Strategic Financial Management and Corporate Performance Analysis ACC5023

- Subject Code :

ACC5023

Introduction

Amazon.com, Inc. has grown to be regarded as the world's leading e-retailer and cloud computing provider, from its inception, which has ensured its continued relevance in the changing business environment. Created in 1994 by Jeff Bezos, Amazon seeks to become "the most customer-centric company on Earth", and the company's purpose is to bring a wide range of products at affordable prices and deliver them quickly and efficiently (Amazon 2023). The company's long-term growth strategy is based on investment in innovation and technology, organic growth of infrastructure, and diversification of activities into new markets. Its planning strategies emphasize customer obsession, operational excellence and geographical expansion.

Macro-Economic and Business Environment

The world economy does not remain unchanged, factors such as inflation, disruption of supply lines, war among nations and changing consumption patterns keep on reshaping it. The global business underwent a paradigm revolution due to the COVID-19 pandemic, which enhanced the market in the ecommerce sector but, at the same time, increased the pressure on the supply chain (Donthu and Gustafsson 2020). This disruption was, on the other hand, advantageous to Amazon, especially with the increasing trend of people doing online shopping more than ever before and the rise in the use of cloud computing services (AWS 2024). Nevertheless, 2022 and 2023 were characterized by an asymmetric recovery of the economies since there were still inflationary tendencies, increases in the cost of borrowing rates, the fears of a recession, and cutting down consumer expenditures and investors' risk appetite.

Financial and Operational Performance: 2022 & 2023

Amazon's financial and operational performance portrays both the endurance and ability to change amidst the changing macroeconomic environment during the years 2022 and 2023. The annual revenue stood at 513 billion U. S. dollars for the year 2022, marking a 9 per cent increase from the year 2021 despite inflationary pressures and disruptions in supply chain management (Amazon 2023a). In 2023, revenues of $85 billion were posted by AWS, representing almost 17% of total revenues.

Rising expenses, including wages and logistics expenses due to inflation, negatively influenced operating income. Amazon's operating profit in 2022 was $12.2 billion, less than half of the $24.9 seen the year before. However, management never ceased to make funds available for these areas, including logistics, robotics, and automation, to enhance efficiency. Investments in AI and cloud technology further drove up operating costs in 2023 as the company sees these as necessary for growth in the future.

The Strategic Planning

Regarding earnings, Amazon's bottom line has not remained relatively stable. In 2022, the retail brand experienced a net loss amounting to $2.7 billion, mainly due to write-offs from investments and increased expenditure. However, only within one year by 2023, Amazon returned to profitability, with net earnings of $9.3 billion as the company incorporated cost-cutting actions, and there was an upturn in the market. Amazon's debt levels thankfully held steady and below danger levels, while operating cash inflows remained positive at $46 billion in 2023, an increase of $7 billion compared to 2022.

Financial Principles and Their Impact on the Bottom Line

Understanding financial accounting principles, policies, and regulations is not just a necessity but a crucial step in ascertaining the actual financial position of a company and ensuring that the business operates within the boundaries of the law. In the case of Amazon, the company's financial reporting is anchored on Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) framework (Jakupi and Statovci 2017). These standards play a pivotal role in safeguarding financial information's integrity, consistency, and reliability. Moreover, the firm's decisions, strategies, and policiessuch as those related to revenue and expense recognition, costs and assets management, and estimating asset lifetimedirectly impact the firm's profitability and market competition.

Financial Reporting Practices and Guidelines

Financial reporting practices and guidelines are imperative to reporting to the shareholders of a company. Amazon portrays its financial position in compliance with global financial reporting standards. One of the leading accounting principles that enormously impacts how Amazon reports its financials is revenue recognition, as directed by the guidelines in ASC 606 (Revenue from Contracts with Customers). Among other things, ASC 606 guides companies to record and report revenue earned concerning goods and services transferred to the customers (Fey et al. 2019). This will also affect how Amazon reports its revenues from e-commerce business, cloud computing (Amazon Web Services), and subscription services such as Prime.

Effects of Revenue Recognition

Amazon's revenue recognition policy is of utmost importance due to the complexity of its income components. For the online retail business, the delivery of goods is the revenue recognition point. However, for goods such as A.W.S. and prime subscriptions, revenue is accounted for over time (Fey et al. 2019). This is also true for A.W.S., where service provision underpins the network's operations and is a significant contributor to Amazon's profits. A.W.S. employs a similar timing of recognition in revenue earned, matching it to the period in which the services are rendered. This approach helps in even distribution of profit irregularities and ensures a steady stream of income even when the retail business has recorded lower sales figures.

Inventory Valuation

Amazon's inventory valuation policy, the First-In, First-Out (FIFO) method, significantly affects the cost of goods sold (COGS) calculation and the general profitability. According to the FIFO method, the assumption is made that the oldest inventory will be sold first. This is usually the case during inflation. Due to increasing prices, the cost of goods held in the balance sheet is lower than the current prices in the market, leading to an increase in gross profit (Tamplin 2024). Amazon's application of FIFO has worked well in its favour, especially in the context of rising costs of inventory replenishment, where e-commerce is characterized by fast inventory turnover. Notwithstanding, the FIFO technique may create a distorted view of the financials when there is high volatility of prices or when the supply chain is disrupted. As an illustration, if the level of inventory held by Amazon becomes excessive owing to a disruption in the supply chain or a fall in consumer demand, the appreciation of the older stock at lower rates could distort cost margins to hide the inefficiencies or risks present.

Depreciation and Asset Valuation

Another key accounting aspect which has consequences on the earnings of Amazon is the straight-line depreciation of its property, plant, and equipment such as fulfilment centres, logistics network, and cloud computing facilities. Amazon applies the straight-line method of accounting for depreciation expense, which means that the cost of its tangible long-lived assets is allocated evenly over the asset's useful life resulting in a consistent slice of the expense in the income statement this way, the corporation controls how the expenses are recognized, reducing the volatility in net profits (Ackermann et al. 2016). Amazon must not under or overstate the useful economic life of its assets because this may lead it to falsify its earnings. Such errors may, in the short run, cause an increase in net income but, in the long run, pose a danger to the company's survival.

The accounting practices that aim to sway investor perception, executive pay, and the firm's worth can result in the possible misuse of financial data in both management and financial accounting. Though accounting frameworks are brought in to increase transparency, firms have been known to take advantage of grey areas to show better results. Given Amazon's vast array of income sources, operational reach, and fast inventory turn-up rate, it faces data integrity threats in various areas.

Earnings management is one issue that falls under the umbrella of financial data misuse. Some firms might 'manage' their earnings by reclassifying or stretching their financial reports to reach the set goals in earning or improve on other key performance indicators (KPIs). In this case, Amazon might postpone expenses or hasten recognizing revenues to achieve the desired net income for that fiscal quarter.

Strategic Financial Management as a Plan of Action

In Amazon, competitive financial management is characterized by strategic planning and execution. The company's leadership in e-commerce and cloud computing is a result approach driven by a vision of investing in technology, logistics, and customer-focused innovativeness (Flamand et al. 2020). Among the essential tenets of Amazon's financial strategy is the high degree of Capital Expenditure (CapEx) on supporting facilities, particularly on A.W.S. and fulfilment centres. In a competitive environment, Amazon's capital investments increase operational effectiveness and provide the necessary growth opportunities. Changing the way certain operations within the company are performed increases overall efficiency. Consequently, it affects Amazon's financial results, whereby even in the wake of increasing costs of wages and inflation, the company can still make a profit.

Another critical area of Amazon's financial strategy is its cost control measures. Amazon is always looking for ways to improve its cost structures through process improvements and vertical integration. Furthermore, Amazon has been able to overcome other competitors in the market due to its financial planning, which is aided by data analytics. The organization uses big data for accurate pricing, demand prediction, and inventory control, all of which contribute to ensuring healthy profit margins.

Ratio Analysis

The ratio analysis focuses on a financial performance analysis of Amazon for 2022 and 2023. In particular, it compares key financial ratios with those of its closest competitor, Walmart, and industry averages. The ratios include profitability and asset utilization ratios, liquidity, debt utilization and market ratios. These financial ratios show the operational efficiency of Amazon, its financial health, and its growth outlook for the future, taking into account other environmental factors, including economic conditions and competition.

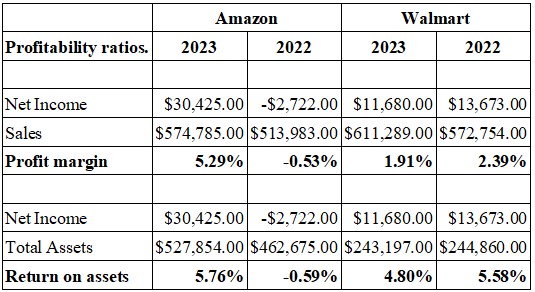

Profitability Ratio

Net Profit Margin

The net profit margin indicates the profit generated from total revenue, that is, how well the company has managed its costs in general. Amazons 2023 profit margin of 5.29% is a remarkable increase from the profit margin, which tumbled to -0.53% in 2022, signalling a turnaround after the wrong year. This recovery could have been achieved through amazon cost-cutting measures, operational efficiency and growth focus in higher margin segments such as AWS Amazons Web Services. In comparison, Walmarts profit margin decreased slightly from 2.39 per cent to 1.91 per cent, which signals higher cost pressures. Margins of amazon.com for the year 2023 are higher than those of Walmart, hence better profitability, which can be attributed to amazon different income streams and technological services. Nevertheless, the profitability of both companies is exposed to threats of inflation and macroeconomic-related cuts in consumer demand for instance, due to high interest rates and recession.

Return on Assets (ROA)

The return on assets indicates how well a business uses its assets to generate earnings. The Amazon business segment's return on assets for 2023 is 5.76%, which is a welcome increase from -0.59% in the previous year. This change implies better utilization of the assets after a tough year, 2022. The massive capital investments and expansion-related costs in an economic downturn essentially caused the negative ROA for 2022. Conversely, Walmart's ROA also suffered by a more minor Marginal degree, from 5.58% to 4.80%, which shows that the customer assets were utilized to the same extent but with operational inefficiency. It can be inferred from the fact that the combined assets of Amazon in the year 2023 were better put to use than in the year 2022 because the company had adopted technology and automation in operational processes. Though this is the case, the two will still have to be on edge as many external elements, like the rise in interest rates, supply chain challenges, and increased labour costs, could diminish their profits.

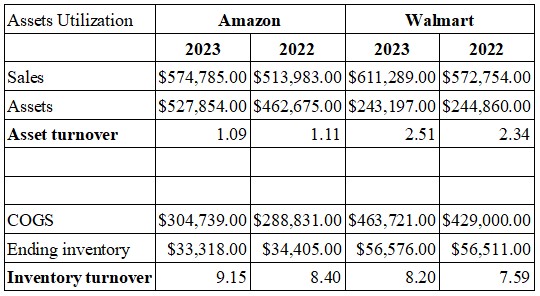

Assets Utilization

Asset Turnover Ratio

This ratio illustrates how well a firm employs its possessions in creating sales. An asset turnover ratio of 2.51 for Walmart in 2023 means the company is better than Amazon in generating sales from its assets. Amazon achieved an asset turnover of 1.09 in the year 2023, although it was a little drop from the previous year, when it recorded 1.11, which indicates that more sales are made per dollar of assets used than is the case for Walmart. This can be partly explained by Amazon's extensive investment spending on different infrastructures, such as its freight and prime air, which do not immediately increase sales. The reason why Walmart's asset turnover ratio is higher than Amazon's is that Walmart has a more developed retail distribution system, which does not require as many fixed assets as incurring sales does. However, Amazon's asset turnover may increase as more of its less capital-intensive AWS division, which has been expanded, comes into play in the overall company sales.

Inventory Turnover Ratio

The inventory turnover ratio shows how well a firm can use its stock at its disposal. The inventory turnover ratio of Amazon grew from 8.40 in 2022 to 9.15 in 2023, implying better effectiveness in inventory management and satisfying customer needs. In addition, Walmart's inventory turnover ratio also increased from 7.59 in 2022 to 8.20 in 2023, though the higher ratio of Amazon's inventory turnover means the company is more efficient in asset management. Such factors as predictive analytics and automation of warehouses most likely explain Amazon's higher inventory turnover. This is primarily because effective inventory management helps reduce the inventory holding charges, which tend to be a problem, especially when inflation is experienced in the economy, which is characterized by increased costs of goods sold (COGS).

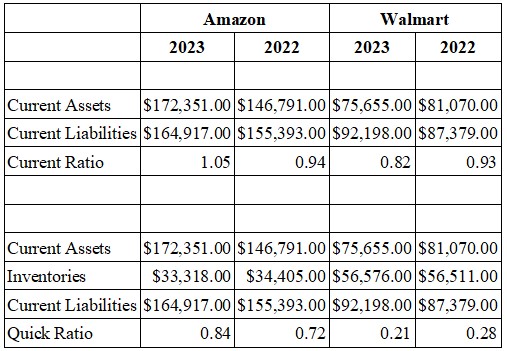

Liquidity Ratio

Current Ratio

The working capital ratio gauged the company's capability to meet its short-term liabilities with its short-term assets. Considering this, Amazon's current ratio rose from 0.94 in 2022 to 1.05 in 2023. This implies that the company has enough short-term assets to handle the short-term liabilities. On the other hand, Walmart's current ratio has shown negative growth where it declined from 0.93 to 0.82. That means the company may have cut out the possibility of making some obligations in the short term. This above implies satisfactory liquidity for a company like Amazon, especially during uneasy economic times. However, striking this ratio will be crucial as the two companies face increasing costs of operations together with the likelihood of a recession.

Quick Ratio

In the liquidity measure referred to as the quick ratio, inventories are not included in the current assets. Amazon's quick ratio improved from 0.72 in 2022 to 0.84 in 2023, meaning the company can meet its short-term liabilities without chunky inventory. Walmart's quick ratio is significantly lower at 0.21 for 2023, indicating that it depends on its inventory for its short-term obligations. The rationale behind Amazon's highest quick ratio is its strong liquidity, which is crucial in cases of sudden financial strain, such as a supply shortage or a depression in demand.

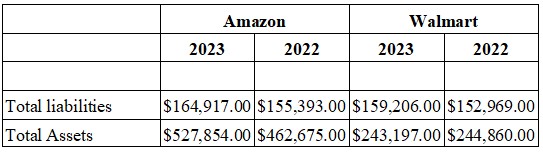

Debt Utilization

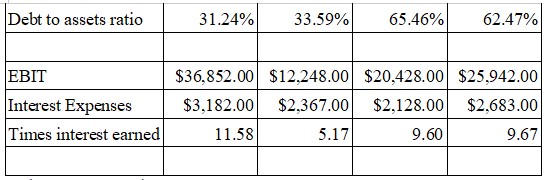

Debt to Assets Ratio

Amazon brought its debt-to-assets ratios down from 33.59% in 2022 to 31.24% in 2023, showing that the company has scaled down on using debt to finance its business activities. On the other hand, Wal-Mart's debt to assets ratios also went up from 62.47% to 65.46%, indicating that the company has become more geared towards debt financing. Amazon's low debt ratio means it is better positioned to withstand economic challenges without compromising on its investment initiatives. Given its increasing interest rates, limiting borrowing levels to manage interest costs and retain earned profits will be essential.

Time Interest Earned

TIE evaluates the possibility of a particular company paying interest on the debt from earnings generated from its operations. TIE for Amazon Ventures LLC has improved significantly from 5.17 in 2022 to 11.58 in 2023, which means that the corporation is in a more favourable position to pay its interest rates. On the other hand, Wal-Mart's TIE remained relatively constant at around 9.60, demonstrating its capability always to manage the interest expenses. The reason for this to also improve for Amazon is the efficient utilization of the operations as they allow room for the uplift of debt even as interest rates increase worldwide.

Market Performance Ratio

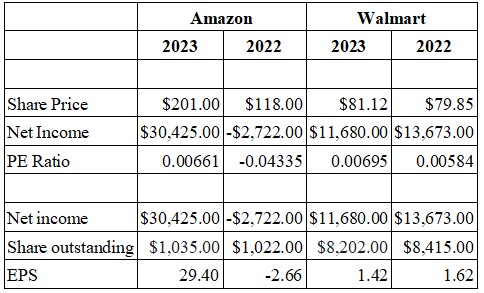

Price-to-Earnings (P/E) Ratio

P/E ratio shows how much investors are willing to pay today for earnings growth in the years to come. In 2023, Amazon's P/E ratio signalled investor confidence after crossing the zero mark at 0.0066 with expectations towards earnings recovery. Likewise, Walmart's P/E at 0.0070, which is a tad higher, indicates stable investor sentiment bolstered by the company's performance within the retail space. Comparatively, the faster growth relative to profits achieved and the expansion of other economic activities perhaps reassured the stockholders.

Earnings per Share (EPS)

EPS measures the profit available to shareholders divided by the total number of shares outstanding. In 2023, the EPS of Amazon became better than other competitors and reached 29.40, as it was backwards in 2022 when it was -2.66, showing a great deal of transformation in profitability. Conversely, Wal-Mart's EPS also showed a decline but to a lesser extent, which points to more consistency in, however, lower growth in the company's earnings.

Impact of External Operating Environment

Inflation, supply chain issues, labor shortages, and changes in consumer spending trends are just a few of the external forces that have impacted both amazon and walmart. Elevated costs of goods and labour increased pressure on margins, and the recent rise in interest rates impacted debt servicing costs. The increasing reliance on e-commerce and a more comprehensive range of digital services boost Amazon's performance, as indicated by its profits and market standing. Compared to 2022, Amazons overall performance in year 2023 is noticeably better, in terms of profitability, asset management, and liquidity and market ratios as compared to Walmart rating. Even in the face of external globalization challenges such as inflation and high-interest rates, Amazon was able to increase productivity and efficiency while decreasing dependency on borrowed funds. As for Walmart, its ability to generate sales from its retail assets is higher and remains constant even during financial distress. The continuing macroeconomic changes underscore the necessity for the two firms to enhance cost containment and operational efficiency to achieve financial sustainability.

Budget Practices

Budgeting, a critical component of management decisions and accounting procedures in nearly all businesses, is not without its flaws, given its extensive use. Its role in today's productive and dependable operations administration is paramount, as control over limited capital is a lifeline for the continuity of public or private organizations (Cote 2022). The budget, the most essential tool for managing the public sector, is a reflection of a government's Public Policy Development Action Plan. However, it's worth noting that traditional budgeting strategies, while important, have their limitations that need to be addressed.

Conventional approaches to Budgeting

Implementing budgeting systems, especially in annual target budgets, has been an essential component of managing finances in organizations for several decades. This entails entering into an agreement or goal setting for a given period (the year being the most common) to achieve specific revenues and incur certain costs supported by historical trends, forecasted figures and other relevant economic indicators(Paul 2024). The traditional budgeting system's main characteristics are incremental Budgeting, zero-based Budgeting, and top-down or bottom-up approaches. These methods put in place a well-organized financial plan but are highly seen as inflexible, slow, and incapable of adjustments to the changes occurring in the market. The incremental budgeting technique is the most common across organizations. This technique increases the previous year's budget by a certain percentage to cater for inflation or any other changes likely to occur (Russell 2023). Even though this approach is relatively straightforward and uncomplicated to implement, it tends to create inefficiencies as it presumes that history will repeat itself and continues setting budgets until a limit is reached, causing innovation and cost containment to be out of the picture entirely.

Zero-based Budgeting (ZBB) calls for expenses to be justified in each budgeting process and does not allow referencing previous budgets. This process, though labour-intensive and time-consuming, can afford organizations (Heath 2020). For instance, Amazon, can examine all expenditures and deploy finances in a given period only on relevant activities. Nonetheless, in a large and multifaceted organization, ZBB tends to be very burdensome regarding cost and time to review every expense item.

Disadvantages of Conventional Budgeting

Although conventional Budgeting outlines a detailed financial planning process, some aspects have limitations, particularly in agile environments like e-commerce and technology. Take the example of an annual budgeting process in which even when the market is predicted to shift, technologies are introduced, or unforeseen circumstances occur (like in the case of COVID-19), the processed budget does not make allowance for such changes (Lorain et al. 2015). For instance, in Amazon's scenario, where competition is cut-throat, the traditional forms of Budgeting can inhibit the ability of the organization to change course, even when it comes to shifting consumer needs and patterns, disruptions in the supply chain, or dealing with new markets.

Shifting to Modern Techniques of Budgeting

As advanced as the concept of budgeting sounds, most businesses have come to understand that traditional budgeting forms are associated with several costs. For this reason, many large corporations, including Amazon, have started moving their attention to modern, better, and more flexible budgeting techniques, encouraging agility, ongoing planning and alignment to the corporate strategy (Jedox 2024). Such techniques include rolling forecasts, activity-based budgeting (ABB) and beyond Budgeting since all of them aspire to fulfil the requirement of being more adaptive to changes in the business environment.

Forecasts rolled out are budgets regularly modified (monthly or quarterly) as per the prevailing conditions and data. Rather than being the same for a year, rolling forecasts reach out to organizations, letting them modify their plans and structures once new information obtain (Hood 2020). Because of the medium to low operability and handling of supplies in its retail operations and the aggressive expansion in AWS, rolling forecasts are paramount to Amazon regarding managing the seasonal demand variation of its business and, more so, the e-commerce business. The rolling forecasts at Amazon allow adjustments in resource allocation, marketing strategies, and cost management on an ongoing basis with a more precise fit with the current market situation.

Contemporary Approaches to Budgeting and Its Advantages

Contemporary approaches to Budgeting are designed to eliminate many issues that bedevil traditional methods.

- Agility and Responsiveness: Rolling forecasts and dynamic Budgeting enable the company to respond effectively to changes emanating from consumer markets, technology, and supply chains.

- Strategic Alignment: Activity-based Budgeting ensures that the money spent in the highest possible revenues missions are needed customer support.

Innovative Techniques in Budgeting and Forecasting

The emergence of smart technologies such as artificial intelligence (AI), machine learning, and data science is changing processes like Budgeting and forecasting in large organizations, such as Amazon (Fller et al. 2022). These technologies improve business processes by providing management with accurate, insightful, and data-backed analytics to enhance the entities' decision-making processes.

- The budgeting process has been revolutionized by incorporating forecasting algorithms through Artificial Intelligence (AI) and Machine Learning techniques. For a company like Amazon, which is otherwise cumbersome due to a plethora of vast data, forecasting tools installed with AI capabilities can work out historical sales, customer impacts, and even general market trends to create accurate projection figures for future demand levels.

- The development in contemporary Budgeting is the emergence of Cloud-Based Budgeting Platforms. Such systems enable Amazon to streamline the budgeting and financial planning activities of its subsidiaries located worldwide and make financial data available to decision-makers on a timely basis.

- Implementing predictive analytics improves the process. This is useful for improving the budget's accuracy by establishing tendencies and detecting deviations in numbers. For instance, prediction analytics that Amazon uses can include sales forecasting, stock level optimization, and cash flow forecasting.

Impact on Operational Performance

The unquestionable transformation of the budgeting procedure is the presence of forecasting algorithms embedded in Artificial Intelligence (AI) and Machine Learning advancements. For a company like Amazon, which is otherwise cumbersome because of the great volume of data, with forecasting tools integrated with AI, one is able to analyze historical sales, customer effects, and even market trends in general so as to forecast demand levels some years into the future with precision.

Austerity budgeting and cost control techniques will prove to be a waste of the rising trend of Cloud-Based Budgeting Systems Adoption because they are an efficient modern technique that utilizes the internet to create, track, and manage budgets in an organization. The budgeting process is based on fiscal discipline, managerial flexibility, and decisions taken through the operational head offices.

Investment Appraisal

Investment Appraisal Methods such as Net Present Value, Payback Period, Internal Rate of Return, Return on Investment, and Profitability Index are all techniques for evaluating investments. The primary objective of this is to determine the effectiveness of a new undertaking (Inyang and Egbunike 2019). These techniques address this issue in a very efficient and reliable manner, providing different perspectives on the project in question.

Net present value

A Net present value (NPV) is the most,t widely accepted method of assessing the investment risk. ButThe net current value is the value of all future positive or negative cash flow occurring from a project discounted to the present time. In most instances, the future cash inflows net present value is adjusted downwards for the weighted average cost of capital (Le 2021). Therefore, the discounted cash flows from the net investments and the contribution of the required rate of return are applied to the initial capital requirement and net present value results. If NPV is positive, the company can assist with this project.

Internal Rate of Return Method

In finance, the term internal rate of return refers to the rate of discount that brings the potential cash inflow to the present value that equals the initial investment. This implies that the corporation is said to break even at this particular discounting rate. On this basis, the Internal Rate of Return or IRR is practiced. It is also possible to say that the IRR rate is zero for the projects net present value or NPV (Mellichamp 2017). i.e.: Cash inflows Present value Cash outflows Present value = zero. When computing the Internal Rate of Return (IRR) performance, percentages are used. This can make it challenging to compare the performance of projects that differ significantly in scale and output. Additionally, projects may vary in granularity and functions, further complicating the comparison process. Investing will be difficult if the IRR deviates much from the capital invested because comparing investments with a different time pattern will be challenging.

Discounted cash flow

Discounted cash flow analysis is the methodology used in determining the parameters for an investments economic and financial success. It is essential first to discuss some basic concepts concerning discounted cash flow analysis before delving into, for instance, financial analysis, cost-benefit analysis, linear planning or estimating non-market benefits. Such DCF analyses are a trivial case of cash flow analysis that considers the time value of money and the investment projects investment risk (Laitinen 2019). In estimating the cost and benefits of projects, the DCF incorporates elements such as net present value, internal rate of returns and benefit-cost ratios B/C, among other adopted measures of project success.

Cash flow analysis

Cash flow analysis is mainly concerned with how the cash inflows and outflows of the venture and the strategy in place will be classified and quantified. In the evaluation of investment projects, the DCF method is used. A project can be undertaken to produce a final product, build an asset such as a facility like a road section or conduct a study. Any project can be defined as the generation of cash flows (Parashar 2024). Cash inflow is understood as cash movement towards an investor, while cash movement away from an investor is Cash Outflow. A cash graphical representation of an investment project will include capital cost vestments and annual operational costs, aka cash outflows. They create Profit or, rather, cash inflows. The annual net cash flow is then determined as the difference between the revenue from the project and the investments plus expenses for the given year. Cash flow can be computed as = bt (kt+ct) during any given year, where it is the cash inflow into the business at time t; kt is the cash outflow for fixed assets in the year, and it is for the cash outflow for operational expenses.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank