ACCT90002 Financial Statement Analysis Assignment

- Subject Code :

ACCT90002

- University :

The University of Melbourne Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

Australia

QUESTION 1 (20 marks):

Required:

QUESTIONS 2 AND 3: AIR FRANCE-KLM (see Exhibits 1 to 5)

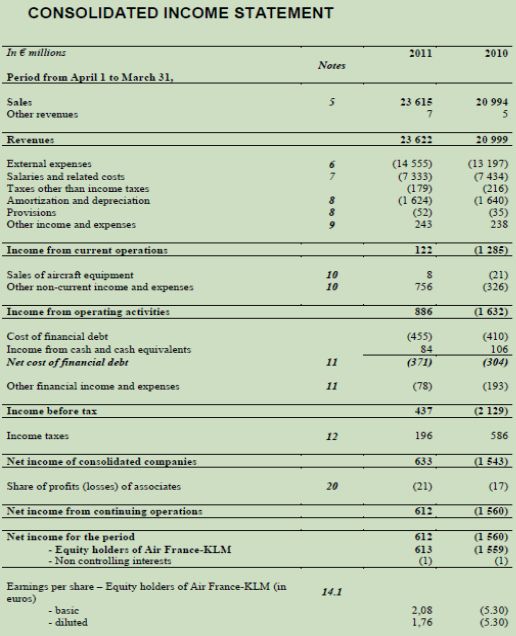

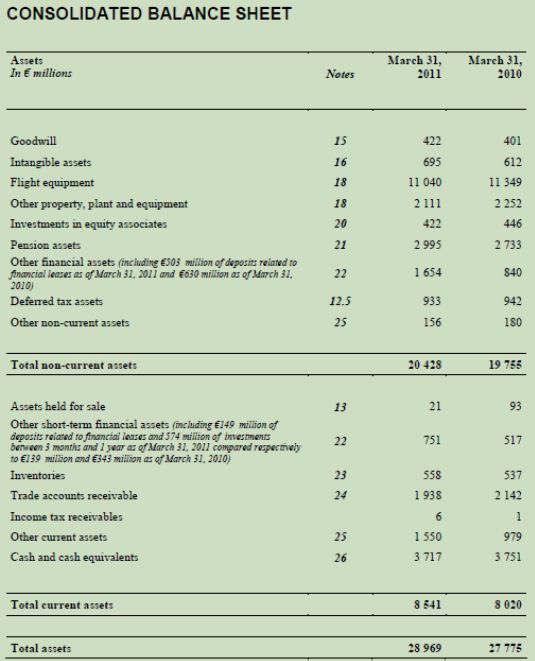

Air France-KLM is an airline group engaged in the business of passenger and freight transportation. It has four segments: Passenger, Cargo, Maintenance and Other. At March 31, 2011, the Air France-KLM group fleet consisted of 609 aircraft, of which 593 were operational. At this date, 274 aircraft were fully owned (45% of the fleet), 117 aircraft were under finance leases representing 19% of the fleet and 218 under operating leases representing 36% of the fleet. After reporting significant net losses for the year ended March 31, 2010, the company reported much improved performance for the year ended March 31, 2011. Commenting on the results reported for the year ended March 31, 2011, Pierre-Henri Gourgeon, Chief Executive Officer, made the following comments:

We have seen a contrasted year, with on the one hand a more favourable economic environment, but on the other a number of exceptional events affecting our operations. Nevertheless, the strategic actions launched last year enabled us to return to profit in spite of a one billion euro rise in our fuel bill and the impact of the various crises. Despite the economic recovery, a number of uncertainties prevail, notably the longer term impact of the earthquake in Japan and the crises in the Middle East and Africa on the economies of those regions, where we have an important presence, as well as the fuel price. However, we are confident in our ability to improve our operating result in 2011-2012, and we remain focused on our longer term objectives. Exhibits 1 to 5 should be used when answering Questions 2 and 3 below, both of which relate to the Air France-KLM information in Exhibits 1 to 5.

QUESTION 2 (17 marks):

QUESTION 3 (33 marks):

(23 marks)

QUESTION 4 (15 marks):

QUESTION 5 (9 marks):

Imagine you are a financial analyst preparing investment advice for your clients.

QUESTION 6 (6 marks):

Identify the letter of the choice that best completes the statement or answers the question. 1.5 marks for each question.

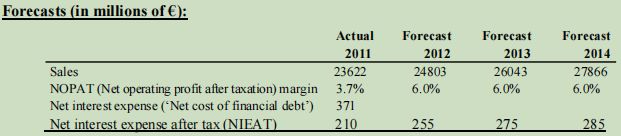

EXHIBIT 1: AIR FRANCE-KLM VALUATION FORECASTS AND ASSUMPTIONS

EXHIBIT 2: AIR FRANCE-KLM CONSOLIDATED INCOME STATEMENT

EXHIBIT 3: AIR FRANCE-KLM CONSOLIDATED BALANCE SHEET

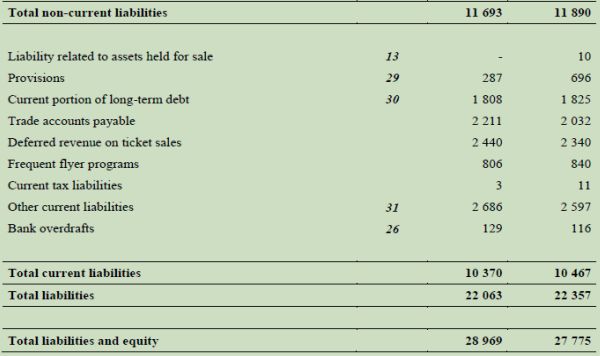

EXHIBIT 3: AIR FRANCE-KLM CONSOLIDATED BALANCE SHEET(continued)

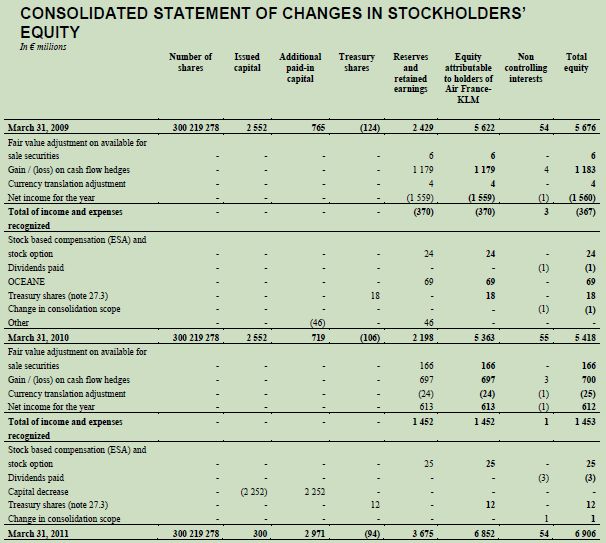

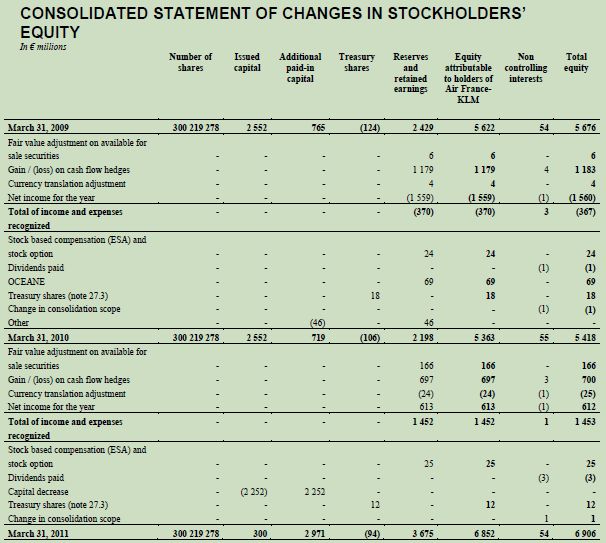

EXHIBIT 4: AIR FRANCE-KLM CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS EQUITY

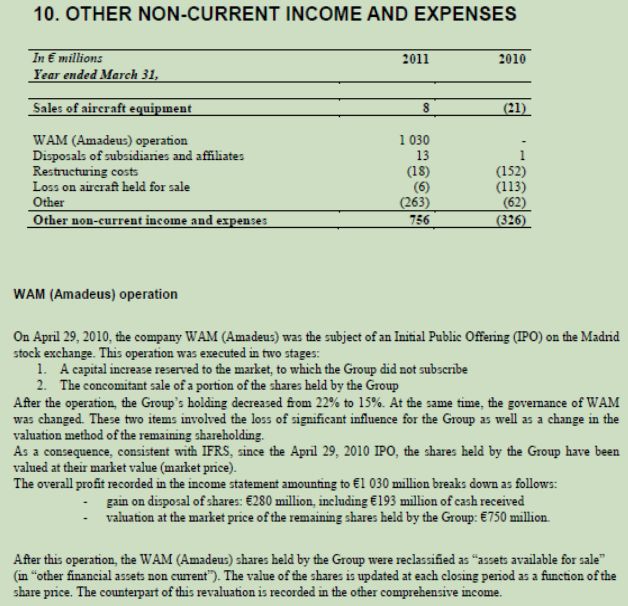

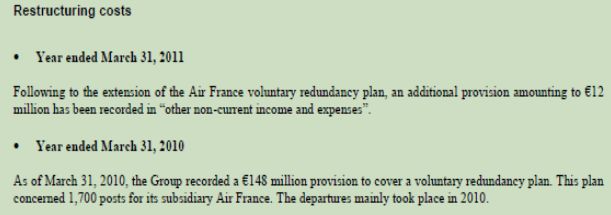

EXHIBIT 5: NOTE 10 TO FINANCIAL STATEMENTS

EXHIBIT 5 (CONTINUED): NOTE 10 TO FINANCIAL STATEMENTS

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank

- Outline and explain the six steps in accounting analysis process.

(6 marks) - Explain how earnings management develop into financial fraud. (4 marks)

- Bink & Lamb (B&L) manufactures and sells contact lenses, lens care products and pharmaceuticals in the US, Europe, and Asia. The company reported the following sales and net trade receivables from 2008 to 2011 (in millions of dollars):

Subsequently it was discovered that the firm had recorded revenues incorrectly. The Securities and Exchange Commission (SEC) investigated and B&L restated their financial statements for certain years.Required:

If you were an analyst examining B&Ls financial statements, what might have caused you to be concerned with the reported numbers above?

(4 marks) - Air Canada sells a round trip ticket for a flight from Melbourne to Toronto for $750. The customer also receives 5,000 award miles, equivalent to 20 per cent of the miles required for future air travel. The average foregone revenues from these flights is estimated to be $400 per passenger. Air Canada also estimates that the incremental costs associated with redemption of frequent flyer awards amount to $100 per passenger. Air Canada records all of the $750 ticket price as sales revenue on the sale of the ticket to the customer.

- Given the accounting treatment above, what questions would you ask Air Canadas Chief Financial Officer?

(4 marks) - Recommend an alternative accounting treatment (no calculations are required)

. (2 marks)

- Identify two key accounting policies and areas of accounting flexibility for Air France-KLM.

(8 marks) - Read Note 10, Exhibit 5: Other non-current income and expenses. Based on your analysis of Note 10, Exhibit 5, outline three relevant questions you would ask the Chief Financial Officer of Air France-KLM regarding Air France-KLMs future recurring profitability. Clearly indicate why you would ask each question you propose.

(9 marks)

- One of the key assumptions underpinning the use of the abnormal earnings (residual income) valuation model is that the clean-surplus relation holds.

- Explain briefly what is meant by the clean surplus relation.

(2 marks) - Does Air France-KLMs accounting violate the clean-surplus relation? If it does, indicate the total amount by which clean surplus is violated for the fiscal year ending on March 31, 2011.

(2 marks)

- Explain briefly what is meant by the clean surplus relation.

- Prepare a condensed balance sheet for Air France-KLMs fiscal year ended March 31, 2011.

Note:- Provisions and retirement benefits and Other non-current liabilities have no (implicit or explicit) interest implications.

- Assume Other short-term financial assets are marketable securities. (6 marks)

- Using the Abnormal Earnings Valuation model, calculate the value per equity share for Air France-KLM as at March 31, 2011. Use:

- A forecast horizon of three years (2012, 2013, 2014).

- The forecasts and assumptions provided in Exhibit 1.

- Outline two key issues an analyst should focus on when assessing a companys revenue recognition policy? Clearly indicate why these issues should be focused upon.

(8 marks) - Explain why terminal values (TVs) in abnormal earnings valuation models are significantly less than those for discounted cash flow valuation models.

(2 marks) -

- Briefly outline and explain at least three drawbacks of the traditional (Du Pont) Return on Equity (ROE) calculation.

(3 marks) - Suggest an alternative decomposition of Return on Equity (ROE) (to the first decomposition level only) that seeks to address the flaws in the traditional calculation. (2 marks)

- Briefly outline and explain at least three drawbacks of the traditional (Du Pont) Return on Equity (ROE) calculation.

- Consider the various sections of an annual financial report. Which section(s) do you think would be of most value to you when it is publicly released? Why?

(5 marks) - What other sources of data would be useful to you if you are reporting on firms in the following industries:

- Building and construction

- Agricultural machinery

- Hospitals and medical services

- Airlines

(4 marks)

- An analyst produces the following series of annual dividend forecasts for company A: Expected dividend(end of) year t+1 = $10; Expected dividend (end of) year t+2 = $20; Expected dividend (end of) year t+3 = $10. The analyst further expects that company As dividends will be zero after year t+3. Company As cost of equity equals 10 percent. Assuming no continuity correction, the analysts estimate of company As equity value at the end of year t is

- $31.16 ,/li>

- $33.13 ,/li>

- $36.36

- $40

- An analyst predicts that company Bs dividend at the end of year t+1 will equal $10. The analystfurther expects that after year t+1 company Bs dividends will grow indefinitely at a rate of 2 percent. Company Bs cost of equity equals 7 percent. Assuming no continuity correction, the analysts estimate of companyBs equity value at the end of year t is

- $100.0

- $111.1

- $142.8

- $200.0

- Consider the following information about company Es performance and financial position in year t:

Net operating profit after taxes (NOPAT) = $50

Beginning book value of net assets = $300

Beginning book value of equity = $90

Cost of equity = 10 percent

Weighted Average Cost of Capital (WACC) = 5 percent

Company Es abnormal NOPAT in year t is- $50

- $45

- $41

- $35

- Consider the following information about company Gs performance and financial position in year t and t+1:

Net profit year t = $60

Net profit year t+1 = $80

Beginning book value of equity year t = 900

Dividend year t = $20

Dividend year t+1 = $50

Cost of equity = 10 percent

Company Gs abnormal earnings in year t+1 is- ($10)

- ($14)

- $20

- $30

- Total shares outstanding at March 31, 2011: 300.2 million.

- Risk-free rate: 3.5%

- Net operating asset (NOA) turnover ratio (using beginning-of-the-year balance sheet data) for 2013 and 2014 is equal to the expected NOA turnover ratio of 2012.

- The ratio of net debt to shareholders equity at the end of each year in the forecast horizon (2012 to 2014) is equal to 0.8.

- Expected rate of return on the market portfolio: 9.5%

- Equity beta: 1.40

- Expected growth in abnormal earnings after 2014: 3.0%

- Given the accounting treatment above, what questions would you ask Air Canadas Chief Financial Officer?