Taxation, Financial Planning, and Business Advisory Scenarios

Importance of Taking Assessments

It is important that you complete your assessment, otherwise it is classed as a failed attempt (unless you have made a successful EC claim relating to Extenuating Circumstances).

If you fail any of your modules you will have to re-take it, although there are limits on the number of times that you can re-take and you may even have to re-study a module you have failed. Having to re-sit or re-study modules means that your workload will be increased and you will be putting yourself under more pressure. You may even be liable to incur more fees if you are required to re-study a module.

The university does appreciate that there are times when you may be unable to take an assessment due to circumstances outside your control such as illness. If this is the case

you need to make a formal claim for an extension or deferral, as without this you are expected to submit within the standard guidelines.

No tutor, module leader or course leader can grant any form of extension to the published deadlines - this is done by a separate team within the university to ensure consistency and fairness for all. For full guidance on what constitutes an exceptional circumstance and how to make a claim, please visit the Extenuating Circumstances page on iCity; you can also contact the Student Support Team for help.

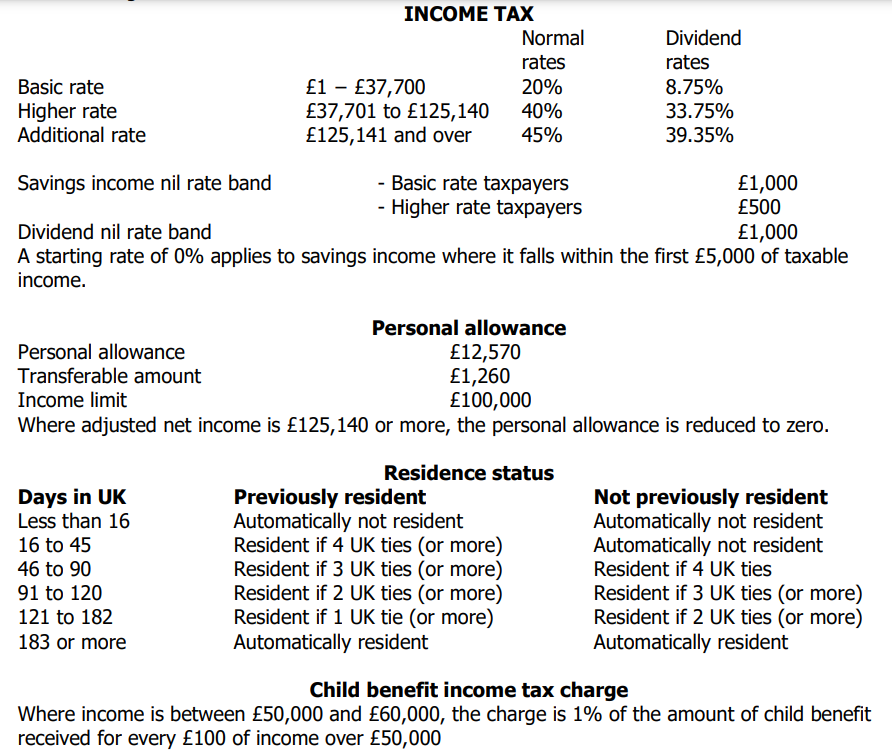

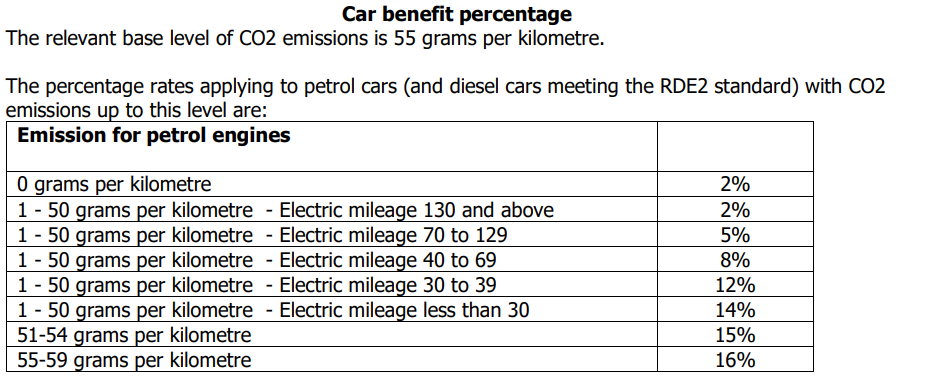

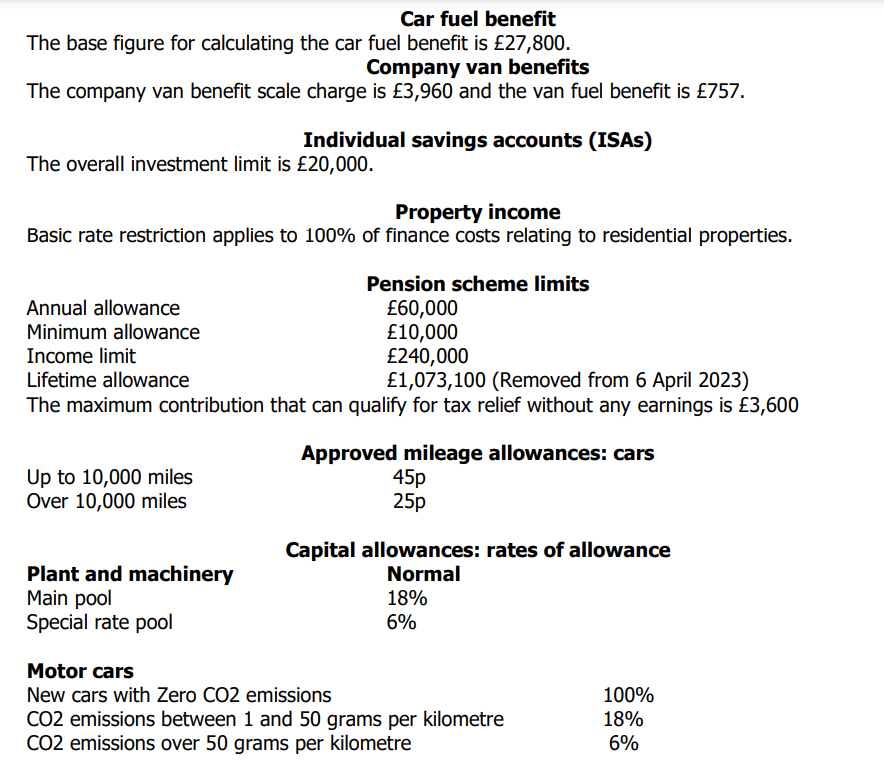

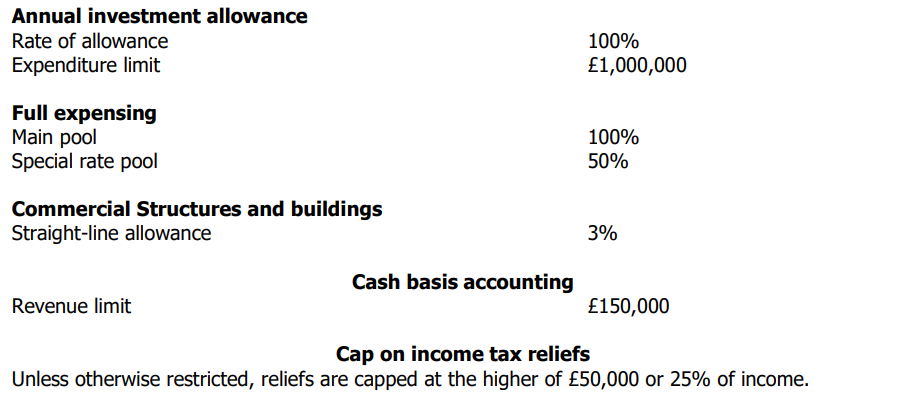

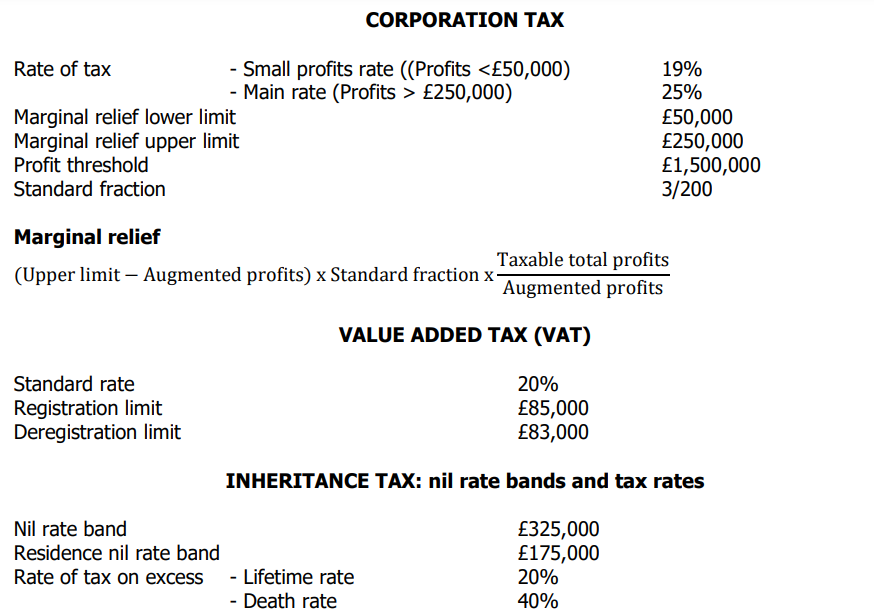

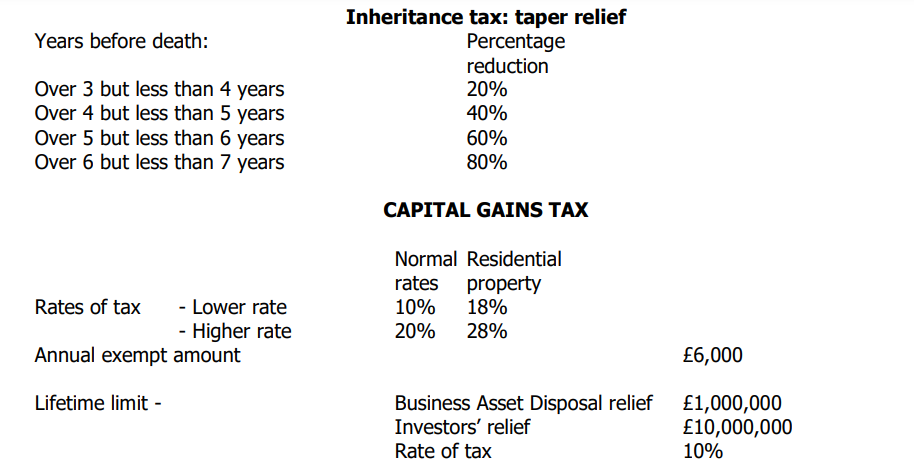

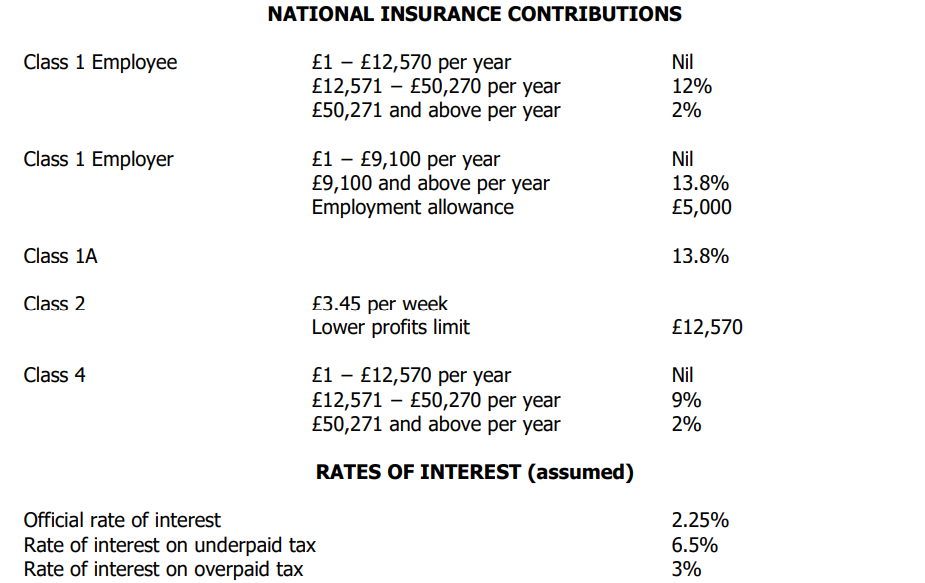

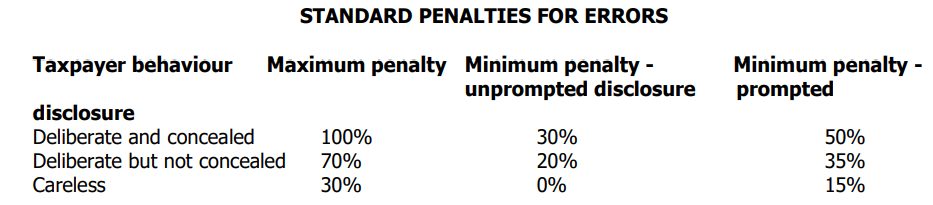

Tax rates and allowances

1. You should assume that the tax rates and allowances for the tax year 2023/24 and for the financial year to 31 March 2024 will continue to apply for the foreseeable future unless you are instructed otherwise.

2. Calculations and workings need only be made to the nearest .

3. All apportionments should be made to the nearest month.

4. All workings should be shown.

Question 1. Choice of trading style

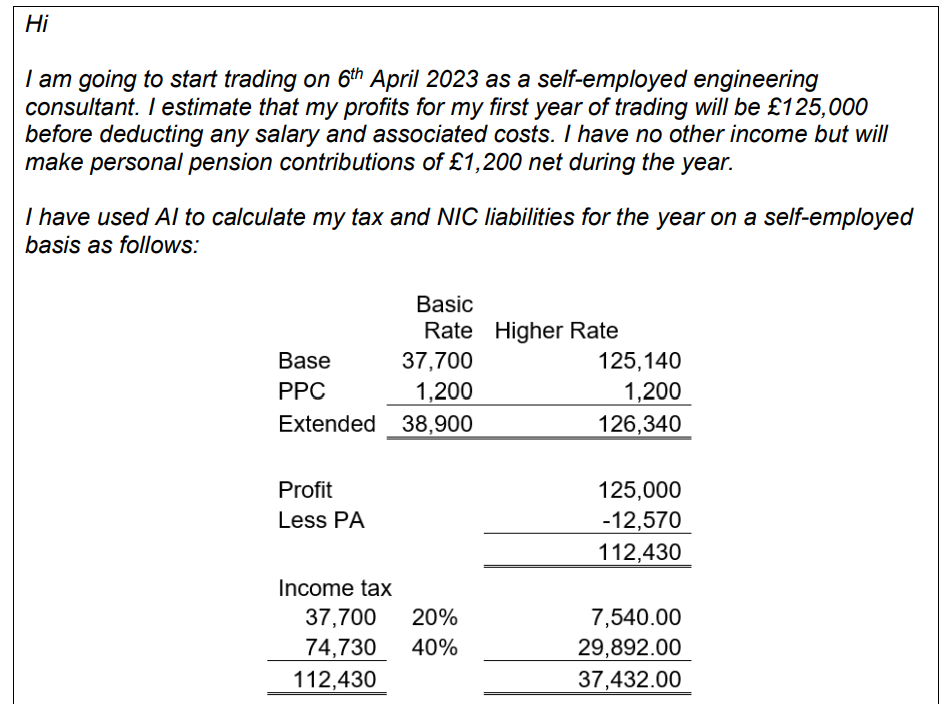

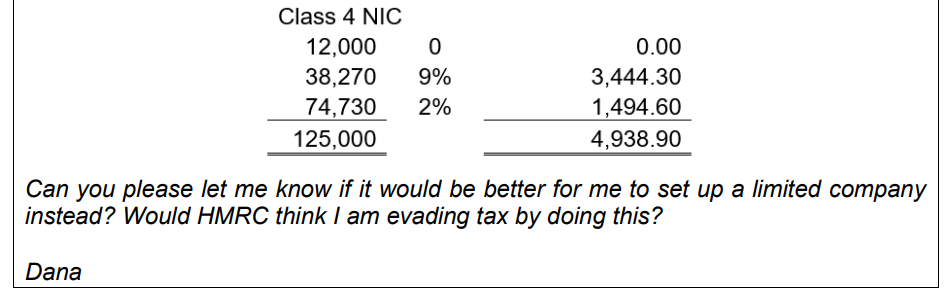

You have received the following email from Dana, one of your clients:

Required:

a) Using as far as possible the same layout as used by Dana, recalculate her total income tax and NIC liabilities if trading as a sole trader, clearly showing any corrections by highlighting in yellow and adding any additional information required. (5 marks)

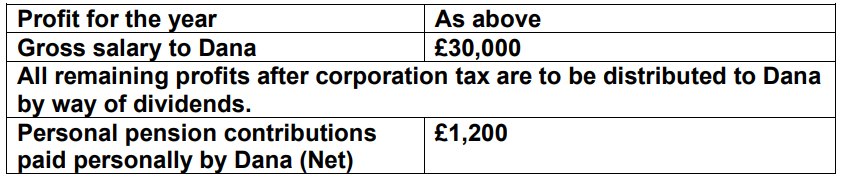

b) Calculate Danas income net of tax and NIC, assuming that she alternatively operates as a limited company with the following data:

(6 marks)

c) Based on your answers, clearly explain, with calculations which of the two options would be most beneficial for Dana and discuss any non-tax considerations that she should consider. (6 marks)

The above details do not include a car for Dana. She is considering purchasing a car for 42,000, with a list price of 50,000. This will have annual running costs of 4,800 including all petrol. Dana expects that 40% of the motoring would be for private purposes. The car has C02 emissions of 44 g/km and an electric range of 75 miles.

d) Explain how Danas profits as a sole trader would be impacted by the purchase of the car and related expenses. Calculations are not required. (3 marks)

e) Calculate the possible impact on the companys taxable profits and Danas taxable income if the business acquires the car for the limited company option, showing all workings. (5 marks)

Total: 25 marks

Question 2. Tax efficient savings and investments

You recently met some new clients who are seeking tax planning advice. Cath and Junaid are married and are both aged 48. They have one daughter, Amy, aged 17. Amy is planning to go to university next year.

Cath has been employed as a senior manager for an IT company for many years. For each of the two tax years to 5 April 2024, she received a salary of 160,000 plus taxable benefits in kind of 7,200. She pays 8% of her salary into an occupational pension scheme and her employer matches this.

Cath has regularly contributed to her pension schemes in earlier years and has unused annual allowances of 1,500 brought forward from 2022/23. During the year to 5 April 2024, Cath made net personal pension contributions of 26,000.

a) Calculate Caths unused pension annual allowance for 2023/24 and the maximum pension savings she could make for 2024/25 without incurring an annual allowance charge. You should assume that the tax rates and allowances for 2024/25 remain unchanged from 2023/24. (5 marks)

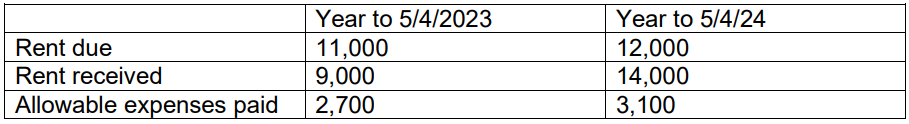

Cath owns a residential property that she has rented out since May 2022. Her rental income and expenses in connection with this property for the two years ended 5 April

2024 were as follows:

Cath did not declare the rental income to 5 April 2023 on her tax return as she believes that it is below her personal allowance.

Cath also owns shares in several quoted companies and received dividends of 12,400 during the year to 5 April 2024. She sold various shares during the year making capital gains of 4,200. Cath owns 3,000 of Premium Bonds and won prizes of 250 during the year to 5 April 2024. Finally, Cath invested 6,000 into shares qualifying for EIS during the year.

Junaid is employed by a local charity and received a salary of 35,000. Cath and Junaid have a joint Building Society account and received interest of 2,600 in total during the year to 5 April 2024. Finally, during the year to 5 April 2024, Junaid donated 1,200 net under gift aid to the charity and paid 1,800 net into a personal pension scheme.

b) Calculate Caths income tax liability for the year to 5 April 2024. Show all workings. (7 marks)

Junaids sister is getting married later this year and he would like to give her a cash gift of 5,000 for her wedding. He had made a similar gift to his brother in the previous tax year.

c) Explain the inheritance tax implications of the gift to Junaids sister, identifying any exemptions and any planning advice that you can suggest. (4 marks)

Cath recently inherited 55,000 and is considering several investment options. They are aware that they may need to use some of this to help with their daughters university costs.

d) Explain the maximum total ISA investments that Cath and Junaid could make during 2024/25, and briefly discuss for each of them if you believe that this would be a better investment than adding to their pensions. You should assume that the tax rates and allowances for 2024/25 remain unchanged from 2023/24. (2 marks)

e) Discuss the tax and professional ethical issues arising regarding Caths rental income to 5 April 2023. (3 marks)

f) Identify any additional action that Cath and Junaid may wish to consider in the future to reduce their overall income tax liability. (4 marks)

Total: 25 marks

Question 3. Inheritance tax

Your client, Hetta, requires some advice on the inheritance tax and capital gains tax implications of gifts made to her daughter Anne.

Hettas daughter, Anne, would like some advice regarding her own IHT position.

Gifts to Anne

Were made as follows:

1 June 2023 - shares in Cumberland Limited, an investment company;

10 March 2024 antique necklace.

Shares in Cumberland Limited

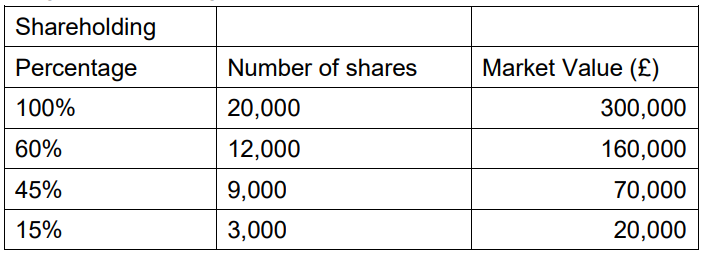

Hetta gave 3,000 shares to Anne. Before the gift, Hetta owned 12,000 shares in Cumberland Limited. Cumberland Limited has 20,000 shares in issue. At the date of the gift shareholdings in Cumberland Limited were valued as follows:

Hetta originally purchased 6,000 shares in Cumberland Limited in 2002 for 3 per share. She inherited a further 6,000 shares in 2010 at a probate value of 24,000.

Antique necklace

The necklace was valued at 56,000 at the time of the gift and had been purchased in 2000 for 30,000.

Previous transfers

On 2 August 2021, Hetta had previously made a cash gift of 300,000 into a discretionary trust, after deducting any available IHT allowances.

Other assets

The remainder of Hettas estate is valued at 1,400,000 including a residential property valued at 600,000.

Hettas late husband

Hettas husband died in 2002 and his nil rate band was fully utilised. However, his full residential nil rate band is available to transfer on Hettas death.

Hettas will

Hettas will leaves her entire estate to her daughter Anne.

Advice for Anne

Anne is considering the transfer of her Cumberland Limited shares into a discretionary trust for her children.

Required:

a) With calculations, write a summary for Hetta of the IHT implications of the gifts of the Cumberland Limited shares and the necklace. (6 marks)

b) Calculate the capital gains arising on the gifts of the Cumberland Limited shares. (5 marks)

c) Calculate the total IHT liability if Hetta died on 31 December 2026, including any IHT arising on each lifetime gift and the estate on death. You should assume that all tax rates and allowances remain unchanged. (11 marks)

d) Comment on the IHT implications of the transfer by Anne of her shares in Cumberland Limited into a discretionary trust assuming that the value

remains unchanged. (3 marks) Total: 25 marks

Question 4. Growing the business

You are acting as tax adviser to Spoon Limited a trading company incorporated in

the UK, manufacturing furniture.

The profit and loss account for the company to 31 March 2024 is as follows:

On 9 August 2023, Spoon Limited sold a warehouse used in its trade for 480,000. The warehouse cost 300,000 and the indexation factor is 0.168. Spoon Limited is to purchase a new warehouse in October 2024 for 455,000 and will claim replacement business asset relief.

It has been calculated that Spoon Limited has capital allowances of 77,000 that may be claimed for the year to 31 March 2024.

Spoon Limited owns 90% of the shares of Dish Limited. Dish Limited made a trading loss of 65,000 for the year to 31 March 2024 and received net rental income of 18,500. Dish Limited will make the maximum possible claim for loss relief against its other income to 31 March 2024 and surrender any remaining trading loss to Spoon Limited as group relief.

Required:

a) Calculate the maximum losses that may be surrendered by Dish Limited to Spoon Limited under Group Relief assuming that Dish Limited initially maximizes the loss claimed against its other income. Your answer should clearly show the calculation of the TTP of Dish Limited. (2 marks)

b) Calculate the adjusted trading profit and TTP of Spoon Limited assuming that claims for group relief, SME R&D relief and replacement business asset relief are made and calculate the Corporation tax liability to 31 March 2024. Your answer should also show the reduced capital gains cost for the new warehouse. (12 marks)

Spoon Limited has identified that it will need to purchase ten vans during the next accounting period for a total cost of 390,000 including VAT. Spoon Limited is VAT-registered.

c) To assist with budgeting for the purchase of the vans, with calculations, show how this purchase would impact the TTP of Spoon Limited and calculate the potential Corporation tax reduction for the year to 31 March 2025 for the van purchases. (3 marks)

On 6 April 2023, Andrew Spoon, the managing director and controlling shareholder of Spoon Limited borrowed 100,000 from the company, free of any interest. The loan is to be repaid in full on 31 January 2025. Andrew Spoon is an additional rate taxpayer.

d) Calculate the total income tax liability that will arise on Andrew Spoon in respect of the loan for the tax years ending 5 April 2024 and 5 April 2025. (3 marks)

e) Calculate the NIC and Corporation tax charges that will arise on Spoon Limited in respect of the loan to Andrew. (3 marks)

Next year, Spoon Limited is to incorporate an overseas trading subsidiary company in the country of Portagia. This new company will manufacture furniture components which it will sell to Spoon Limited at cost, so as not to create any taxable profits in Portagia.

f) Briefly explain if this new company will be subject to UK corporation tax and how these inter-company sales will be treated for UK Corporation tax purposes. (2 marks)

Total: 25 marks

Question 5. Succession and Retirement planning

You have been instructed to act on behalf of the Brown family.

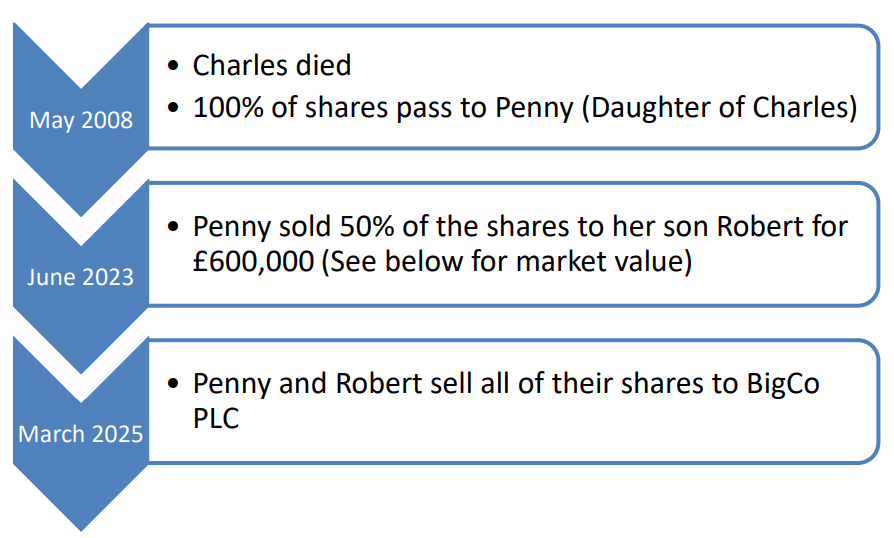

Dunbar Limited has been owned by the Brown family since 1955. The company manufactures components used in the motor industry. Dunbar Limited was established by Charles Brown in 1985 when 100 shares were issued to him for 1 each. Charles died in May 2008 and the following share transfers have taken place.

Penny became managing director of the company in May 2008 and the value of the shares for capital gains tax on her fathers death was 1,000,000.

In June 2023, for capital gains tax purposes 50% of the company was valued at 800,000. Penny and Robert made a gift relief (Holdover relief) election on this sale and Robert

started working for the company at that time.

Penny is a higher-rate taxpayer and had made no capital gains before the sale to Robert.

In March 2025, Penny and Robert sold 100% of the shares of Dunbar Limited to BigCo PLC for 2,100,000.

Required:

a) Explain the IHT and capital gains tax position on the transfer of the Dunbar Limited shares to Penny on Charles death. (3 marks)

b) Explain the IHT implications on the sale of 50% of the companys shares by Penny to Robert in June 2023. (4 marks)

c) Calculate Pennys capital gains tax liability on the sale to Robert in June 2023.(7 marks)

d) Calculate the capital gains tax cost of Roberts shares after the gift relief claim. (1 mark)

e) Assuming that tax rates and allowances remain unchanged for 2024/25, calculate Roberts capital gains tax liability on the sale of his shares to BigCo PLC in March 2025. Robert is a higher-rate taxpayer and has made no other gains. (4 marks)

f) Describe how the sale in March 2025 has impacted the potential IHT position of Penny. (3 marks)

g) Explain why it could be advantageous for Penny to invest some of the proceeds from her sale to BigCo PLC in shares qualifying for Enterprise Investment Relief (EIS).

(3 marks)

Total: 25 marks