ACC3168M International Accounting 2 Portfolio Case Study

- Subject Code :

ACC3168M

- Country :

Australia

Case Study Scenario Prince Charming Ltd

You are an accountant working for Balance & Sheet Accountancy Ltd. You have been asked to aid the newly promoted chief financial officer (CFO) of Prince Charming Ltd with preparing the consolidated financial statements as well as offering advice on a variety of other financial reporting issues. Prince Charming Ltd is in the retail industry and you have been asked to write a report to the CFO on the five key tasks they need help with. The report will be presented to the CFO and the board of directors; therefore the report must appear professional and contain all detailed workings.

The tasks are summarized below:

Task 1 (25 marks)

Prepare a consolidated statement of financial position for the year ended 31 December 2022 for Prince Charming Ltd.

Task 2 (20 marks)

Prepare a consolidated statement of cash flows for the year ended 31 December 2022 for Prince Charming Ltd.

Task 3 (15 marks)

Advise the CFO on the accounting treatment of proposed foreign currency transactions.

Task 4 (10 marks)

Advise the CFO on the accounting treatment of a proposed financial instrument.

Task 5 (30 marks)

Advise the CFO on specific requests about corporate governance & non financial reporting.

Additional information for each task is provided on the following pages.

Task 1

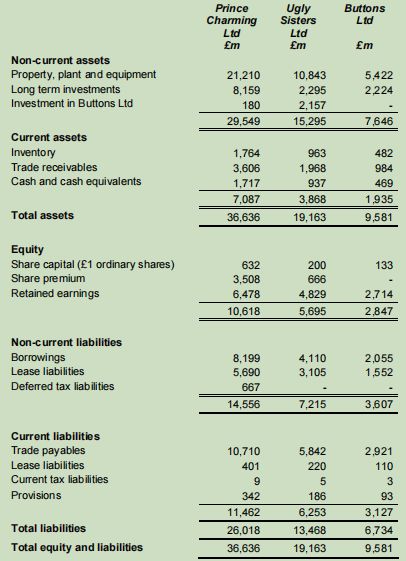

The following draft statements of financial position relate to Prince Charming Ltd, Ugly Sisters Ltd and Buttons Ltd at 31 December 2022:

Additional information for task 1

- On the 1 March 2022 Prince Charming Ltd acquired 85% of the ordinary share capital of Ugly Sisters Ltd in a share for share exchange of one share in Prince Charming Ltd for four shares in Ugly Sisters Ltd. The issue of these shares has not been reflected in the financial statements of Prince Charming Ltd. The value of one Prince Charming Ltd share as at the 1 March 2022 was 125.00.

- On the 1 May 2022 Prince Charming Ltd purchased 12% of the ordinary share capital of Buttons Ltd.

- On the 1 March 2022, the fair values of Ugly Sisters Ltds assets and liabilities were equal to their carrying amounts with the exception of equipment. These had a fair value 350m in excess of their carrying amount. The equipment had a 30 year remaining useful life on 1 March 2012. The fair values of Buttons Ltds assets and liabilities on 1 May 2022 were equal to their carrying amounts.

- The profits for the year ended 31 December 2022 were 365m and 145m for Ugly Sisters Ltd and Buttons Ltd respectively.

- Ugly Sisters Ltd acquired a 75% holding in Buttons Ltd on 1 May 2022 for a consideration of 2,157m.

- Prince Charming Ltd values goodwill on consolidation based on the fair value of the non-controlling interest (gross goodwill).

- At the date of acquisition of Ugly Sisters Ltd by Prince Charming Ltd the fair value of one Ugly Sisters Ltd's share was 31.00. At the date of acquisition of Buttons Ltd by Ugly Sister Ltd the fair value of one Buttons Ltd share was 23.00. These values can be taken to represent the value of the noncontrolling interest at the date of acquisition.

- On the 31 October 2022 Prince Charming Ltd had sold goods to Ugly Sisters Ltd for 120m. One quarter of these were included in the closing inventory of Ugly Sisters Ltd. The goods were sold at a markup of 15%.

- Apart from the share for share exchange on the 1 March 2022, there have been no other changes to the share capital in any of the three companies.

- Goodwill has been impaired by 8%.

Required:

Prepare the consolidated statement of financial position for Prince Charming Ltd and its subsidiaries at 31 December 2022.

Task 2

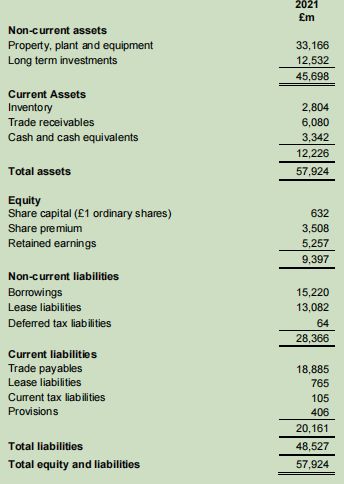

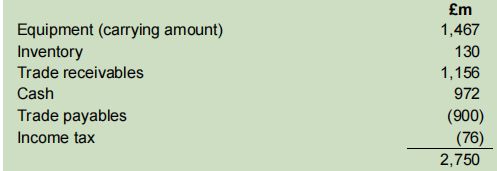

Consolidated statement of financial position for Prince Charming Ltd for the year ended 31 December 2021:

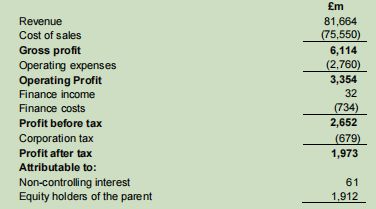

Consolidated statement of comprehensive income for Prince Charming Ltd for the year ended 31 December 2022:

Additional information for task 2

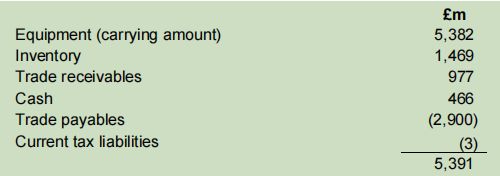

- Information relating to the acquisition of Buttons Ltd is as follows:

Required:

Prepare the consolidated statement of cash flows for Prince Charming Ltd and its subsidiaries for the year ended 31 December 2022 using the information provided above and your answer from Task 1.

Task 3

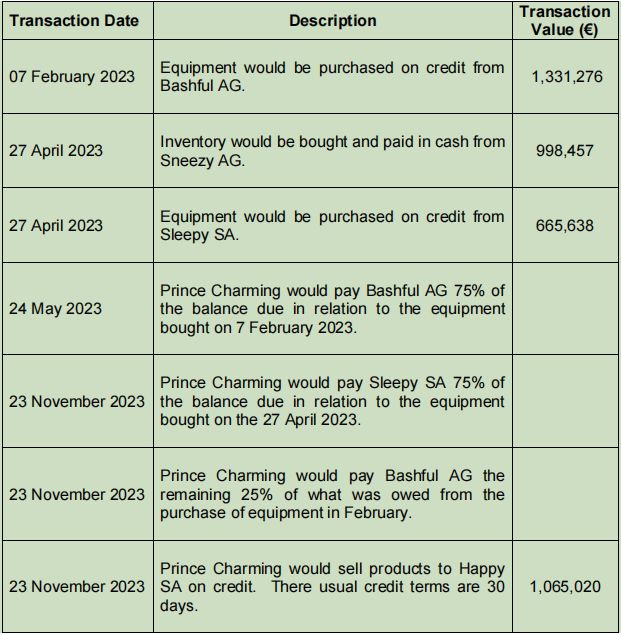

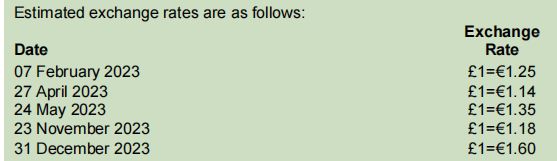

Prince Charming Ltd are considering purchasing specialist equipment and inventory from the EU as well as begin selling their products to customers within the EU. These transactions will occur in Euros (). The information relating to the potential purchases and sales made in for the accounting period ending 31 December 2023 are as follows:

Required:

- Explain the accounting treatment of each of the potential transactions.

Include in your answer:

- The double entry adjustments for each transaction.

- The period-end balance of trade receivables and trade payables.

- Total exchange differences for the year ended 31 December 2023 (assuming no other foreign currency transactions occur during the year).

- IAS 21 requests that transactions 'shall be recorded, on initial recognition in the functional currency'.

Required:

Explain in your own words how business entities determine their functional currency.

Task 4

The following information is relevant for the year ended 31 December 2023 and therefore is correctly excluded from the financial statements for the year ended 31 December 2022.

On 1 January 2023 Prince Charming plc purchased a 3.91% coupon bond for 13,312.76 (nominal value 16,640.95) and paid an additional 1,331.28 for brokers fees. Prince Charming plc expects to hold the bond, which is quoted in an active market, to its redemption on 31 December 2027.

Redemption is at a premium of 13.31% on the nominal value. The bond has an effective interest rate of 9.22% pa.

Required:

Advise the CFO of the accounting treatment of the bond. Include in your discussions:

- the relevant international financial reporting standard(s)

- the initial categorization and accounting treatment

- the amounts to be recognized in the statement of financial position as at 31 December 2023 and the income statement for the year ended 31 December 2023

(10 Marks)

Task 5

Your answers to this section should include evidence of wider reading including references in the Harvard referencing style. You must include both in-text citations and a final reference list.

As the CFO is newly promoted, they would like to improve their knowledge of what responsibilities Prince Charming Ltd has in relation to corporate governance regulation.

They have some idea of the 2018 UK Corporate Governance Code however would like you to provide more detail. Prior to working for Prince Charming Ltd, the CFO worked for companies in different countries, all of which followed a rules-based system. He is skeptical of a principle-based system and is unsure of what Prince Charming is required to do to comply with each principle.

They have read that the 2018 UK Corporate Governance Code introduced five key principles which emphasize the value of good corporate governance to long-term sustainable success. The principles they read about were:

- Board Leadership and Company Purpose

- Division of Responsibilities

- Composition, Succession and Evaluation

- Audit, Risk, and Internal Control

- Remuneration

Required:

- Compare and contrast a rule-based and principle-based system of corporate governance, highlighting the advantages of a principles-based system such as the UK Corporate Governance Code. (Word count: 250 words) (4 marks)

- Briefly comment on why governance mechanisms may differ between countries. (Word count: 250 words) (4 marks)

- Choose ONE of the five key principles listed above and outline in your own words, the key provisions of this principle. (Word count: 250 words) (4 marks)

- Critically discuss how conforming to the principle chosen in c), will help the board of directors of Prince Charming Ltd achieve the long-term success coveted the code. (Word Count: 500 words) (8 marks)

- Summarise the narrative reporting requirements with regards to section 172 of the Companies Act, commenting on the success of changes to section 172 reporting in improving disclosure quality. (Word count: 750 words) (10 marks) [Total = 30 marks]