Financial Risk Management and Investment Analysis FIN4027

- Subject Code :

FIN4027

Question 1

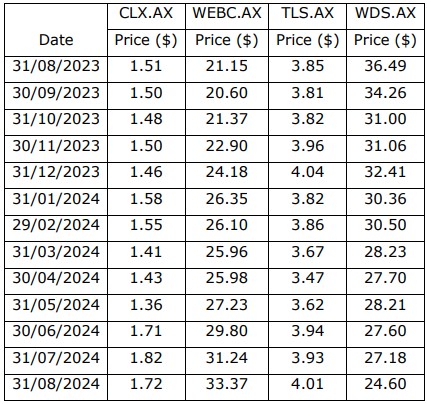

The table below contains the share prices of CTI Logistics Limited (CLX.AX), Westpac Banking Corporation (WEBC.AX), Telstra Group Limited (TLS.AX), and Woodside Energy Group Ltd (WDS.AX) for the 13 months from 31 August 2023 to 31 August 2024 (Price data downloaded from Yahoo Finance).

a) Calculate the monthly holding-period returns for CTI Logistics Limited, Westpac Banking Corporation, Telstra Group Limited, and Woodside Energy Group Ltd (there will be 12 monthly returns for each share).

b) Calculate the average monthly holding-period returns and the standarddeviations of these returns for CTI Logistics Limited, Westpac Banking Corporation, Telstra Group Limited, and Woodside Energy Group Ltd.

c) Assume you have decided to invest 40% of your money in CTI Logistics Limited, 20% in Westpac Banking Corporation, 20% in Telstra Group Limited, and 20% in Woodside Energy Group. Calculate the expected monthly holdingperiod return and the standard deviation of the return for the four-share portfolio.

d) Discuss with evidence whether you have gained benefits through the creation of the portfolio of 40% in CTI Logistics Limited, 20% in Westpac Banking Corporation, 20% in Telstra Group Limited, and 20% in Woodside Energy Group.

Note: Use an Excel spreadsheet for parts a, b, and c, but the answers, working process, explanation including formula used, and discussion should be in a Word document. Submit the spreadsheet as an appendix in your answer script. [2+2+2+4=10 marks]

Question 2

a) Discuss the sources of business risk to ship owners and charterers in the shipping industry and explain the techniques that could be employed to deal with them. Use real examples to support your discussion. (Word limit: 200 words)

b) Lee Tasmania is expected to receive US$500,000 from an importer in the USA in three months from now. The company is considering hedging currency risk by using either a forward hedge or an option hedge. Relevant information is provided below.

The spot exchange rate is A$/US$0.67. However, the company expects in three months that the exchange rate will move to A$/US$0.75 when it receives the US$500,000.

The 90-day forward rate as of today is A$/US$0.71.

A call option on US$ that expires in 90 days has an exercise price of A$/US$0.70 and a premium of US$0.01.

A put option on US$ that expires in 90 days has an exercise price of A$/US$0.69 and a premium of US$0.01.

What is the best strategy for the company to avoid receiving the least amount of A$ by hedging its exchange rate risk? Justify your answer with evidence. [3+5=8 marks]

Question 3

A company has a demand for $500,000 which is estimated that this amount will be used for purchasing goods for the increasing demand for the next 6 months. Discuss three sources of financing for the company to raise money. (Word limit: 200 words.) [4 marks]

Question 4

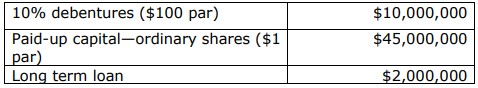

a) The below information is extracted from ABC Shipping Asia Ltds balance sheet

Additional information:

The ordinary shares are currently traded at $5.00 per share.

The beta coefficient of ABC Shipping Asia Ltd is 2.

The risk free rate (a 10-year government bond) in the market is 5%.

The average historical market return for the past 10 years is 11%.

Its debentures are priced at $102.

The interest rate for the long term loan is 7%.

The current return (i.e. market yield) on the companys debentures is 8% .

Company tax is 30%.

The existing capital structure is unlikely to change.

Calculate the Weighted Average Cost of Capital (WACC) of the company.

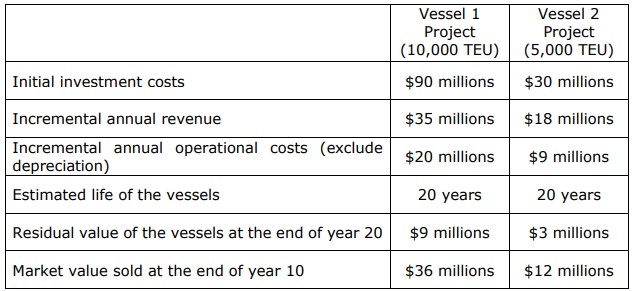

b) ABC Shipping Asia Ltd is planning to add one new container vessel to its operation for 10 years. Two container vessels with various capacities are considered. Both vessels are expected to have equal lives of 20 years. The capital cost of each new vessel can be depreciated using the straight-line depreciation method. The below table shows estimated projected sales and costs for each Vessel Project and the residual value of each vessel at the end of year 20. The vessel will be sold at the end of year 10 and the expected

market value of each vessel for sale is also given in the table. The company tax rate is 30%.

The required rate of return used for evaluating the projects is the companys WACC from part a.

i) Using a table in Word or an Excel spreadsheet, set up the cash flows for each option.

ii) Calculate the payback period of each Vessel Project. The company has a maximum acceptable payback period of 5 years. Which Vessel Project should the company accept based on the payback period?

iii) Calculate the Net Present Value (NPV) of each Vessel Project.

iv) Calculate the Internal Return Rate (IRR) of each Vessel Project. You can use the formula function in Excel to get the IRR but need to show the process.

v) Which Vessel Project should ABC Shipping choose based on your answers in part ii, iii and iv? Justify your answer. [4+(8+2+2+1+1) =18 marks]

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank