Kwick Mobiles Assignment

- Country :

Australia

Question 1

Kiwi Plc makes and sells smartcell phones. The Chief Executive, David Jas is reviewing the budget for its cash cow model which is also its best seller for the past year as the company is considering how it might improve its performance. The original budget shows expected sales to be 40,000 units at an average price of 400 per unit. At this level of sales, total variable costs will be 8,000,000 and total fixed costs will be 7,000,000.

Cherry Bever, the Sales Manager suggests that if the price of the cell phones were reduced by 10%, then she estimates that the sales volume would increase by 20%.

Rayan Meyer, the Marketing Manager, has a different opinion. He believes that the best way to increase sales is to have an increased marketing drive across all their current markets. He reckons that to increase sales by 20% it would need an additional marketing push costing 1,500,000.

The board has asked for some figures and advice to help it decide which of the three strategies to adopt:

- Remain with the original budget

- Adopt Cherry Bevers proposal,

- Adopt Rayan Meyers proposal.

(Each alternative should be considered independently.)

Required

You are required for each of the three strategies to:

- Using the Cost Volume Profit model, determine:

- The profit

- The breakeven point in s and units

- The margin of safety in percentage (%)

- The sales level that would be required if the company wishes to make a profit of 1,900,000

(15%) - Critically evaluate and analyse the figures that you have determined for each strategy in part (a) above and advise the Board on which strategy they should pursue and why. (25%)

- Critically evaluate four of the basic assumptions of the Cost Volume Profit model used in part (a), with particular focus on the manufacturing industry. (30%)

- With examples, describe the different ways of classifying costs and explain how viewing cost in different ways assists management decision making within the manufacturing industry. (30%)

1000 word maximum for parts b, c and d of question 1.

(Total 100%)

Question 2

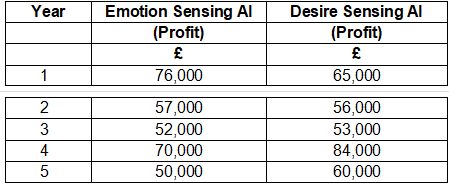

KMaxx Mobiles Ltd is considering investing into a new Artificial Intelligence research project to develop new model of cell phones with different sensors such as either Emotion Sensing AI or Desire Sensing AI, to help enhancing customer usage experience. Cost of developing each AI based sensor is 750,000 and have a life span of 5 years. Emotion Sensing AI has a resale value of 50,000 and Desire Sensing AI has a resale value of 75,000. The company uses the straight-line method of depreciation.

The expected profits to be generated by each AI based sensors during its expected life after depreciation has been charged are as follows:

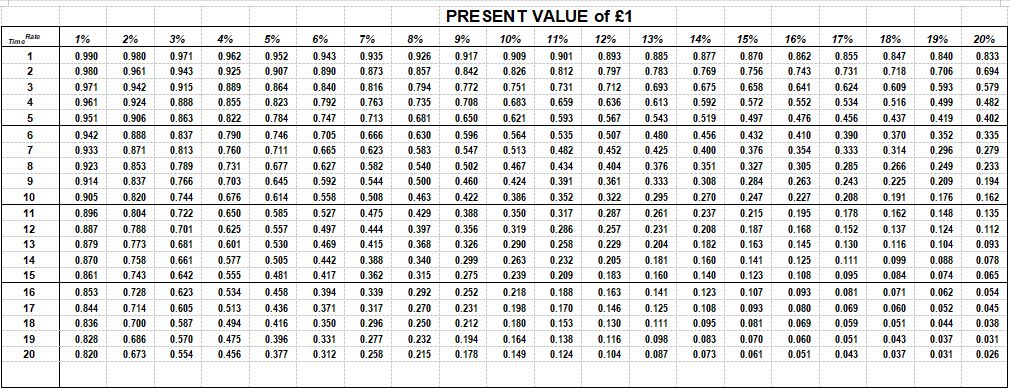

The companys cost of capital is 10% but uses a 13% hurdle rate when assessing capital projects.

Required

- Determine the financial viability of the investment by calculating the projects:

- Payback

- Accounting Rate of Return

- Net Present Value (Using the cost of capital)

- Net Present Value (Using the hurdle rate)

(30%) - Appriase in detail the results of your calculations in part (a) of this question. Ensure that you state whether the project should be undertaken. Justify your answer.

(Candidates are encouraged to research what constitutes a reasonable return in todays business environment) (20%) - Critically evaluate the use of the models above within the manufacturing sector taking into consideration any factors unique to the manufacturing industry and other relevant factors such as the size of the organisation. (50%)

words maximum for parts b and c of question 2.

- (PV Table is attached at the end of the file). (Total 100%)

Question 3

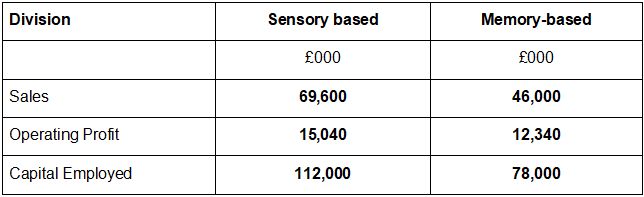

Kwick Limited is a company manufacturing mobile phones with two divisions specialising in Sensor-based and Memory-based. The results for its last year are presented below:

The company currently use Return on Capital Employed (ROCE) to both measure and reward the performance of divisional management. The company has a cost of capital of 7%.

Required:

- Based on the above information, for each of the divisions, calculate and assess the expected Return on Investment. Critically analyse the results, benefits and limitations of methods. Also, discuss the behavioural problems that may arise if the companys senior management insist on using the industrys ROI as a measure to assess divisional performance and staff reward. (20%)

- The divisional managing directors are unhappy about the results produced by the calculations in (a) and have heard that a performance measure known as Residual Income (RI) may provide more information. Calculate the annualised RI for each of the divisions, based on the operating profit figure and critically discuss benefits and limitations of using RI to assess divisional performance and staff reward. (20%)

- Non-financial as well as financial performance measures are also crucial to the success of organisations within the manufacturing industry. Discuss and critically analyse the use of financial and non-financial performance measures. Also, Using the balanced scorecard identify, select and justify performance measures (four measures for each of the four dimensions) to use within the manufacturing industry or your own sector. (60%)

750 words maximum for question 3.

(Total 100%)

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank