Effects on Unemployment Inflation and Exchange Rates

- Country :

Australia

Question 1.

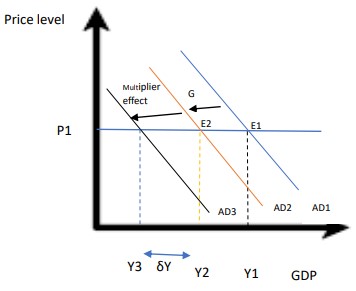

In response to the continuous high inflation in the UK economy, the government is considering ramping up austerity measures. Using the aggregate demand (AD) model with a multiplier effect, we shall explain the potential sequences of such a policy shift.

In the AD model, the economys total output is determined by the level of aggregate demand, which consists of consumption (C), investment(I), government spending(G), and net exports (NX). The multiplier effect occurs when changes in one component focus on the impact of austerity measures on government spending.

Starting in the first half of 2023, the UK economy has experienced stagnant growth and underinvestment as noted in Karen Gilchrists article on CNBC(Gilchrist, 2023).Business investment has slumped compared to G7 peers, and the economy is in a doom loop. High inflation, as highlighted by Richard Partington in the guardian(Richard Partington, 2023), is a concern. At this point, the aggregate demand curve (AD1) intersects with the short-run aggregate supply curve(SRAS) at a point below potential GDP(y1).

If the government decides to ramp up austerity measures as stated by former Tory Treasury minister, Jim ONeil in the independent(Jim ONeil, 2023), it would mean a reduction in government spending (G), which would shift the AD curve to the left, resulting in a new AD2 curve. This reduction in government spending is intended to combat inflation by reducing the overall demand in the economy.

As the government reduces spending, there will be a decrease in aggregate demand, causing a decrease in economic activity and output. This shift from AD1 to AD2 leads to a new equilibrium (E2) at a lower level of GDP(Y2). This means the economy is producing below its potential.

Considering the multiplier effect, while assuming a multiplier of 2.0, the initial reduction in government spending (?G) leads to a multiplier decrease in GDP (?Y) to Y3. In this case, if we take ?G as 10 billion, it will lead to a decrease in GDP of 20 billion.

Over the next year and a half, therefore, as austerity measures persist, the economy could continue to contract. As private businesses see lower demand, they might cut back resulting in a prolonged period of economic stagnation, high unemployment, and potentially deflationary pressures(Gilchrist, 2023).

It is thus essential to consider the broader economic implications of austerity measures, as they may exacerbate existing issues rather than resolve them.

Ramping up austerity measures to combat high inflation could lead to a contraction in economic output and prolonged economic stagnation as illustrated by the AD model. The multiplier effect magnifies the initial decrease in government spending, potentially creating a doom loop of economic underperformance, as observed in the UK in 2023.

Question 2.

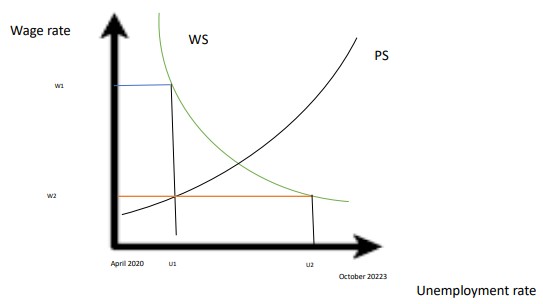

In the context of the WS/PS(Wage Setting/Price setting)model, we can analyze the United States labor market and its recovery from the effects of Covid-19 until October 2023, with an unemployment rate of 3.8%. we shall consider the impact of unemployment benefits and working bargaining power( including unions on the labor market in the United States.

Unemployment benefits: unemployment benefits have played a very important role in the recovery of the united states labour market. According to the article by Dupo rams Arbogast, the effects of pandendic emergency unemployment benefits have been a subject of debate(Dupor & Arbogast, 2022). These benefits were introduced to support individuals who lost their jobs due to the pandemic. In the WS/PS model, these benefits can be seen as an external factor influencing wage- setting process.

At the beginning of the pandemic in April- Jun 2020, the unemployment rate peaked at 14.8%. the existence of generous unemployment benefits at that time helped individuals cope with the economic shock, reducing the immediate pressure to accept low-wage jobs. As a result, the wage-setting process shifted to favor employees, leading to higher wage demands.

Over time, as the economy recovered, the unemployment rate gradually decreased. The reduction was also influenced by changes in unemployment benefits. As the WS/PS model predicts, when unemployment benefits started to expire or were reduced, it put pressure on workerd to accept available jobs, contributing to wage moderation and eventual decrease in unemployment. The impact of the benefits on the wage-setting process is evident in the labour markets recovery trajectory.

Working bargaining power and unions:

Rosalsky in his article suggest that the union boom may not be as robust as initially perceived (Greg Rosalsky, 2023). Unions play a critical role in influencing wage-setting. In the WS/PS model, a strong union presence leads to higher wage demands by workers, which can subsequently impact the overall wage setting process.

Ghilarduccis article highlights weakening laour power(Greg Rosalsky, 2023),indicating that unions may not have the same level of influence they once did. This weakening can be attributed to various factors such as legal changes or declining union membership. As working bargaining power dinishes, it shifts the wages- setting process towards employers, results in more favourabale conditions for the employer.

Mutikani in his article notes that the united sates unemployment rate spiked to 3.8%, suggesting that despite some labour market momentum, it is still fragile(Lucia Mutikani, 2023). This could be due to the relative imbalance of power between workers and employers, which is an essential aspect of the WS/PS model.

From the diagram above, the initial high unemployment benefits during the pandemic led to higher wages (W1), but as benefits waned, wage growth slowed, and unemployment gradually decreased. The role of unions and working bargaining power can also be seen in thetrajectory of wage shanges to (W2), with weakening labour power leading to more favourable conditions for employers.

Question 3.

a) credit- constrained households: according to Ainsworth(Kate Ainsworth, n.d.), credit- constrained households, those with limited financial flexibility, often living paycheck to paycheckmay face heightend financial stress. These are likely to be more negatively affected by an increase in mortgage reapyments. As interest rates rise, their monthly mortgage payments increase, which ultimately leads to financial stress. They may need to cut back on discretionary spending, leading to a reduction in consumerdemand, and they may also struggle to meet their mortgage obligations, potentially facing delinquencies or defaults. This can have a broader implications for the banking systems stability and economy.

Less credit- constrained households: on the other hand, less credit constrained households, as pointed out in the article by ryan(Peter Ryan, 2023), are typically better equipped to manage the increased mortgag . they might continue to spend on non-essential items, albeit possibly at a slightly reduced rate. However , they are less likely to experience severe financial stress on their mortgage payments.

b. in late march 2022, as reported in Ziffers article(Ziffer, n.d.), the cash rate in Australia was at 0.10%, and the exchange rate (AUD/USD) stood at 0.76. by late September 2023, as in dicated in taylors article(David Taylor, 2023), the cash rate had increased to 0.75%, and the exchange rate depreciated to 0.070.

| Time period | Cash rates(australia) | Exchange rates(AUD/USD)) |

| late march 2022 | 0.10% | 0.76 |

| late September 2023 | 0.75% | 0.70 |

Winner: Australian exporters benefit from weaker AUD. Alower exchange rate makes australian

exporters more competitive in internal markets, potentially increasing export demand. This can boost

the austrialian economy , create jobs and contribute positively to tha balanve of trade.

Loser: Australian consumer who imports goods face higher prices due to the demad depreciated AUD. Imported products become more expensive, which can lead to inceeased inflationary presseures and reduced purchang power for australian consumers.

Aggregate Demand (AD) Curve:

Initially, the AD curve is at point A, with low unemployment and high inflation. When the RBA raises interest rates, it reduces consumer spending and investment. This leads to a leftward shift of the AD curve to AD', resulting in lower real GDP and inflation.

Phillips Curve:

The initial point on the Phillips curve (Point X) shows a low unemployment rate and high inflation. As the RBA increases interest rates, unemployment is expected to rise, moving along the short-run Phillips curve to Point Y, with higher unemployment and lower inflation.

Aggregate Supply (AS) Curve: The impact on the AS curve depends on various factors, including the expectations of businesses and workers. If they expect higher inflation and lower demand due to the RBA's policy, the AS curve might shift left, resulting in stagflation (higher unemployment and inflation).

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back! Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank