Commodity Price Interdependence: A Decade of Soybean and Oil Market Dynamics ECOM4026

- Subject Code :

ECOM4026

Slide 1: Introduction

- Soybean is a primary feedstock in the biodiesel industry, and its prices rely on international oil prices (Morciani, 2023).

- Variation in oil prices influences the transport and production expenses of soybeans.

- Both commodities have relations of demand and supply especially in the energy markets for both commodities.

- Fluctuations in oil prices affect soybean market demand through biofuel regulation.

Speaker Notes: The following presentation analyses the shift in global commodities through the passing of time but with an emphasis on a comparison of soybean and oil (petrol) prices within the last ten years. Given its position as an agricultural product, soybeans have a rather specific link to oil in the form of an input to biofuel biodiesel, which is used instead of traditional petroleum-based fuels. Soybeans are also dependent on oil for production and transportation thus; the price of the oil directly affects the cost of the soybeans. In terms of demand and supply analysis, interactions regarding price elasticity amongst substitutes and complements are presented.

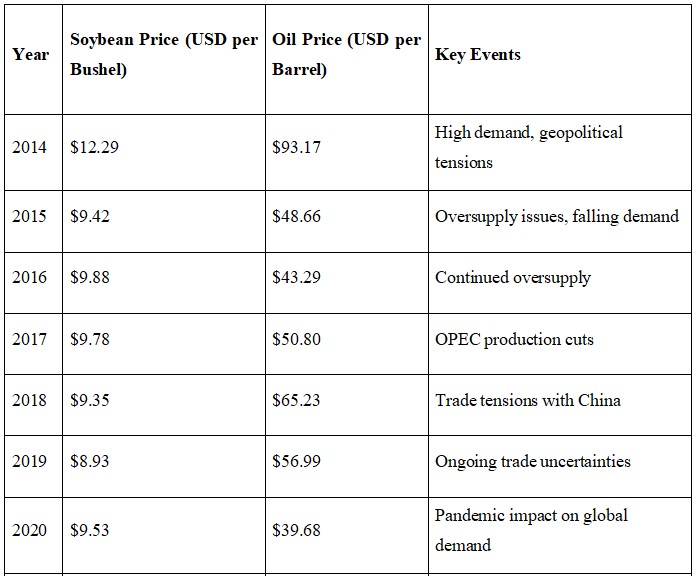

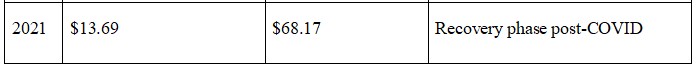

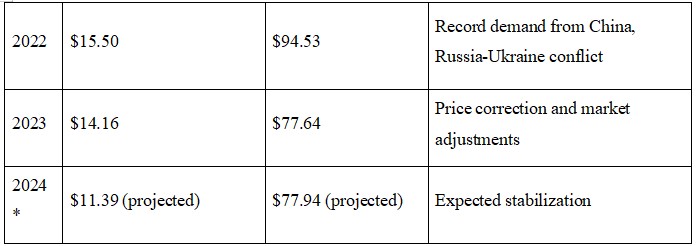

Slide 2: Historical Price Trends (2014-2024)

- Price Fluctuations: Soybean prices ranged from $12.29 in 2014 to $15.50 in 2022 and declined to an average of $14.16 in 2024 (Macrotrends, 2022).

- Key Drivers: The prices increased due to a demand push from China and a supply pull due to geographical issues.

- Market Corrections: It reduced to $8.93 in 2019 mainly as a result of supply exceeding demand due to the existence of new plants.

- Future Projections: 2024 projections are lower to approximately $11.39 as a result of shifts in weather and export demand.

Speaker Notes: The prices of soybeans, which have shown high fluctuation in the period 2014-2024 have been influenced by some of the factors. The average price in 2014 was $12.29 per bushel but continued to drop to $8.93 in 2019 because of low demand and high supply. The market recovered slightly in 2020 and traded at $9.53 per bushel, then it again made an increase to $15.50 in the year 2022. This was largely attributed to vigorous consumption from the Chinese market and interferences in supplies occasioned by geopolitical factors. After a period of decline in average prices to $14.16 in 2023 and expected to drop to $ 11.39 per bushel in 2024. This reduction indicates that prices have returned to earlier levels seen before recent spikes, as a result of one or more of several factors including adverse weather conditions, export demand concerns, and continuing geopolitical concerns.. The act on the soybean market during the discussed period can be determined as having significant ups and downs throughout the years, reflecting the processes of interdependently linked supply and demand.

Slide 3: Overview of Soybean and Oil Prices (Year-on-Year Data)

Speaker Notes: Soybean and oil rates showed a volatile tendency from 2014 to 2024 mainly due to some global factors. The price per bushel of soybean reached $12.29 in 2014 because of the high demand and geopolitical issues and a barrel of oil equally has cost $93.17. However, through the year 2015, soybean price drop to $9.42 due to oversupply similar to the situation of oil which was priced at $48.66. The year 2016 also followed this trend of low soybean prices the average being $9.88 while oil was $43.29. It started recovering in 2021 with the global recovery with the soybean prices reaching $13.69 and oil $68.17. Soyoabean price reach to $15.50 in 2022 due to record demand from China and Russia Ukraine crisis, on the other hand oil price reach to $94.53. The average price in 2023 was Soybean at $14.16 and Oil $77.64. The estimated value for 2024 points to new stabilities those are; soybean $11.39: oil $77.94: Markets change to the previous high.

Slide 4: Demand and Supply Analysis (Soybeans)

- Increasing demand from food industries and biodiesel production has spurred higher soybean prices.

- Weather patterns, geopolitical tensions, and COVID-19 have disrupted soybean supply globally.

- Together, these two countries dominate global production, influencing international supply levels.

- Prices fluctuate due to demand for alternative uses like soybean oil and meal (Voora et al., 2024).

- U.S. and Brazil subsidies help stabilize production despite external challenges.

Speaker Notes: The use of soybeans is determined by both their traditional applications as food products and by emerging markets including oil-based biodiesel. The combination of accelerating population growth and increasing health trends and environmental concerns promoting plant-based diets ensure that the demand for soybeans increases at a rapid clip. On the supply side, weather conditions such as droughts in Brazil or frost in the U.S. can impact crop yields significantly. Additionally supply shocks can also arise from things as simple as trade tensions between the US and China. The effect of all these factors on the price of a ton of soybeans can be considerable. To balance the risk of these shocks, government subsidies to farmers in major producing countries hedge the price paid by consumers. This results in a relatively stable aggregate supply from these producers.

Slide 5: Demand and Supply Analysis (Oil)

- Increased economic activity, particularly in emerging markets, drives higher demand for oil.

- OPEC plays a major role in managing global oil supply by adjusting production quotas (Kisswani, Lahiani and Mefteh-Wali, 2022).

- Geopolitical tensions and natural disasters cause sharp supply disruptions, leading to price swings.

- New extraction methods like shale oil in the U.S. have increased global supply.

- Shift toward renewable energy has influenced long-term oil demand projections.

Speaker Notes: Oil demand is strongly correlated with the state of the world economy, expanding when economies grow and implying an increase in energy, and particularly transport fuels, demand. OPEC, particularly Saudi Arabia, remains a significant factor in managing global supply by moving products to the market in response to demand or to stabilise prices. That can be disrupted by geopolitical disputes, sanctions or natural disasters, and results in some of the short-term spikes in prices seen in recent years. The Ukraine conflict sent shock waves through energy markets around the world. High-volume US shale oil production is becoming a major factor in global oil markets, expanding supplies internationally and, in the short term, putting downward pressure on prices. In a longer time frame, demand for oil is expected to be reduced by competitive green energy alternatives, and by environmental concerns such as carbon emission regulations that will lower demand for oil.

Slide 6: The Link Between Soybean and Oil Prices

- Soybean oil is a significant feedstock for biodiesel, linking its price to oil.

- Changes in crude oil prices often affect biodiesel demand and, in turn, soybean oil prices.

- Higher crude oil prices incentivize greater use of soybean oil in biodiesel production.

- Rising oil prices increase transportation and production costs, indirectly raising soybean prices (Bushnell et al., 2022).

- There is a strong correlation between energy prices and agricultural commodities like soybeans.

Speaker Notes: Soybean and oil prices appear to be connected primarily through the presence of soybean oil as a feedstock for biodiesel: when crude oil prices rise, such that biofuels become more competitive, more market demand makes its way into soybean oil, which in turn bids up the prices of soybeans since a larger portion of the crop is directed to oil production instead of food products. The opposite holds true when crude oil prices fall, namely, demand for biofuel declines, the surplus of vegetable oil weighs on prices, and market conditions remain weak. Finally, it is clear that soybean prices rise when oil prices rise because the energy-intensive nature of farming inputs and transportation push up these costs, too. Historical prices have displayed positive correlation between the two markets. Periods of high prices in one market tend to be mirrored in the other, albeit with oil prices showing greater fluctuations that make their way more immediately to soybean prices.

Slide 7: Elasticity of Demand and Supply (Soybeans)

- Soybeans have relatively inelastic demand due to their essential role in food and biofuel industries (Catarina et al., 2024).

- Supply is more elastic in the long run as farmers can adjust acreage based on price signals.

- Demand is less responsive to price changes due to limited substitutes, particularly in food products.

- Supply elasticity is influenced by weather conditions and agricultural productivity.

- Changes in global trade policies can quickly affect both supply and demand elasticity.

Speaker Notes: Relatively elastic demand because soybeans are an important input in both food and biofuel production and little elasticity on the supply side in the short-run because there are not good substitutes for livestock feed and biodiesel. In the long-run, demand is inelastic because there is a small number of substitutes for soybeans, and in the long-run supply is elastic, farmers can choose how much acreage to use on soybeans based on expected profitability. Nevertheless, short- be less elastic, as it is constrained by external factors such as weather. More complex to consider are interactions with the international market for soybeans. Trade tariffs and quotas can distort supply and demand; with such large nations as China and US with big interests in world trade, these factors make demand and supply both more inelastic than typical commodities.

Slide 8: Elasticity of Demand and Supply (Oil)

- Oil demand is price inelastic in the short term due to limited substitutes.

- Over the long run, as alternative energy sources emerge, demand becomes more elastic.

- OPECs control over supply can affect the price elasticity of oil by adjusting production levels (Quint and Venditti, 2023).

- Innovations in energy technology can lead to more elastic supply over time.

- High volatility in oil prices creates challenges for measuring true elasticity.

Speaker Notes: In the short run, the demand is in-elastic because oil is still primary energy supply and has no systematic substitute in transportation and industry. However, in the long run, with the development of renewable energy sources such as solar and wind powers, the demand can be more elastic. The supply side is also manipulated by OPEC. By reducing or increasing the production, OPEC can affect price elasticity. On the other hand, the technological improvements in the level of energy recovery and production, such as fracking in the US, introduced a growing elasticity of the supply side over the time. Although the prices of oil are in many ways determined by geo-political factors and by extreme events, this volatility makes both the estimation of demand and supply elasticity difficult.

Slide 9: Substitutes for Soybeans and Oil

- Peas, lentils, and other legumes serve as protein substitutes in food production.

- Palm oil and rapeseed oil are alternative biodiesel feedstocks to soybean oil.

- Solar, wind, and electric vehicles offer alternatives to oil in the energy and transportation sectors.

- Plant-based proteins, like peas and algae, are emerging as substitutes for soy in vegan diets.

- Transitioning to renewable energy can reduce oil dependence and increase demand for bio-based alternatives (Estevez et al., 2022).

Speaker Notes: While there are many substitutes for soy, for example in food production where lentils, peas and other legumes are utilized as protein sourcing alternatives, soy still dominates in many processed foods and animal feeds. In the biofuels industry, alternatives exist such as palm oil and rapeseed oil which can be used as biodiesel feedstocks that, however, have their own set of environmental issues. In the energy sector renewables such as solar and wind are reducing the global demand for oil, particularly as electric vehicles become more common. Changes in consumer tastes, including the rise of plant-based meat and sustainable agriculture, are driving the development of new sources of protein, including algae and other alternatives, that could replace soy. In the very long term, these trends could fundamentally alter the demand.

Slide 10: Compliments for Soybeans and Oil

- Soybean oil is one of the main feedstock for biodiesel and a substitute for crude oil in the energy market (Suhara et al. 2024).

- Soybeans and oils are related to production and transportation since oil-based fuel has a direct impact on the cost of soybeans (Zeneli, 2022).

- Oil hikes can push the demand for biofuel and demand for soybeans will be pushed up.

- Soybeans and oil are reflected by the higher prices of oil resulting in extensive farming for the soybeans.

Speaker Notes: Soybeans and oil are closely linked through the production of biodiesel, where soybean oil serves as one of the main feedstocks. As oil prices rise, so does the cost of transportation and production for inputs in agriculture such as soybeans, since fuel is an important input in agriculture. As a result, oil and soybeans are complements in production. Furthermore, when crude oil prices rise, demand for other renewable fuels such as biodiesel also increases, thereby elevating demand for soybean oil too. As a consequence, the soybeans renewable energy production increases the soybeans value in the marketplace. As oil prices rise, those higher costs are passed along to farmers, so cottonseed prices are higher due to the increased cost of farm inputs such as fuel, fertilizers, and power. Thus, high oil prices contribute to the cost of production as well as the market price of soybeans.

Slide 11: Other Factors Impacting Commodity Prices

- Cooperation itself ties supply chains and it is getting affected by conflicts, sanctions, and trade wars that influence prices.

- Droughts, floods, and frosts kill yields and commodities of the agricultural lands available (Qian et al. 2020).

- Swings in major currencies affect the international price of commodities and the U.S. dollar has the largest impact of all major currencies.

- Advancements in competition and extraction techniques can instigate augmentation in supply and subsequently lower its prices.

Speaker Notes: Natural calamities such as wars and other trade restrictions are common causes of product shortages and much higher prices. Likewise, variations in weather factors like drought, frost, and others have a significant effect on the production of crops, for the efficacy of food commodities in relation to availability in the markets. The volatility of exchange rates, especially of the US dollar has a prima facie relationship with the setting of prices of commodities that are exchanged internationally. Finally, innovation in the farming practices in food production, the methods of extracting oil, or the supply chain to the supermarket may reduce costs and therefore supply will trump demand over the long run.

Slide 12: Conclusion

- Policymakers should take soybeans and oil together due to the relationship between biofuel and transport costs.

- They both are so sensitive to price shocks of geopolitics, environment, and economics, that prices could fluctuate massively.

- Soybean has a low cross elasticity of demand while oil and it increases as the technology for other energy develops.

- Leverage is anticipated to stabilize in both markets excluding extraneous variables impact on prices.

Speaker Notes: The changes in the soybean market are most closely related to biodiesel and energy usage in the farming of soybean and oil. The two have been volatile in the past resulting in geopolitical tension, natural disasters, and shifts in demand in the global arena. Soybean requirement is less sensitive to price changes because good substitutes are unavailable but oil requirements are set to reduce their price sensitivity as new sources of energy emerge. The more time is forecast into the future, future trends indicate a continual level of neither growing fast, nor dropping drastically for both commodities, but shifts in global trade policies, weather conditions, and advances in technology will still affect the prices of the said commodities.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank