Personal Investment Strategies and Economic Analysis FIN2035

- Subject Code :

FIN2035

Task 1: summary of the economic environment

Introduction:

The ensuing overview of the nature of investing is predicated on the idea that understanding the state of the economy is essential to making wise financial decisions. This synopsis addresses the international and domestic elements that impact Karl and Rui's investment, namely the economy of New Zealand.

New Zealand Economic Trend: Rising Interest Rates

Context:

The RBNZ, New Zealand's central bank, has been raising interest rates over the last year in an effort to control inflation. The official cash rate has been raised to 5% till June 2024. This is an attempt to make sure that the yearly inflation rate of the bank, which is between 1% and 3%, is not exceeded. Even if inflation has been gradually declining, interest rates are still high, which raises the cost of capital and might have an impact on investment.

Impact on Investments:

1.Fixed Income Investments (Bonds): A decrease in bond prices often results in a rise in interest rates. If they both possess bonds, yields may rise and the price of these bonds may decrease. This implies that the price of bonds might decrease owing to changes in interest rates, and they could suffer a loss if they have to sell their bonds before they mature.

2.Mortgage Costs: Karl and Rui's borrowing costs will only go up if they have or plan to have a mortgage, which will directly affect their disposable income and rate of savings. Increased mortgage rates resulting from commercial buildings may limit their options for making investments in other industries. Moreover, rising rates of inflation may make homes unaffordable, leading to greater monthly payments and lower returns on real estate investments.

3.Consumer Spending and Equity Markets: These two factors have the ability to reduce consumer spending, which would hinder stock market success. Organizations focused on retail and consumers may face a fall in earnings, which might negatively impact their stock price. Karl and Rui should exercise caution when making investments in these fields because the state of the economy might affect the rewards.

Reference: New Zealand central bank raises interest rates to tackle inflation - The New Zealand Herald, June 2024

International Economic Trend: Global Supply Chain Disruptions

Context:

This is especially true of the interruptions to the global supply chain caused by the conflict between Russia and Ukraine, which have resulted in high raw material costs, delivery delays, and shortages because of COVID-19 limitations. These difficulties have been felt in a variety of industries, including manufacturing and consumer goods, which has caused the global economy to become unstable.

Impact on Investments:

1.Equity Markets: Industries like manufacturing and technology that rely on foreign markets for their supply chains will have to deal with increased expenses and delayed delivery, which might reduce their profit margins and affect stock prices. Karl and Rui believe that these industries could be a little risky since a disruption in the supply chain could result in a low return.

2.Inflation: Since supply chain interruptions create inflation in several nations, this has been seen and discussed. Inflation has the potential to negatively impact economic development and investment returns, hence elevating market risks. The fluctuations in value of Karl and Rui's investments might be a result of these worldwide economic issues.

3.Diversification: Karl and Rui ought to advise diversifying their assets by industry or geography in order to avert such a tragedy. Diversification is a useful tool for reducing risk and preserving portfolio quality, particularly in an era of global economic uncertainty.

Reference: How COVID-19 impacted supply chains and what comes next - EY New Zealand

Broader Discussion:

Borrowing for real estate investment projects may become more affordable with decreased inflation and interest rates. Even though borrowers now pay greater fees for loans due to rising interest rates, term deposits and savings account returns are also higher. Disruptions to the global supply chain, however, lead to unstable markets and, consequently, unstable returns on investments. Karl and Rui are particularly concerned about these variables in their investing activities; in order to address these difficulties successfully, they will need to avoid concentrating their capital into a small number of stocks.

Conclusion:

In sum, interest rates in New Zealand have been rising, and interruptions in the global supply chain present both possibilities and risks for investors. Karl and Rui should thus keep an eye on these developments and evaluate any potential impact on different asset classes and investing strategies. It becomes quite easy for the companies to make prudent judgements and maybe achieve the company's economic objectives in the middle of these economic risks through strategies like risk diversification and ongoing monitoring of the economic conditions.

TASK 2: EXPLANATION OF TERMS

Conclusion:

As these investment concepts shape the financial world, the writers are in a position to make the right decisions base on there investment needs, wants and deftness of taking risks. Every of the options has benefits and drawbacks concerning their investment plan and effects.

TASK 3: INCORPORATING NON-FINANCIAL FACTORS IN INVESTING:

Introduction:

Today, people like Karl and Rui, who want to invest their money in companies that consider the environment, care much for ECS analysis. Specifically, the three methods presented in this section of the paper: ESG integration, theme investing and grenade exclusion will help them integrate environmental information into their investment process. Thus, using these strategies, they can identify potential advantages and/or control for risks as well as harmonize beliefs with the investing portfolio.

1. ESG Integration:

Integration of ESG factors means that along with typical financial constraints there has to be considered an environmental aspect when performing an investment analysis. This strategy considers how such risks pollution, resource depletion, climate change, and the like may affect the companys finances (Eccles et al., 2017).

Benefits:

1.Risk Management: regulating and administering external risks which may affect return on investment.

2.Performance Insight: offers a snapshot of how viable an organization is likely to be in the future as far as making profits is concerned.

3.Positive Impact: Promotes the corporate organizations to undertake environmentally sensitive policies and practices.

Drawbacks:

1.Complexity: Because ESG aspects are incorporated in the research, it entails more information and work to undertake.

2.Inconsistent Measurements: This is because there is a problem of want equal in the reporting of ESG data, making the evaluation also unequal.

Example: Raise the energy efficiency and estimate the level of carbon leakage before investing in the aggressive climate change goals.

2. Themed Investing:

Investing with a theme is also more precise and concerns particular challenges of the environment, to include water, energy, and food. This tact is refined to those activities or those corporate or sectors which try to solve environmental problems.

Benefits:

1.Growth Potential: Some of the businesses that are expected to grow include; IT, renewable energy, among others that can improve the returns.

2.Impactful Investment: Funds concepts and ventures that are green and socially responsible.

3.Diversification: Helps bring new ideas and markets to an organization to conduct business with.

Drawbacks:

1.Sector Concentration: Specialization is thus the downside of investing in a certain area of competence.

2.Market Dependency:The extent that the chosen subject rises will be the benchmark for the success.

Example: Purchasing an index fund that focuses on the stakes in companies that are into generation of green energy

3. Negative Screening:

It is applied to drop out the negative economy or business types, for instance, oil and gas or companies involving themselves in deforestation.

Benefits:

1.Alignment with Ethics: Ensure that the investor has chosen an investment type that reflects their bend towards the subject of ethics and the environment.

2.Risk Avoidance: Shunning business activities that have the capability to harm the environment in the long run.

3.Reputation Benefits: Reduces the chance of being associated with legal malpractice.

Drawbacks:

1.Limited Options: Having a smaller number of possibilities could be a disadvantage of limiting the number of possible investments.

2.Potentially Reduced Returns: The move may also have a detrimental effect to eliminate some highly profitable businesses which have badly polluted the environment from the mix.

Example: All its investment operations have to avoid supporting companies or projects involved in the production of fossil fuels or organizations that engage in large-scale deforestation.

4. Positive Screening:

Another strategy used alongside negative screening is the positive screening, that is the identification of businesses with good environmental standards (Humphrey & Lee, 2011). Hence, positive screening entails identifying and endeavoring to stake in industries champions that are excellent in environmental management and sustainability in different sectors.

Benefits:

1.Promotes Best Practices: Thus, it exerts pressure on organizations to slowly shift the environment to lure investors into investing.

2.Supports Innovation: Encourages projects in the nascent fields of clean technology, green goods, resource efficiency, and renewable energy.

3.Potential for Strong Returns: Businesses who can show that they are doing a better job of protecting the environment may also be able to grow sustainably in the long run.

Drawbacks:

1.Limited Universe: It's possible that fewer companies will meet strict environmental compliance requirements.

2.Research Intensive: Must be closely examined in order to ascertain which leaders are long-term.

Example: Purchasing stock in companies that have been acclaimed for their superiority in the production of sustainable agriculture or renewable energy.

Conclusion:

The use of environmental factors in investment decisions enables Karl and Rui to invest responsibly in the assets that they support while locking horned between risk and return. By means of ESG integration, themed investing, negative screening, and positive screening, they will be able to make good and sustainable investment decisions. Besides, sustainable investment not only contributes towards the protection of the ecological environment of the companies in which it invests, but also pursues the objective of developing a sustainable economy in general. This strategy does not only focus on financial profitability, on the contrary, it includes utilization of sustainable practices and clean energy initiation.

TASK 4: PRODUCT RECOMMENDATION

Introduction:

Karl and Rui's investment decisions should thus consider the level of risk they are ready to take, the quantity of money they want to spend, and the time horizon for which they want to make the investment. This financial advice is unique to the customer and is based on diversification, which maximizes returns while lowering risks. Karl and Rui want to save money for a house or just for retirement, as well as a quick trip to China. This is a list of recommended goods and methods for achieving each of the stated objectives.

Short-Term Goal: Vacation to China

Goal: Save $20,000 for a vacation to China within 12 months.

Recommendation:

Product: High-Interest Savings Account

Rationale: In the near term, minimal risk, convenient accessibility, and interest combine to provide the greatest possible combination with a high-interest savings account. The suggested strategy works well in the near run since Karl and Rui can accomplish their objectives without jeopardizing their money in the stock market.

Implementation: Move the $20,000 to a higher-interest account, and create a methodical investing plan to make sure you obtain the most return on your investment.

Medium-Term Goal: Property Deposit

Goal: Save $200,000 for a property deposit within 3-5 years.

Recommendation:

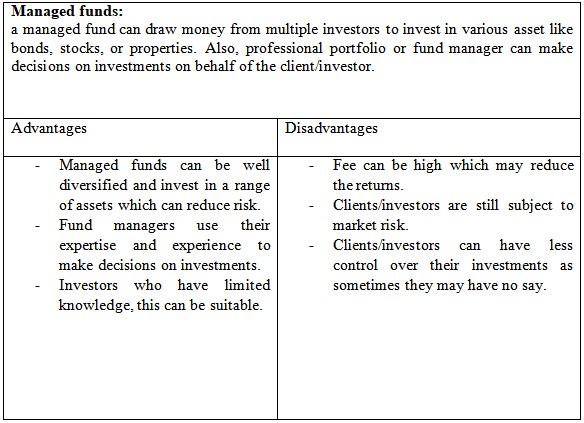

Product: Balanced Managed Fund

Rationale: Regarding intermediate-term objectives, it is noteworthy that managed funds offer diversification across various investment classes. Bonds and equities can be invested in a balanced managed fund that offers both the chance to avoid the biggest risks and the opportunity for growth. Because of the short to medium time horizon of three to five years, this technique significantly reduces market swings.

Implementation: Invest $200,000 in a managed fund that is balanced: The $200,000 can be divided, depending on the objective, into $100,000 for retirement planning and $100,000 for the purpose of owning real estate. The money for the property deposit can also be increased by making additional, regular installments of $1,000 USD every month.

Long-Term Goal: Comfortable Retirement

Goal: Secure $52,000 annually in retirement income.

Recommendation:

Product: Growth KiwiSaver Fund

Rationale: Karl and Rui should strive for steady, long-term progress because they are still very young. This is so because the Kiwisaver fund, a growth KiwiSaver fund, makes investments in high-risk, high-return projects because it anticipates higher returns down the road. Karl needs KiwiSaver, particularly given his youth, and he should begin contributing right away to maximize the benefits of compound interest.

Implementation: Karl and Rui should each set aside a minimum of 3% of their salary to invest in a KiwiSaver fund with a growth objective. If able to do so, they ought to think about increasing the payments to 4% in order to improve retirement savings.

Implementation Strategy:

Dollar Cost Averaging (DCA):The impact of volatility may be reduced by making regular, affordable deposits into KiwiSaver accounts and managed funds, which average out the costs.

ESG Considerations: Investing in a firm and assets that will produce sustainable profits for Karl and Rui's portfolio over time, together with favorable social and governance outcomes, is known as integrated ESG investing. The suggestion is to use KiwiSaver and ESG managed funds as they promote sustainable and ethical investing.

Ongoing Monitoring and Review: This implies that if market conditions and individual circumstances change over time, the portfolio will eventually need to be evaluated and reorganized to make sure Karl and Rui remain on track and accomplish their goals. Reaching the goal may occasionally need shifting investments based on assets and increasing approach.

Conclusion:

It is advised that they invest in growth KiwiSaver funds, balanced managed funds, and high-interest savings accounts in order to address current issues and make future plans. By completing evaluations, incorporating ESG variables, and calculating dollar cost averaging, they may attain the greatest results when looking at things from a long-term viewpoint. They ensure that their investments are positioned to provide the necessary rates of return and meet their financial objectives in this way.

TASK 5: PROVIDER COMPARISON AND RECOMMENDATION:

Introduction:

Karl and Rui must choose the business that best fits their demands, which are focused on the New Zealand market. This comparison examines the offerings, fees, performance, client happiness, sustainability/ESG, and performance of two significant New Zealand investing firms: Milford Asset Management and Kiwi Wealth.

Short-Term Goal: $20,000 for a Trip to China

Karl and Rui plan to save $20,000 for a trip to China within the next 12 months. Given the short-term nature of this goal, liquidity and low risk are critical.

Provider Comparison:

1.ANZ - Serious Saver Account

Interest Rate: 4.50%

Fees: No monthly account or deposit fees

Withdrawal Penalty: One free withdrawal per month, $5 for additional withdrawals

Risk: Low

2.Heartland - Direct Call Account

Interest Rate: 4.60%

Fees: No monthly account or deposit fees

Withdrawal Penalty: No penalties, unlimited withdrawals

Risk: Low

Recommendation: Heartland's Direct Call account is recommended because it offers a somewhat higher interest rate and allows for unlimited withdrawals without incurring fees. For Karl and Rui, this makes it the better option in terms of their immediate financial needs.

Medium-Term Goal: $200,000 for a Home Deposit in 3-5 Years

Karl plans to contribute $200,000 towards a down payment on a house within the next three to five years. Given the medium-term view, a moderate involvementbut only with managed fundsis advised.

Provider/Fund Comparison:

1.Fisher Funds (FisherFunds, 2024)- Income Fund

Annual Returns (5 Years): 2%

Fees: 0.96% of total investment annually

Suggested Timeframe: 4 years

Asset Allocation: 35% NZ Fixed Interest, 65% International Fixed Interest

Risk: Low to Medium

ESG Focus: Prioritized

2.Milford - Conservative Fund

Annual Returns (5 Years): 7.18%

Fees: 1.05% of total investment annually

Suggested Timeframe: 3-5 years

Asset Allocation: 18% Growth Assets, 82% Income Assets

Risk: Medium

ESG Focus: Prioritized

Recommendation: It is recommended to invest in the Conservative Fund of Milford rather than the FTSE Mia since it has a more diversified company list and greater historical performance (Milford Assets, 2022). Karl and Rui's opinions align with a more intense integration of ESG. Their investing horizon of three to five years makes the medium risk level ideal for them as well.

Long-Term Goal: Retirement Income of $52,000 Annually

Karl and Rui have decided that they want to save $52,000 a year for their retirement. Since this is a long-term investment, it is best to put money into a growth-oriented KiwiSaver fund.

Provider/Fund Comparison:

1.Fisher Funds - Growth Fund

Annual Returns (5 Years): 7.1%

Fees: 1.02%

Asset Allocation: 81% Growth Assets, 19% Income Assets

Risk: Medium to High

ESG Focus: Integrated

2.Milford - Active Growth Fund

Annual Returns (5 Years): 11.72%

Fees: 1.05%

Asset Allocation: 78% Growth Assets, 22% Income Assets

Risk: Medium to High

ESG Focus: Integrated

Recommendation: The selection of the Milford Active Growth Fund is based on its superior past performance as well as its implementation of good ESG practices. This fund, with its strong growth returns, is better for Karl and Rui's retirement income creation because they are long-term investors.

Conclusion:

In light of Karl and Rui's financial objectives, the following goods are suggested:In light of Karl and Rui's financial objectives, the following are suggested:

Short-Term Goal: Heartland Direct Call account for the $20,000 China trip.

Medium-Term Goal: Milford Conservative Fund for the $200,000 home deposit.

Long-Term Goal: Milford Active Growth Fund for their retirement income.

In this approach, Karl and Rui can both optimise their returns while taking their tolerance for risk and the environmental, social, and governance considerations into account. They will be able to get closer to reaching their financial objectives with the discussions and plan modifications.

TASK 6: GOALS ANALYSIS:

Introduction:

Based on the historical returns or current interests provided by the providers of the selected financial tools, this analysis aims to examine the financial plans that Karl and Rui can come up with towards the realization of the short-term, medium-term and long-term financial objectives. Karl has $8,000 invested in a Sharesies portfolio now, which can remain invested if desired.

Goals Overview

1.Short-Term Goal: Saving for a trip to China.

2.Medium-Term Goal: Saving for a house deposit.

3.Long-Term Goal: Saving for retirement.

4.Short-Term Goal: Saving for a Trip to China

Goal: Save $20,000 in 12 months.

Contributions: $500 fortnightly into a Heartland Savings Account with an interest rate of 4.60%.

Total Savings After 12 Months:

Fortnightly Contribution: $500

Total Amount: $26,261

Interest Earned: $261

Conclusion: It will therefore be very simple for Karl and Rui to meet their short term financial target of saving $ 20, 000 for a trip to China in the forthcoming year. They are to contribute $500 on a fortnightly basis, or $1500 per month, and in one year, they will have $26,261 to contribute, which is well in excess of the figure targeted.

2. Medium-Term Goal: Saving for a House

Goal: Accumulate $208,384 for a house deposit in 5 years.

Initial Funds: The initial capital includes $100,000 from inheritance and $20,000 from previous savings giving a total capital of $120 000.

Estimated Growth: After 5 years, this amount is expected to amount to $208 384. This calculation cannot take into account inflation, whilst it is useful for planning for the long term the real costs can be higher.

Conclusion: Taking from the aforementioned budget factors, Karl and Rui can confidently meet their medium term financial goal of saving for a house deposit. With the help of specific accurate assessment of the value of savings to be accrued in future, one is in a position to plan adequately. To ensure they stay on track periodic revision and updating to reflect factors such as inflation will be done.

3. Long-Term Goal: Saving for Retirement

Goal: Karl wants to retire at 60 so he will retire five years earlier than the New Zealand Superannuation age.

Investment Strategy:

Karl: Invests in the managed fund with $100,000 from the inheritance fund with moderate risk profile.

Projected Returns: Learning from the historic data of Milford Balanced Fund, the investment by Karl can reach about $ 2779252 within 30 years.

Rui: Has $38,000 in KiwiSaver and currently pays 3% of her $68,000 ($2,040) per annum. Her KiwiSaver is expected to accumulate to a total of almost $299,246 by the age of 65.

Retirement Income:

Before Age 65: Before Age 65 Karl will necessarily use the managed fund for income. The amount of $2,742,178 projected from the managed fund will be available to meet this need in this period.

Post Age 65: After reaching the age of 65, Karl will be attending KiwiSaver and New Zealand Superannuation. Ruis KiwiSaver will accrue around $299,246 into the retirement pool for him and his family.

Altogether, they will have superannuation of $1,003 each week or $52,156 per annum.

Conclusion: They can comfortably retire with all their financial needs for their golden age catered for. KiwiSaver and New Zealand Superannuation will not be available until retirement and so people will have to depend on their investments to provide them with the income. They also can check their portfolio over time and rebalance their portfolios to make certain that they will be financially set when they retire (MacDonald et al., 2013).

Final Conclusion

From the above Karl and Ruis financial plan, it can be seen that they are able to meet their short term, medium term and long term financial objectives using the selected providers. With regular evaluation and alterations, they will be able to meet the set financial goals and be financially secure during their retirement (Wilson et al. , 2020).

SECTION B: TIME VALUE OF MONEY

TASK 7 FUTURE VALUE AND RETIREMENT ADVICE:

Karls goal is to build an amount of $100,000 for retirement. He intends to retire at 60 but KiwiSaver and New Zealand super (NZ super) can only be claimed at 65. Hence the need for Karl to develop a way of meeting all his income needs as he turns 60-65 up to the retirement period, and ensure that he sustains his income during retirement.

Future Value Calculation

Parameters:

Initial Investment (PV): $100,000

Annual Interest Rate: 7.18%

Number of Years: 30

Using the provided parameters, the future value of Karl's investment by age 60 is approximately $2,779,252. This assumes a consistent annual return of 7.18%.

Retirement Income Needs and Planning

Income Goals: Karl and Rui are planning for retirement and they want their post retirement income to be $52,000 per year. NZ Super for a couple is about $35,000 annual for a couple but it starts at age 65 only. This money shall therefore be invested in a managed fund and between the age of 60 and 65; Karl and Rui shall be solely dependent on it.

Income from Managed Fund: As Karl will be allowed to withdraw from his managed fund, to meet their income needs up to 5 years before he will be allowed to draw from KiwiSaver and NZ Super when he reaches 65 years of age. If Karl were to go by a safe withdrawal rate of 4%, then the amount that he could withdraw stands at $111,170.8 per year from a $2,779,252 managed fund. This sum definitely covers and then goes beyond the required supplementary $17,000 per annum when the future NZ super income is taken into account.

Implications and Considerations

1.From Age 60 to 65:

Managed Fund Withdrawal: Karl can get funds from the managed fund in case of need to cater for other living necessities. Given the estimated fund size, it still means that the stated withdrawals are feasible and that they will be able to make do with the income they have before they retire at the age of 65.

2.From Age 65 to 90:

NZ Super and KiwiSaver: At the age of 65, Karl and Rui will be receiving NZ Super of $35,000 per year, apart from the money they will be getting from the managed fund they will be invested in as well as Ruis KiwiSaver.

Longevity of Funds: Karl might wish to use some of his years between 65 and 90 and therefore must decide the withdrawal rate based on their needs and return on investment. The withdrawal rate used in this strategy is at 4%, which is regarded as safe, but one that should be reviewed in regular intervals to reflect changes in inflation and the clients chosen quality of life.

Additional Advice

1.Increase Contributions: Thus, Karl and Rui should contribute more to their managed fund and KiwiSaver for increasing the potential of closing the gaps in their retirement income.

2.Diversify Investments: This way, any likely losses within the portfolio will be well-diversified hence minimize the risk, and at the same time come up with better potential returns especially towards their retirement age.

3.Monitor Inflation: For Karl and Rui, inflation poses a risk in that the value of their savings may decline hence they need to focus on seeing that investment realizes profits that are higher than inflation rates in order to maintain their lifestyle.

4.Review and Adjust Regularly: Monitoring and some changes in their retirement plans, contribution amount or withdrawal frequency will be essential for their financial stability in those years.

Conclusion

While Karl's current investment plan will grow significantly by the time he reaches 60, it's crucial to consider the period between ages 60 and 65, when NZ Super and KiwiSaver are not yet accessible. The managed fund should provide sufficient income during this period, but Karl and Rui should increase contributions and diversify their portfolio to ensure their long-term retirement goals are met. Proactive financial planning and regular adjustments will help them achieve a comfortable and secure retirement (MacDonald et al., 2013).

TASK 8 OPTION COMPARISON:

Karl and Rui have the option to receive half of their inheritance either as a lump sum of $100,000 or as an annuity paying $5,700 per year over 30 years, with the annuity reinvested at a 4% real return rate. This analysis compares the future value of both options to provide a recommendation.

Calculations

1. Future Value of Lump Sum

Initial Investment: $100,000

Annual Interest Rate: 4%

Number of Years: 30

The future value of the lump sum investment, assuming it is compounded annually at a 4% interest rate over 30 years, is approximately $324,339.

2. Future Value of Annuity

Annual Payment: $5,700

Interest Rate: 4%

Number of Years: 30

Payment Timing: Start of each year

When calculating the future value of the annuity, its essential to account for the payments being made at the start of each year, which increases the future value slightly compared to an end-of-year payment structure.

Considering these parameters, the prospective value of the annuity payments, reinvested over 3 decades at an interest rate of 4%, amounts to roughly $319,684.15.

Recommendation

Lump Sum vs. Annuity:

Lump Sum Future Value: $324,339

Annuity Future Value: $319,684

Conclusion

Karl and Rui need to think of picking the Lump sum option. When accurately calculated, considering the endorsements made every new year, the prospective value of the lump sum (324,339) slightly exceeds the future value of the annuity($319,684). While the annuity option has its own advantages the lump sum offers immediate access and greater flexibility for unexpected costs or other ventures (Mayhew et al., 2019).

TASK 9 OPTION ANALYSIS:

Karl and Rui are considering two options for using their $200,000 inheritance: either buying a house now (Scenario A) or saving the entire amount for retirement (Scenario B). The analysis evaluates the financial implications of each option, considering Karl and Rui's plan to retire at age 60.

Scenario A: Using the $200,000 Inheritance to Buy a House Now

Future Value at Retirement: $0

Retirement Implications: If Karl and Rui use the inheritance to buy a house, the $200,000 will not be available to grow for retirement. They will have a home but will need to save separately for their retirement needs.

Scenario B: Saving the $200,000 Inheritance for Retirement

Annual Interest Rate: 4%

Number of Years: 30

Future Value at Age 60: $648,679.50

If Karl and Rui save the entire $200,000 inheritance and invest it at an assumed 4% annual return for 30 years, the future value at age 60 will be approximately $648,679.50.

Scenario B: Funds Available at Age 65

If Karl and Rui retire at age 60, they will need to consider how much of the $648,679.50 will remain by the time they reach age 65, when they can start accessing NZ Super and their KiwiSaver accounts.

Withdrawals from Age 60 to 65:

Assume a withdrawal rate of 4% per year to cover living expenses during these five years.

Annual withdrawal: $25,947.18

Remaining Balance at Age 65:

After five years of withdrawals and assuming the remaining balance continues to grow at 4%, the estimated remaining balance at age 65 would be approximately $548,174.

Retirement Income Sources from Age 65 Onward:

1.NZ Super: For this purpose Karl and Rui will be in a position to receive around $35000 of the year in a combined fashion from the NZ Super.

2.KiwiSaver: KiwiSaver which Rui has and any extra contributions made by Karl for instance, would give further retirement income.

Comparison and Considerations:

Scenario A:

Pros: Home ownership on the onset which can be more stable and potentially experience an increase in value.

Cons: Lack of increase in the $200,000 inheritance for retirement, therefore needing to save for retirement in another account.

Scenario B:

Pros: Significant growth of the $200,000 inheritance, resulting in approximately $648,679.50 by age 60. This amount would support withdrawals from age 60 to 65, with a remaining balance of about $548,174 at age 65 to supplement NZ Super and KiwiSaver.

Cons: Is a rigid method of financing the purchase of a home since it lacks the other forms of financing that can be used to purchase a home.

Other Factors to Consider:

Housing Market Conditions: Potential gain or loss on the home one acquires now.

Interest Rates and Mortgage Terms: Effect on the price range in case they opt to take a mortgage for the house.

Inflation: Consider the consequences on the cost of home and the purchasing power of retirement funds.

Liquidity Needs: Having money which in one way or another can easily be made available in a situation that requires one to spend.

Conclusion:

If Karl and Rui decide to utilize the inheritance to acquire a home at the present moment, they are guaranteed home owners yet future retirement assets are lost. Saving the whole of inheritance for retirement is likely to grow to a huge amount to support the retirement period, though it means another way of financing the purchase of a home. They need to make a wise decision by seriously taking into account the wish of becoming a retiree at 60, financial and lifespan goals, type of housing that is desired, inflation and other prevailing market factors.

TASK 10: ONGOING ANALYSIS

This is normally the case for clients who seek to know their investments performance, not only in varying economic circumstances but in specifically volatile situations. These drawbacks are well understandable and reporting the clients on a regular basis and detail also help to mitigate these concerns and make the clients aware about the different scenarios prevailing the portfolio. Below are three scenarios, along with their implications for investments and how these would be communicated in a quarterly update.

SCENARIO A: The Reserve Bank Cuts the OCR by 50 Basis Points

Impact on Investments:

Interest Rates: Lower interest rates reduce borrowing costs, which can stimulate economic growth. This may also help sanction borrowing and investment by the firms thereby increasing corporate profits.

Equities: For stock markets, especially in emerging markets, more often than not as cheap credit enables companies to pursue more investments, hence achieving higher profit margins and stock returns.

Bonds: These high coupon bonds are more valuable than the newly issued lower yielding bonds because clients preferred to stick with earlier bonds that have higher returns. Nevertheless, the yield of new bonds is lower and future income by bond investors may decline.

Real Estate: Reduced mortgage rates can improve real estate investments since costs of financing are cheap for users and investors.

Quarterly Update:

Economic Outlook: To this, I would give an overview of the decision made by the Reserve Bank of cutting the OCR including reasons including attempts at boosting economic activity, or tackling inflationary trends. This section would encompass a discussion of how lower interest rates will be expected to affect economic activity.

Portfolio Performance: As a pro, I will emphasize the role of relatively low interest rates to the equity markets focusing on sectors with high sensitivity to credit enlargement. The effect on the number of bonds would also be explained; focusing on the increase of the value of the current bond portfolio and the ability to generate less income from newly purchased bonds in the future.

Future Expectations: In respect of the overall portfolio, I would be able to predict future expectations in light of the current scenario of the economy. It might also address possible further development in the equity markets, and how the portfolio is situated to benefit from them.

SCENARIO B: Firm XYZ, a Large and Well-Known Constituent of the S&P 500, Files for Bankruptcy

Impact on Investments:

Equities: The onset of a big firm in bankruptcy is likely to put an impact on the stock prices especially within sectors and indexes connected with it. The S&P 500 could fall and thus result in an erosion of investors confidence, consequently instability in other markets.

Sentiment: The bankruptcy could lead to increased fluctuations in the market, and more importantly more investors risk will be developed if the company was perceived to be a good performing firm.

Specific Holdings: If the portfolio has stocks in Firm XYZ or related sector ETF, these assets may yield direct loss.

Quarterly Update:

Event Overview: I shall highlight reasons for the bankruptcy of Firm XYZ owing to poor management, high level of debt or due to the unfavorable dynamics in the industry. This section, for instance, would also describe how the impact of the analyzed news item filters across the market in terms of related sectors, or the index if the news item concerned a firm listed in the index.

Portfolio Exposure: I would paint the picture in terms of the quantum of business done with Firm XYZ or the sector that has been impacted and levels of loss made known to the public. If the exposure is restricted, I would want to stress that diversification helps in lessening its effect on the rest of the portfolio.

Risk Management and Reallocation: I would detail any action that has been made or proposed to shift funds in a more stable investment avenue. This may include moving your investment to areas which the bankruptcy does not have much impact or to other better Companies.

SCENARIO C: The Market Declines 10% in the Past Quarter

Impact on Investments:

Equities: It primarily contains a reduction of most of the equity investments, thus lowering the portfolio values. This could be due to factors like economic volatility, operations of international relations, or in views from the market.

Bonds: The effects may be borne on the bonds, they may reduce or dilute it. Government bonds, or safe-haven bonds, for example, could rise in price, while non-government bonds may fall.

Investor Sentiment: A downturn in the market implies that investors feelings are created and it can lead to the sale of other stocks creating more down turns.

Quarterly Update:

Market Context: In this case, I will explain the factors that led to the market decline whether it is economic conditions, political conditions, or a change in the investors attitude. This context serves the purpose of helping the clients to appreciate and accept the cycle of changes in the markets as they engage in investing.

Portfolio Performance: In the first meeting, I would give a portfolio overview and analytically explain impacts of the fall in market. This section would also look at how diversification helps in avoiding or reducing losses.

Risk Management and Rebalancing: Regarding the possibilities of risk mitigation, for example in the operational management I am speaking about diversification and asset allocation. Further, I would enlighten the clients on any portfolio adjustment that was made to place it on a recovery mode, in relation to the clients long term investment objectives.

Encouragement to Maintain Perspective: The long-term view is another recommendation I would give clients; usually, markets come down and then go up. This section would urge them to the core strategy less emotional and panic decisions fueled by short-term market volatility.

Conclusion

Continual updates and reviews of investment is important in the preparation of the necessary reports on how the occurrence of economic events affect its clients portfolio. From my viewpoint, explanatory evaluations, concise analysis of performance, identification of risks and their management make the clients more reliable in the frameworks of their investments. Such constant communication is important in nurturing the trust of the clients and to make sure that they are on track with their financial planning.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank