Sustainable Finance and Green Investment Strategies FIN306

- Subject Code :

FIN306

Final Business Plan:

Greener Gains Ltd.

Masters in finance

Promoter: Raya Drenski

Word Count: 12737 words

Executive Summary

Greener Gains is a firm that seeks to make tailor-made investment solutions that consider ESG factors for the users. We aim to offer investors environment-friendly portfolios with minimum risk and good returns. The market for sustainable finance was valued at USD 5.4 trillion in 2023 and is expected to only grow further by 22% from 2024 to 2032 (Statista, 2023). However, there still lacks a platform which primarily focuses on green investment. This provided Greener Gains an opportunity to make a breakthrough in this Industry. Greener Gains offers Investors a unique, easy-to-use platform that primarily focuses on green investment solutions. To position itself in the competitive market of the UK, Greener Gains will promote its USP, i.e. expert sustainable financing solution, access to ESG investment opportunities and knowledge, and personalized consultation delivered conveniently through a single online platform. With a starting investment of 1,000,000 as a seed fund, the company is able to generate revenue of 1,576,000, which indicates that the investment is profitable. Its founders comprised financial specialists, sustainability experts and technology professionals who saw the need for a dedicated platform that could specifically address ecological investor concerns in London. The brand positioning statement of Greener Gains is to empower UK investors to make an impact on the planet and people by unlocking sustainable investment opportunities and gaining sustainable returns through seeking expert consultation.

Table of Contents

1.1.Presentation of the Entrepreneur/Promoter or Founding Team

1.3.Personal Characteristics of Our Founding Team

2.3.Job Creation Opportunities

3.1.Background of Business Plan

4.1.Definition of Product or Service

4.2.Describe the goods/services that your firm expects to provide and their usefulness.

4.4.Analysis of Sector/Industry

4.5.2.Potential Customer Profile

4.5.3.Potential Market size and Available Market Size-200

4.7.Customer Value Proposition

4.10.SMART Objectives for Marketing and Sales

5.2.5.Milestones and Alternative Pathways

5.2.6.Hypothetical Sales Forecast

5.3.Supply Policy and Storage Policy

6.1.Design the Structure of the Organization

6.3.Organize the different tasks to be carried out

6.4.Assign Responsibilities and Line of Command

6.5.Develop human resource planning

7.6.Legal Form and Constitution of the Company Permits License and Regulation

7.7.Obligations and Scope of Liability

7.9.Organism and Measures Providing Support for Creating Companies

Appendix 1: Implementation Schedule

Appendix 6: Details of the Market Survey

Appendix 7: Production Schedule

Appendix 8: Details of Technology

Appendix 9: Break Even Analysis Calculation

Appendix 11: Initial Investment Plan

Appendix 12: Projected Income Statement

Appendix 13: Projected Balance Sheet

Appendix 14: Link to References PPT and Link to Excel (Workings)

1.Introduction from the Entrepreneur/Promoter or Founding Team

1.1.Presentation of the Entrepreneur/Promoter or Founding Team

The plan of proposing the idea of Greener Gains was designed by diverse team members of vision-oriented entrepreneurs having a shared commitment to transforming the investment landscape. The team comprises experts with various backgrounds in sustainability, technology and finance. Their combined and diverse experience will be best suited for this plan to attain the gap between ethical, profit-driven investment and sustainable actions. The primary members who will be the founders of Greener Gains will bring their own skills and expertise for responsible investment.

The key founders of Greener Gains will be its former investors from the bank and myself, who have good experience in capital markets and asset management. After the founder's research, it was understood that there has been a rapid change in the contemporary financial aspects, including the shift from bond portfolios and traditional stocks to socially and holistic-oriented investments (Schoenmaker and Schramade, 2019). However, the founders will work on a platform that will align with the changing global concentration on sustainable efforts.

Another member of the founding team will be a software engineer who will have an in-depth understanding of artificial intelligence and data analytics. This founding team member will have a fruitful track record in the continuous development of the fintech platform that will help Greener Gains obtain valuable technological insights to grow. Also, the software engineer will focus on the utilization of big data and machine learning to assess environmental, social and governance aspects, which will ensure that the proposed platform will deliver data-driven and comprehensive investment-related advice to the customers/users.

As Greener Gains will work on changing an investment landscape, the third most important founding member will be a sustainability expert who will have significant experience in environmental policy and CSR policy designing. They will have experience with different multinational companies in the integration of ESG principles into corporate tactics and strategies. The role of this founder will be pivotal to assure that Greener Gains will stay smooth and connected with its mission of encouraging responsible investment and will make a significant effect on environmental and social upshots.

The diverse and influential mixture of teams, including sustainability experts, financial acumen and technical experts, will surely result in the great success of this plan. The founding members of this plan are driven by profitability and have a strong desire to create a significant and positive imprint on the environment and society. This good cause of this plan will be a critical success factor. An amalgamation of Greener Gains' diverse set of skills will make it unique from other investment platforms.

1.2.Primary Considerations

The vision of the founding team of Greener Gains is aligned around primary considerations that have shaped the goals and development of the platform in a unique manner.

The primary consideration will be an increase in the demand for ethical and sustainable investments. The founding team will consider the growing global interest of people and companies in sustainable and ethical investment. The research signifies that investors in this era are not only focused on attaining financial gains but also seek to imprint positive environmental and social effects (Hill, 2020). In addition, the study by the Global Sustainable Investment Alliance depicted that investment assets have reached 35.3 trillion dollars worldwide, and the trend was initially significantly implemented in Europe, where investors were highly concerned about the effect of investment on society and the environment (Apostolov, 2023). The Greener Gains vision will consider this by tapping into the rapidly growing demand for responsible investments.

Another primary consideration for the founders will be the need and implementation of accountability and transparency in ESG investment. Many investment platforms offer limited aspects of how ESG factors are amalgamated into the investment process, leaving investors confused about how their investment will make a difference. Our company, Greener Gains, will be different and provide comprehensive and precise data on ESG ratings and their effect on every investment being made. The use of AI and advanced analytics in our platform will support investors to make real time decisions on ESG Performance.

Another primary consideration of Greener Gains will focus on empowering and educating investors, specifically those who might be newbies to the concept of sustainable finance. The platform will be unique, featuring an excellent educational resources library with webinars, videos and articles that will help investors increase their literacy on socially responsible investment and ESG principles.

Technology will be the key consideration in bringing change. The founding team will mainly work on technology as the critical success factor; by the use of big data, machine learning and artificial intelligence, the platform Greener Gains would be capable of offering customized investment suggestions that will value the financial goals and risk tolerance of investors. The use of algorithms in the platform to evaluate ESG data will ensure that investment advice is relevant and accurate. Further, the platform will also offer unique tools that will help monitor the real-time effect of investment on different ESG metrics, which in turn will make the investment process engaging and interactive.

For our team of Greener Gains, sustainability will not just be a short-term and buzzword trend, but we will consider it as a long-term strategy for future investment. The team believes that companies prioritising ESG factors will be successful in the long term as they will be easily able to manage risks related to climatic change and issues related to governance.

1.3.Personal Characteristics of Our Founding Team

The personal characteristics of our founding team will play a significant role in the success and development of Greener Gains. The traits and values will reflect the mission and vision of the platform; thus, they will play a role as key drivers behind the commitment of the company to sustainable investment.

Our founding team will value integrity as they believe in working on the right things. The bottom line of our company is not only to work for society but for the whole planet. This is evident in their devotion to accountability and transparency in the investment process. The team is highly committed to providing investors with data-driven advice and transparent and honest perspectives on the ESG performance of investments. The integrity level of our team will build trust among users, which will be a USP of Greener Gains.

Our teams other primary trait will be sustainability. Our commitment to sustainable efforts is a significant trait which will underpin every prospect of Greener Gains. By selecting opportunities for investment in educational resource development, our team will ensure that sustainability will be the root of the operations of our platform.

The key traits of the founding team will also include adaptability and innovation, specifically when it comes to the utilization of technology. Our team will constantly explore new manners to integrate data analytics and AI into the process of investment, which will enable Greener Gains to become a new competitive platform. This personal trait will extend beyond technology to new investment developments such as ETFs and green bonds that will offer a wide array of options for investors to build up sustainable portfolios. Further, the team will be adaptable and will quickly respond to changes in the trends of the market.

Social responsibility and empathy will also be a significant trait of our founding team. This will help the platform to obtain profitable financial returns that will imprint a positive effect on society and the environment. Our team also understands that major investors are driven by not only profitability but also want to align with the companies aligned with CSR values. The trait of empathy for the investor's goal of extensive social good will reflect in the attainment of the mission of the platform.

Vision and leadership will be the foremost characteristics of our founding team. The team trait will be characterised by a clear vision and strong leadership. The team will not just react to the contemporary trend in ESG investment but will also proactively shape this industry's future. The Greener Gains vision is to design a platform that will not just be a financial tool but also a major drive that will empower investors to make a real difference in the environment. Through leadership, the team will successfully build a company with a combination of financial experts, and it will position the company as the leader in the responsible investing field.

By considering the growing demand for ethical investment, prioritization of transparency and growing awareness about ethical investment, our team will provide a platform that will be influential in the market. The personal characteristics of our team, including innovation, integrity, and a socially responsible attitude, will ensure that Greener Gains will continue to lead the way in making sustainable investments in future years.

2.Reasons why (personal interest, the desire to implement an idea of ones own, to create jobs)

The idea is to create Greener Gains, a sustainable investment solution that takes into consideration ESG factors. The business idea includes financial specialists and sustainability enthusiasts to address the ecological investment in London. The rationale for choosing this proposal is driven by personal interest, professional aspiration and employment opportunities.

2.1.Personal Interest

Personal interest includes specific individual attributes, values, skills, and aspirations that compel an individual to pay attention to particular events, ideas, objects, or processes. Personal interest can influence the business creation. It is supported by a study that business creation is a planned and intentional behaviour. The formation of such intentions is dependent on personal attitude. It is a voluntary and conscious choice to become an entrepreneur. However, personal interest reflects attitude, faith, and perception in the business creation journey (Vod? and Florea, 2019). Personal interest is determined by personality, formal education, personal values, and experiences. Personal interest and a positive attitude towards business can foster the desire of entrepreneurs to make the best of available opportunities, bring change in society and transcend ones vision. It is also justified that individuals in the early stage can seek personal development as part of their intrinsic motivation (Vo, Tuliao and Chen, 2022).

The personal factors linked to the idea of Greener Gains include passion towards the investment industry and sustainability. This passion is driven by my relevant hobbies and skills, personal values, and sustainable living practices. My personal interest towards sustainability has been a motivation for me to engage in different volunteer programs for sustainable community and living. My interest towards sustainability pushed me to gain knowledge from various sources, and I have attended conferences and webinars relevant to it. Seeking information made me curious to align sustainability goals in the investment sector as it is a neglected domain. The notion of sustainability is implemented in different sectors, mainly in corporate, but the financial industries still lack sustainability alignment in their operations. It is found that green financing is still an underdeveloped and struggling area. Moreover, there are also regulatory gaps and incentive-led challenges in green financing (Demekas, Dimitrios and Anne, 2019).

In addition, my personal interest is also influenced by my sustainable living style and sustainable practices in routine life. Being aware of the sustainability gaps in the current times and the increasing concern towards environmental harm, societal issues and personal interest have influenced my entrepreneurial intention towards the development of Greener Gains. My personal values are also inclined towards recycling, reusing, and minimizing waste to contribute to a better and cleaner future. It is supported by a study that entrepreneurial intentions serve as a mechanism for self-employment decisions for individuals holding humane-oriented personal values (Santos et al., 2021).

My interest towards sustainability and eco-friendliness has strongly shaped my perspective and personality attributes. It has also positively improved my dedication towards my career choice of becoming a green financing enthusiast, leading to the development of Greener Gains, as the name suggests, Greener Gains, indicating that investment towards the environment and society can lead to more significant gains in the long run.

2.2.Professional Aspiration

Professional aspiration is defined as long-term career goals and plans that shape their identity and future aspirations (Dudovitz et al., 2017). Professional aspirations are formed due to personal interests, professional goals, ambitions, experiences, and knowledge. It is revealed that professional aspirations can guide the career choices of individuals. The individuals can have a vision of what they want to be and set their goals accordingly by having a career aspiration. Furthermore, a career aspiration can also shape the skills of individuals and prepare them towards their future goals (Al-Bahrani et al., 2020).

My career aspiration in green finance is influenced by my degree, personal interest, and recognition of the market gap. Pursuing a master's in Finance has opened a gateway of knowledge and career opportunities for me. This degree has helped me understand different finance theories and introduced me to the concept of green financing. It has also polished my skills by providing practical exposure to financing concepts in a real-world setting. My research on finance grew with my Masters degree. Having heard different case studies and experiences, my professional goal towards green financing progressed.

Apart from the role of knowledge in shaping my professional aspiration, the market gap in sustainable finance also justifies my career choice as a green finance enthusiast. A report has supported the idea that there is a gap in green investment in the UK. To meet the 2050 net zero target, the country will need to plan and increase its low-carbon investment from 10 billion euros to 50 billion euros annually by 2030 (Walker, 2023). The Brexit situation further accelerated the green finance gap as prominent investment opportunities were lost due to failed negotiations across the borders (Tapper, 2018). It is also demonstrated in a report that the current conventional banking setup has transformed into green financing, recognizing the prevalence of green investment and financing opportunities (Rahman et al., 2022). Considering the market gap, I recognized a need to introduce Greener Gains, a sustainable financing solution in London.

The scope of green finance in the near future also fuelled my aspiration and led to the proposal of Greener Gains. The gap in the green investment market has created an awareness among the public and a call for action from the authorities. In London, LGF or London Green Fund was launched to improve the green infrastructure and regulations in the city (Greater London Authority, 2024). Another green finance fund is declared that will lend up to 500m to meet with the net zero waste objective in the city. Clean technologies are also introduced and experimented to further support the cause of sustainability. Green investment opportunities are being investigated, and support programmes are planned to improve the progress of green investment (Macfarlane, 2023). The support programmes and sensitivity of the sustainable financing concern among the public and authorities have positively inclined my interest towards Greener Gains.

2.3.Job Creation Opportunities

According to Martnez-Martnez ,(2022) the, entrepreneurial persistence is not relevant to the firm survival, but it is related to the personal attitude and benefits that the company brings in terms of employment options. In addition to the personal interest and professional aspiration, an essential factor that led to the discovery of Greener Gains is the employment opportunities that the project brings. Through the development of Greener Gains, employment opportunities can be created. Employment opportunities can serve as an important precursor to economic growth and community development. Several individuals can get employed through this business opportunity and make their livelihood.

Literature has also supported the idea that entrepreneurial ventures catalyse economic growth by developing jobs, creating employment opportunities, empowering income, and overcoming poverty (Adenutsi, 2023). However, it is also highlighted that entrepreneurial thinking should be promoted in an economy with the support of the government and relevant authorities to extend the job creation system. Another study has proposed that entrepreneurship ventures can increase individuals' access to economic opportunities by offering knowledge, human resources training, skills development, and capital access for business development. Through new businesses, jobs are created by forward and backward linkage (Sartono and Hemawan, 2023). It is further suggested that the long-term benefits of entrepreneurial setups include job creation and economic benefits. Job creation is directly linked to economic benefits as more people have access to employment opportunities and can lead a better lifestyle.

Statistics have revealed that the unemployment rate in London has increased and is higher than in the other cities of the UK. In 2023, the unemployment rate was found to be 3.7% (London Datastore, 2023). The employment gap increased after the pandemic as layoffs were done to stabilise the business losses during the lockdown. The recent financial crisis and economic fluctuations in the state have further fuelled the unemployment ratio. Another report has found that job opportunities in the financial sector of London have dropped to 40% as a result of inflation and market turbulence. In 2023, job availability in finance decreased by 38% compared to the previous year, and the number of job seekers also dropped to 16% (Reuters, 2024).

The statistics and current turbulences in the financial market of London indicate towards a need for job creation to stabilize the economy. Greener Gains can actively contribute to employment by opening job creation opportunities in London. Additionally, the startup can contribute to community development by improving the access of individuals to a better lifestyle through employment. The poverty rate can be decreased, and a prosperous, sustainable community can be created by increasing employment opportunities.

?

3.Business Identity and Objectives

3.1.Background of Business Plan

The idea of sustainable investment has become popular in the last decade due to the enhancement of consciousness of the global society about environmental and social problems. From this trend, Greener Gains have risen as firms seek to make investment solutions that take into consideration ESG factors. Its founders, comprising of financial specialists and sustainability enthusiasts, saw the lacuna of a dedicated platform that could specifically address ecological investor concerns in London. The firm was established in the year 2023, though it was intended to begin operation in 2025. While Greener Gains is in the pre-launch stage, the business analyses have been conducted, and the structure and the partnerships are under construction. The company operates at an early stage and has already received seed capital; at the same time, there are plans to finalize the technological platform. Marketing analysis and synthesis are also in progress; hence, the launch will be successful.

3.2.Firm Statement

The underlying vision of the Greener Gains is to revolutionize the idea of sustainable investments by addressing the increasing demand for ethical and sustainable opportunities, thereby ensuring the transparency factor in the ESG domain.

The mission of the proposed business idea is to cater to the growing ethical investment trend. Seeing the global shift towards green investments focusing on not only the monetary benefits, but also on the environmental and social impacts. Next, the business also has the mission to stay committed to transparency by empowering decision-making. The business plans aim to bring impactful change and, most importantly, meaningful change.

3.3.Mission and Objectives

The main aim of Greener Gains is to enable investors to get better earth-friendly portfolios which can give good returns. The objectives are as follows:

- To lay a ground which can be used to factor in the ESG element into the investment process.

- To accommodate investors who are not only interested in profits but also in making the right social investment.

- To develop a comprehensive list of sustainable investment opportunities.

3.4.Business plan strategy

The plan of proposing the idea of Greener Gains was designed by diverse team members of vision-oriented entrepreneurs having a shared commitment to transforming an investment landscape. The team is comprised of experts with various backgrounds in sustainability, technology, and finance. Their combined and diverse experience will be best suited for this plan to attain the gap between ethical, profit-driven investment and sustainable actions. The primary members, who will be the founder of Greener Gains, will bring their own skills and expertise to ensure responsible investment.

The key founder of Greener Gains will be itts former investor from the bank, who will have good experience in capital markets and asset management. After the research of the founder, it was found that there has been a rapid change in the contemporary financial aspects, including the shift from bond portfolios and traditional stocks to socially and holistic-oriented investments (Schoenmaker and Schramade, 2019). However, the founder will work on a platform that will align with the changing global concentration on sustainable efforts. The diverse and influential mixture of the teams, including sustainability experts, financial acumen and technical experts, will surely result in the great success of this plan. The founding members of this plan are not only driven by profitability but also have a strong desire to create a significant and positive imprint on the environment and society, and this good cause of this plan will be a critical success factor. An amalgamation of Greener Gains' diverse set of skills will make it unique from other investment platforms.

4.Marketing Plan

4.1.Definition of Product or Service

Greener Gains is set to be an online investment platform where, besides other services, investors will be able to buy mutual funds, ETFs and green bonds. Technology and software tools will also be applied to collect and analyze ESG information to recommend which investments to make. Also, there will be a section for educational materials to improve investors knowledge of SRI and sustainable finance (Marquit, 2020).

4.2.Describe the goods/services that your firm expects to provide and their usefulness.

Greener Gains expects to provide an online investment platform where dedicated sustainability and financial specialists and investors can offer investment solutions while considering ESG factors. Apart from consultation, the investors will also be provided with an opportunity to buy mutual funds, ETFs and green bonds. To create awareness of ESG investment, the platform will provide educational resources to improve the knowledge of investors and address their ecological concerns in investment. The service is helpful for investors across the UK as they will be able to recognize the need for sustainable investment and make informed decisions for sustainable investment (Cunha, Meira and Orsato, 2021). The service is also helpful as it has been linked to ESG principles in investment decisions. ESG investment decisions will allow the investors to comply with the environmental, social and governance standards and transition their investment decisions towards sustainability (Krussl, Oladiran and Denitsa Stefanova, 2023). The service is also valuable as it is convenient for the investors to consult ESG investment experts and gain knowledge of the ESG trends and investment plans within one platform.

4.3.PESTEL Analysis

Political:At the political level, the UK government has taken a very active approach in encouraging and supporting green finance, which is favourable for sustainable investment. The Green Finance Strategy was published in 2019 and acts as a policy to set directions for the countrys financial sector toward sustainable development goals (GOV.UK, 2024).

Economic:From an economic point of view, the state is in a phase of gradual growth, as the GDP has increased by 2. It was further projected to be 1% in 2023; however, it offers a stable environment for investment business activities (ONS, 2023). The steady increase in disposable income and asset accumulation of the people of the United Kingdom confirms the solid market prospect of Greener Gains.

Social:A new update shows that social dynamics are playing a big role in shaping investment. Climate change, social justice issues, and other socio-political factors are making investors embrace ESG factors to guide their investment decisions. Another survey conducted by YouGov in 2023 among UK investors showed that 68% focus on ESG factors, which proves the cultural shift in investing. This trend holds the potential for the concept of Greener Gains to extend a segment that is focused firmly on creating sustainable change (Yougov, 2024).

Technological:Development in technology is central to changing the structure of the investment management industry. Innovations such as the application of AI and blockchain support the platforms to deliver customized and clear investment products. These technologies improve end-user engagement, increase market coverage and strengthen investors confidence by providing reliable data on ESG compliance (Deloitte, 2023).

Environmental:The increase in sustainable investment is being stimulated by the environmental agenda by the regulation that sets targets, such as the net-zero emission regulation in the UK by 2050. This is a regulatory momentum that situates Greener Gains as a vehicle through which investors seek to be agents of change in the environmental space.

Legal:Ideally, ESG disclosure requirements are legal and necessary for arbitrary recognition and improvement of the platforms legitimacy. The rules call for maximum disclosure in the UK, thus making investment products to be very much credible.

4.4.Analysis of Sector/Industry

The sustainability landscape within the financial sector has witnessed a dynamic transformation, as the investors are committed to fulfilling the environmental, social and governance principles. A recent report on the sustainable financial consultation market has revealed that investors have recognized sustainability issues impacting their financial performance (Tobisova, Senova and Rozenberg, 2022). As an outcome, the Principles for Responsible Investment have also received a large number of memberships from investors who publicly commit towards responsible investment. A study has also demonstrated that the climate change concerns are the driving force behind sustainable investment. The 2021 UN Conference for Climate Change managed to gather members with $130 trillion in assets to promote the goal of decarbonisation in the economy (United Nations, 2022).

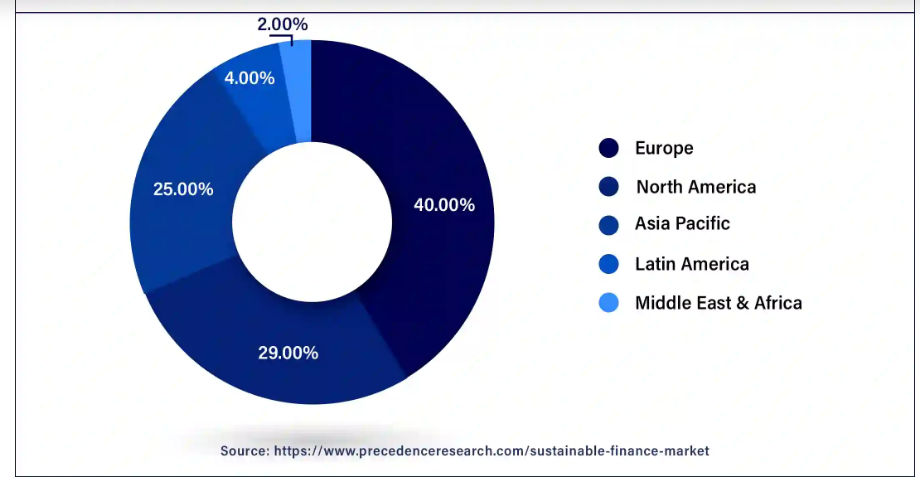

The trends of the sustainable finance market can be illustrated through statistics. The CAGR growth ratio of the sustainable finance market is expected to reach 20% from 2024 to 2034 (SR Group, 2024).

Source: (Precedence research, 2024)

It was found that Europe will be a prominent player in the sustainable finance market in 2023. The European government is an active supporter of funding sustainable finance initiatives. The European Investment Bank has also launched green financing solutions by providing funds for sustainable projects across Europe (Precedence research, 2024). Another prominent trend is the increase of awareness among consumers and investors towards environmental, social, and governance issues. This awareness is increasing the use of green financing products such as green bonds, ESG funds, and loans. Online platforms for financial consultations are also increasing in the sustainable finance market (Global Market Insights Inc., 2023).

As the sustainable finance industry is maturing, a surge in competition is found. Traditional financial institutes are integrating sustainability-focused solutions, whereas fintech startups and innovative platforms are also being launched. Key competitors include BlackRock, Refinitiv, Nomura Holdings, HSBC Group, and others. BlackRock invests in renewable projects, Refinitiv provides an online platform for ESG data and insights by using AI, and Nomura Holdings provides green bonds (Future Market Insights, Inc., 2023).

4.5.Market Research

4.5.1.Targeting Customers

- Segmentation

An STP analysis is conducted below to target the customers for Greener Gains. STP analysis is an acronym for segmentation, targeting and positioning. Under segmentation, demographic, psychographic and firmographic aspects are targeted. The demographic segmentation for Greener Gains includes age. Specifically, Millennials and Generation Z. Research has found that two-thirds of Millennials investors are likely to invest in sustainable projects and comply with ESG factors in comparison to any other age group (Versace and Abssy, 2022). Another study has found that the increased awareness and consciousness of climate change issues among Generation Z has increased their adaptability towards sustainable financing (Azizuddin, 2022). Furthermore, income range, occupation, and education have also been considered in terms of demographics. Entrepreneurs, SMEs and banking institutes are more likely to invest in sustainable investment solutions. Education further strengthens investors' dedication to climate and social concerns. The geographic target is the UK (Mendez and Houghton, 2020). The UK is a growing market in terms of green financing solutions and has a significant growth ratio in sustainable financing (SR Group, 2024).

The psychographic segmentation is categorized into sustainability champion, financial pragmatist, risk-averse and innovation seekers. Sustainability champions have high regard and commitment to environmental and social issues, whereas financial pragmatists prioritize long-term returns through sustainable investment (JPMorgan Chase and Co, 2022). Risk-averse are cautious investors who are looking for sustainable investment for security, while innovation seekers are interested in innovation-led sustainable financing solutions.

Firmographic aspects include firm-related factors to target sustainable financing. Firms committed to ESG and SDG goals will be more willing to invest in sustainable financing solutions.

- Targeting

Based on the segmentation, Greener Gains primarily target institutions that are focused on sustainable investment and have strong ESG mandates in the UK. The drivers of the target institutions can be championing sustainability, avoiding risk, prioritizing financial returns through sustainable investment, and innovating.

- Positioning

To position itself in the competitive market of the UK, Greener Gains will promote its USP, i.e. expert sustainable financing solution, access to ESG investment opportunities and knowledge, and personalized consultation delivered conveniently through a single online platform. The brand positioning statement of Greener Gains is to empower UK investors to make an impact on the planet and people by unlocking sustainable investment opportunities and gaining sustainable returns through seeking expert consultation.

4.5.2.Potential Customer Profile

The sustainable investment market is still growing fast as the AUM approaches thirty-five billion dollars, as shown in the table below. Three trillion worldwide by the end of the year 2022 (GSIA, 2022). There is an increasing concern for ethical and environmental investments in the United Kingdom at present.

Potential Customer Profile:

Location:London, UK

Age:25-45 years old

Values:Environmentally and socially conscious, seeking investments that align with personal values

Income Level:Middle to high-income earners

4.5.3.Potential Market size and Available Market Size-200

The market size of sustainable finance was valued at USD 5.4 trillion in 2023, whereas from 2024 to 2032, the market is further projected to grow by over 22% (Statista, 2023). The growth in the market of sustainable finance is driven by the increase in awareness of firms to invest in sustainable projects and promote environmental and social sustainability. Climate change has also posed a risk for businesses in achieving their returns. Hence, their consciousness towards sustainable financial solutions has increased. The government is also stepping up its initiatives to support sustainable financing projects and investments. The impetus behind government-led initiatives is rooted in the growing concern to achieve sustainable developmental goals (Global Market Insights Inc., 2023). The increase in market size of sustainable financing solutions through online consultation, ESG scoring, data and insight on sustainability, green bonds and sustainability project loans has increased.

4.6.SWOT Analysis

Strengths:The ESG investor market is simply more extensive and more attractive for Greener Gains due to its positioning on sustainable finance. The professional background of the founding team also lies in finance and sustainability, so the platform complies with sound business values and appeals to investors concerned with ethical standards. ESG data providers are strong partners of the platform because they provide accurate and insightful information that will lead to the right decision (Bloomberg, 2024).

Weaknesses:One of the major problems that Greener Gains has is low brand awareness, which is characteristic of newcomers in the sphere of investments. Currently, it may take a lot of time and marketing efforts to be trusted and credible among potential clients. Also, the development phase may have some technological issues since this platform uses modern technology to ensure the best user experience and accurate data analysis.

Opportunities:The increasing awareness and need for sustainable investments mean that there is room for growth for Greener Gains. More investors are beginning to consider ESG factors, and that is why there is a great opportunity to provide relevant products. Also, it is possible to expand internationally, especially to countries where sustainable investing is on the rise (Startup Genome, 2024).

Threats:The new entrant may also face competition from established investment firms which are gradually integrating ESG factors into their performance, thus posing a threat to Greener Gains. Another risk is a regulatory change affecting ESG criteria since policy changes could affect the operations of this platform and compliance rules.

4.7.Customer Value Proposition

The value proposition provides justification to customers to analyse the value they seek from the provider (Rintamki and Saarijrvi, 2021). The value proposition that Greener Gains aims to deliver to its customers is as follows. Greener Gains, a sustainable finance consultation platform, empowers investors and institutions to align their ESG goals with their investment decisions, make sustainable financing decisions, and unlock sustainable financing opportunities through expert consultation. The unique selling point of Greener Gains includes an expert team for sustainable finance consultation, customized investment strategies, ESG analysis and reporting, educational resources to promote ESG-led decisions in investment and a user-friendly interface.

4.8.Branding Policy

Branding is defined as the process of giving valuable meaning to a specific offering or organization to establish a favourable reputation in consumer minds (Galvin, 2020). The branding policy of Greener Gains includes its name, logo, tagline, colour palette, brand message, tone, trademark, copyright, partnerships and values. The name Greener Gains is catchy and associated with its sustainable returns. The tagline is also strong, i.e. empowering sustainable investors. The colour palette is kept in earthy tones to relate to the cause of sustainability where, and the brand message reflects the USP of Greener Gains. Greener Gains, a sustainable finance consultation platform, empowers investors and institutions to align their ESG goals with their investment decisions, make sustainable financing decisions, and unlock sustainable financing opportunities through expert consultation. The tone is kept professional and rational. The brand message will stay the same across all the marketing channels to deliver a consistent message to consumers.

4.9.Policy of Services

The service variety of Greener Gains includes consultation primarily. However, investors will also be provided with an opportunity to buy mutual funds, ETFs and green bonds. To create awareness of ESG investment, the platform will provide educational resources to improve the knowledge of investors and address their ecological concerns in investment. Disruptive technological tools such as Artificial Intelligence and Machine Learning algorithms are integrated into the interface of the platform to provide seamless, personalized and evidence led solutions to consumers. Maintenance and updates will be performed rigorously to maintain the quality of the platform.

Upon accessing the platform, the logo, name, and tagline of Greener Gains will pop up on the screen. The users will be provided with the login credentials to sign up and look for their desired financing solutions. To monitor the performance of the platform, the respective application store ratings, reviews and feedback from customers will be ensured and considered to make changes as per the consumer's needs.

To launch the platform successfully, a product life cycle is used (Bombardier, 2022). In the introduction stage, free trials will be offered to the clients. Social media marketing and partnerships will be done to promote the platform. In the growth stage, premium features and expansion to new markets are planned, whereas, in the maturity stage, user experience and UI will be enhanced, including strategic partnerships with other financial institutes for growth. The later stages will involve integrating new technologies and looking for merger and acquisition opportunities.

4.10.SMART Objectives for Marketing and Sales

Specific:Establish Greener Gains with at least 1000 registered members in the first year of the implementation of the program.

Measurable:To take market share to new levels, reaching at least 20% of the sustainable investment market in London within the next five years or by 2027.

Achievable:Advertise and partner with potential investors through the use of multiple online advertising techniques.

Relevant:Ensure that marketing is directed to the increasing appetite for sustainable funds.

Time-bound:Within the first two years, the usage of the platform will increase by 30%.

4.11.Communication Policy

A communication policy is defined as a set of guidelines and regulations to direct the communication plan (Mowlana, 1992). The communication policy for Greener Gains includes the brand message, channels of communication, KPIs to assess communication effectiveness and approach to communicating the service (Kareh, 2017).

There are several approaches to developing a communication plan. For Greener Gains, an integration marketing communication (IMC) approach has been selected. The purpose of integrated marketing communication is to ensure that the brand message, position, and strategy are delivered to the customers globally (Kitchen and Tourky, 2015). Through integrated marketing campaigns, a consistent brand identity can be developed across all marketing channels (Patel, 2022).

The brand message for Greener Gains to be communicated with the target audience is Empowering investors to make sustainable investment decisions, sustainable financing just a click away, subscribe to Greener Gains today, Make an impact on environment and society through Greener Gains, Tailored investment strategies for a better future, Your investment for a better present, and future. The message demonstrates personalization, expertise in sustainable investment, focus on a sustainable future and trusted collaboration. The tone of voice in the message is professional, informative and inviting. The brand message will follow the branding policy.

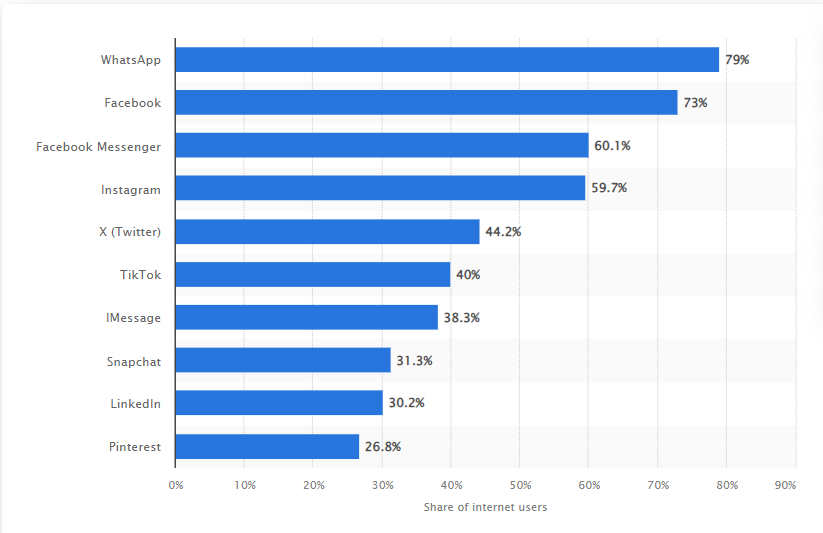

The communication channels selected to communicate the brand message are social media marketing, educational webinars and content marketing, and partnerships with influential figures in sustainability. Social media is a popular marketing channel with the maximum users and reach in the UK (Tankovska, 2023).

(Dixon, 2023)

Platforms like WhatsApp, Facebook, and X (formerly Twitter) will be used to market the service, as these platforms are popularly used in the UK (Dixon, 2023). Content marketing and influencer marketing strategies will be utilised within the social media channel to promote the service. Influencer marketing is a trusted marketing strategy as reliable influencers having mass followers tend to promote the service by word of mouth (Joshi et al., 2023). Educational webinars on Greener Gains will allow the investors to discover the service feature and understand its significance. The KPIs used to assess the effectiveness of the communication plan are social media analytics to understand the reach and views of the target audience as the service is marketed on social media (West, 2023). The customer retention and satisfaction rate to monitor the number of loyal customers and their experience and the number of users registering on the Greener Gains platform will be tracked.

4.11.1.Distribution Policy

Distribution policy refers to the activities, decisions and measures taken by a company to ensure that the service or product reaches the end consumers through appropriate channels and conveys to the point of sale (Wirtz, 2024). There are two types of distribution strategies i.e. direct and indirect. A direct-distribution policy involves directly contacting the target customer to distribute the product or service, whereas indirect distribution involves indirect contact with customers through strategic partners, leaders and collaborators (Hua, 2021).

The distribution policy selected for Greener Gains is indirect. An indirect distribution policy allows for broader reach by leveraging partnership networks and expertise to reach end users. The cost is also low in indirect distribution as the sales and marketing expenses are shared with partners or funded by partners. The scalability of indirect distribution is also better than direct distribution as it has faster growth through partnered networks. Indirect distribution also allows specialization as the partnerships with industry experts is possible (Chennamaneni, Desiraju and Krishnamoorthy, 2016).

In indirect distribution policy, strategic partnerships, referral networks and affiliate program strategies can be used. In strategic partnerships, collaboration with financial institutes, investment platforms and ESG-focused organizations can be partnered (NetSuite.com, 2021). Moreover, referral networks through financial advisor partnership and affiliate program where influential industry experts and content creators are partnered to distribute Greener Gains.

The distribution channels involved in distributing the service among the target audience include online platforms such as websites and social media channels. Other indirect distribution channels include financial institutions, industry events such as webinars and content partnerships where influencer collaborations can promote products (Joshi et al., 2023).

4.11.2.Pricing Policy

The pricing policy defines the price set for the service, the method used for setting the price, discounts and rates and payment terms and conditions (Joosse et al., 2022). The objective of pricing is to maximize the revenue and maintain competitiveness in sustainable finance consultation. The pricing method used to set prices for Greener Gains is competitive pricing. Competitive pricing will allow Greener Gains to align the price with industry standards and competitor prices (Gerpott and Berends, 2022). Through competitive pricing, Greener Gains will be able to understand the market position and attract more customers.

The specific selling price for the green grains would vary on the basis of users. For example, for individuals, we will charge a monthly fee to provide access to ESG analytics and tools. The fee charge will be 60 per month. Moreover, for the larger investors who are interested in consultation and regular updates regarding the changes in the market trends etc (premium service), we will charge a lumpsum fee of 5,000 annually. Setting this price is justified as the global sustainable investment assets have reached about $35 trillion, demonstrating a robust market expansion. Also, this price would give positive revenue generation to the business.

Within the pricing policy, discounts, payment terms and conditions are also set. Discounts for Greener Gains will include 5-10% discounts for long-term subscribers who utilize the service for the long term (6 to 12 months). Another discount strategy is referral incentive, where referred users are provided with discounts up to 5 to 10%. A bundle service discount is also planned, and clients are provided with 10 to 20% discounts when they subscribe to combined services. A free trial is also offered to the users. The payment terms are 30-day payment terms and instalment programs to ease payment deadlines and dues. The payment condition involves payment methods, i.e. bank transfer and credit card. Late payment fees will cost an additional penalty of 2% where, whereas the cancellation policy will cost 50% of the cancellation fee and a notice for 30 days.

4.11.3.Service Policy

The service policy includes pre-sales and after-sales service of Greener Gains. The pre-sales service of Greener Gains is free of cost. The first consultation is a trial to understand the needs of the client and offer an overview of the sustainable financing solution. A customised estimate is offered to customers to outline the scope, timeline, costs, and proposal details for specific services. Within the pre-sale service, expert guidance on ESG consultation and regulatory compliance is provided as per the investment objectives and goals of the client.

The after-sales service of Greener Gains includes implementation support, where clients are assisted in integrating sustainable finance solutions into consumer portfolios. Monitoring and maintenance are also offered after-sales as the client portfolio and ESG goals are reviewed, including updates as per trends, changes and best practices. Moreover, a 12-month warranty on consulting service and service fees liability is also offered after sales.

The maintenance and support services are also important to keep the platform up to date (ORIL, 2023). They are categorized into basic, premium and enterprise levels. The basic level package involves quarterly check in, and portfolio review on annual basis. The premium level package involves monthly check in, and portfolio review twice in a year. Lastly, the enterprise package involves quarterly strategy sessions and personalized support.

The service level agreement includes response time, resolution time, and service quality. The response time includes 24 hours to respond to client inquiries, resolution time is 72 hours to resolve client concerns, and service quality involves client rating (Susilo and Ikhsan, 2020). To ensure seamless resolution, client feedback through ratings and surveys will be used (Mourtzis et al., 2018). The service policy also involves client support channels where clients are contacted through support lines, platforms and email.

4.12.Selling Program

A selling program refers to a set of steps that can help businesses to generate sales. The selling program is aligned with the business goal and target audience. The selling program of Greener Gains includes setting up a sales training program, developing a sales plan, and setting selling program strategies. The sales training program for Greener Gains involves helping sales teams and leaders to develop sales skills and establish strategies. To train the team for sales, Greener Gains will launch virtual workshops and sessions (Singh, Sen and Borle, 2021). These workshops will allow the team members to understand their roles and responsibilities, recognize the target objectives, and set metrics to track their progress. These training workshops can upskill the sales team and encourage them to achieve the set targets. The selling plan also involves a sales pitch. The sales plan for Greener Gains also includes its distribution channel, sales strategy, revenue target and activities to achieve set goals. Greener Gains has planned an indirect sales strategy where the platform will collaborate with influencers, experts and financial institutes to promote and sell its services (Hua, 2021). The distribution channel includes online channels, financial institutions, industry events such as webinars and content partnerships where influencer collaborations can promote products. For sales, competitive pricing is set for the service, whereas activities to promote the service include discounts, free trials, and marketing.

The selling program also involves access to resources and knowledge related to the current trends of ESG and sustainable financing. The key performance indicators for reviewing the sales target progress are sales revenue growth, acquisition rate, and client retention rate. These metrics will allow Greener Gains to assess its sales performance and review its target achievement (Wang et al., 2024).

5.Production and Operation Plan

5.1.Service Process Aspect

The operations of the online business platform will revolve around providing a streamlined user experience employing dependable backend technology and an intuitive interface. Important prerequisites for operations will be composed of the following:

- An adaptable and safe cloud-based system will allow consolidating the protection of cloud-based networks for streamlined, continuous analysis and monitoring of various systems, endpoints, and devices (Ige and Kupa, 2024). It will also allow managing policies and software updates from one place and executing disaster recovery plans.

- A committed group of customer service representatives is available that will help the target segment decide among various sustainable fund options.

- Collaborations with ESG data suppliers to make sure precise analysis will be done by ensuring clear channels of communication. Regular meetings, feedback and updates will inform suppliers about ESG expectations and goals. The focus will be on developing standardized reporting frameworks as these frameworks outline particular metrics suppliers require to support (Yang, 2024). Providing the required training to the staff and suppliers on how to use these frameworks may improve the overall data quality. The focus will be on ensuring data security and privacy. The business will implement secure data-sharing protocols and ensure that sensitive information is protected against unauthorized access. Furthermore, offering training sessions, continuous support, and workshops can help suppliers understand the value of ESG reporting and how to comply with reporting requirements.

5.2.Description of Resources

5.2.1.Premises and Facilities

The business is located in London, the UK. Greener Gains is set to be an online investment platform where investors can buy mutual funds, green bonds and ETFs. The location is eco-friendly, and it has minimal environmental influence that increases green credentials as well. The facilities for the target audience include accommodating investors to make the right social investment, providing consultancy services and developing a detailed list of sustainable investment opportunities.

5.2.2.Technical Equipment

The technical equipment includes computers, printers, high-end technology and access to a room or office to create a unique investor experience. There is an arrangement of sophisticated mechanisms for operating assessment to deliver investment advice in the context of environmental governance. Moreover, there is a need to have ease of use of mobile and web applications along with having a secure cloud-based infrastructure and setup.

5.2.3.Human Resources

The team is comprised of 14 workers in the first year, and the number may increase depending on the expansion of the business. The team is divided into different departments, such as customer service, ESG team, marketing and technology departments, to provide valuable service to customers. Besides, some fintech professionals will also be outsourced for better establishment of the business.

5.2.4.Raw Material

Access to raw materials such as market research and analysis tools is needed. These tools will help to understand the demand for green services. For consultancy, the team will need environmental reports, market research from different firms along with, having an idea regarding national and regional environmental regulations. There is a need for funds and capital to buy a cloud-based computing system that will help to offer green investment services to customers. Besides, raw material also includes the technical equipment listed above along with the human resources.

5.2.5.Milestones and Alternative Pathways

Some milestones for the future include achieving 99.9% platform uptime, using robust measures of cyber security to guarantee the security of the platform and giving priority to a profound user experience to increase customer satisfaction. The business intends to complete its operating capacity by the first quarter of 2026.

The paramount ratios for the business help to decide on the profitability and have an idea of the time taken to have a return on investment (ROI) (Palepu, 2020). The following ratios show the values that can help the business remain profitable and sustainable in the market.

5.2.6.Hypothetical Sales Forecast

The sales forecast given below is for the first to fifth year. The Yearly sales forecast is given as:

|

Year |

Revenue () |

|

1 |

1,576,000 |

|

2 |

1,623,280 |

|

3 |

1,671,978 |

|

4 |

1,722,138 |

|

5 |

1,773,802 |

(Source: Self Developed)

5.3.Supply Policy and Storage Policy

The supply policy revolves around focusing on responsible investment. Before collaborating with ESG data suppliers, their profiles will be checked in the industry to ensure that they provide the relevant information. Collaborative and cooperative relationships will be formed with them for the sake of accuracy and credibility (Castaner, 2020).

The investment will be aligned with green principles only. For instance, this emphasizes financing of renewable energy projects, energy-efficient buildings and efforts of environmental conservation. It also includes providing updated information services and other essential resources that enable a company to continue growing. On the other hand, the storage policy of the "Greener Gains" protects the information that is fetched from investors and suppliers and the information will be stored in a coded computer. All investment decisions related to environmental, social and governance will be stored securely to ensure that financial support is directed towards projects and clients (Aksoy, 2022).

5.4.Application of Technology

The technology applied at the "Greener Gains" business will be an adaptable and safe cloud-based system. The collaboration with ESG data suppliers will be done for quality management. The investment in the platform intends to use high-end technology to ensure a unique customer experience. Key technological elements for the sake of accuracy and quality management include sophisticated mechanisms, a cloud-based system as discussed above and easy-to-use web applications.

Workplace accident prevention will be done by implementing safety protocols, enhancing employee engagement and carrying a sustainability focus. A non-toxic cleaning policy will be implemented as per the business agenda. Lastly, all the environmental considerations like ESG compliance, following green principles and analysis of ESG information are focused.

6.Organization Plan

The organizational plan of Greener Gains is focused on creating a highly efficient and sustainable structure that provides greater facilitation to the mission of the company so that eco-friendly solutions can be promoted. This plan is focused on developing clear goals, team members, and the use of human resources for driving growth in the green technology sector.

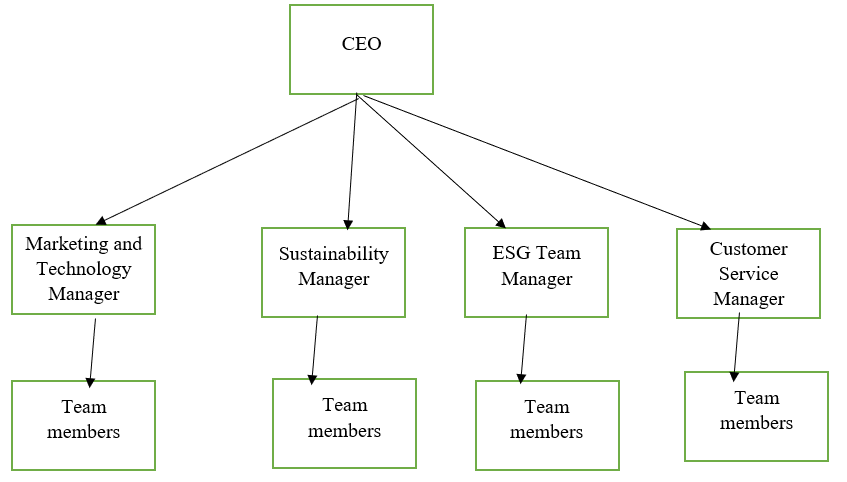

6.1.Design the Structure of the Organization

The structure of Greener Gains is a hierarchical organizational structure, so open communication can be encouraged by making quick decisions and responding based on the demands of the organization. It usually promotes of collaboration so that employees are allowed to engage freely in the organization. The structure is based on multiple departments, including Marketing and Technology, Sustainability, Customer Services, and ESG. Each department has its head to assign tasks and align the activities of team members with their goals. It helps in enabling specialization according to functions and activities to ensure operational efficiency (Saiti and Stefou, 2020).

(Source: Self Developed)

6.2.Specify the type and number of tasks or activities to be carried out in the company and the best people to do them

Different tasks and activities to be performed in Greener Gains are given in the following:

Product Development:Sustainable products will be perfectly designed, tested, and launched to ensure high quality and sustainable patterns.

Market Research and Analysis:Market trends will be identified based on the needs and preferences of customers and in this way, eco-friendly innovations are also considered perfectly.

Customer Engagement and Support:High-end and strong relationships will be developed with customers or clients by giving them proper education about sustainability. In this way, high-end solutions will be provided according to their tailored needs and achieve better performance (Ghlichlee and Bayat, 2021).

Quality Control and Sustainability Audits:The quality control mechanisms are adopted where it is ensured that multiple products can meet environmentally-friendly and ESG standards. In this case, continuous improvement is also done perfectly to maintain quality control standards.

Sales and Distribution:The supply chain of the company will be managed perfectly with high-end distribution and strong partnerships so that reach can be maximized to a greater extent. Therefore, the size and task of human resource allocation will be different in each department because marketing and technology need greater resources because of considering innovation in products, quality of production and product reach. At the start, there will be 25 employees, but this will increase with time (Saiti and Stefou, 2020).

Green Gains has different departments with multiple expertise employees in the adoption of sustainability, environmental mind set, and technical skills.

ESG Team:For the ESG team, engineers and scientists need to have a strong background in green technology and environmental sciences, and the company will also introduce reward programs and employee promotions to encourage knowledge gain (Xiong, 2021).

Sustainability:In the sustainability department, professionals will be encouraged to have experience in the adoption of high-sustainability practices.

Marketing and Technology:The marketing and sales team includes those with greater experience and skills in green marketing and proper knowledge about eco-friendly consumer trends along with technology integration.

Customer Service:The customer service team includes Individuals with strong collaboration, communication skills, and commitment to environmental awareness.

Human Resources:HR specialists with experience in adopting sustainable HR practices are part of the human resource department of a company.

6.3.Organize the different tasks to be carried out

A collaborative approach is used for organizing tasks of Greener Gains that would assist in using project management tools and cross-departmental meetings to ensure proper alignment of tasks and activities. Tasks are perfectly organized based on greater priority.

For daily tasks, routine market checks, effective customer service and check and quality checks are included. Team meetings and sustainability audits are included in weekly tasks. Monthly tasks include strategic planning sessions, and analysis of the overall market are included. All tasks are perfectly grouped based on alignment with the goals of the company so that accountability can be promoted.

6.4.Assign Responsibilities and Line of Command

Each department of Greener Gains will report to the COO (Chief Operating Officer) who focuses on supervising daily activities. The head of the department will manage their teams in their areas to ensure company standards are being followed and goals are achieved. CEO will provide high-end and strategic direction by reviewing outcomes in departments. In this way, this line of command offers a supportive environment where teams are encouraged to perform their duties (Lee, 2021).

6.5.Develop human resource planning

Job Analysis- The HR team of Green Gains will analyse roles, responsibilities and qualifications in each department to get a detailed overview of whether each department is performing its job well or not.

Diversity- The company is highly committed to providing a diverse workplace to employees by including persons from different backgrounds. It also aims to develop a culture that gives value to diversity so that the company can increase engagement and develop knowledge-sharing behaviour (Lee, 2021).

Competencies and Skills- The company gives value to greater expertise in the adoption of eco-friendly technology, collaboration, and problem-solving skills. Training sessions are also regularly conducted to enhance the skills of employees in different areas so that evolving industry trends can be focused.

Recruitment Policy- The recruitment policy is based on specialized education and experience in relevant fields and fits into the culture of sustainability and innovation. The company will also have annual internships to promote social investing and sustainability to upcoming future talents.

Training Policy- Employees are given proper training about the adoption of sustainability practices, customer service, and knowledge about products. Employees can get access to different learning resources like industry conferences, workshops, and certifications to stay updated about advancements in the adoption of green technology (Lee, 2021).

Placement Policy- Placement policy depends on placing employees in their desired roles that can increase their strengths and properly align with their organizational goals. In this way, internal mobility is encouraged by allowing employees to perfectly explore their roles. High-end career growth and retention are also promoted in the organization (Rachmawati and Rijanto, 2024).

Compensation Policy- The compensation policy of the company is highly competitive and based on the performance of employees. Incentives are also provided to employees based on their contributions and achievements. They are also provided with extra benefits like flexible working schedules, environmentally friendly options such as bike sharing programs, public transport allowance, etc. Furthermore, eco-friendly health-related policies so that the company can follow a commitment to environmental responsibility and their well-being (Kang and Lee, 2021).

7.Economic, Financial, Legal and Taxation Plan

7.1.Initial Investment Plan

An initial investment plan is a roadmap that helps the company in managing its finances in the companys startup phase. A good Investment plan boosts investor confidence which in turn could help the company acquire additional funding. Greener Gains plant to Attain 1,000,000 as seed fund. The breakdown is given below:

|

Category |

Year 1 (Seed Fund) |

|

Personnel Costs |

480,000 |

|

Marketing & Branding |

50,000 |

|

Technology Infrastructure |

80,000 |

|

Data Licensing (ESG Data) |

20,000 |

|

Office Rent & Utilities |

50,000 |

|

Regulatory & Compliance |

30,000 |

|

contingency fund (20%) |

142,200 |

|

Miscellaneous expense |

147,800 |

|

Total |

1,000,000 |

?(Source: Self Developed)

7.2.Cash Flow

The cashflow statement shows the movement of cash throughout a period. The cashflow statement is prepared by collecting the respective figures from the profit and loss account and the balance sheet.

?(Source: Self Developed)

As seen in the cash flow forecast of Greener Gains. The company is able to generate significant net cash balances in Years 1 and 2, although the increase slows down from year 3. This is mostly due to the company growing organically and the company is regularly reinvesting its profits into its operations.

7.3.Profit and Loss Forecast

?(Source: Self Developed)

The company generates 1,576,000 as its revenue in year 1, and the revenue continuously grows by 3% every year. Aditionally, the cost of goods sold is assumed to be 15% for ease of calculation. When analyzing the profit and loss forecast it is clear that Greener Gains is profitable.

Break-Even Analysis

Break-even analysis helps a business understand how many units have to be sold so that the total revenue generated is equal to the total cost, i.e. fixed cost and variable cost the business incurs. The Breakeven analysis of Greener Gains is given below:

|

No of units |

1000.00 |

|

Revenue |

|

|

Base Subscription |

576,000 |

|

Premium Subscription |

1,000,000 |

|

Total Revenue |

1,576,000 |

|

Total Variable Cost |

366,400 |

|

Contribution margin |

1,209,600 |

|

Contribution margin per unit |

1,210 |

|

Break-even units |

479 |

?(Source: Self Developed)

Greener Gains expects to sell 1000 subscriptions in Year 1, with 800 users under base subscription and 200 users under premium subscription, which will generate Greener Gains revenue of 1,576,000. additionally, the revenue is expected to grow by 3% every year. The variable cost is estimated at 366,400 and the fixed cost stands at 580,000. The break-even units stand at 479 subscriptions. This means that the company is able to generate profits from the sale of the remaining 521 units i.e. (1000 units - 479 units).

7.4.Project Appraisal

Inputs and Assumptions

Revenue Projections:

|

Year |

Revenue () |

|

1 |

1,576,000 |

|

2 |

1,623,280 |

|

3 |

1,671,978 |

|

4 |

1,722,138 |

|

5 |

1,773,802 |

(Source: Self Developed)

Costs:

- Operating Expenses: Adjusted to 15% of Revenue, scaling with growth.

- Initial Startup Costs:1,000,000

- Discount Rate:10%, accounting for the cost of capital and business risk.

- Terminal Value (TV):Assuming a terminal growth rate of 3?yond Year 5

- Year 5 Cash Flow = 712,450

- Growth Rate = 3% = 0.03

- Discount Rate = 10% = 0.10

Terminal Value = 10,483,191.16

Discounted Terminal Value = 6,509,236.92

(Source: Self Developed)

Interpretation of Financial Metrics:

A positive NPV of 10,088,426 shows that the post-implementation net cash inflows outweigh the cost of the investment, therefore supporting the financial feasibility of the investment.

7.5.Balance Sheet

(Source: Self Developed)

The projected balance sheet shows the financial position of Greener Gains. The balance sheet is developed based on assumptions; The current assets include cash and cash equivalents worth 1,866,000. The figure has been taken from the forecasted cash flow. The work in progress in the current asset refers to additional features in the application that have not been out in the market yet, i.e. 50,000. Furthermore, Property plant and equipment include Desktops and other IT components worth 100,000, which are essential for the business. additionally, intangible assets include patents worth 200,000. Current liabilities consist of accounts payable, which include bills due to Amazon web services for hosting servers and fees for the various ESG tools used worth 100,000. The balance sheet also includes short-term loans, i.e. 50,000, and long-term loans, i.e. 633,800, to support the business. Moving forward under the equity part of the balance sheet, there is the seed fund of 1,000,000 and retained earnings of 472,000, which is the profit generated by the business at the end of the financial year . The company has a closing balance of 2,256,000 at the end of the year.

7.6.Legal Form and Constitution of the Company Permits License and Regulation

There are many regulatory, legal, and licensing requirements needed by "Greener Gains" to get sustainable investment in the UK that focuses on Environmental, Social, and Governance (ESG) principles. By adopting those rules and regulations companies can be able to perform their operations, adhere to pertinent regulations, and the development of trust among investors, stakeholders, and regulatory agencies. Some of the important rules are given below:

Legal Structure and Constitution of the Company

The legal structure of the business will private limited company (Ltd). Under the private limited structure, the owners have flexibility, scalability and protections while appealing to potential investors. For the constitution, the business will adhere to the following constitutions:

- Voting Rights: The founder of the business will have the veto power for strategic decisions. However, the shareholder may follow a major rule for routine decisions.

- Intellectual Property Rights: The company will own all IP related to AI and ESG analytics. The founders and employees will also be assigned to IP developed for the company as a part of their roles.

- Financial Conduct Authority (FCA) Authorization:"Greener Gains" will obtain FCA authorization to provide investment solutions and advisory services (Bowley, 2017).

- Management Of Assets:Greener gain will ensure that asset management is done according to ESG standards.

- Financial Product Distribution:While advertising the various business offerings, the business will ensure that it will follow all the guidelines and procedures that are mentioned in the law of the UK.

- Trademark Protection:To guard against illegal usage, the brand name "Greener Gains" and its logo will be registered with the Intellectual Property Office (IPO) according to the rules and regulations made by the government of the UK (Kmetyk and Beluga).

- Copyrights or Patents:The company will ensure to follow the pattern of patent protection or copyright of its software if it creates a private technology such as a special ESG investment platform or other software that is used by the company to run its operation.

- Environmental Impact:The business will follow all those guidelines and methods which is beneficial for the environment and meet the legal objectives of the country, even when its services may be centered on investments such as reducing carbon footprints, making sure that offices follow sustainable practices, and emissions of harmful substance and gases need to be avoided (Franchetti and Apul,2012).

- Investor Protection Legislation:The business will ensure that the Financial Services and Markets Act of 2000 and the Consumer Rights Act of 2015, among other UK consumer protection legislation, are followed (Khan, 2017).

- Financial Statements:The company will make sure that it is performing regular audits, open reporting, and will always adhere to International Financial Reporting Standards (IFRS) (Nurunnabi, 2021).

- ESG Certifications:The firm will ensure to follow ESG standards, such as Task Force on Climate-related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and the Global Reporting Initiative (GRI) which help the company to gain the trust and credibility of investors, stakeholder and customer (Ibrahim et al, 2024).

Its important for Greener Gainss success to follow all legal and regulatory landscapes, guarantee adherence to pertinent sustainability and financial standards, and ESG-focused financial solutions that help the company to run its operations easily.

7.7.Obligations and Scope of Liability

- As a UK-based business, "Greener Gains" is liable for a variety of tax laws and rules. The firm is entitled to pay the regular 25% corporation tax rate on profits.

- The business is entitled to submit an annual tax return to HMRC of 12 months from the end of its accounting period.

- The business can be eligible for R&D Tax Credits or other tax breaks for creative ventures or investments that support sustainability objectives (Evans and Joseph, 2022).

- The company is required to register for VAT with HMRC if its taxable revenue is above 85,000 per year (Rawson, 2024).

- The business must register for PAYE with HMRC, which deducts national insurance and income tax from workers' paychecks (Metcalf, 2018).

- The business can be eligible for government green finance incentives like Enhanced Capital Allowances for energy-efficient equipment.

- To practice sustainable finance, "Greener Gains" makes sure that it impacts environmental suitability.

- The company must make sure that its sustainable investment products comply with both the UKs environmental standards and international standards.