategies to local consumer preferences while maintaining its core values of affordability and customer service excellence.

|

Current State |

Domestic Market - ANZ |

|

Domestic Market Focus |

Bunnings operates 513 retail locations and employs over 55,000 employees across Australia and New Zealand. The company has a significant presence with over 381 stores in Australia alone, holding around 50% market share in the DIY hardware sector. |

|

Proven Business Model |

The business is built on three strategic pillars: Lowest prices, a wide range of products, and an unmatched customer experience. Revenue of Bunnings increased 2.3 per cent to $18,968 million for the year, with earnings increasing by 0.9 per cent which is $2,251 million. |

|

Market Strategy |

Bunnings adopts a localized approach, tailoring product assortments to meet the specific housing and lifestyle needs of Australian and New Zealand customers. The company is expanding its product range and enhancing service offerings, including a focus on digital sales which accounted for 5.1% of total sales. |

|

Sustainability |

Bunnings was able to achieve the reduction in the Scope 1 and Scope 2 emissions to 49.4 (ktCO2e). The operational waste that was diverted from the landfill were about 60.6%. |

|

Limited International Presence |

The company focuses primarily on the ANZ market, resulting in limited global brand recognition compared to competitors like Home Depot and Lowes. Bunnings is currently exploring opportunities to expand into Canada but lacks a significant international footprint. |

Table9:Bunnings current strategy in ANZ

|

Future State |

Strategies for Expansion into Canada |

|

Market Research and Customization |

Conduct thorough market research to understand Canadian customer preferences, housing trends, and regional variations to tailor offerings effectively. This includes analyzing local competitors and identifying gaps in the market. |

|

Brand Positioning |

Develop a strong Canadian brand identity that emphasizes affordable, sustainable, and eco-friendly products to compete effectively with established players like Home Depot and Lowe's. Highlighting community engagement initiatives can enhance brand loyalty. |

|

Localized Marketing |

Implement a marketing strategy that resonates with Canadian culture and seasonal needs, targeting both urban and suburban DIY consumers. This could involve partnerships with local influencers and community events. |

|

Operational Strategy |

Establish a robust local supply chain through partnerships or infrastructure investments, ensuring competitive pricing, timely delivery, and market-specific customer service by recruiting local talent. This includes potential collaborations with local suppliers for product sourcing. |

|

Sustainability and Community Engagement |

Launch sustainability initiatives while actively engaging with Canadian communities to build trust and enhance brand image. Bunnings has previously raised over $47.4 million through community activities in Australia and New Zealand, showcasing its commitment to social responsibility. |

Table10:Bunnings future strategy for Canada

Additional Considerations for Bunnings Expansion

- Competitive Landscape: Understanding the competitive dynamics in Canada is crucial. Bunnings must analyze competitors' strengths and weaknesses to identify gaps in the market.

- Product Customization: Tailoring product assortments to meet specific Canadian needs will be essential for gaining market acceptance.

- Community Involvement: Building relationships with local communities through sponsorships and community events can enhance brand visibility and loyalty.

Recommended Strategies

Bunnings' success in Canada hinges on a phased approach encompassing immediate market entry, medium-term expansion, and long-term consolidation. Each phase is strategically aligned with targeted branding and marketing initiatives, customized pricing and product strategies, and a well-planned expansion roadmap. Additionally, establishing strong supply chain partnerships will ensure competitiveness and profitability, while maintaining an exit strategy to mitigate potential risks.

Short-Term Strategies (Year 1-2)

Gaining a foothold in the Canadian market by addressing market-specific product needs and implementing a competitive pricing strategy will enable Bunnings to build brand awareness and recognition, laying the foundation for future expansion and growth.

|

Strategy |

Description |

Supporting Rationale |

|

Launching Flagship Stores in Alberta and Ontario

Outcome:Establish a strong market presence for Bunnings in two of Canadas most populous and economically robust provinces. This will test market conditions and will help fine-tune supply chain and logistics operations Estimated execution time:t-12 to t0 months |

In Alberta, launch 3 Bunnings Warehouses in Calgary, Edmonton and Red Deer. In Ontario, launch 2 Bunnings Warehouses in Toronto and Ottawa. These warehouses will help showcase Bunnings brand and create awareness among all customer segments. They will also feature in-store workshops, personalized services and expert consultations. |

Alberta has a very high percentage of high-budgeted renovations while Ontario is the most populated province with an average spend of $11,560 per household as compared to the country average of $10,860 (MadeinCA, 2025). In addition, the Alberta and Ontario enjoy the highest average income of $58,800 and $57,000 as compared to the other provinces (Wowa, 2024). In terms of the signature warehouse store locations, the cities chosen are the most populated residential areas with a stable and diverse economy ensuring a strong demand for home improvement products. |

|

Opening Smaller Format Stores and Trade Center in Alberta and Ontario

Outcome:Extending Bunnings reach to urban and suburban areas with a targeted approach to serve specific customer segments. Estimated execution time:t0 to t18 months |

In addition to the signature Bunnings warehouses, the plan is to open 10 Smaller Format Stores and 6 Trade Centers in the following cities Calgary Edmonton Red Deer Lethbridge St. Albert Grande Prairie Ottawa Ontario Waterloo Oaksville The smaller format stores will appeal to DIV homeowners and urban professionals who prefer convenience and localized offerings. The trade centers on the other hand will cater to contractors, builders and commercial clients by providing a specialized and professional environment for bulk orders, tools, materials and expert advice. |

Alongside flagship Bunnings Warehouses, which require significant investment in infrastructure, storage, insurance, and labor, the strategy includes launching smaller-format stores and trade centers near major shopping hubs. This approach mirrors Bunnings ANZs successful model, where smaller stores typically stock 20-25% of top-selling products, tailored to the Canadian market. Additionally, trade centers will offer a broad selection of building and trade supplies, focusing on bulk materials and professional-grade products to cater to commercial tradespeople. |

|

Localized Marketing and Brand Building

Outcome:Differentiate Bunnings from competitors, generate brand awareness and excitement in the market. Estimated execution time:t-12 to t12 months (aggressive marketing with promotional events) t12 and beyond (more targeted marketing) |

Develop targeted marketing campaigns for each region through social media platforms and influencers and organize community events to enhance brand recognition and customer interaction. |

In the Canadian home improvement Red Ocean market dominated by Home Depot and Lowe, effective marketing and branding campaigns will play a crucial role in establishing Bunnings by creating strong brand recognition, generating early customer interest, and differentiating it from existing competitors. Leveraging social media, influencers, and community events will help Bunnings connect with local audiences, build trust, and establish a loyal customer base. Pop-up stores will provide hands-on experience with Bunnings products, reinforcing the brands value proposition and driving word-of-mouth marketing. |

|

Establish supply chain partnerships with established local brands

Outcome:Increase operational efficiency. Establish a robust and reliable supply chain. Gather local expertise on market demands, consumer preferences and regulatory requirements Estimated execution time:t0 to t24 months |

Create trade agreements including pricing, delivery schedules, return policies, and quality assurance measures with Timber suppliers like West Fraser Timber Co. Ltd. and Canfor Corporation. Hardware manufacturers like Canadian Builder Hardware Manufacturing Inc Paint manufacturers like PPG Paints Inc This is addition to extending existing partnerships with global brands like Bosch, Makita, Ryobi, Scotts Miracle-Gro, Dulux etc to supply products to Canadian stores Negotiate cost-sharing arrangements for marketing, co-branding opportunities, and joint promotional efforts. Collaborate with local partners to streamline logistics and distribution channels, ensuring timely and cost-effective delivery of goods. Collaborate with legal and compliance teams to stay updated on any changes in local laws that might affect the supply chain. |

Given the geographical distance between Bunnings existing domestic market and Canada, establishing a local supply chain is crucial for cost-effective sourcing and operational efficiency. Collaborating with well-established North American brands will enhance customer trust and foster brand loyalty. Additionally, leveraging local suppliers' market insights will enable Bunnings to stock products that align with Canadian consumer preferences, ensuring relevance and competitiveness. |

Table11:Recommended Strategies Short Term (Year 1-2)

Projected Outcomes by end of Year 2:

- 5%of overall Canadian Home Improvement Retail market share

- Annual revenue of$4.8 billion

- Begin establishing brand loyalty and customer trust

Risks and Mitigation Plan

|

Risks |

Mitigation Plan |

|

There is a potential risk that the Canadian market may not immediately embrace Bunnings' flagship stores and smaller format stores, leading to lower-than-expected customer traffic and sales. |

To attract early customers, offer introductory promotions and discounts, creating an incentive for initial purchases. After the launch, gather and analyze customer feedback to quickly identify areas for improvement, enabling rapid adjustments to refine offerings and better meet customer expectations. |

|

The costs of launching flagship stores, smaller format stores, trade centers, and setting up supply chain partnerships can be significant, potentially straining financial resources. |

Focus on phased rollouts to manage capital expenditure and assess ROI before scaling further. Seek financial support or incentives from local governments or investment partners to promote regional business expansion. Continuously monitor store performance to ensure investments are meeting expectations, while implementing cost-saving measures like optimizing layouts, using local suppliers, and reducing operational inefficiencies. |

|

Establishing supply chain partnerships with local brands may face challenges, such as delays in production, transportation disruptions, or inventory shortages. |

Diversify suppliers to minimize reliance on a single brand or region, ensuring a steady product supply. Implement strong inventory management systems to track stock levels and demand fluctuations, maintaining availability. Establish contingency plans and secondary sourcing options for supply disruptions. |

Table12:Short term risks and mitigation plan

Medium Term Strategies (Year 3-5)

Further expansion into other provinces and suburban areas to expand reach with a focus on affordability, sustainability and enhancing customer experience.

|

Strategy |

Description |

Supporting Rationale |

|

Expansion to British Columbia and Quebec

Outcome:Boost revenue, increase market share and enhance brand recognition. Estimated execution time:t24 to t48 months |

Launch all format types of stores in British Columbian cities Vancouver, and Surrey. In addition, launch stores in Quebec, launch Bunnings stores in Montreal and Quebec City. The plan is to open warehouses on the outskirts of the cities with smaller format stores near shopping hubs and trade centers near industrial areas. |

After successfully launching stores in Alberta and Ontariocovering approximately 50% of the Canadian populationand implementing targeted marketing efforts to establish Bunnings as a trusted home improvement retailer, the next phase of expansion should focus on Vancouver and Quebec. This expansion would extend Bunnings reach to roughly 85% of the Canadian population, ensuring a strong nationwide presence and enhancing its ability to capture a larger market share from competitors. |

|

Enhanced focus on providing tailor-made products for the Canadian market

Outcome:Improved customer satisfaction and stronger brand loyalty. Foster deeper connections with consumers. Estimated execution time:t24 and beyond |

Expand products in categories: Insulation and weather proofing Snow and Ice management Heating solutions Plumbing and pipe protection Emergency and backup power Exterior Protection & Maintenance Incorporate eco-friendly and sustainable practices into the product design and sourcing process to align with Canadian consumer demand for green solutions. Ensure that all tailor-made products meet Canadian regulatory requirements, including safety standards, environmental regulations, and quality assurance. |