Equity Valuation and Strategic Investment Analysis: A Case Study of Grab Holdings Limited FIN4027

- Subject Code :

FIN4027

Executive Summary

This is the detailed valuation assessment for Grab Holdings Limited, one of the major super-apps operating across Southeast Asia. Founded in 2012 as a ride-hailing company, it diversified into food delivery, digital payment, & financial services, becoming a part of everyday life for millions within the region.

After performing detailed analyses using both the DCF method & the Market Approach method, supplemented by a qualitative assessment of the company's strategic position & risks, this study recommends an investment in Grab Holdings Ltd. This recommendation is driven by strong growth prospects, robust market presence, & strategically diversified risk mitigation.

Company Overview

Business Model: Through the Grab platform, it connects millions of consumers with driver- and merchant-partners, who enable interaction & trade. The most significant source of revenues comes from the service fees & commissions charged from these partners retained by Grab from fares or orders it collects on their behalf (Jugnoo, 2021). Other sources of revenue for Grab include payment processing transaction fees charged to the merchant-partners.

It also gives various incentives to driver & merchant-partners that are recorded as reductions in revenue. At times, these rewards are even higher than the commission & fees that Grab earns.

Revenue Segments: Deliveries: It facilitates services such as GrabFood, GrabKitchen, GrabMart, etc. which allow meal, grocery, deliveries on-demand & scheduled (Grabs, 2024).

Mobility: This includes transport services like GrabCar, GrabTaxi, GrabBike, etc. all of which give customers alternatives for transportation in the form of private cars, motorcycles, & car rentals.

Financial services: GrabPay, GrabRewards, GrabFinance, GrabInsure, & OVO provide digital payment, lending, insurance, & wealth management solutions (Grabs, 2024).

Key Value Drivers: Diversification of services: It has multiple revenue streams which originate from a diversity of services.

Market Leadership: It has a stronghold in Southeast Asia.

Several strategic partnerships will be established with financial institutions & local businesses, in general (Grabs, 2024).

Industry Analysis

It operates in the fiercely competitive landscape of Southeast Asia's super-app market for ride-hailing, food delivery, and financial services. This region has a fast pace of growth in the digital economy, which is driven by increasing internet penetration and smartphone usage, thereby making for a fertile ground for the delivery of varied services (Global data, 2023).

Its competitors include; Uber Technologies Ltd., DiDi Global Inc., Lyft, Doordash Inc., Deliveroo Plc., Sea Limited, Meituan (Tracxn, 2024).

Among the competitive advantages that set Grab apart from regional & international competitors alike are a comprehensive service portfolio & strong regional focus.

Historical Financial Analysis

From 2018 to 2023, Grab's revenue grew strongly from negative revenues of $-845 million in 2019 to $2,359 million in 2023, thus showing strong growth. Their cost of goods sold increased modestly from $1,320 million in 2019 to $1,499 million in 2023, thus showing better cost management (Appendix-1).

Net earnings improved from -$3,747 million to -$434 million, which indicates the company is trending toward reduced losses & possible profitability. The gross margin was turned positive in 2022 & reached 36.5% in 2023, reflecting enhanced operational efficiency (Appendix-1).

Receivable days also improved from 2020 to 2023, Leverage decreased from 0.28 in 2021 to 0.26 in 2023, & thus the financial risk decreased. ROA, ROE, and ROCE, while negative, improved significantly during the period. Improved capital utilization was thus portrayed.

The debt-to-equity ratio also decreased from 10.9 in 2019 to 0.06 in 2023, portraying high deleveraging.

On the whole, the historical financial performance of Grab portrays strong revenue growth, improved profitability, and enhanced operational efficiency.

Financial Projections

Based on the data & computations furnished, the financial projections for 2024 are presented in Appendix-2 and justification is as follows:-

Revenue:

Average Annual Growth: (2359-(-845))/5=640.80

Average Annual Growth Rate: 640.80/?845?75.83

Projected 2024 Revenue: 2359*(1+0.7583)?4147.93

Costs of Goods:

Average Annual Growth: (1499?1320)/5=563.80

Average Annual Growth Rate: 563/1320= 42.71%

Projected 2024 Costs: 1499*(1+0.4271) = 2139.25

EBIT:

Average Annual Growth: (?482-(-2981))/5 = 499.8

Average Annual Growth Rate: 499.80/?2981=-16.77%

Projected 2024 EBIT: ?482 (1?0.1677)=?401.19

Earnings:

Average Annual Growth: (?434-(-3747))/5=662.6

Average Annual Growth Rate: 662.60/-3747=-17.68%

Projected 2024 Earnings: ?434*(1?0.1768)=?357.25

Gross Margin:

Average Annual Growth: (0.36?2.56)/5=0.59

Average Annual Growth Rate: 0.59/2.56?22.85%

Projected 2024 Gross Margin: 0.37(1+0.23)=0.448

Valuation Methods

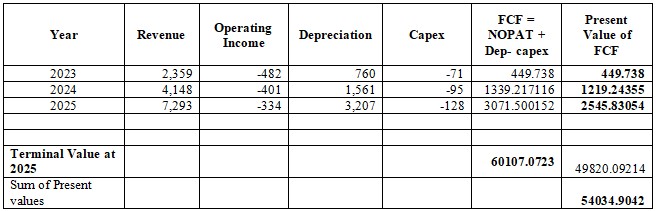

Anticipating Future Cash flows, with compounded annual growth rate projected in Appendix-2 & perpetuity growth of 4.5%

Using Discounted cash flow model (DCF)-

TerminalValue at 2025 = (3071.50*1.045)/(0.0984-0.045) = 60,107.0723

Present value of TerminalValue at 2025 = 60107.0723/(1.0984)2 = 49,820.03214

Sum of Present values from 2022 to 2025 = 60107.0723 + 49820.032 = 54,034.9042

Using Market Approach-

TEV/Total Revenues

Grab Holdings (GRAB): 4.2x

Comparables:

Uber: 3.6x

Lyft: 1.2x

DiDi Global: 0.6x

Gojek: 2.1x

Sea Limited: 3.1x

The multiple of 4.2x stands well above the mean and median of its peer group, at 1.8x and 1.7x respectively, indicating a high market valuation regarding revenues, hence strong investor confidence in Grab's future growth.

TEV/Forward Total Revenue

Grab Holdings (GRAB): 2.5x

Comparables:

Gojek: 2.1x

Lyft: 0.96x

DiDi Global: 0.6x

Sea Limited: 2.61x

With the multiple higher than the mean & median, respectively, at 2.5x, that gives a view of expectations of strong future revenue growth compared to regional peers.

Risk Analysis

Financial Risk- Despite huge revenue growth, Grab hasn't generated any profit yet. How well the company does in containing cost structures and delivering on positive EBITDA is key to long-term valuation.

Impact: Medium.

Competitive Risk- It competes neck and neck with regional and global players like DiDi,, Uber, GoTo, & Sea Limited.Impact: High.

Regulatory Risk- Grab operates across multiple countries in Southeast Asia, each of which comes with its unique regulatory environment. Any change in regulationsstricter rules on ride-hailing services, data protection laws, or financial servicescan deal a big blow to Grab's operations and profitability.

Impact: High.

Conclusion and Recommendations

Following is a detailed analysis of the DCF and market approach methods, and taking a closer look at Grab's strategic position and growth prospects against the risks, we are quite positive about recommending an investment in Grab Holdings Limited. Though currently unprofitable, Grab has shown robust revenue growth, improved operational efficiency, & a strong market in Southeast Asia. The valuation methods indicate the confidence investors have in its future growth, reflected in higher multiples compared to peers. Though the level of regulatory and competitive risks remains very high, this company still demands closer tracking. Closer scrutiny is needed in cost management and strategic partnership strategies in the quarters ahead, which are critical for maintaining a growth trajectory & moving to profitability.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank