Risk And Return :Middle Management Positions In The WorkplaceAssignment

- Country :

Australia

Purpose:

Using spreadsheets to solve complex problems is a key competence in fact a requirement for many middle management positions in the workplace. Corporate finance provides many opportunities to use MS Excel to solve problems that cannot easily be solved manually.

In this assignment, you will be applying the basic calculation tools to analyze the cost of capital for a corporation and apply calculate the weighted average cost of capital.

Instructions:

- Use the scenario below to answer the questions.

- Use MS Excel for all calculations or the BA II plus calculator and MS Word to submit your assignment.

- Submit your report in MS Excel format. Attach any supporting Excel documents to the D2L assignment tool.

Question 1: (10 marks)

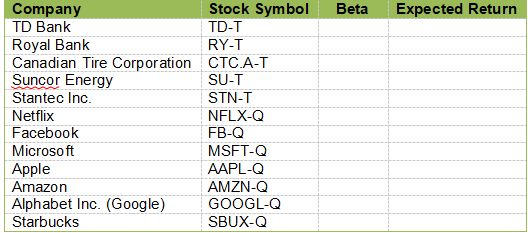

Find the following Betas for the companies listed below: (use www.yahoofinance.com)

Assuming a risk free rate (Rf) of 2% and the Return from the market (Rm) of 6.5?lculated the expected return of each company based on the Capital Asset Pricing Model.

Re-order your list from the lowest beta to the highest and compare their expected return.

- Comment on your results. (Hint: Look at the grouping of the companies, and the value of betas from 0 to 0.5, from 0.5 to 1, from 1 to 1.25 and 1.25 and up)

- What does the value of beta tell us about a company? What does the value of beta and CAPM tell us about the risk in investing in a company?

Question 2: (15 marks)

Given the following information for McCumber Energy:

Debt 7,000 6 percent coupon bonds outstanding, $1,000 par value, 25 years to maturity selling for 106 percent of par; the bonds make semi-annual payments

Preferred shares 15,000 shares paying a dividend of $3.65 per preferred shares outstanding currently selling at $72 per share

Common shares - 300,000 common shares outstanding, selling at $55 per share.

McCumber Corporate Tax Rate: 35%

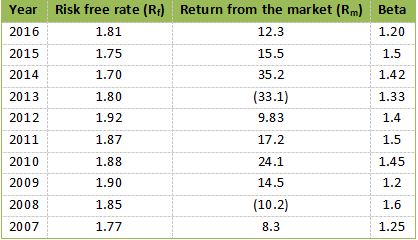

Table 1 - Market data:

- Calculate the average Risk free rate (Rf), Return from the market (Rm) and beta (?) from data collected in the last ten years in Table 1.

- Calculate the market value of each component of the capital structure of the company.

- Calculate the cost of debt, cost of preferred shares and cost of common shares. Note: Use CAPM for the cost of common shares using your averages for Rf, Rm and Beta

- Calculate the weighted average cost of capital (WACC) for McCumber Energy.

Question 3: (10 marks)

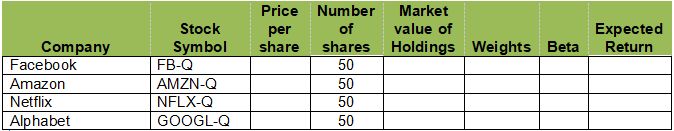

You have heard that the latest in portfolio diversification is to invest in FANG stocks. FANG being the stocks of Facebook, Amazon, Netflix and Google.

From www.yahoofinance.com), find the current stock price of each of those four companies, and buy 50 shares of each companies for your portfolio.

Calculate the weighting of each company from your portfolio based on the market value in the investment in each of the four FANG.

Using a risk-free return of 2% and a stock market return of 6%, calculate the following:

- Weightings of each company on your portfolio (2 marks)

- Find the betas from each company using www.yahoofinance.com) (2 marks)

- Expected return from each company based on CAPM (2 marks)

- Weighted Expected return of your portfolio (2 marks)

- Weighted Beta of the portfolio (2 marks)

Present your financial data in a table similar to Table 1 on the following page.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank