BEHAVIOURAL ECONOMICS AND SUSTAINABLE POLICY

Question 1: Improving donations to charities (10 marks)

- What reason explains it is better for a charity to seek donations on sunny days rather than cloudy days? (2 marks)

- Use the decoy effect to encourage more donations to a charitys clean water project rather than a charitys housing project. Explain your reasoning. (8 marks)

- It appeals to the emotional aspect; hence, it is better for a charity to solicit its donations on sunnier rather than cloudy days. In general, people feel good when the sun is out. By increasing this good mood, people may be motivated to be more generous in their donations to charity. People are exposed to the beautiful sunny weather that pushes them outside where they become more jovial, social, and optimistic about their lives which in turn makes them more open to charity work. Therefore, charities reap the advantage of having high donation rates on sunny days because potential donors are receptive towards donating to a happy cause during happy moments.

- The strategy also involves using the decoy effect so that donors give more money towards a charitys clean water rather than a housing project. This can be accomplished as follows:

- Clean Water Project: $50 allows for one month of clean water for a family.

- Housing Project: This means that one can give fifty dollars and shelter a homeless family for a month.

- Enhanced Clean Water Project: Clean water for a period of one month and extra education resources cost $60 for one family.

For that, the Enhanced Clean Water Project plays a trick. Adding another alternative, which is better than the conventional clean water project, gives the impression that the standard scheme is good value for money. Although both support clean water objectives, people will opt for the affordable one since they perceive the advanced version of the water project as an expensive solution. The decoy effect is applied here, and this increases donations for the clean water project as potential donors have more reasons to believe that the enhanced option (that is education added to the project) is a better choice compared to other options.

Question 2: Probabilities (10 marks)

A fair dice is to be rolled 6 times. The dice has been rolled 5 times with the following numbers appearing: 2,5,6,1,4.

- A gambler expects that, on the 6throll of the dice, the number 3 will certainly appear. What kind of fallacy is this called? (2 marks)

- What are the similarities and differences between the hot hand effect and the law of small numbers? (8 marks).

- The belief that the gamblers bet on the appearance of number 3 in the sixth rolling over might be true is the Gamblers Fallacy. However, this fallacy arises when a person erroneously thinks that two random events have impacted each other. In such instances believing that the dice is due for a three because there have not been threes for the last five rolls is wrong. Every throw of dice is an individual event and the chance of getting 3 at the sixth throw equals 1/6 in the same manner as any other throw.

- Hot Hand Effect and the Law of Small Numbers are both cognitive biases related to how people perceive and interpret patterns in random events, but they are distinct in their characteristics:

Hot Hand Effect:

- The hot hand effect refers to a false notion that someone with good luck in an arbitrary occurrence will also have great fortune for a while after its occurrence.

- This phenomenon frequently refers to the idea of hot hands in sports, especially on occasions like shooting baskets in basketball when this belief implies that a shooter who has scored in consecutive attempts becomes even better positioned for the subsequent shot.

- Hot hand refers to the possibility of a positive correlation among successive events.

Law of Small Numbers:

- This is called the Law of Small Numbers, another form of cognitive bias where people believe small samples will portray similar statistical properties as those found in large samples.

- Because of this, it makes people come to instant judgments upon limited information.

- It presupposes that observations for a small data set predict for a large dataset.

- A bias of this nature, however, does not always mean that events have been interdependent but merely asserts expectations on continuity.

Similarities:

- These two types of bias are based on a misunderstanding of probabilities and the occurrence of random events.

- These are cognitive biases that cause people to erroneously assume that future results could have been deducted by drawing conclusions from historical events.

Differences:

- Hot hand effect relates to an assumed success or failure as part of a sequence of events, and the Law of Small Numbers deals with assuming little information to act like large data.

- Hot hand effect usually presupposes a positive correlation (success comes after success), whereas the Law of small numbers represents expectations from relatively small data sets either with correlated or uncorrelated events.

Question 3: Bayesian updating and beliefs (10 marks)

The standard economic model suggests that individuals update their beliefs/probabilities in a Bayesian way.

- Consider a town of 100,000 people. Hypothetically the chance of someone in the town having the flu is 1 in 1,000. The flu test returns a positive result 99% of the time if you definitely have the flu. The flu test returns a positive result 1% of the time if you definitely do not have flu. Using Bayes approach, what is the chance of you having the flu if the flu test returns a positive result (i.e., what proportion of the positive results represent people who have the flu)? (5 marks)

- Why does the flu test appear to fail? (2 marks)

- Explain why real people dont use Bayes approach when considering probabilities. (3 marks)

- a) We could use Bayes theorem to determine the likelihood of having the flu when the test is positive (conditional probability). Let's denote the following:

A: Having the flu

B: Test returning a positive result

It is given that:

P(A): There are 1 out of every 1,000 people who have the flu, thats P(A)=0.001.

P(B|A): For example, if have the flu, the test will give a positive reaction about 99% of the time therefore P(B|A) = 0.99.

P(B|A): If dont have the flu, then the test will give a positive result about one percent of the time. Therefore, it can be stated that P (B | A) = 0.01.

The main objective here is to locate P (A ?B) which denotes the probability of having a fever given that the test outcomes are positive. Using Bayes' theorem:

P(A|B) =

P(B)= P(B|A) ?P(A)+P(B|A) ?P(A)

P(A) =1-P(A)

Therefore, P(B)=0.99?0.001+0.01?(1-0.001) =0.00099+0.00999=0.01098

P(A|B) =(0.99*0.001)/0.01098= 0.0901

There is therefore about 9.01% probability of being afflicted with the flu should one get a positive flu test.

- b) While the flu test seems to fail, it is due to its relatively high false positive ratio of 1%. Sometimes, this leads to a false diagnosis of flu in cases where an individual is not infected by the same. People are likely to experience unnecessary anxiety and costs resulting from false positives, while these situations are resource-draining and require additional tests and treatment.

- c) Real people often do not use Bayes' approach when considering probabilities due to several reasons:

Cognitive Biases: Cognitive biases like availability bias, anchoring, and representativeness affect human decision-making. Therefore, these biases could drive individuals towards using heuristic and intuitive judgment instead of the standard mathematical likelihood inference.

Limited Statistical Knowledge: For most people to understand statistical concepts such as conditional probability and Bayes theorem, they need to be applied in real-life situations.

Time and Effort: For more difficult problems, however, it may take some time before one arrives at a conclusion using Bayesian reasoning techniques. Often the decision is made without great deliberations as people go with immediate, intuitive judgments which are easier than elaborate thinking.

Emotion and Perception: Ones emotions and beliefs make it difficult for one to reason objectively. One way is when they put too much fear in them or exaggerate fewer probable incidents that are emotionally significant such as plane crashes and minimize everyday risky things.

Information Overload: The world is flooded with information and hence people do not possess all the details and resources that are required to employ Bayes formula for each step. This makes them adopt the quickest means and intuition.

Question 4: Off to the casino (10 marks)

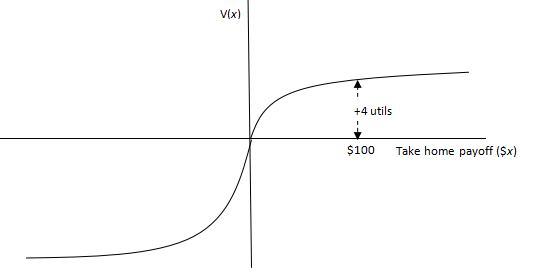

Experimental testing has shown that the value function that humans use, looks like the one described in Figure 1, where V(x) is the value, V, of prospect $x. Pretend that this is a value function for John.

Figure 1: Prospect Theorys value function for John

a)John arrives at the casino with $80 and expects to leave the casino with $80. This is his reference point. Explain why John feels a lot more pain leaving with $70 than the pleasure of leaving with $90 (2 marks) b)Use the information in figure 1 to explain why John prefers the chance of winning 25% of the time an amount of $75 and winning the other 75% of the time an amount of $100 rather than winning 100% of the time an amount of $80. Ignore the difference between perceived and actual probabilities when answering this part. (5 marks) c)How would the difference between perceived and actual probability (as depicted in figure 2) affect your calculations in part b? (3 marks)

Figure 2: Prospect theorys Perceived probability versus actual probability.

- Prospect Theory defines the value function of Johns emotional response with respect to gains and losses in Figure 1. The slope of the value function looks higher on the left side (losses) rather than on the right (gains), representing the notion of decreasing sensitivity to gains and losses.

Thus, when John departs from the casino with $70, he loses $10 out of his $80 reference. As per Prospect Theory, the steeper slope in the loss side of the value demonstrates that emotionally it hurts twice as much for one to lose $10 as it makes for one to gain $10. This simply means that the agony of staying with $70 exceeds the enjoyment of departing with $90. This is called the loss aversion phenomenon.

- Characteristics of prospect theory may explain why John would prefer a chance of winning 25% of the time an amount of $75 and winning another 75% of the time an amount of $100, rather than a sure win of $80.

In this dilemma, John is presented with a risk where he stands to lose 25% on winning $75 at least while on good chances of winning $100. In fact, it all depends upon the profile of the value function depicted in Figure 1. According to Prospect Theory, human beings tend to be risk-seeking about losses, while they behave as risk-averse when facing possible gains.

John opts for the first choice despite its lower expected value ($81.25) in comparison to $80 since there is a high possible reward of $100 and slight losses as reflected by the steeper losss domain of the value function. The $100 gain is psychologically heavy for John as compared to a given $80 for this reason follows Prospect Theory on the subjective notion of value perception and uncertainty.

- The difference between perceived and actual probability, as depicted in Figure 2, can indeed affect calculations in part b. In Prospect Theory, individuals often rely on their subjective perceptions of probability, which may not align with the actual objective probabilities. This can lead to variations in decision-making. Let's explore how this difference may affect calculations:

In the context of John's preference between two options:

- Option 1: "Winning 25% of the time an amount of $75 and winning the other 75% of the time an amount of $100."

- Option 2: "Winning 100% of the time an amount of $80."

The perceived probabilities, as indicated in Figure 2, are essential to John's decision-making. If John perceives a 25% chance of winning $75 and a 75% chance of winning $100 differently than their actual probabilities, it can influence his choices. For example:

- Underestimation of Risk: If John perceives the 25% chance of winning $75 as less risky than it is, he might be more inclined to choose Option 1, favouring the potential gain, even if his subjective probability estimates are incorrect.

- Overestimation of Gain: If John overestimates the perceived probability of winning $100, it might make Option 1 more attractive to him because he perceives the larger gain as more likely.

- Misperceptions of Expected Value: Differences between perceived and actual probabilities can lead to misperceptions of expected value. John might believe that Option 1 offers a higher expected value, even if this is not the case.

In conclusion, the difference between perceived and actual probabilities can impact John's calculations in part b by influencing his perception of risk and expected value associated with each option. Depending on how he subjectively evaluates these probabilities, his choices may differ from what traditional expected value calculations suggest.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects.

Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank