Corporate Governance, CSR and Sustainability in Business Practice BUS3056

- Subject Code :

BUS3056

Introduction

Business Governance, Corporate Social Responsibility (CSR) & sustainability are linked themes leading contemporary business practices. Good Corporate Governance ensures businesses are managed transparently and responsibly to balance the demands of shareholders and managers. CSR takes this responsibility even more and integrates ethics to make businesses help society (Fatima & Elbanna, 2023). Sustainability concentrates on how business choices impact the planet, society and economy as time passes. As talking about these principles in relation, this particular article details the role corporate governance theories Agency Theory & Stewardship Theory play in Governance practice and offers proof from a real-world scandal with severe implications of Governance failings.

The Relationship Between Corporate Governance, CSR, and Sustainability

Business Governance, Corporate Social Sustainability and Responsibility are integral concepts in figuring out contemporary business practices. All these 3 ideas are connected together: Corporate Governance outlines the legal framework through which businesses can enforce ethical behaviour; CSR is a company's environmental and social responsibility; and Sustainability may be the long-term result of all these efforts. With organisations under pressure from stakeholders, governments and society to perform sensibly, blending governance, responsibility and sustainability is crucial for sustainable business performance and legitimacy.

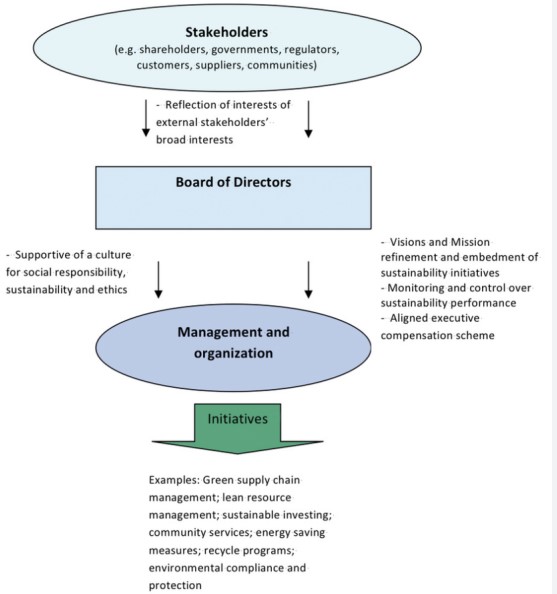

Figure 1: Corporate Governance Sustainability

(Source: Researchgate.com)

Corporate Governance will be the set of guidelines, methods and procedures whereby a business is directed and controlled. It entails pursuing the needs of a business's several stakeholders, shareholders, financiers, suppliers, customers, management, authorities and the community. Corporate Governance establishes the foundation for attaining an organisation's objectives across almost every aspect of management - from internal controls and action plans to corporate disclosure and performance measurement. The OECD states that good governance includes a dedication to moral standards, honesty and accountability. Scholars like Kassem (2022), state that powerful corporate governance methods help reduce unethical conduct since businesses are accountable to their boards of shareholders and directors. Corporate Governance has diversified over time to achieve not merely shareholder profit targets but also Corporate social responsibility. With a record of corporate scandals including Enron's collapse and also the 2008 financial crisis, corporate Governance has turned into an established risk management tool in stopping fiscal fraud and unethical conduct. Corporate governance frameworks must embed CSR and sustainability strategies to avoid such failures. This can help make sure companies are not only concerned with numbers - but on producing value for everybody.

Corporate social responsibility (CSR) is a design which encourages companies towards being accountable for the Social, environmental and economic results of their actions. Even though profitability is nevertheless a core objective for businesses, CSR highlights that businesses should also consider their social responsibility. Rodriguez-Gomez et al. (2020), defines CSR as comprising four kinds of economic, legal, moral and charitable obligations. The economic responsibility entails the hope of profitable enterprises, the legal responsibility includes the duty to obey regulations and laws, the ethical responsibility is doing what's right above what's legally permissible, and the philanthropic responsibility is a voluntary expectation that companies help social improvement. The emergence of CSR mirrors the increasing demand amongst stakeholders like customers, employees and investors that businesses adopt responsible business practices which benefit society. This particular change is partly fueled by heightened recognition of worldwide problems including climate change, inequalities & environmental degradation. Dolan, Huang & Gordon (2021), point out that CSR shouldn't be an additional feature to company operations, but a part of shared value - in which companies enhance their competitiveness while caring for social problems. By concentrating on sustainable development, a robust CSR plan can help companies mitigate reputational risk, increase consumer loyalty and stimulate innovation. Within the context of Corporate Governance, CSR isn't philanthropy or compliance with law; it's about relationships. It's about encoding ethical business practices within the organisation's management system. This integration assures that board and senior management decisions are informed by the long run interests of society, environment and generations to come. CSR corresponds to sustainability in which both highlight social and environmental balance.

In terms of business sense, sustainability is some company strategy which allows it to operate sustainably in regard to its governance, social, and environmental (ESG) effects. Sustainability is "a way of addressing current demands while not compromising the capability of future generations to meet up with their very own needs" (Brundtland Commission 1987). It discusses just how business activities relate to much larger societal and environmental problems and emphasises how businesses must lessen damaging externalities such as pollution, social inequality and resource depletion. Sustainability is at the centre of Corporate CSR and Governance since it anchors company choices to wider environmental and social responsibility themes (Bhattacharyya & Verma, 2020). This particular relationship is usually interpreted in the triple bottom line (TBL) strategy created by John Elkington in 1994. The TBL framework encourages companies to prioritise 3 performance areas: individuals (social responsibility), earth (social sustainability), profits (financial worth). Enterprise which practises sustainability is better placed to hedge against regulatory change, resource shortage and customer shift. In terms of Corporate Governance, sustainability is crucial in maintaining companies tenacious & competitive in a digitally connected world. Improved transparency regarding the way businesses manage ESG risks was backed by the rise of sustainability Reporting, like the Global reporting Initiative (GRI) and also the Task Force on Climate-related Financial Disclosures (TCFD). These frameworks offer governance models which hold businesses responsible for social and environmental performance and embed sustainability into corporate decision making (Aldowaish et al., 2022).

Corporate Governance, Sustainability and CSR exactly how each assists the other. Corporate Governance offers the structures and controls to ensure businesses operate ethically, responsibly and transparently. CSR is a sign of a company's wider social and environmentally friendly responsibility, and it's transferring governance structures towards helping not just shareholders, but those of staff members, communities and the future generation. Sustainability in turn ensures the methods of corporate CSR and governance adopted aren't temporary fixes to fix a future issue. Integrated Corporate Governance, CSR, and Sustainability into operational frameworks are recognized to have higher long term success rates for businesses (Aguilera et al., 2021). This is simply because such companies are far better placed to handle risks, project a good public image and attract investment from consumers who value sustainability and ethics. Additionally, by integrating these principles into their governance frameworks, companies can stay resilient and agile to worldwide trends including global warming, regulatory changes and changing customer expectations.

Corporate Governance Theories

Corporate Governance theories offer an underlying conceptual foundation for understanding the way a corporation functions, its responsibilities and roles, particularly with regards to decision making, influence, and accountability. Agency Theory & Stewardship Theory rank amongst the leading concepts in the region of Corporate Governance. Both approaches present opposing viewpoints on the interaction among managers (executives) and shareholders (owners) in an enterprise and the dynamics of the interaction between these two primary stakeholders of corporate governance. Whereas Agency Theory is likely to put substantial focus on possible conflicting interests between shareholders and management, Stewardship Theory advocates a far more cooperative relationship, with administrators acting in the company's long-term interests.

Agency Theory is among most extensively talked about and researched Corporate Governance frameworks. Educated by the work of Handayani et al. (2022), Agency Theory analyses the relations between owners (shareholders) and agents (managers) of a corporation. The theory is based on the premise that agents, or maybe agents, don't constantly act for all the principals 'interests. This particular conflict of interests is called the principal agent problem and results from the separation of control and ownership in contemporary companies. Shareholders, who supply capital and also own the business, generally hand over decision making authority to professional managers. This particular delegation, however, produces the potential for managers to follow their very own personal goals (empire building or higher compensation) while sacrificing shareholder value. Agency Theory suggests managers might seek short-term revenue, alter economic reporting, or take excessive chances to improve personal wealth or even keep a project, particularly in case their interests aren't consistent with those of shareholders. Agency expenses would be the expenses that shareholders pay for observing and gratifying employees to conform to their objectives.

These expenses can consist of performance-based compensation plans, auditor costs, or robust internal controls and management to lessen the information asymmetry between investors and management. To deal with this particular possible conflict of interest, agency Theory advocated for certain Corporate Governance strategies to tackle Agency concerns. One particular mechanism would be executive pay packages which match executives' economic incentives to business overall performance. Managerial rewards like stock options are usually linked with increases in shareholder value. Directors in addition supervise management to make sure it's in the shareholder's best interest. Kristanti et al. (2024), assert that a good board consisting mainly of independent directors not directly associated with operating the organisation can offer good oversight and stem managerial opportunism. External elements like the company command industry and legal frameworks are also essential in reducing agency issues.

The corporate control market is premised on the belief that bad - managed firms with declining shareholder value are open to hostile takeovers. So, the takeover threat may discipline executives and ensure they're acting in the shareholders' best interest. Legal guidelines and reporting requirements further reinforce management and their accountability. Even though influential in detailing contemporary corporate governance structures, Agency Theory has been criticised because of its narrow view of corporate relationships and human behaviour. Critics assert that Agency Theory presupposes selfish acts by managers, ignoring the chance that managers might really be responsible stewards of the firm's resources.

Hughes et al. (2022), created Stewardship Theory as a Theory that managers rather than acting in selfishness, act from a responsibility and desire to serve the group and its stakeholders. Unlike Agency Theory, which postulates innate conflicts between shareholders and managers, Stewardship Theory proposes that managers' aims are naturally linked to the long-term results of the corporation. As stewards, managers safeguard and develop shareholder value since they feel personal fulfilment and satisfaction when a business achieves organisational success. Stewardship Theory is founded on the premise that managers are intrinsically driven to work toward the firm's success via faithfulness, organisation identification, along with a psychological attachment to the company's mission. This strategy recognizes the need for trust, collaboration and long-term strategic thinking in Corporate Governance instead of continuous monitoring and management.

In a stewardship standpoint, granting managers much more autonomy and decision-making power means far more accountable behaviour and an even greater contribution to the company's future success. In practice, Stewardship Theory asserts that governance structures must enable managers by offering them autonomy and resources to lead the organisation efficiently. Instead of heavily rewarding performance or monitoring the board of executives or directors, stewardship-oriented governance aims to establish positive relations with shareholders. In this respect the board serves not merely as a watchdog to monitor and direct employees toward strategic organisational objectives (Gee et al., 2023). Stewardship Theory also links to the greater Corporate Governance viewpoint of stakeholders being past shareholders. Whereas Agency Theory concentrates on maximising shareholder value, Stewardship Theory promotes a governance design which balances interests of staff members, consumers, vendors and the neighbourhood. This stakeholder focused approach fits with brand new expectations of sustainability and CSR in the present-day corporate world and challenges executives to create long-term strategies which maximise economic performance and societal sustainability.

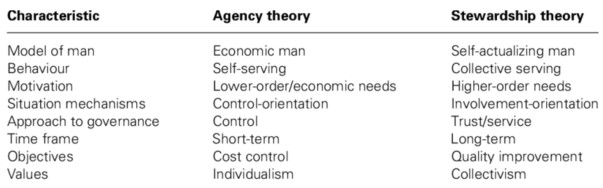

Agency Theory and Stewardship Theory have different ideas regarding organisational behaviour and human nature when compared. Agency Theory is much more pessimistic, imagining managers as ad hoc representatives with minimal visibility in their very own actions and therefore needing monitoring along with rewards to conform to shareholder expectations. This particular viewpoint underscores the importance of balances and checks within the governance framework to stem managerial opportunism. Stewardship Theory, though, takes a far more positive perspective and positions managers as stewards that are innately inclined to act in the company and the stakeholders best interest. This particular theory places focus on trust, empowerment and long-term strategic vision as qualities of effective governance (Stupak, Mansoor & Smith, 2021). However, both concepts have practical applications and limitations. In practice, though, no one principle completely captures the depth of corporate governance. Although Agency Theory might be more applicable in organisations where shareholders and managers clearly have opposing interests, Stewardship Theory might be much more appropriate in organisations where managers and shareholders have very similar long-term objectives and share an organisational culture of achievement. Additionally, contemporary governance frameworks usually combine areas of both theories, realising that a sense of balance between oversight and empowerment is needed for good management and sustained corporate overall performance.

Figure 2: Comparison of Agency Theory and Stewardship Theory

(Source: Reseachgate.com)

Case Study: Real-Life Business Scandal

The failure of Enron Corporation in 2001 is among the greatest business scandals of recent times, demonstrating both Agency Theory and Stewardship Theory in its failures. When Enron was among the world's largest energy companies, it turned into a term for business fraud and honest offences when it was discovered the company had perpetrated widespread accounting fraud to conceal its actual economic situation (Rashid et al., 2022). The scandal prompted the firm to declare bankruptcies, its accounting company Arthur Andersen disbanded, and widespread public fury over an absence of control in the business world. With its demonstrated damaging consequences of managerial selfishness and failing to appropriately balance the needs of shareholders and managers, Enron's scandal is a great model to evaluate from both Agency Theory and Stewardship Theory perspectives. Additionally, it illustrates just how intransparency and mistrust in corporate governance structures are able to have devastating effects for stakeholders.

Figure 3: Enron Logo

(Source: images.google.com)

The collapse of Enron started once it became clear the company had disguised huge debt by creating complicated accounting methods, which includes off-balance sheets, to artificially boost earnings. The organisation's board of directors and outside auditors provided direction and leadership of these deceptive methods, including CEO Jeffrey Skilling and CFO Andrew Fastow. Enron portrayed itself as a lucrative and cutting-edge business and investors jumped higher, sending its share price rocketing (Rathakrishnan, Baskar & Campus, 2024). But the company was in financial difficulty with billions in hidden debt and failed companies. The scandal occurred when the company needed to recalculate its earnings - showing the extent of the cheating. In December 2001 Enron went bankrupt and its demise destroyed pensions and savings of a huge number of investors and employees. The scandal also spurred considerable reforms in corporate governance, which includes the 2002 implementation of the Sarbanes Oxley Act intended to increase public company transparency and accountability.

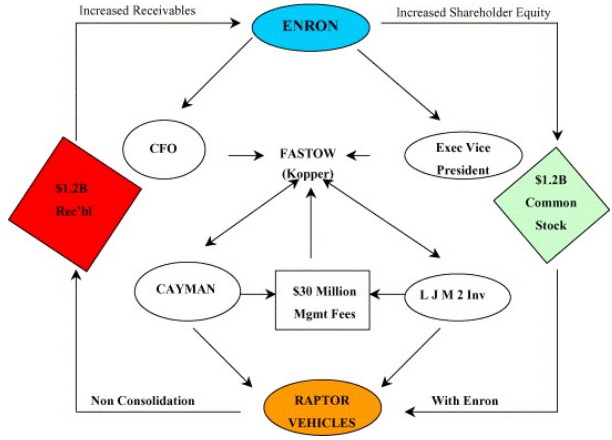

Agency Theory outlines the way managers (agents) could differ from shareholders (principals) when inadequate governance structures occur. Agency Theory will help explain exactly how executives in Enron used their positions to personalise themselves while ruining the company's shareholders, workers along with other stakeholders (Schaedler, Graf-Vlachy & Knig, 2022). The concept at the centre of Agency Theory is the fact that managers may act in their very own self-interest, maximising short term personal satisfaction over the long-term benefit to the organisation. In Enron's case, executives like Fastow and Skilling got enormous salaries specifically associated with the company's stock price. Stock options and bonuses rewarded them for manipulating profits and artificially increased the company's figures to help keep up stock prices. This produced unrestrained risk taking & dishonesty since executives had been more interested in their personal success than the sustainability of the business. The principal-agent issue was amplified as Enron's board of directors hadn't adequately monitored the management group. The board, who ought to have acted to verify managerial ability, was involved in the fraud. Additionally, it approved off-balance-sheet entities along with other dubious accounting procedures without assessing the risks involved (Awalluddin, Maznorbalia & Yiam, 2022). This particular oversight failure shows the fragility of governance structures at Enron: the board acted beyond shareholders 'interests and permitted management to act unprofessionally.

Agency Theory advocates for tighter governance to have averted the Enron scandal. For instance, greater independence and crucial oversight by the board of directors may have detected the fraud earlier. Additionally, managerial incentives dependent on long-range performance versus stock price swings may have decreased executive incentives to manipulate. Performance-based rewards such as long-term stock ownership or profit sharing tied to organisation sustainability would've lined up managers with investors. Enron also failed internal governance functions, which includes regulatory bodies and auditors. Enron engaged Arthur Andersen as its outside auditor to offer an outside 'check on the company's finances. However, due to conflicts of interest Arthur Andersen was compensated handsome consulting fees by Enron - it couldn't offer an objective view of the company's finances. This particular breakdown of external oversight compounded the agency troubles at Enron.

Stewardship Theory thinks that managers aren't driven by selfishness but by a wish to be very good stewards of the firm's resources. The company most likely would've taken a completely different course if Stewardship Theory applied for Enron. Stewardship Theory presumes managers are pleased with organisational performance and with working to the long-term health and balance of the organisation. However, at Enron, top executives exhibited utter lack of stewardship. Instead of becoming the caretakers of the organisation's long term, leadership at Enron made short term, personal decision making. Enron's culture cultivated a "win no matter what mentality" that discouraged ethical conduct and encouraged gambling and deceit. As trustees, Enron's executives would have thought about the sustainability of the organisation because of its society, customers, and employees in addition to shareholders (Clarke, 2022). A stewardship strategy would have promoted openness, moral judgments and long-term strategic planning.

Figure 4: Enron Exposed

(Source: images.google.com)

In a governance viewpoint, Stewardship Theory states the board of directors ought to have empowered supervisors to look past short term stock performance to what the business stands for. This may have been attained via open communications, ethical governance and leadership which supported management and shareholder alignment. Moreover, Stewardship Theory would've promoted trust between stakeholders and management, allowing collaborative management whereby choices are made for the benefit of the group and also the long run. The collapse of Enron demonstrates not just where Stewardship Theory's concepts are absent, but positively harmed by a culture which rewarded unethical conduct (Abu-Ali, Al-Jamal & El-Masry, 2024). The employees weren't faithful to or responsible to the corporation's stakeholders; Rather they utilised the business as a private profit machine. This bad management resulted in the loss of trust among Enron and its customers which eventually led to the organisation failing.

Discussion and Analysis

The demise of Enron shows the serious consequences of Corporate Governance failures to complement executive desires with shareholder interests as argued by Agency Theory. The company's top executives fraudulently conducted accounting for individual profit, especially stock options along with bonuses associated with short-term stock performance. In an Agency Theory viewpoint, the executives were self-interested agents that utilised the company's maze of financial plans to mislead the regulators, and shareholders marketplace. They had been assisted by insufficient oversight and monitoring by the board of directors externally and internally by regulatory authorities and auditors.

Agency Theory thinks the governance structures must reward managers for their long-term performance, generally via long-term performance compensation rather than short term gains (Luo, 2022). However, in several crucial respects Enron's governance system was faulty. The board of directors that manages management didn't perform its task. The board didn't exercise independent monitoring and rather sanctioned off-balance sheets along with other risky financial practices without thinking about the implications. Additionally, the external auditor, Arthur Andersen, was complicit in the fraud through conflicts of interest triggered by his dual role as auditor and advisor for Enron. These governance mistakes permitted the principal-manager issue to go unattended, resulting in decisions which placed executive wealth above business health. Principal takeaways from Agency Theory used below consist of the role of external controls (such as regulatory oversight) and auditing in addressing Agency issues. The failure of Enron demonstrated the dangers of permitting conflicts of interest to sway these outside governance systems. For example, Arthur Andersen's inability to fairly examine Enron's claims due to its consulting services relationship with the business demonstrates just how conflicted incentives are able to weaken business reporting. This particular failure resulted in sweeping laws, like the Sarbanes Oxley Act which needed more strict auditing requirements and improved executive accountability for fiscal reporting precision.

Though outside controls are essential, Agency Theory also highlights the importance of internal governance structures like the board of directors in fighting managerial opportunism. With Enron, the inaction of the board and its propensity to approve suspect accounting procedures without due diligence had been driving forces behind the collapse of the firm. This internal governance failure illustrates that board composition and independence are crucial to ensure that managerial actions are consistent with shareholder goals. Corporate Governance best practices now suggest boards have the majority of independent directors and the knowledge to critically examine highly regulated business transactions (Federo et al., 2020). Consequently, boards may effectively check managerial authority and mitigate agency risk. While Agency Theory comes with an impressive explanation of the management failures at Enron, it also has shortcomings. The theory asserts that managers are intrinsically self-serving, and that the biggest governance difficulty is balancing their interests with those of shareholders. This presumption, however, doesn't reveal managers possibly being stewards of the organisation's future success as reported in Stewardship Theory.

Figure 5: Enron Agency problems

(Source: Sciencedirect.com)

Unlike the self-serving predicted by Agency Theory, Stewardship Theory thinks that managers are pleased with organisational performance and because of their role as supervisors of the company's resources. Stewardship Theory might have favoured a governance model as Enron whereby managers were empowered to create long-term value rather than short term stock price manipulation. If Enron executives had followed a stewardship approach, they might have pursued sustainable business models and transparent financial reporting instead of engaging in short-term market - boosting stunts. Key insights from Stewardship Theory applied to this particular situation consist of the desire to develop a trust, accountability, and ethical leadership culture inside the business. The way in which taking risks and monetary manipulation promoted Enron was inconsistent with responsible management. The business leadership rather than encouraging long-term achievement created an atmosphere where short-term personal satisfaction was the highest priority. Stewardship Theory asserts that Corporate Governance structures must concentrate on developing a culture where managers feel responsible for the group and its stakeholders (Banda, 2023).

The wider Enron scandal extends outside of the theoretical disputes involving Agency Theory and Stewardship Theory. The business error revealed basic flaws in the regulatory framework managing business behaviour, especially in accounting requirements and auditing. The Sarbanes Oxley Act adopted following the scandal creates a brand-new regulatory climate, targeted at strengthening Corporate Governance and rejuvenating public trust in financial markets. Principal provisions of the law, which require businesses to have internal controls on financial reporting, and executive accountability for the reality of financial statements, stem from Enron's demise. These regulatory changes have had a long-lasting effect on corporate Governance practices and also show that accountability, transparency and honest leadership are imperative for the corporate planet.

Conclusion

The Enron scandal is an ominous reminder of the catastrophic outcomes of disorganised Corporate Governance. Agency & Stewardship concepts both outline frameworks that if followed would have avoided the unethical behaviours which resulted in the business failure. Agency Theory stresses controlling managerial selfishness, while Stewardship Theory advocates ethical leadership and vision. Lessons learned from Enron demonstrate that highly effective monitoring needs to be balanced with a culture of trust and responsibility. Harmonising governance, CSR and sustainability is vital for staying away from similar scandals and ensuring sustainable, ethical business practices.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank