Strategic Functional and Financial Analysis of Apple Inc. BUS4021

- Subject Code :

BUS4021

Task 1

1.1 Introduction

Apple Inc., founded in 1976, is a multinational technology firm headquartered in Cupertino, California. It creates, produces, and distributes various technology products and services. Apple's most well-known digital goods include iPhones, iPads, Mac computers, Apple Watches, and Apple TVs, as well as operating systems including iOS, macOS, and watchOS (Apple Inc, 2023). The corporation also operates a highly effective communication network, including the App Store, Apple Music, and iCloud. By the end of 2024, Apple Inc. will be one of the world's most valuable corporations, with a market value of more than $2 trillion and the NASDAQ stock symbol AAPL (Apple Inc, 2023). The purpose of Apple is to offer the customers the best user experience possible using innovative hardware, software and service solutions. Conversely, the companys vision statement reads: to produce top-of-the-range products globally while leaving behind a better world.

1.2 Functional areas within Apple Inc.

Apple Inc.s (Apple) functional areas are as follows: Importance/Role of the Functional Areas:

- Research and Development (R&D): Apple has prioritized R&D as a critical component of its strategies since it creates the form and affordability of quality products. Due to dedicated investment in research and development, the company can maintain its competitive technological advantage, as illustrated by its constant launch of innovative products, including the iPhone and MacBook. This area is strategic to Apples success and to the maintenance of its competitive advantage as well as nurturing employees' creativity and high standards. Technology is a crucial driver of differentiation, and through its global investment in Research and Development, Apple also builds on the it's brand equity by constantly improving product and service offerings (Podolny & Hansen, 2020).

- Marketing: Apple's marketing plan revolves around making the customers have a great brand experience. The company's advertising messages and spectacular product launches are aimed at the consumers' feelings. This approach makes products as consumables or services and builds a long-term relationship between the brand and buyers, which is significant to modern markets. From the case of Apple's advertisements, it is evident that it has achieved its marketing objectives of creating product awareness and building consumer expectations (Podolny & Hansen, 2020).

- Operations: Apple's supply chain and manufacturing are strategic business functions that address the company's global needs. The company can procure goods and services from various suppliers and manufacturers across the globe, thus, cutting down on time and embracing quality. Apple has effectively utilised operations management to achieve its aims of efficiency, cost reduction and sustained quality of products. This particular functional area is critical in maintaining Apple's capacity to deliver products on time and to consumers' satisfaction, enhancing the business' growth in general (Staff, 2023).

- Sales and Customer Service: Apple's sales and customer service processes are designed to provide a positive customer experience. The retail Apple Stores and online platforms serve as customer touchpoints, enhancing brand identity through their commitment to quality service delivery. The company places a high value on maintaining close contact with customers for consumption and fostering loyalty. This functional area plays a crucial role in building strong customer relationships and ensuring their satisfaction with Apple's products and services.

- Finance: The finance department is a cornerstone of Apple's operational success, responsible for the company's financial planning, analysis, and reporting. This section of the company deals with crucial financial tasks such as budgeting, projection, and fund control. These responsibilities are instrumental in managing expenditures and preparing financial forecasts, which in turn support the company's growth strategies and investments. Sound financial management is particularly important if Apple is to continue supporting its creativity-cantered projects and maintain its market dominance.

Relative Importance of Finance as one of the Fundamental Functional Areas.

Finance is particularly significant at Apple Inc. for several reasons:

- Resource Allocation: Finance guarantees that capital is well managed by allocating funds to the business venture that generates the most profits.

- Risk Management: It is important to note that the finance team handles financial risk assessments and finds ways to best manage these risks to protect the company's resources and investments.

- Performance Measurement: This analysis assists Apple in quantifying its performance and identifying its strengths or weaknesses in relation to industry benchmarks for strategic direction.

- Investor Relations: A vital finance function also involves accurate communication with the investors where the investors' confidence and stock performance must be well sustained.

1.3 Financial Statement Analysis

Analysis based on Profit and Loss Statement

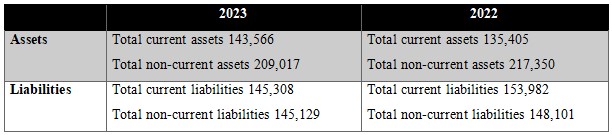

An essential tool used in analysing a company's financial performance is the profit and loss statement, which reflects Apple's financial performance for the latest fiscal year. The total revenue for the second quarter of 2024 was $90.8 billion, according to the latest financial statement of Apple Inc., about three billion dollars decline from the previous years revenue of $94.8 billion, of which 68 billion dollars was spent on foods, posting a net income of $23 billion (Yahoo, 2024). The Current and noncurrent assets and liabilities are presented in the following table.

Population accessing the internet Pre & post-pandemic By country Pre-pandemic Post-pandemic Total internet users 4,504 billion 4,390 billion Total world population 7,775 billion 7,860 billion Gap in internet connection 64 billion, down from $24. 16 billion year-over-year (Yahoo, 2024).

Major Incomes and Expenses

Major Incomes:

- Much of the income is generated from product sales of which the iPhone is a mainstream source.

- Services like Apple Music and iCloud, etc., have slowly and gradually increased, breaking the monotony of having revenue only from either iPhone or iPad, thus making the overall revenues more stable.

Major Expenses:

- Direct and variable costs are a major factor, with total cost coming to $ 128,721 as cost of goods sold (COGS) in July 2023 for the quarter ending increase to $136,804 in July 2024.

- Selling, general, and administrative expenses combined with research and development expenses were about $14. 48 billion.

Comparison with Previous Year

Some issuesthe saturation of the markets and the intensification of competitionaffected the company's revenue and, consequently, net income. On the other hand, operating profit-to-sales margins have been steady, suggesting efficient cost controls have been observed.

Recommendations for Upcoming Year

To improve financial performance, Apple should consider:

- Enhancing Product Innovation: Investment in research and development to expand the company's product portfolio and introduce new enhancements that appeal to the consumer.

- Expanding Services: Continuing the growth promotion of the services segment, which is highly stable and capable of growth.

- Cost Management: Revisiting and improving the supply chain management and operations to cut costs.

Balance Sheet Analysis

As of March 30, 2024, Apple's balance sheet reflects a robust financial total assets amounting to $ 337 billion. The company's total liabilities of $ 263.22 billion are uncomfortably offset by a substantial shareholders' equity of $ 74.19 billion, Apple's financial strength (WSJ, 2024).

Financial Position

- Apple's financial flexibility is bolstered by its predominantly liquid and flexible assets. The company holds significant cash and marketable securities, enabling it to respond swiftly to market changes and investment opportunities.

- Liabilities: The Company has a moderate amount of debt, supported by its debt-to-equity ratio of approximately 140.97%, clearly showing a good balance on this aspect of leveraging for growth.

Future Actions

To strengthen its financial position, Apple should:

- One area where Apple can further strengthen its financial position is debt management. By effectively managing its total debt, the company can mitigate fluctuating risks and potentially lower its debt interest rates, improving its financial health.

- Invest in Growth Opportunities: Invest towards growth and developing key growth areas for the next five to ten years and beyond.

Financial Ratios

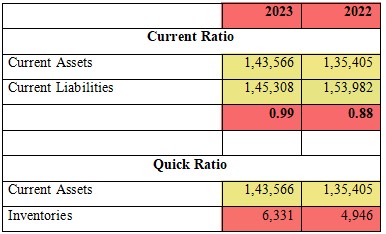

- The current ratio shows how efficiently Apple can manage its short-term liabilities with its current assets. With a ratio below 1 it means that the current liabilities are more than current assets, and such a debt threatens a firm's liquidity. Nevertheless, there has been a slight change from 0. 88 in 2022 to 0. 99 in 2023, meaning that Apple has been moving towards enhancing its liquidity position, approaching the ideal ratio of 1 or more (Apple Inc., 2023). Thus, it will be good for Apple to find ways of improving its working capital management so that it can maintain a current ratio above 1.

- The quick ratio is more stringent than the current ratio because the former does not consider inventories when calculating the measure of liquidity. The change of stock out period from 0.85 in 2022 to 0.94 in 2023. Such a state of affairs indicates that Apple should make further efforts to improve its quick ratio, either by increasing its cash resources or decreasing its current liabilities (Apple Inc., 2023). If Apple's quick ratio is one or more, it will show its adequate security to meet its current obligations.

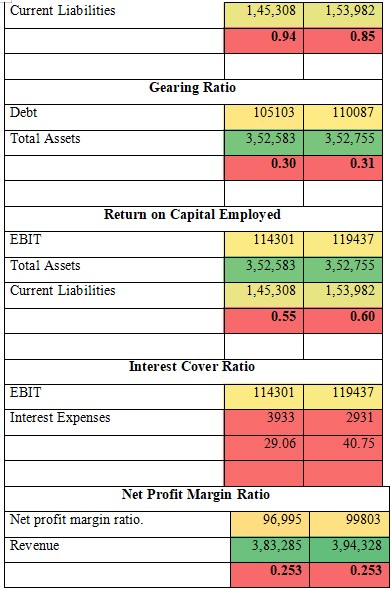

- The gearing ratio shows the percentage of debt to the total amount of assets to establish the company's degree of financial leverage. The customary ratio may be lower, and such a smaller amount of debt to equity is considered less dangerous. As shown in the table above, Apple's gearing ratio slightly declined from 0.31 in 2022 to 0.30 in 2023, meaning that this type of financial risk has slightly begun to reduce. Apple needs to keep its gearing ratio as low as possible to ensure that the company is always financially responsive. The practical and profit-making use of the capital invested in the company is more appropriate in the case of Apple. However, there is a slight dip from 0.60 in 2022 to 0.55 in 2023, indicating a change in capital utilization efficiency. This indicates that there is an area of concern for the management of Apple to address, which can enhance ROCE. The management of Apple must, therefore, bring in improvements to the capital structure of the company to ensure that it has the best place to invest in high-return projects to increase profitability.

- The interest cover ratio shows Apple's capacity to pay into the borrowed funds using Earnings before Interest Tax (EBIT) instrument. However, slightly lower in 2023 at 29.06, depicting a decline in the company's ability to cover company expenses. Apple must also ensure that its cover ratio by interest has high interest, so it should look for ways to reduce interest expenses by either refunding or paying down the debt.

- The net profit margin ratio of 25.3% in both years shows the general profitability of Apple's Total revenue. The stable profit margin speaks for the company's reasonable cost-price policies. If Apple has to maintain and enhance the net profit margin level, it must continue making high-margin products and services. Nevertheless, optimizing costs and increasing revenue could further improve Apple's margins.

Task 2

2.1

Budgeting is one of the essential activities in managing financial resources, which helps organizations work out their planned expenditures. It estimates the income and the expenditure expected to be incurred in a given period, often in one year and the rationing of resources in the same period. Budgeting consists of establishing financial objectives and figures, increasing responsibility and ensuring the necessary funds will be available to achieve the organization's objectives (Schmidt, 2024). It is also used in the performance assessment since actual results can be compared with budget numbers, with conclusions on what has been noticed.

Methods of Budgeting

There are several budgeting methods, each with distinct characteristics:

- Zero-based budgeting (ZBB) is a method that requires every cost to be justified anew for each new period, starting from a 'zero base.' While this approach demands a comprehensive scrutiny and analysis of all costs, it can significantly improve resource utilization. However, it's important to note that ZBB can be time-consuming and may require substantial effort from all departments (Acharya, 2024).

- Activity-Based Budgeting (ABB): This approach is centred on the cost of activities essential in offering a product or a service (Schmidt, 2024). It correlates budget expenditures with the work that generates expenses and is a more accurate, curated measure of resource requirements.

- Flexible Budgeting: This type of budget is reviewed from time to time to match the level of spending to the level of activity. As such, it is useful in organizations that experience fluctuating sales or production. This method is suitable for evaluating performance, but its only disadvantage is that it has to be constantly checked (OBrien, 2023).

- Forecasting: Forecasts, a method that allows for budget revisions based on current performance details and new factors, can enhance an organization's responsiveness. However, if not carefully controlled, it can lead to 'budget fatigue,' a situation where constant revisions and adjustments can overwhelm the organization.

Recommended Budgeting Approach

As a Finance Manager at an organization, I will use Zero-Based Budgeting. This approach also reduces expenses, as activities that would have incurred expenses are forced to justify them. Secondly, over time, this approach shapes the cultures within the organizations by promoting accountability and resourcefulness. It helps multiple departments to think critically before going gaga over various petty projects and ensures that initiative are ranked in order of which ones can benefit the company the most, thereby promulgating financial prudence.

Budget and its relation with the technology

The plan budgeting process has been shaped by technology in one way or another. Better and more efficient budgeting software and other financial controllers make it easy for managers to use real-time data and make analysis for the budgets faster and even involve other departments in the process. These tools allow for:

- Automated Data Collection: Eliminating errors that may be occasioned by manual inputting of figures and compiling the financial information, which may be time-consuming.

- Enhanced Forecasting: As more and more historical facts and analytics are used to create the budgets, they are much more reliable.

- Collaboration: It allows the use of one or many cloud platforms to involve all the stakeholders in providing or approving the new budget, assuring that all departments follow the same financial strategy.

- Real-Time Monitoring: It enables organizations to monitor expenses or costs against the budget in real-time, hence having a means of revising costs instantly, enhancing the control of financial resources.

Performance evaluation is essential in organizations since it forms the basis for determining the extent to which they have achieved their objectives and the areas that need improvement to maximise resource utilization. Measuring performance against set objectives enables firms to discover advantages and challenges and thus improves responsibility and sustainability (Lamture, 2023). It also supports decision-making and ensures the organization's activities comply with strategic goals, hence improving the organizational financial performance and its competitiveness.

2.2 Types of Performance Management Tools and Techniques

Many performance management tools and techniques can be utilised by large international firms in assessing their applicability to different business and economic contexts. Some of the critical methods include:

- Key Performance Indicators (KPIs): KPIs are measurable values that provide an organization's essential success criteria. They may be revenue or income growth or operating margins, tangible or intangible goals such as customer satisfaction or employee morale index (Undru, 2024). KPIs assist an organization in tracking the achievement of strategic objectives and in directing decisions based on quantifiable evidence.

- Balanced Scorecard: This tool is used to create a clear picture of an organization's performance based on the two key dimensions, the financial and the non-financial, with a focus on four elements that include the financial view, the customer perspective, the internal business process view, and the learning and growth view (Kaplan, 2021). The balanced scorecard helps connect business performance measures with an organisation's vision and strategy to provide performance metrics and feedback on the strategy.

- Benchmarking: This occurs when an organization benchmarks its performance indicators with those of other industries or with other players in the same industry. More importantly, the identification of those gaps will enable the organization to adapt some of the best practices and enhance its processes (Harper, 2023). Benchmarking is very useful, especially in unstable global environments where the issue of positioning is crucial.

- Performance Appraisals: Performance appraisal is a routine activity of evaluating an employee's performance to determine the extent to which the employee requires training to enhance their performance. It empowers people and helps to create focus on achieving company objectives (Van Vulpen, 2023).

Impact of Technology on Performance Measurement

The use of technology has dramatically improved performance measures. Business intelligence is an integrated system of technologies for gathering, analysing, and providing greater access to details about an organization's operations. Online collaboration tools support the implementation of international work. Joint cloud utilities help share and transfer data with other members. Also, there is less likelihood of people's errors, and the preparation of reports is eased, freeing managers and supervisors to concentrate on decision-making. Technology is a powerful ally in the budgeting process, enhancing flexibility, accuracy, and efficiency. Business analytical and automation tools empower financial managers to analyze large volumes of data in a fraction of the time, reducing the risk of erroneous decisions. For example, BI tools facilitate real-time analysis, improving budget forecasting by minimizing human errors through integrated data entry.

Furthermore, technology enables cross-department working, as all the plans and data related to the budget are located in one place. This reduces information isolation in that all the stakeholders can access the same information, which is essential, especially when aligning departmental strategies with the organizations goals and objectives.

Furthermore, technology alleviates financial teams from the burden of repetitive, manual tasks, enhancing their productivity. Organizations can leverage cloud-based budgeting software, which offers flexibility to adjust budgets in response to market conditions or shifts in organizational priorities.

Task 3

A

Acquisition and Utilization of Funds:

Different Methods through Which a Business Can Obtain Capital

The business can access various forms of capital for financing operations or investment in business enhancements. These sources can be broadly categorized into internal and external sources:

Internal Sources:

- Retained Earnings: Payments made to the company for product development, advance research, and technological innovation rather than dividends paid to the shareholders. This is usually the first source of funding for a project because it is usually cheaper than other sources of funding and does not require people to repay the money borrowed (Team, 2023).

- Sale of Assets: Some assets may not be essential in producing goods and services or are underutilized, and companies may sell them to raise cash. This can be the fastest method of generating more funds without borrowing more money.

External Sources:

- Debt Financing: This involves taking out bank loans or using bonds. Debt financing is preferable since the interest expense on the debt cost is tax-deductible. However, the debt level as a measure of the company's leverage and risk is adverse (Eakin et al., 2022).

- Equity Financing: Selling of shares in an organization to obtain capital. This reduces ownership, does not need repayment, and is less risky than debt.

- Venture Capital: This form of external finacing entails sourcing funds from financial backers who invest in expanding companies with high growth potential. It avails funds but is expected at the sacrifice of equity and control.

- Crowd funding: People invest comparatively small amounts of money from numerous investors, often using the Internet. This is good when introducing a new product to the market or an organization that has well-supported stakeholders in the community.

- Grants and Subsidies: Grants are monies that governments or other institutions offer for special projects, such as research or sustainable solutions.

An Analysis of the 15% Net Asset Investment Decision:

Technological Upgrade

Apple Inc. is prominent for the enormous amount of money it spends on technology, which is vital to sustain its dominance in the dynamic and constantly changing market. A 15% Net Asset Investment in upgrading technology shows a good sign of intention to sustain this advantage.

Apple has more than enough retained earnings that would be most suitable to finance this investment. Apple has consistently been profitable and produces significant incomes, so it can invest a lot without attracting extra funds from outside. This minimizes the dilution of ownership associated with equity financing and the leverage faced in debt financing.

Capital Investment Decision: Investment Appraisal Techniques

To hold its lead in technology, the best possible decision for Apple Inc. is to go on with a 15% net asset investment considering current aggressive competition in the industry. In this case, Apple should use its retained earnings or issue corporate bonds, which is an excellent financial position and avoids ownership dilution. As such, Apple is required to use discounted appraisal methods considering NPV and IRR since these will ensure sustained profitability from long-term investments after considering the time value for money. Raising corporate bonds might be helpful in case of a need for more capital, especially since current interest rates are relatively low, and its healthy credit rating would help secure better interest rates on the issued bonds.

B:

In the following, an evaluation of the different techniques used in investment appraisal is critically assessed.

Net Present Value (NPV)

NPV is a discounted cash flow method used to determine the present value of an investments cash receipt less cash payment streams. It also includes the aspect of cash flows at different points in time and offers an accurate signal of the profitability of the investment. A positive NPV implies that the earning potential of the investment is greater than its cost and therefore is preferred.

Internal Rate of Return

IRR is another example of the DCF technique whereby the rate of return is determined by discounting the investment cash flows resulting in a zero NPV. It gives the percentage return that is expected from the investment and this could then be compared with the companies required rate of return or the cost of capital. IRR is good for determining the economic return on a project and also for comparing projects as it gives the order of Returns.

Sensitivity Analysis

Sensitivity analysis deals with the evaluation of the effects of fluctuations in such variables as volume of sales, price, or costs on the profitability of an investment. It enables Apple to know which factors have more impact on its success or failure in the execution of the project and hence be in a position to design the necessary contingency plans.

Scenario Analysis

Within the context of scenario analysis, the investment has to be assessed under various future circumstances which range from the better, the worst, and the probable future circumstances. It helps Apple gain a better perspective of the possible outcomes and also identify whether or not the investment is well protected. This way Apple can consider multiple possibilities and even if one of them were to occur the company was at least prepared and has moved to limit the impact of that possible eventuality.

By applying these investment appraisal techniques cumulatively, it will be easy for Apple to arrive at a better decision about its capital investment with an overall aim of achieving its strategic plan and thus enhancing the shareholders value. The proper application of both NPV and IRR is retained due to the valuation of money over time while sensitivity together with the scenario analysis helps in establishing the risks and volatilities per investment.

Analysing the Differences and Similarities between the Discounted and Non-Discounted Techniques

Discounted Techniques (e.g., NPV, IRR, PI):

- Time Value of Money: These methods consider the value of time, which makes them appropriate for preparing long-term financial plans.

- Decision Quality: They better measure profitability and risk since all cash inflows and outflows, as well as their timing, are taken into consideration.

- Complexity: Discounted techniques are generally more complicated than basic techniques because they require more comprehensive information regarding the financial aspect and analysis.

Non-Discounted Techniques (e.g., Payback Period):

- Simplicity: Since they are relatively simpler to compute than the cash flows, they are appropriate for rapid evaluations, for instance, of minor activities or organizations with little or no quantitative background.

- Focus: It stresses the idea of getting back the initial investment, which is vital for discriminating between various decisions regarding improving liquidity.

- Limitations: They fail to consider the time value of money and, therefore, do not take into account any cash flow beyond the payback period, which means that the decisions made can be far from optimal.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank