Accounting Principles and Financial Reporting Analysis ACC4012

- Subject Code :

ACC4012

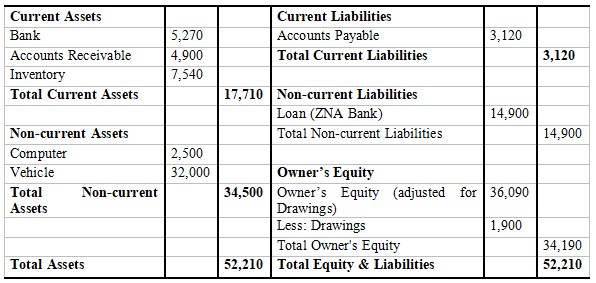

Question 1: Bryon Bay Books Balance Sheet

a. Balance Sheet

Bryon Bay Books

Balance Sheet as at December 31st 2024

NOTE:

Owner's Equity:

- Capital before Drawings = Total Assets - Total Liabilities

- Capital = $52,210 - ($3,120 + $14,900) = $52,210 - $18,020 = $34,190

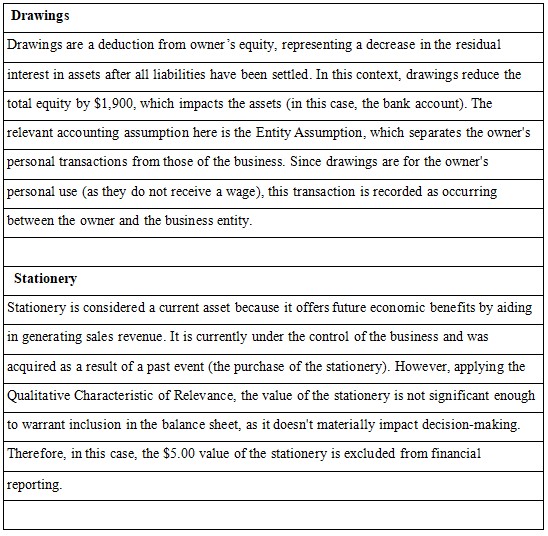

b. Explanation for Treatment of Drawings and Stationery

The mark allocation for each element will be as follows:

- 1 mark for clearly defining the element.

- 1 mark for accurately describing its presentation on the Balance Sheet.

- 1 mark for connecting it to the appropriate Qualitative Characteristic or Accounting Assumption and explaining its relevance.

QUESTION 2

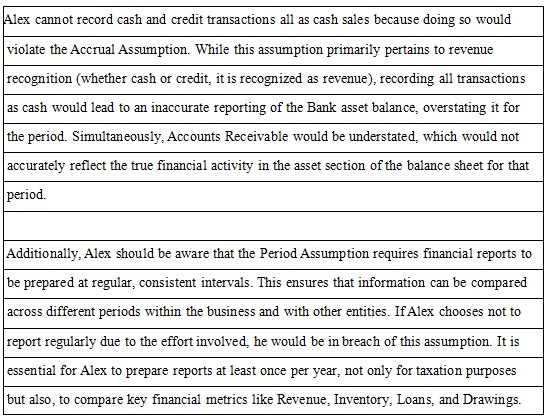

Alex is the owner of Biome, a business that sells a range of different reusable coffee cups and water bottles. Alex struggles to understand the complexity of accounting and has asked you, as his accountant, to make the reports that you provide simpler. Alex has suggested the following two changes:

- All cash and credit sales to be recorded as an increase in the bank account. Alex believes this to be more efficient because all credit sales eventually come in as cash anyway.

- To calculate the businesss profit every 2 years. Initially, Alex calculated the profit of his business in his first year using a one-month reporting period. When he found that his method was taking up too much of her time, he changed to a 6-month reporting period. He then got tired of that method and now determines is businesss profit every 2 years.

Using the above information, provide appropriate written feedback to Alex in terms of either supporting or rejecting his two suggestions. Justify your feedback with reference to the relevant Accounting Assumptions or Qualitative Characteristics.

Feedback to Alex

For each scenario, the marks will be allocated as follows:

- 1 mark for clearly stating whether you support or reject the suggestion,

- 1 mark for accurately identifying the relevant Accounting Assumptions or Qualitative Characteristics,

- 1 mark for providing a thorough explanation that justifies your decision, demonstrating an understanding of how the suggestion aligns or conflicts with accounting principles.

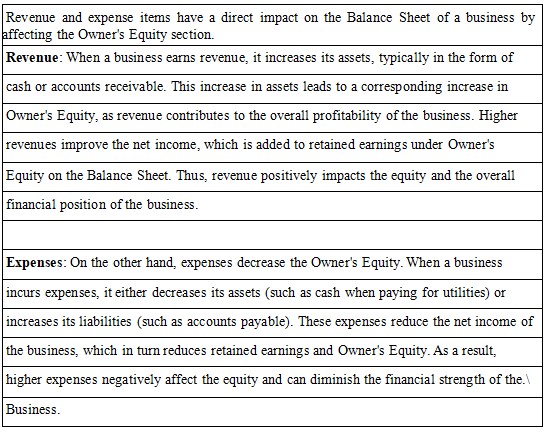

QUESTION 3

Effect of Revenue and Expense Items on the Balance Sheet

Mark allocation:

- 1 mark for correctly identifying which element of the Balance Sheet is affected by the Revenue or Expense.

- 1 mark for explaining how the identified Revenue or Expense impacts the Balance Sheet.

- 1 mark for detailing the corresponding debit or credit entry and its effect on the financial position.

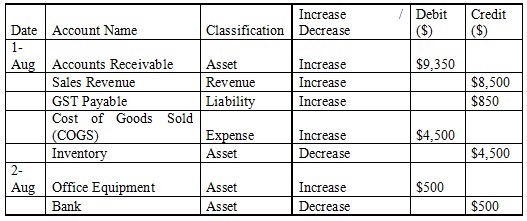

Question 4: Analysis Chart for Henry's Cabinets (August 2023)

- Classification indicates whether the account is an Asset, Liability, Revenue, or Expense.

- Increase/Decrease shows how the transaction affects the account balance.

- Debit or Credit indicates whether the account is debited (increased for assets/expenses or decreased for liabilities/revenues) or credited (increased for liabilities/revenues or decreased for assets/expenses).

For each transaction, the mark allocations are as follows:

- 1 mark for correctly identifying and inputting elements with a debit balance.

- 1 mark for correctly identifying and inputting elements with a credit balance.

- 1 mark for accurately classifying the account and its impact on the balance sheet (increase or decrease).

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank