Strategic Roadmap for Enhancing Protogens Corporate Governance and Market Competitiveness

Introduction

There is no hope of breaking into the North American market, as hinted in Protogens current SWOT analysis and strategic plan summary below. Concerning low performance and a deteriorating governance structure, Protogen is genuinely seeking practical remedies that would guarantee its existence in the short run and profitability and viability in the long run. When starting to write the report, a brief and relatively schematic evaluation of Protogens corporate governance system is made by pointing to its main advantages and disadvantages. Further, a discussion involving assessing the organization's structure leans towards understanding its correspondence to strategic goals while revealing its weaknesses. Last but not least, there is a clear roadmap, specific governance reforms, and strategic overview for Protogen to increase its competitiveness and cope with challenges in the agriculture tech space.

Assessing and analyzing the effectiveness of Protogens corporate governance mechanisms

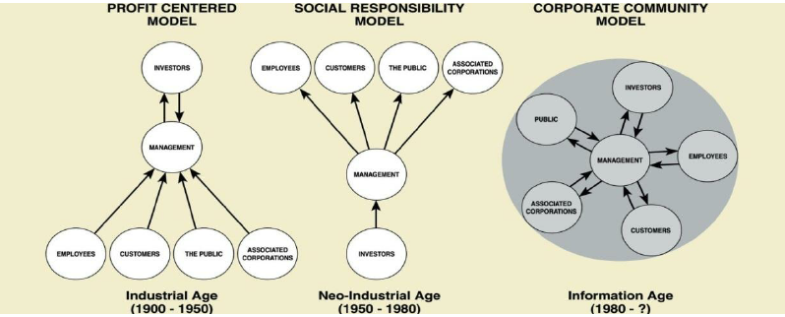

Figure 1: Corporate governance model

(Source: Researchgate, 2015)

The answer would be moderate when evaluating the degree of effectiveness of Protogens corporate governance mechanisms. On the one hand, similar to the previous strategy, the stakeholders' interests are aligned with the key investors, for example, with members of the board of directors like Jules-Pierre Mao, which can create strong and durable shareholder value (Hanson et al., 2016). Also, vice presidents are included, but some people from outside the company, such as James Holden, represent some independence or at least some supervision. However, some issues arise with the board of directors which are first, most members are affiliated with the company either as shareholders or ''related'' to the shareholders Jules-Pierre Mao has daughters; second, the board of directors may have conflicts of interest with the company's interests.

Further, there is a lack of separation of power and authority in the company, whereby Jules-Pierre Mao occupies the two most senior positions, CEO and chairman of the board, thus compromising the Secretary and seniority of decision-making. Due to the identified deficiencies in the effectiveness of Protogens governance, the company should focus on the following recommendations which are the proportion share of independent directors should be increased on Protogens board of directors; Divisions of the positions of the CEO and the chairperson of the board of directors; The Protogen board of directors should encourage transparency and accountability in the managerial decisions.

Describe Protogens organizational structure and provide an assessment of its strategic efficacy

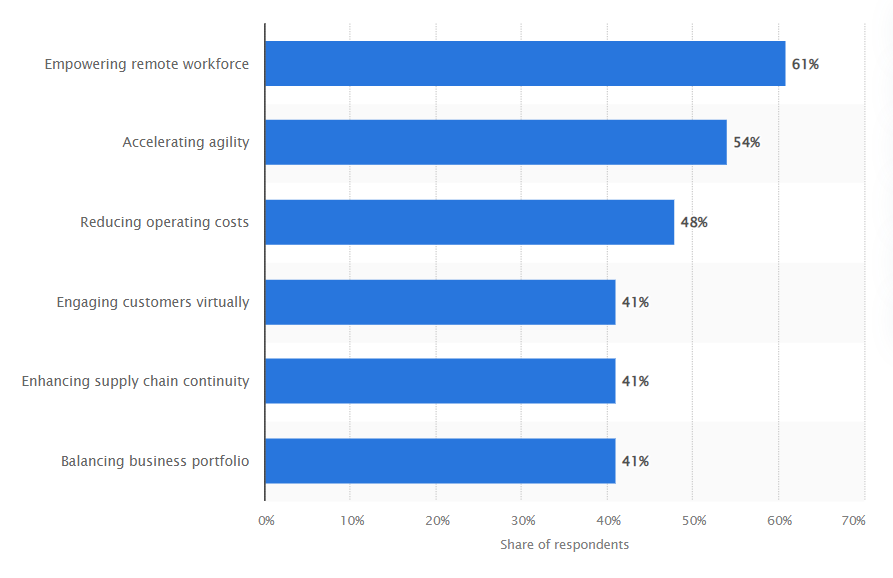

Figure 2: Organisational strategy

(Source: Statista, 2021)

Current and former employees also highlighted that Protogen has a diversified product offering that reflects and adapts to the products and services offered by the agricultural-tech company. Such structure allows Protogen to target different regions and niches and explore key trends in gene modification, controlled farming techniques, and others. However, the structure also has its drawbacks regarding the organization's integration and distribution of resources for numerous products in a wide range of categories (Frederiksen, Gottlieb & Leiringer, 2021). Furthermore, the centralization of management headed by the chief executive officer, Jules-Pierre Mao, who has the extra title of chairperson, might slow down adaptation to market trends and conditions.

In summary, Protogen's organizational approaches have been practical and strategic. Although the diversified portfolio is consistent with the company's strategy and is based on innovation and market development, it may sometimes be ineffective and even characterized by below-par results in several segments if it is not centralized. To improve strategic planning, Protogen may need to consolidate the niche product categories and aim to create a broader range of offerings with high growth potential, in addition to segmenting decision-making responsibility at the operational level. It would help Protogen to utilize its core competencies optimally and focus on achieving long-term success in the increasingly saturated agricultural tech industry.

Detailing a plan

1. Enhancing Corporate Governance:

Immediate Actions:

- Increase Board Independence: Hire more independent directors to join the board to help them include various interests and reduce self-interest frictions (Pucheta-Martnez & Gallego-lvarez, 2020). To ensure independence, it should not take more than six months to achieve at least 50% of the board as independent members.

- Separate CEO and Chairman Roles: Today, there is increased pressure and push for splitting roles of chief executive officers and chairpersons in organizations. It is recommended that a new post be established for the board's chairman and that an independent director or an outsider be appointed within the next three months.

- Implement Transparent Reporting Practices: To improve internal communication, shareholders and stakeholders should be regularly provided with the company's financial statements, minutes of board meetings, and KPIs (Depraetere et al., 2021). Establish a phased reporting framework and ensure it is comprehensive in the first three months of development.

Long-Term Actions:

- Establish Board Committees: Organise committees in particular areas (for example, audit, remunerational, and nomination/ governor committees), including only independent directors. Publish formal committee charters detailing working scopes, responsibilities, and lines of reporting within the next six months (Orazalin, 2020).

- Regular Board Evaluations: Perform board evaluations at least once a year to determine whether the board is performing effectively, which challenging areas need to be worked on, and whether the board's performance is in tandem with the company's goals and objectives. Arrange board self-assessments and external evaluations within one year and establish a structured evaluation process to fulfil this goal.

- Strengthen Shareholder Engagement: Improve shareholder Interaction by frequently holding meetings, hosting town halls, and providing constant updates. Within the next six months, set up a structured shareholder communication system that involves seeking opinions and resolving grievances (Dey, Starkweather & White, 2023).

2. Strategic Advice for Immediate and Long-Term Survival:

Immediate Strategies:

- Portfolio Optimization: Under the heading of realization, it is necessary to carefully analyze the composition of the product range offered by Protogen today to determine which segments are unprofitable or have no strategic significance. Formulate the strategy to shed or manage these assets more effectively to resort to the efforts where expert competencies could be applied (Hanson et al., 2016). Target provides information for investors about plans to divest from businesses and hopes to complete the process within three months.

- Cost Rationalization: Initiate measures to reduce costs to enhance financial productivity and revenue. These may include cutting non-essentials, conducting trade negotiations with suppliers, and effectively managing human resources. It would be great to achieve at least a 10?crease in operating expenses during six months.

- Market Expansion: New market areas and, ideally, new partners should be sought to sustain revenue sources with minimum affiliations with current markets (Jafari-Sadeghi et al., 2021). Also, allocate resources to market research and feasibility studies of the key growth segments and figure out how to enter them.Target is also campaigning to introduce new ventures in at least two new areas within one year.

Long-Term Strategies:

- Innovation and R&D Investment: Invest funds to promote R&D undertakings to promote the growth of new products and services and, hence, establish uniqueness (Min, Kim & Sawng, 2020). Initiated an innovation fund for internal development initiatives and partnered with key stakeholders such as universities and Startups. The organization should aim to spend about 15% of the overall revenues in the research and development process within the next three years.

- Talent Development: Allocate resources to find, train, and nurture talent that will assist in fostering the creation of competitive talent to aid in sustaining innovation and execution of strategic projects. There is a need to offer promotion opportunities to have performers focused on achieving organizational goals. The corporation has the aim of attaining the target that the score regarding the satisfaction of the employees will rise up to 20% in the next three years.

- Sustainability and ESG Integration: Integrate Purposeful ESG principles into Protogens governance structures and performance management systems to improve long-term performance and sustainability. Establishing a substantial ESG approach on the environmental, social, and governance fronts is crucial. Specific goal is to achieve ESG certificates within a period not exceeding five years (Clment, Robinot & Trespeuch, 2022).

Quantitative Component:

- By implementing the proposed corporate governance enhancements and strategic initiatives, Protogen aims to achieve the following quantitative improvements:

- It will foster shareholders' confidence and investors' trust, causing the company's share price to rise by 20% in the next 12 months.

- Profit enhancement and a better financial position would result in an EBITDA margin of 15% in the coming two years.

- Market share and revenue growth targets are increasing, with a projected 25% annualized revenue growth for the next three years.

- Improvements in an organization's annualizedness and resilience will result in a 30% downward trend in earnings and company shares in the future.

- The plan also offers solutions to the mentioned corporate governance issues affecting Protogen and a strategy for short and long-term operations. It revealed that Protogen intends to improve governance practices, diversify and revitalize its portfolio, and execute strategic initiatives to revive and strengthen the company's position in the agricultural-tech industry and revenue and longevity.

Conclusion

Finally, the organizational strategy proposed in this paper provides a coherent vision of the immediate and future corporate governance solutions. With the help of improving the board of directors' independence, transparency, organizational focus on strategy, and other activities, Protogorganizational investors' trust for sustainable development. Based on the sound objectives outlined above, the recommendation presents a structural and feasible roadmap for Protogen to forge out of the current issues and become a strong contender for the agricultural tech market. Through the collective efforts to ensure the full and proper execution of these programs, Protogen can reap the immediate benefits of survival and continued prosperity in the future.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank