Personal Financial Planning and Risk Management FINA3102

- Subject Code :

FINA3102

Question 1

Email: Home Loan Recommendation

Dear Tom and Rewa

Thank you for reaching out regarding your home loan. After considering your situation and plans, I have researched the current outlook for home loan rates and selected a suitable loan structure that aligns with your goals. Below, I summarise the recent commentary on home loan rates and a recommended home loan structure that suits both your financial position and long-term objectives.

a. Current Outlook for Home Loan Rates

Interest rates in Aotearoa New Zealand are fluctuating meaning the housing market is fragile and unstable. According to an ANZ Bank commentary, the Reserve Bank of New Zealand (RBNZ) has been riding inflationary pressure recently by hiking Official Cash Rates (OCR). The OCR sits at a near-high level of 5.5%. Therefore, banks have continued to move their mortgage rates even higher. While that has made it more expensive for would-be homebuyers to borrow, the OCR is edging closer to its peak at least if early indicators are anything to go by and future rate hikes will probably be subject to a diminishing pace or could well come to an end. In the second half of 2024, more benign inflation pressures and an RBNZ that has started shifting towards a more accommodative stance will likely result in some economists predicting a gentle easing in interest rates.

Over the short term, mortgage rates should remain higher. But, importantly for the longer term, fixed-rate loans could protect against rises as the borrower stands to benefit when market rates go up. Combining fixed rates and floating may also be used flexibly to make the most of falling rates expected in future while protecting from short-term upswings (ANZ Bank New Zealand, 2023).

b. Recommended Home Loan Structure

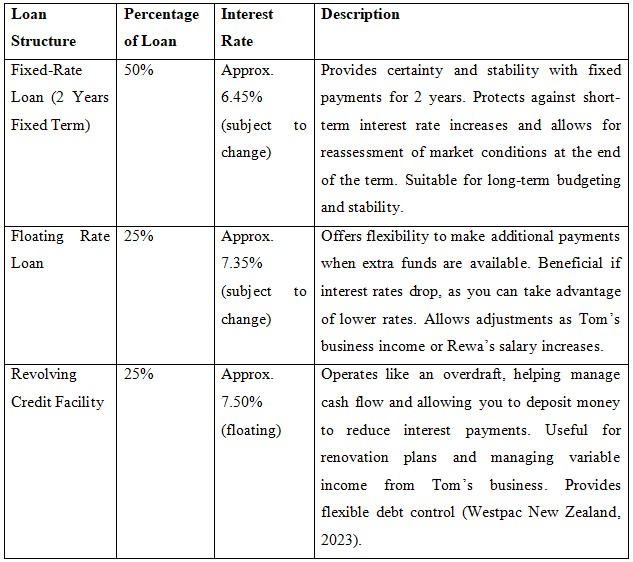

For the present situation, the research aspect of the home loan products offered by Westpac New Zealand as they provide a wide range of flexible mortgage options that synchronize well with the needs and preferences.

Suggested Home Loan Structure:

Why This Structure Works for You:

Character and Goals:

Conservative Rewa is more guarded and has likened fixing a large portion of the loan will giving her peace of mind by providing stability in repayment. From a riskier borrower perspective, Tom may be more drawn to the flexibility inherent in the floating portion and the facility itself. It appealed to both since it does provide a mix of fixed and floating portions.

The revolving credit facility also works to renovate the property and makes sense because it helps manage debt. The more additional savings or income placed into the revolving credit account, the lower your overall interest and help further your early retirement goals.

Financial Situation:

Both of you are on solid career paths by the age of 35, and likely to continue earning more as long as in retirement. Floating and revolving credit allow you to pay some parts of the loan faster, all of this helps keep you reduce your debt sooner and easily make it to retirement without having to carry a large mortgage with you.

Tom has a healthy growing business but now lives with large income variability. This preference for a more elastic, or flexible structure of loan is used to mould against the cash flow variance to provide a way of avoiding the spatial and temporal over-constrained that revives those plan paydown quicker each time it may be done.

Outlook for Interest Rates:

With interest rates as high as they currently are, fixing part of your loan is a way to hedge against further increases. Still, a floating rate portion means you get the upside if rates fall as some economists are now forecasting. The revolving credit facility, in combination with the floating component, also provides a lever to you so that you can handle the loan more actively and reduce your interest costs as much as possible.

Conclusion

The way I have recommended structuring the loan is a combination of stability, flexibility and control which will perfectly fit within your early retirement/ home improvement / controlling Tom's income volatility goals. At the same time, it factors in the market at present, so you can hedge against higher rates today while leaving yourself options for tomorrow.

If you have any questions or need help with the next steps, feel free to leave a comment and let me know. I am more than willing to assist you with your loan and promise that I will make it as smooth a process as possible.

Best regards,

Question 2

Subject: Insurance Recommendations for Your Current Needs

Dear Simon,

Thank you for meeting with me and sharing your personal and financial situation. I understand that as a solo dad of two young daughters, Julie and Olivia, you want to ensure their security and well-being, especially following the recent passing of your partner. Below, is a comprehensive insurance strategy tailored to your needs and budget. This includes recommendations for general insurance, life, disability, and health insurance, with a focus on prioritization.

Part A: General Insurance Products

After reviewing your situation, I recommend looking into Tower Insurance as your general insurance provider. They are a well-known insurance company in New Zealand that offers comprehensive coverage options suited to your needs (Tower Insurance, n.d.).

Recommended General Insurance Products:

Contents Insurance: Given that you live rented and by itself figures upon having around $140,000 valuation on goods, Contents Insurance is essential. It will cover your property from losses (like fire, theft, and natural disasters)

Justification: As a renter, you may not need home insurance but you would like to know your new materials are covered for the replacement value if anything were to happen. This way you are not left with the bill of needing to replace everything on your own.

Comprehensive car insurance: If you have a car worth $25,000 and owe $12,000 to the used car lot, comprehensive car insurance covers you in case of accidents, theft or damage. The insurance will pay for repairs or replacement and offer liability coverage.

Justification: You want comprehensive coverage since you are carrying a loan. This insurance saves you from having to pay off the loan if the car is totalled or badly damaged, but also pays for most of your repair or replacement costs.

Individual liability insurance: Individual liability insurance, which is usually included in a building or car policy, covers any damage caused involuntarily by one person to the property of another or to others.

Justification: We never know when we will have an accident, and personal liability insurance is there to cover the cost of having to settle with others.

Priority: If your budget allows you to choose between home or contents-only cover, go with Contents Insurance, as this will protect what matters most to you. Consider full coverage car insurance to prevent you from falling into financial difficulty due to your vehicle.

Part B: Life, Disability, and Health Insurance Products

For life, disability, and health insurance, I recommend AIA New Zealand as a provider. They offer a comprehensive suite of products that can be customized to your unique situation(AIA New Zealand, 2023).

Recommended Products:

Term Life Insurance: If you are a single parent, this is the most crucial product for you. A term life insurance policy will pay out a lump-sum amount to help take care of your daughters should you pass away. It can support them with various other needs as well e.g. living, education etc.

Justification: You are the only support for both of your daughters. At least you know for sure that if anything is done without you they will be financially okay because of this term life insurance. Because it is cheap and provides indispensable defence for their future.

Income Protection Insurance: This policy allows you to protect up to 75% of your income if you are unable to work, due to an illness or injury. Flexible Income Protection Options that Suit Your Earnings is What AIA.

Justification: If you are the main breadwinner then income protection insurance is essential as your salary pays for the financials mentioned above. This way, you can cover your rent and any living costs in case you cannot work for an extended period without exhausting your savings.

Critical Illness Insurance: Critical illness cover pays out a tax-free lump sum if you are diagnosed with one of the specific medical conditions or injuries listed on the policy. This way in case you ever need to take some time off from work and recover, you have a payment that is going to pay for your medical expenses and normal bills.

Justification: Trauma insurance provides a financial safety net to cover expenses during serious illness, reducing the need for you to dip into your assets. Life or income protection is more important than this but, yes it adds quite a bit of value to your tasks (New Zealand Government, 2023).

Health insurance: It makes fighting a disease like cancer much easier as we can opt for treatment from indicated private hospitals where high-quality machinery and operations are conducted. AIA offers a range of coverage options through its policies, including both hospital plans and comprehensive plans.

Justification: New Zealand has a good public health system, but private health insurance can lead to faster treatment. That said, this is a low priority since you are strapped financially.

Summary of Prioritization:

1. Term Life Insurance High Priority.

2. Income Protection Insurance High Priority.

3. Trauma Insurance Medium Priority.

4. Health Insurance Medium Priority.

5. TPD Insurance Lower Priority.

I hope this helps clarify your insurance priorities. If you need assistance with setting up any of these policies or have further questions, feel free to reach out.

Best Regards.

Question 3

Subject: Understanding Your KiwiSaver Investment

Hi Veda,

Thank you for reaching out with your questions about KiwiSaver! Im here to help you navigate this investment and make informed decisions.

a. KiwiSaver Basics

i. What type of investment is KiwiSaver?

KiwiSaver is a voluntary, work-based savings initiative with numerous benefits. By a combination of you, your employer and the government making contributions which are invested in a fund that grows over time. The basic idea is to save enough money so that you can retire comfortably, by 65.

ii. Two unique benefits of KiwiSaver:

Government Contributions: When you belong to KiwiSaver, the government will even match your best efforts with an equal amount of up to $521.43 a year (as long as you contribute at least $1,042.86 annually). Which means you are saving more without even trying!

Employer Contributions: If you are employed, your employer must make a minimum 3% contribution of your salary to your KiwiSaver account. Long term, this will make a big difference in your savings account(s), especially with compound interest.

b. Default Fund Update

i. Default KiwiSaver Provider:

Lets use the ASB KiwiSaver Scheme as an example.

Latest Fund Update: (ASB KiwiSaver Scheme, 2024)

ii. Asset Classes and Target Percentages:

For the ASB Default KiwiSaver Fund, the asset classes and their target percentages are typically as follows (please verify from the actual fund update):

- Cash: 10%

- Fixed Interest: 20%

- Shares (Equities): 60%

- Property: 10%

iii. Why Invest in Different Asset Classes?

A fund manager buys a portfolio of asset classes to distribute risk and return:

Cash: Typically low risk, providing safety and lower returns. Ideal for short-term needs.

Fixed Interest: Fixed Interest provides good returns with relatively lower risk as compared to equities.

Shares (Equities): More market risk and more volatility yet higher rewards. Good for long-term growth.

Property: Diversification and maybe some income, has huge market risk.

Whether the fund remains diversified or goes on concentrating would result in a different risk-adjusted return profile across various market types.

c. Evaluating Vedas Profile

i. Why the Default Fund Doesnt Match Vedas Profile:

The default fund is typically conservative and designed for members who may not actively manage their investments. As a growth investor, you will likely have a higher risk tolerance and a longer investment horizon meaning you could benefit from a more aggressive investment strategy.

ii. Recommended KiwiSaver Fund:

I recommend the ASB Growth Fund, which aligns with your profile as a growth investor.

Latest Fund Update:

iii. Asset Classes and Target Percentages:

For the ASB Growth Fund, the target asset allocations are generally:

- Cash: 5%

- Fixed Interest: 15%

- Shares (Equities): 75%

- Property: 5%

Compared to the default fund, the growth fund has a significantly higher allocation to share, reflecting its focus on long-term growth (ASB KiwiSaver Scheme, 2024).

iv. Potential Long-term Impact of Switching Funds:

Given your 26 years of age, and the distance to retirement that you have, just moving to the Growth Fund will likely improve your long-term returns. As an investment strategy, it runs all the risks of a much heavier equity weighting but consequently a higher opportunity for growth. In the long term, this compounded difference in higher returns can make a huge difference in your retirement savings and get you closer to accomplishing your financial goals.

I hope this information helps clarify your KiwiSaver options! If you have any further questions or would like to discuss this in more detail, feel free to reach out.

Best regards,

Question 4

Part A: Understanding Discretionary Family Trusts

Ari asked whether setting up a discretionary family trust would be beneficial. Heres a brief overview to help him understand.

i. How a Discretionary Family Trust Operates

A Family Discretionary Trust is a legal structure where assets are transferred to Trustees (appointed by you) who control them and use the income for the benefit of beneficiaries. The key roles in a trust are:

The settlor: It is the person who created the trust and who transfers assets to the trust. For example, in this case, Ari would be the settlor.

Trustees: People or entities whose role is to oversee and control the assets of the trust, as set out in the terms of the trust deed. Both could be trustees Ari and, say, Kathi or a professional. They have the power to decide when and how trust assets are distributed to beneficiaries.

Beneficiaries: Those who benefit from the trust could go to Ari's family members, like Molly, Maia, Noa, and Ella. On the other hand, they have no guaranteed entitlement; it is left to the discretion of the trustees when funds are distributed.

Trust Deed: The deed lays down the constitution of a trust and specifies how the trustees may administer the assets and distribute these. Also given the trust's discretionary nature, beneficiaries must rely on the discretion of trustees to make distributions as they need change.

ii. Two Advantages of Setting Up a Trust

Asset Protection: When assets are placed in a trust as part of estate planning, they may help protect those assets from risks such as creditors (if Ari's business fails, gets sued etc). This means that the assets now belong to that trust, not Ari which would make it harder for creditors to get their hands on.

Succession Planning: By setting up a trust, Ari can dictate what happens to his assets (e.g. the seaside boat shed) on his passing. For example, he may control to remain with the family according to his wishes, removing the risk that if it is left as an asset of tenancy in common and one (or all) beneficiaries subsequently sell their share.

iii. Two Disadvantages of Setting Up a Trust

Complexity and Costs: Establishing and administering a trust means incurring attorney fees, accounting costs, and ongoing administration requirements. Ari's finances gain another layer of complication with the requirement that his trust remains within legal requirements and is managed as such.

Loss of Direct Control: Once assets are in the trust, Ari would hold neither direct ownership nor full control over those assets. Control over the assets would be with Trustees (or more) so Ari may not have a free rein on these assets.

Part B: Wills and Enduring Power of Attorney (EPA)

i. The Purpose of a Will and Its Necessity with a Trust

A will is used to specify how assets will be distributed following death, as well as allow for the naming of guardians for children. This still means that a Will is needed:

Assets that cannot be transferred into the trust such as KiwiSaver or personal effects in question are the property of the person who died. A Will addresses their disposal.

Appointment of Guardian: A Will appoint guardians for Ari's children again, a necessary step to fight back on some litigation.

Safety Net: A will can include a pour-over clause to transfer remaining assets into the trust after death.

This means a Will is still necessary for handling assets that are not inside the trust and providing for Ari's children.

ii. The Purpose of an Enduring Power of Attorney and Its Necessity with a Trust

An Enduring Power of Attorney (EPA) is a legal document that authorizes someone to make decisions on Ari's behalf should he lose mental or physical capacity. There are two types:

Property EPA: This is for dealing with financial affairs that do not involve Trust property such as a bank account or his car.

Personal Care and Welfare EPA: This appoints someone to look after Ari's health and personal care if she is ever unable to make those decisions.

An EPA is not replaced by a trust. Trustees control trust assets, but they do not have the right to determine how Ari's care or properties that are not part of a legal trust are managed. An EPA is there to appoint someone to pay your bills and take care of your welfare should you become ill or otherwise incapacitated.

Therefore, a trust does not replace the need for an EPA as he needs to address both his pecuniary affairs and also personal matters.

Are you struggling to keep up with the demands of your academic journey? Don't worry, we've got your back!

Exam Question Bank is your trusted partner in achieving academic excellence for all kind of technical and non-technical subjects. Our comprehensive range of academic services is designed to cater to students at every level. Whether you're a high school student, a college undergraduate, or pursuing advanced studies, we have the expertise and resources to support you.

To connect with expert and ask your query click here Exam Question Bank