Corporate Financial Analysis and Investment Strategies FIN302

- Subject Code :

FIN302

A brief description of the Coles -Ltd

Coles Group Ltd. is a publicly traded company that operates a large number of retail chains and is exceptionally well-known in Australia. With a primary focus on the sale of food and groceries, alcoholic beverages and petrol, the company has grown to become the second-largest retailer in Australia. Strategy formulation has been utilised by the corporation in order to conduct an analysis of the organization's strategic technique. The Coles Group is a retail company that primarily focusses on customers, and it has implemented a mix of planned and emergent strategies in its sales and marketing strategies. It focusses on groceries, fresh produce, household goods, apparel, alcoholic beverages, and other consumer goods. Coles offers online shopping at coles.com.au. The company offers same-day, overnight drop-and-go and click-and-collect home delivery. Coles Financial Services offers personal loans, credit cards, and insurance. Through its shop brands Liquor land, First Choice, First Choice Liquor and Vintage Cellars, the corporation sells alcohol. It also serves as a flybuys loyalty program and is frequently used in Australian towns.

(Coles Ltd, 2024).

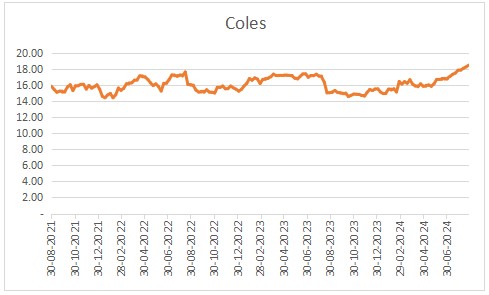

Analysis of companys share price

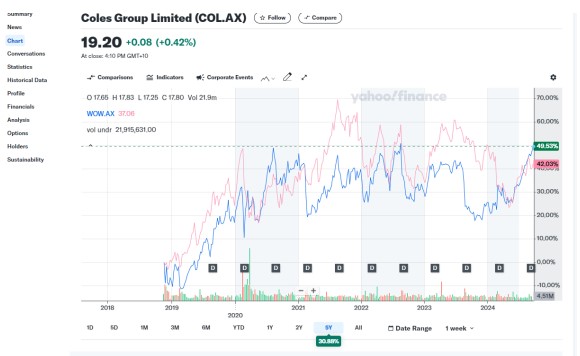

Combination of dividend payments and capital appreciation, the investment has the potential to generate attractive returns on an overall basis. Despite the fact that the effects of the pandemic are beginning to lessen, the company continues to see robust financial growth. Since the beginning of the COVID-19 pandemic, the grocery industry has flourished.

Analysts are of the opinion that the bullish momentum for Coles shares may continue for some time. It is reasonable to assume that the company would see an increase in both its income and its earnings as a consequence of growing pricing.

Suppose Coles were to reach a profit margin of 5%, then the company would make a profit of $5 from a total of $100 in sales. In the event that the identical assortment of products was sold for $105, a profit margin of 5% would result in a profit of $5.25 of more revenue.

The continuous activities of Coles experienced a 3.9% growth in sales, which brought the total to $20.8 billion. Additionally, the company's earnings before interest and tax (EBIT) increased by 9.9%, reaching $1.06 billion. The earnings per share (EPS) number reached 46.3 cents, representing a rise of 11.6%. Over the course of this period, it is undeniable that margins have increased. (Coles Ltd, 2024).

The Australian Broadcasting Corporation (ABC) reported on the comments made by Vittoria Bon, the government and industry relations manager for Coles, noting the increase in profit margins that occurred during discussions with the Senate Committee. The committee mentioned that the store had decreased prices on several items. There are campaigns such as Dropped and Locked that we run because of this. At any given time, we have 5,000 products available for purchase, all of which are currently going on sale and provide our consumers a tremendous deal of value. Additionally, we offer a large selection of things that may be purchased for less than one dollar, such as canned tuna and canned veggies. These items are made accessible for purchase (Coles Ltd, 2024) (Yahoo Finance, 2024).

The fact that we are introducing value-driven advertising is due to the fact that we are aware of the financial difficulties that our clients are currently facing. The Australian Broadcasting Corporation (ABC) claimed that Coles disputed suggestions that it was gaining from inflation and instead attributed the situation to a decrease in expenses tied to COVID.

The gross profit margin of Coles improved by 43 basis points (0.43%) over the period in question, reaching a total of 26.5%. This is an improvement for the company. As a result of the increase of 28 basis points, the EBIT margin reached 5.3%. As a result of the fact that our demand for food does not fluctuate, we do not respond dramatically to changes in price, as stated by David Bassanese, who is the head economist of Beta shares.

Despite the fact that we are not thrilled with the prospect of spending more money on peanut butter and Vegemite, we will continue to buy them despite the fact that their prices have climbed. According to our observations, businesses that have been presented with such circumstances have been able to successfully transmit the increase in costs to their prices, and as a result, overall sales have stayed rather stable. Specifically, my colleague James Mickleboro brought to my attention that Citi views Coles stock to be a beneficial investment and has established a price target of $20.20 for the shares. This suggests that the share price of Coles might potentially climb by more than ten percent (Infront analytics Coles Ltd, 2024).

According to the broker, the earnings before interest and taxes (EBIT) for the first half of the fiscal year 23 were higher than anticipated, which suggests that the predicted consensus for EBIT for the fiscal year may increase. Coles will pay out a dividend per share of 69 cents annually in the fiscal year 2023, which would result in a dividend yield of 5.5% when the dividend is grossed up. It is possible that the dividend per share that is predicted for FY24 will reach 71 cents, which would result in a dividend yield that is 5.7% when grossed up.

(Coles Ltd, 2024).

Stock BETA Analysis

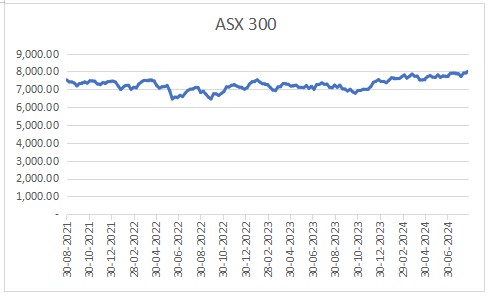

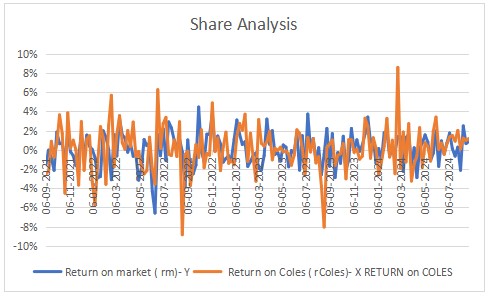

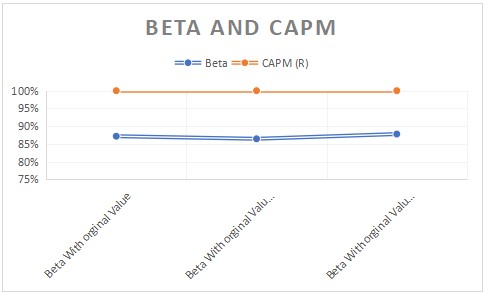

Beta is a statistical metric that evaluates the volatility of a stock in comparison to the volatility of the entire market, which is typically represented by a benchmark market index. Beta is a measure of the correlation between the two. Due to the fact that the market continues to function as the standard, its beta is always 1. A stock that has a beta that is greater than one is expected to increase in value more than the market when the market is bullish, and it is expected to decrease in value more than the market when the market is bearish. If a stock has a beta that is less than one, it is anticipated that it will gain less than the market during movement in the upward direction and will decline less than the market during movement in the downward direction. It is possible for a stock to have a negative beta, which indicates that it moves in the opposite direction of the general market trend. With a Beta value of 0.461, Coles Group Ltd. is evaluated. One is less than this value. According to this statistic, the level of volatility witnessed by Coles Group Ltd. is lower than that observed in the market. The data shows Coles Ltd.'s beta levels over time, as well as competitors' and the markets.

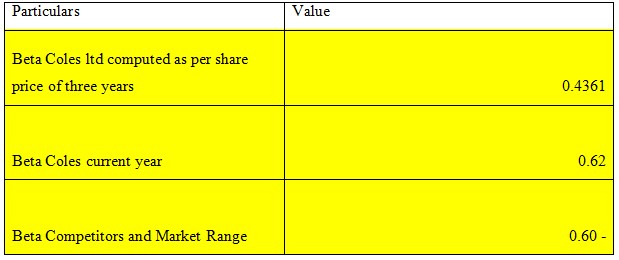

Coles Ltd. has had lower beta than the market during the past three years. A beta of 0.4361 means the stock fluctuates 43.61% as much as the market. This reduces risk and market profit potential. The current year's beta of 0.62 indicates higher volatility than the three-year average. Coles Ltd.s stock has correlated 62% with market swings this year, indicating greater sensitivity. Recently changed firm operations, market dynamics, or other external factors may cause such a situation. Competitors and the market are compared using beta 0.60. Coles Ltd.s beta of 0.62 is somewhat above the benchmark, indicating that it is more volatile than its competitors and the market average (Tarazi, R., 2024).

Coles Ltd. became more volatile as beta rose from 0.4361 (three-year average) to 0.62 (current year). This can be caused by market movements, company events, or economic factors, Coles Ltd. has historically had lower volatility than the market, but it has increased this year. The beta is slightly higher than the market and competitors, indicating increased risk. These volatility swings indicate Coles Ltd.'s changing risk profile, so investors must consider them before investing.

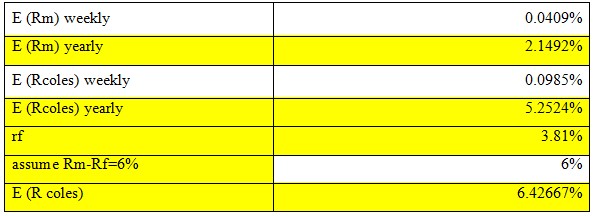

Cost of equity, using the CAPM return

Capital Asset Pricing Model (CAPM) to calculate the required rate of return.

The formula is: Cost of Equity = Risk-Free Rate of Return + Beta of Asset * (Expected Return of the Market - Risk-Free Rate of Return)

Coles Group generates more returns on investment than the funds needed to start the enterprise. A corporation expecting ongoing positive surplus returns on future investments will gain value as growth accelerates.

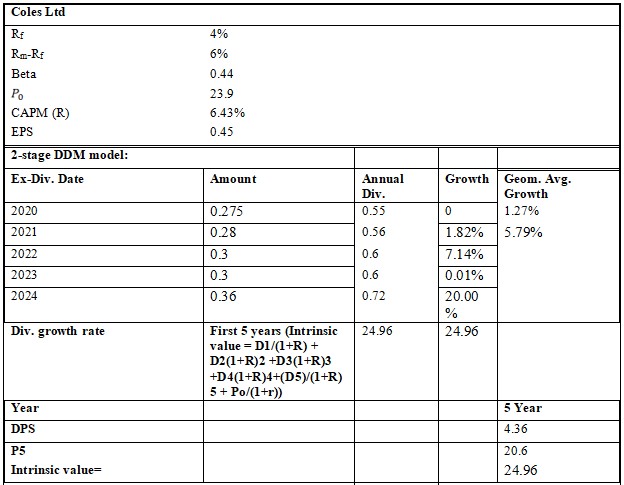

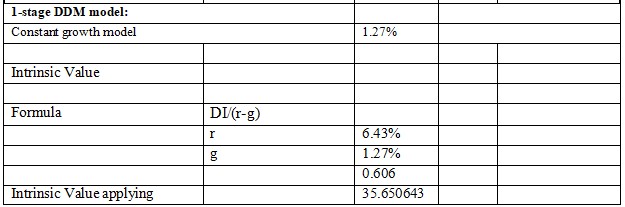

Estimate the intrinsic values using 1-stage models (the constant dividend growth model) the 2 stage non-constant dividend growth model)

Two procedures are needed to calculate a stock's intrinsic value:

Constant Dividend Growth

Two-stage non-constant growth model

Although both models offer substantial insights into stock valuation, it is important to note that each model is accompanied by a unique set of assumptions and some limitations. When it comes to applying these theoretical underpinnings and limits to practical circumstances, having a solid understanding of them is absolutely necessary. Utilising a number of different models in conjunction with sensitivity analysis can make it easier to do a more comprehensive appraisal (Tarazi, R., 2024).

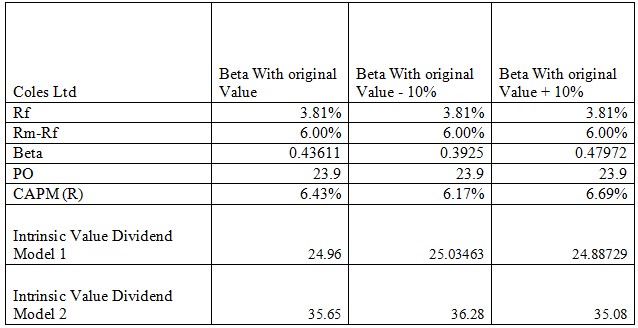

Beta Variation Analysis

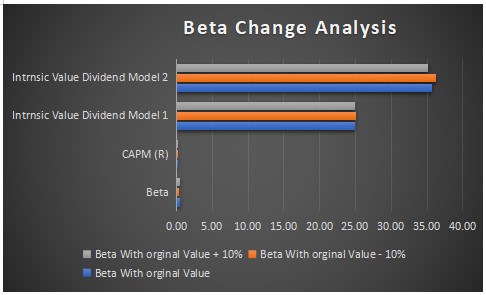

Coles Ltd.'s intrinsic value under different beta scenarios shows how risk profile changes affect its value. The table compares the Capital Asset Pricing Model (CAPM) return and two Dividend Discount Models (DDM) with a 10?ta drop and increase. The initial beta of 0.4361 produces a CAPM return of 6.43%, with intrinsic values of $24.96 in Dividend Model 1 and $35.65 in Model 2. A 10?ta reduction to 0.3925 lowers the CAPM return to 6.17%, showing a lower risk perception. The intrinsic value rises to $25.03 in Model 1 and $36.28 in Model 2 when beta decreases. When beta is low, investors are willing to accept lower returns for lower risk, raising the stock's valuation. When beta is increased by 10% to 0.4797, the CAPM return rises to 6.69%, showing higher risk-related returns. The intrinsic values drop to $24.89 in Model 1 and $35.08 in Model 2. This fall shows that risk increases investor demand for higher returns, lowering stock valuation.

Dividend Model 1 displays modest sensitivity to beta situations, ranging from $24.89 to $25.03. It is less sensitive to risk changes, making it a more conservative way to evaluate Coles Ltd. Dividend Model 2 is more sensitive to beta, with intrinsic values from $35.08 to $36.28. This represents risk dynamics more accurately and may be better for investors seeking a valuation model with a larger risk-return spectrum.

Dividend Model 2 consistently has higher intrinsic values, which may appeal to risk-takers or Coles Ltd. dividend-stability investors. Dividend Model 1 is more consistent and may be better for cautious investors that prefer stability and are less affected by beta variations on intrinsic value. Investors choose these models based on their risk tolerance and preference for stability vs a valuation model that responds to market risk.

Stock Valuations

(Yahoo Finance, 2024)

Based on Coles Ltd.'s intrinsic worth and market conditions:

1. Intrinsic Value Constant Growth Model Evaluation:

Intrinsic: $26.85

Present Share Price: $ 23.90

The Constant Growth Model yields substantially higher value than the share price which comes to around $ 35.66 . This suggests the market undervalues Coles Ltd. This model assumes steady dividend growth, which may not account for short-term basis for the Coles Ltd.

2. Dividend Growth Model: 2 Stages

$24.52 intrinsic value

Present Share Price: $ 23.90

Examination: The Two-Stage Dividend Growth Model also finds Coles Ltd. cheap, although its intrinsic value is slightly lower than the Constant Growth Model. This model accounts for variable growth rates, which may be more realistic for Coles Ltd.'s growth.

2. Compare Competitor Prices:

Woolworth ltd Competitive Price: $35.08

The competitor's share price far exceeds Coles Ltd.'s intrinsic value and current pricing. This suggests that Coles Ltd is cheaper than its competitors, but it's important to understand why. Competitors may have different growth, risk, or market profiles.

3. Investment Proposal Purchase:

Reason: Coles Ltd.'s share price is below both intrinsic values, suggesting undervaluation. Capital appreciation is possible if the market self-corrects and the stock price approaches its true value. If one believes in the company's growth and longevity, this suggests a purchase.

Maintain:

If you own Coles Ltd. shares, keeping them is smart. The stock's undervaluation may provide rewards if the market values it. Assess market circumstances, industry trends, and Coles Ltd. performance.

Recommendation

Coles Ltd. appears cheap based on intrinsic value and market pricing. This is a buying opportunity if you believe in the company's potential and can mitigate the risks. After investing, keeping shares may be wise if you believe the company's long-term prognosis (Coles Ltd, 2024).

One of the events discussed should be from 2024.

COLES LAUNCHES NEW GREAT LENGTHS CAMPAIGN TO RECOGNISE AUSSIE DAIRY FARMERS WHO PROVIDE QUALITY MILK ON SUPERMARKET SHELVES

Coles' current Great Lengths ad shows its long-time connections with Australian dairy producers and its everyday efforts to provide high-quality, tasty milk to customers nationwide. Coles' Great Lengths campaign honours its partnership with 109 Australian dairy farmers in Victoria, central and southern New South Wales, South Australia, Western Australia, and Tasmania, who supply over 500 million litres of milk annually for Coles Brand fresh milk and 19 cheeses and cream. Australian dairy farmers and Coles are working together to create a more sustainable future using the supermarket's direct sourcing model, which guarantees pricing consistency and long-term sustainability. For three seasons, Coles has employed fourth-generation Victorian dairy farmer Adrian Bond and his family in the Great Lengths advertisement (Coles Ltd, 2024). Coles multi-year contracts give dairy producers like Adrian clear farmgate prices to plan ahead. Coles supports Australian dairy producers and provides high-quality Coles Brand dairy products through comprehensive sourcing. Coles' Dairy, Frozen, and Convenience Products General Manager Brad Gorman said the company would keep working with Australian dairy producers. We assure farmers they may keep creating our consumers' favourite premium milk and dairy products. Farmers, growers, and suppliers are important to us. Our close contacts allow us to stock our shelves with fresh, delectable Australian products daily. Through Coles' direct sourcing policy, dairy producers can work with the Coles Sustainable Dairy Development Group (CSDDG) on sustainability. CSDDG has granted over $5.28 million to on-farm initiatives, including the Bond family's recent infrastructure and growth grant. Our sustainability approach uses CSDDG. Brad stated we can support farms and establish a more resilient dairy economy by uniting farmers and promoting innovation. The CSDDG has 11 farmers on its advisory committee and comprises all 109 Coles direct-sourcing dairy farms. Coles' new Great Lengths campaign debuted yesterday in-store, online, on TV, and on social media. Coles' Australian dairy suppliers are featured. This news is turned out to be good news as the company shows to have taken an organised moved and leading to increase sales in future (Coles Ltd, 2024).

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank