Apply Construction Principles to Cost Forecasting and Variation Management CPCCCM5005

- Subject Code :

CPCCCM5005

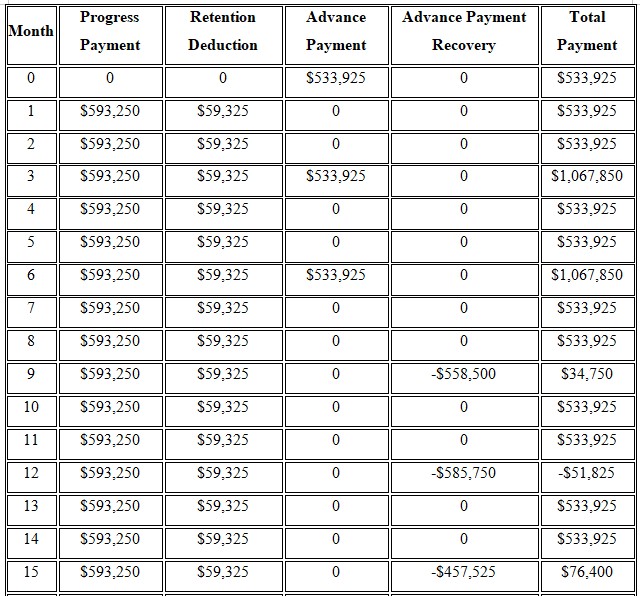

Task 1 cashflow

For the sake of calculating the cash flow forecast for Success Construction Pty Ltd's project using the AS 4000 General Conditions of Contract, a structured 10-step process is imperative.

Step 1: Identify the Contract Sum and Period

- Contract Sum: $10,678,500 (excl GST)

- Contract Period: 18 months

- Defects Liability Period: 12 months

Step 2: Determine Retention and Release Conditions

- Retention: 10% of each interim payment, up to 5% of the total contract sum.

- Release: Half of the retention at practical completion, with the remainder released at the end of the Defects Liability Period.

Step 3: Understand Advanced Payments

- 15% of the contract sum will be paid in advance, split across three installments:

o 5% at project start

o 5% at the end of the 3rd month

o 5% at the end of the 6th month

Step 4: Plan the Recovery of Advanced Payments

The advanced payment is recovered in three stages:

- 9th month: $558,500

- 12th month: $585,750

- 15th month: $457,525

Step 5: Set Monthly Progress Payment Structure

It is already given that the project period is 18 months. Therefore, monthly progress payments can be discerned on the grounds of the contract sum.

Keeping this in hindsight, uniform expenditure can be expressed as:

- Monthly expenditure = $10,678,500 / 18 months = approximately $593,250 per month.

Step 6: Calculate the Retention Deductions

The retention is 10% from each interim payment (that comes about - 10% of $593,250 = $59,325 per month). This will accumulate until the retention cap of 5% of the contract sum is reached.

- Retention cap = 5% of $10,678,500 = $533,925.

- Once this cap is reached, then only retention deductions will stop.

Step 7: Apply Advanced Payments

The advanced payments are received as follows:

- Month 0 (start of project): 5% of contract sum = $533,925.

- End of Month 3: 5% of contract sum = $533,925.

- End of Month 6: 5% of contract sum = $533,925.

These advanced payments help cover early-stage costs. However, it is imperative to note that it will be deducted later during the recovery period.

Step 8: Deduct Advanced Payments

- Month 9: Deduct $558,500.

- Month 12: Deduct $585,750.

- Month 15: Deduct $457,525.

These amounts will be subtracted from the progress payments in the respective months.

Step 9: Handle Retention Release

At practical completion (assumed at month 18), half of the retained amount ($533,925 2 = $266,962.5) will be released. The remaining half will be released at the end of the 12-month Defects Liability Period.

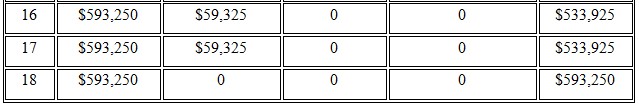

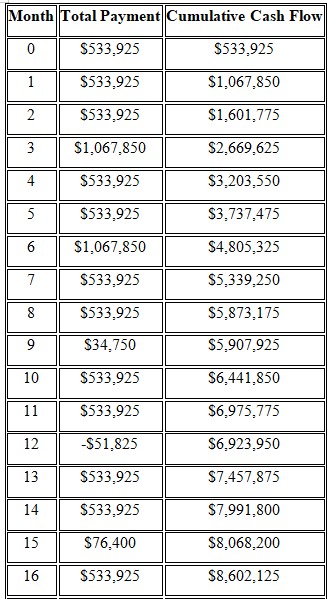

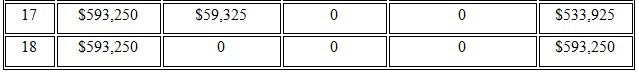

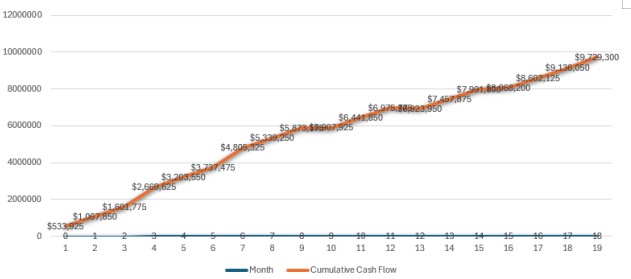

Step 10: Construct the Cash Flow Table and Generate the S Curve

- Months 0-3: Cash inflow due to advance payment of 5%, and progress payments begin from month 1.

- Months 4-6: Another 5?vance payment at month 3, with regular progress payments continuing.

- Months 7-9: Final 5?vance payment at month 6, and first recovery of advance payment in month 9.

- Months 10-12: Regular progress payments, second recovery in month 12.

- Months 13-15: Final advance payment recovery in month 15.

- Months 16-18: Regular progress payments up to practical completion, with half of the retention released.

The table summarizes the cash flow in an illustrative manner.

The S-curve inherently depicts the cumulative cash flow over time. It not only revealed a gradual rise. This is denoted as early costs. However, it is followed by slower accumulation as the project progresses with retention and payment recovery deductions (Thomas & Wright, 2020).

The S-curve inherently depicts the cumulative cash flow over time. It not only revealed a gradual rise. This is denoted as early costs. However, it is followed by slower accumulation as the project progresses with retention and payment recovery deductions (Thomas & Wright, 2020).

This forecast structure is dynamic as well as flexible one, which is subject to project milestones.

Task 2 valuation of variation

To advise Success Construction Pty Ltd concerning the steps to undertake prior to acting on the superintendents instructions (Architect's Instructions AI-03 and AI-04) regarding changes in tile supply and kitchen layout are diverse. The firm must stringently adhere to these instrumental measures to affirm compliance with contractual obligations.

1. Review the Contract and AS 4000 Clauses

The first course of action that is imperative for Success is to dissect the relevant clauses in the AS 4000 General Conditions of Contract. This is prudent since it delineates the legal obligations regarding variations (O'Sullivan, 2020).

- Clause 36 (Variations): It defines the aspects that constitutes a variation along with the procedures that is exigent to be abided by when variations are requested.

- Clause 37 (Time and Cost Implications): It also furnishes guidance on the process for adjusting the contract price and time extensions for variations (O'Sullivan, 2020).

Success should simultaneously affirm that both AI-03 and AI-04 are classified as valid variations under these clauses.

2. Confirm the Validity of Architects Instructions (AI)

In addition to that, Success must confirm that the superintendents AI-03 and AI-04 are formally issued and valid instructions under the contract.

- It is imperative to assess that the instructions have been properly authorized and fall within the superintendent's authority.

- It must be affirmed that the variations requested are sufficiently documented as well as detailed to allow proper valuation and inculcation.

3. Provide Notice of Potential Cost and Time Impact

In consonance with Clause 36 of AS 4000, Success is required to promptly notify the superintendent if the variation will likely lead to additional costs or ramification on the construction schedule. This notification should be carried out meticulously (O'Sullivan, 2020).

- A cost estimate for the variation must entail any increases in material, labor or subcontractor fees due to the change in tiles and kitchen layout.

- A time impact assessment that innately details any delays or modifications to the schedule caused by the variation.

4. Seek Written Instructions for the Valuation of Variation

Prior to proceeding with the work, Success should request the superintendent to issue a written valuation of the variation. This valuation will discern how much the contract sum will be adjusted to account for the changes in kitchen tiles and layout.

- The valuation should be conducted as per the procedures delineated in Clause 36.4 (Valuation of Variations) of AS 4000.

5. Affirm Adequate Documentation

Success must document all communications related to the variation intricately.

- Copies of AI-03 and AI-04.

- Written confirmation of costs and time adjustments.

- Any agreements or disagreements pertinent to the scope of the variation and its valuation (Thomas & Wright, 2020).

6. Assess Subcontractor Implications

If subcontractors are involved in the kitchen work, Success should adhere to diverse measures.

- Inform and consult with relevant subcontractors regarding the amends required under AI-03 and AI-04.

- On this grounds, it is imperative to obtain any revised quotations or cost estimates from subcontractors (O'Sullivan, 2020).

7. Proceed Upon Written Approval

Success should not commence work on the variations until it has received:

- Formal written confirmation from the superintendent regarding the cost and time adjustments (Thomas & Wright, 2020).

8. Keep a Record of the Impact on the Construction Schedule

- Update the construction program to reflect any delays or re-sequencing required by the change in kitchen layout or materials.

As far as calculation of the cost implications due to changes in the Architect's Instructions (AI-03 and AI-04) is concerned, it is prudent to adhere to a systematic method. It considers the price and quantity changes for both the pavers as well as the base layer (Thomas & Wright, 2020).

1. Cost of Pavers (AI-03)

The paver size was changed from 200 x 100 x 40mm to 240 x 120 x 50mm. It impacts the cost per piece and the number of pieces required per square meter.

Original Pavers

- Cost per piece: $1 per piece

- Number of pieces required per m?2;: 50 pieces/m?2;

- Total area: 500 m?2;

However, for the original pavers - the total cost is:

OldPaverCost = 500?m?2; 50?pieces/m?2; 1?$perpiece = $25,000

New Pavers

- Cost per piece: The new pavers cost $2 + 0.1 lastdigitofSID.

Since the last digit of the SID is 4, the cost is -

NewPaverCostperPiece = 2 + 0.1 4 = 2.4?$perpiece

- Number of pieces required per m?2;: 35 pieces/m?2;

For the new pavers, the total cost is

NewPaverCost = 500?m?2; 35?pieces/m?2; 2.4?$perpiece = $42,000

Cost Implication for Pavers:

PaverCostDifference = 42,000 ? 25,000 = 17,000?$increase

2. Cost of Base Layer (AI-04)

The base layer thickness was increased from 80mm to 94mm (90mm + 4mm, where 4 is the last digit of the SID). We will calculate the cost of the base layer using a pro-rata method based on the change in thickness.

Original Base Layer

- Thickness: 80mm

- Cost per m?2;: $60 per m?2;

For the original base layer, the total cost is:

OldBaseCost=500?m?2; 60?$perm?2; = $30,000

New Base Layer

- Thickness: 94mm

- Cost per m?2;: The cost for a 100mm base layer is $75 per m?2;. We use a pro-rata method to calculate the cost for 94mm:

NewBaseCostperm?2; = 60 + (75?60100?80) (94?80) = 60 + (1520) 14 = 60 + 10.5 = 70.5?$perm?2;

For the new base layer, the total cost is:

NewBaseCost = 500?m?2; 70.5?$perm?2; = $35,250

Cost Implication for Base Layer:

BaseCostDifference = 35,250 ? 30,000 = 5,250?$increase

3. Total Cost Implication

The total additional cost due to the changes in AI-03 and AI-04 is:

TotalCostDifference=17,000?$(Pavers) + 5,250?$(BaseLayer) = 22,250?$increase

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank