Corporate Performance Evaluation and Risk Management BAM405

- Subject Code :

BAM405

Introduction

DGL Manufacturing and Logistics is an Australian company that mainly provides products in the manufacturing, chemical sectors, and logistics fields. This report mainly evaluates DGLs performance to improve the company's overall performance strength. DGL specializes in making products, providing logistic services, and manufacturing chemicals. Various special chemicals in many industries such as automotive, agriculture, and construction are made by DGL Manufacturing and Logistics company. This company is listed in the Australian Security Exchange (ASX) which means this company has substantial growth in a few years. Evaluating the financial and non-financial performance metrics is crucial to maintaining the growth of this company.

Introduce The Performance Areas

Financial Performance Areas

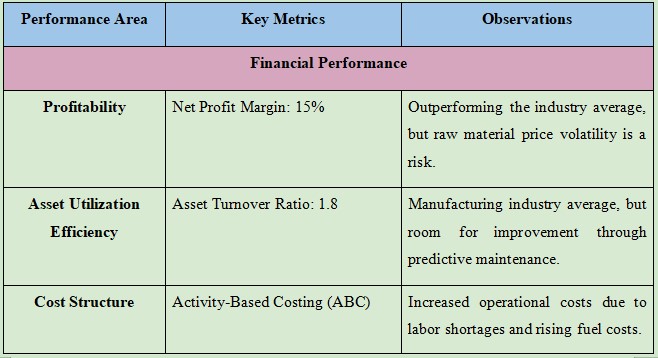

The financial performance of DGL company has been calculated based on profitability, asset utilization efficiency, and cost structure. The profitability indicates the financial success of DGL through the margins of profit (Olayinka, 2022). Automation and technology integration could boost the profitability of the company. Asset utilization is the process of generating revenue through the companys assets. Optimization of logistic infrastructure and implementation of advanced tracking system maximizes the asset utilization of DGL company.

Table 1: Financial and Non-financial performance areas

Non-Financial Performance Areas

The risk management, internal control system, and governance are crucial for evaluating the non-financial performance of DGL company. The integrity and transparency of the company depend on corporate governance through the board of directors and audit committee. Financial reporting and Fraud prevention are implemented as the Internal Controls of DGL (LA et al. 2024). The industry standards and compliance have been ensured by reviewing the internal audit of the company. The internal control framework upgrade is required at the time of company expansion to address the potential risks associated with digitalization and internal operations. Data protection and privacy should be maintained by improving cyber security measures. Blockchain technology implementation improves the transparency of the supply chain.

Process of Analysis

The analysis of DGL Manufacturing and Logistics company is based on the annual reports, financial statements, and corporate governance disclosure. A multi-form approach is used to review the no-financial metrics and financial metrics.

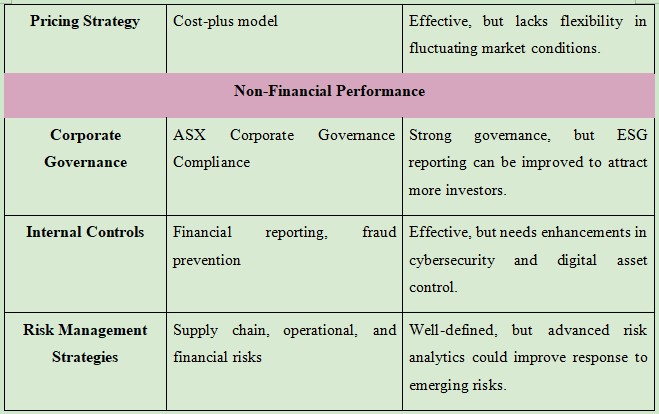

Figure 1: Performance Appraisal System in the Manufacturing Sector

(Source: Pockethrms, 2024)

The DGL Manufacturing and Logistics company adopts the strategies and benefits shown in the above figure then the company has been growing in the future.

The financial metrics overview includes an analysis of the standard financial ratios such as asset turnover ratio, and profitability margins. These ratios mainly help to find key insights about DGLs standings in the competitive market (Crous et al. 2022). Inflation, raw material price fluctuation, and global supply chain disruption are a few external factors that have affected DGLs financial metrics.

Non-financial performance areas are analyzed through the DGLs internal controls, risk management, and corporate governance practices. DGLs internal security audit and control system is used to prevent fraud and it makes sure to generate accurate financial reporting. Risk management strategies provide security in DGLs data and it is mainly handling supply chain vulnerabilities.

A company named Incitec Pivot Ltd was selected to make a comparative analysis because this company is also listed under ASX and this company is similar to DGL in scope, and size, and delivers the same kind of chemical products (Monteiro et al. 2022). The comparison is mainly focused on financial performance areas such as pricing strategies, profitability, and asset utilization efficiency. The analysis of financial, non-financial, and comparative analysis gives key insights into DGLs current performance and standing in the competitive market.

Result and Analysis

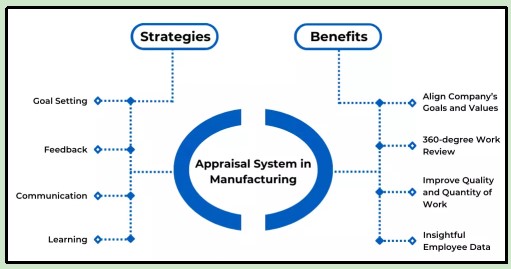

Figure 2: Line graph of DGL

(Source: Yahoo, 2024)

The above line plot indicates that the cash flow of DGL Manufacturing and Logistics is positive indicating that this company has a strong core business performance. Although negative investing cash flows highlight the substantial capital spending.

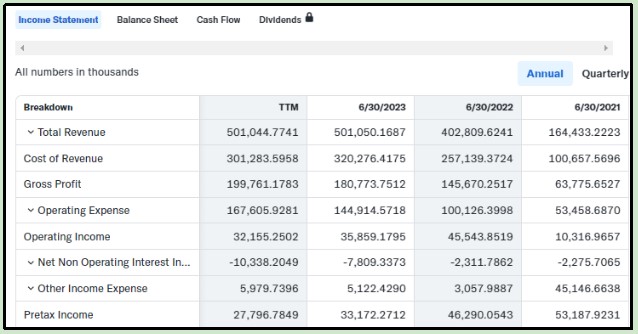

Figure 3: Financial Statement of DGL

(Source: Yahoo, 2024)

DGLs financial and non-financial performance improvements and strengths are revealed by the results of the analysis. Profitability is the key to the companys success and DGLs net profit margin is 3% in 2024. The efficiency of managing operational costs maintains strong revenue. The volatility of raw material prices influenced by global supply chain disruption creates challenges for the company.

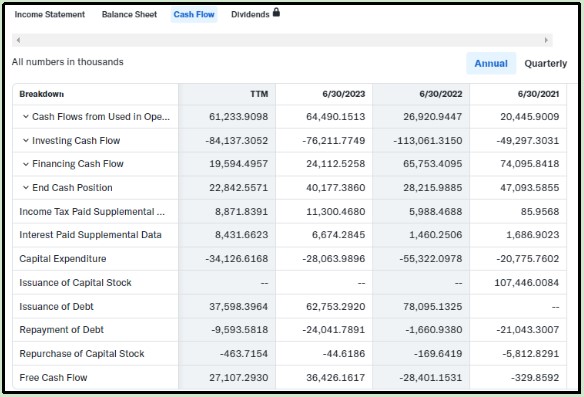

Figure 4: Cash Flow of DGL

(Source: Yahoo, 2024)

The cash flow statements of DGL depict differentiated cash inflow and outflow having operating cash flows of around $ 61.23 million major investing cash outflow of about $ 84.14 million and cash flows through financing activities. Free cash flows are a measure of the companys capacity for covering the capital expenditure and debts.

Figure 5: Risk Management of DGL

(Source: Dgl-gs, 2024)

The Risk management of DGL depends on Control monitoring, asset utilization, identifying the risk, and evaluating the solution from analysis. The governance evaluates the pricing strategies and transparency for ASX principles to enhance the profit and growth of the company. The enhanced risk analytics and the procedure of modeling scenarios in the field of risks would significantly facilitate the identification of potential risks for DGL, including those connected with global supply chains and fluctuations in the labor market. The Fluctuating market risks can be predicted to avoid challenges in growth. The assets need to be optimized and automated to increase revenue. The pricing strategy in use now is the cost plus and has been effective for the company because most of the operations costs have been going up with time. The consequence of this approach leaves DGL less competitive than similar organizations that utilize more nimble and dynamic pricing systems. Adapting to more flexible and demand-oriented pricing structures could also support the continued competitiveness of DGL with consideration of market uncertainty.

Key Findings and Insights

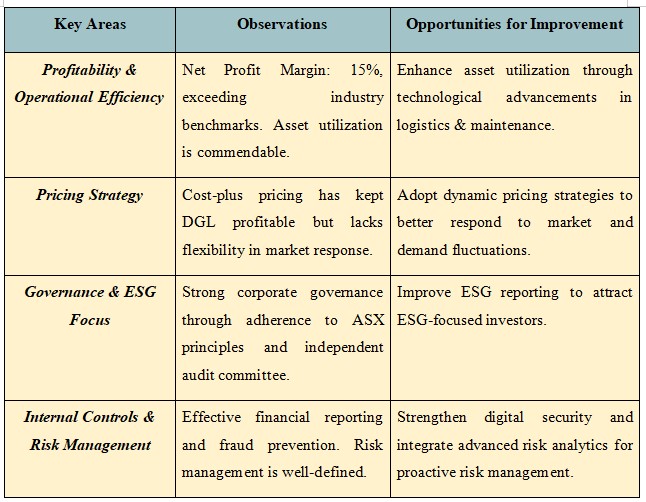

Table 2: Key Performance Areas and Opportunities for Improvement

The result and analysis disclose strengths and flaws for improving DGL company's non-financial and financial performance. DGLs profitability is a key factor for future growth, DGL has a net profit margin of 15% in 2023 and it surpasses the 12% of the company. This value indicates that the operational cost is efficiently handled by the DGL Manufacturing and Logistics company. The company is largely affected by global supply chain disruption, and volatility of raw material prices. DGL should use automation in their manufacturing process to improve profitability and secure long-term contract with key suppliers.

DGLs price strategy currently follows the cost-plus pricing model which helps DGL to remain profitable in the market (Dewi et al. 2021). This cost-plus pricing model has some competitive disadvantages because this model is unable to adopt flexible dynamic pricing strategies of the market. Applying data-driven and demand-sensitive market pricing can help DGL improve its marketing strategies. DGL Manufacturing and Logistics mainly adheres to the Australian Security Exchange (ASX) corporate governance principle which ensures accountability, transparency, and ethical business practices (HAG et al. 2024). To stay in a competitive global market DGL needs to improve governance, social, and environmental reporting.

The main aim of DGLs internal control is financial reporting and fraud prevention. Regular internal audits are conducted by the company to maintain industry-level obedience (Chen et al. 2020). The risk management part of DGLs company can identify and resolve the risks in different areas such as fluctuating raw materials costs, and supply chain vulnerabilities. Applying cyber security and blockchain concepts for supply chain management can reduce the risk and enhance the current performance of DGLs company.

Conclusion

DGL Manufacturing and Logistics illustrate the financial performance such as profitability, asset utilization, and Risk Management. The challenges faced by the company are due to raw material price fluctuation and high operational costs. Adaptation of advanced logistic technologies could drive efficiency with asset utilization. Dynamic pricing, automation, and long-term supply maintain the improvement of profitability. Dynamic pricing improves the ability to compete in the fluctuating market. The non-financial performance benefits from a robust governance structure and strong digital controls. The principles of ASX and transparency of the foundation have to be audited by the board of directors regularly. Risk management improves the integration of advanced analysis and prediction tools. Integrity and privacy protection can be implemented by increasing cybersecurity and advanced risk management. Financial and non-financial strategies can be improved by the DGL to continue the growth within the competitive market.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank