IMPACT OF CORPORATE GOVERNANCE MECHANISMS ON SYNDICATED FIN602

- Subject Code :

FIN602

- University :

others Exam Question Bank is not sponsored or endorsed by this college or university.

- Country :

India

LANCASTER UNIVERSITY

DEPARTMENT OF

ACCOUNTING AND FINANCE

IMPACT OF CORPORATE GOVERNANCE MECHANISMS ON SYNDICATED

LOAN CONTRACTS AND TERMS

Abstract

The purpose of this dissertation is to investigate how corporate governance mechanisms affect syndicated loan contracts and conditions.

Chapter 1 presents The research focuses on the problem of debt contracting as a key aspect of business in financial markets and outlines major research questions related to borrower-lender relationships and governance effect on loan contracts.

Chapter 2 is the literature review which revealed that prior research lacks a clear understanding of the relationship between aspects of financial reporting quality, the economic environment, and market conditions on syndicated loan contracts.

Chapter 3 builds hypotheses according to the literature theories, such as agency theory and information asymmetry, to examine the impact of financial fraud and ESG disclosure scores on loan interest rates and terms.

Chapter 4 presents the research method that involved the collection of quantitative data from the syndicated loan markets, while statistical analysis was conducted using RStudio and regression models to test these hypotheses.

Chapter 5 provides empirical findings to argue that the increase in effective corporate governance, measured by board independent and high audit quality, results in better loan conditions in terms of rates of interest and covenant strings. It also discovers that the firms that have better ESG scores enjoy a lower cost of borrowing because they are perceived to be safer.

Chapter 6 concludes the discussion of the practical applicability of the governance mechanisms by asserting that the comprehension of the mechanisms can improve financial decision-making and policymaking in financial institutions.

Chapter 7 concludes the study by providing a summary of the findings, directions for further research on the interaction between corporate governance and loan markets and suggestions for future research. This dissertation makes a significant contribution to the knowledge base and generates new insights that, if implemented, can enhance financial resilience and the efficiency of debt contracting.

Table of Contents

Chapter 2: Literature Review.. 8

2.2 Syndicate loans and syndication structure. 10

Chapter 3: Hypothesis Development 11

Chapter 4: Research Methodology. 13

Chapter 5: Empirical Analysis. 16

5.2 Variables Descriptions and Formulas: 16

5.3 Descriptive Statistics. 17

Chapter 6: Empirical Results. 24

6.2 Robustness Tests for Regression Results. 30

7.2 Summary of Key Findings. 32

7.3 Recommendations for Future Research. 33

7.4 Acknowledgment of Limitations. 33

7.5 Conclusion and Contribution. 34

Table of Figures

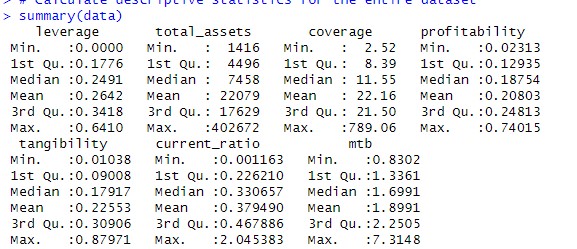

Figure 5.3.1: Descriptive Statistics for the entire Dataset 18

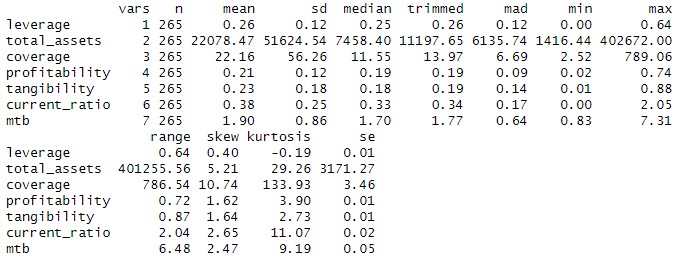

Figure 5.3.2: Detailed Descriptive Statistics. 19

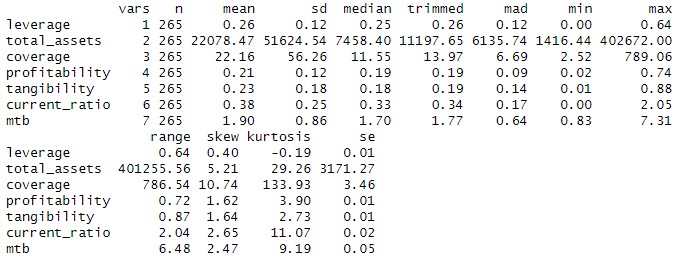

Figure 5.3.3: Specific Descriptive Statistics Manually. 20

Figure 5.3.4: Descriptive Statistics for All Numeric Variables. 21

Figure 5.4.1: Correlation Matrix. 22

Figure 5.4.2: Visualization of Correlation Matrix. 23

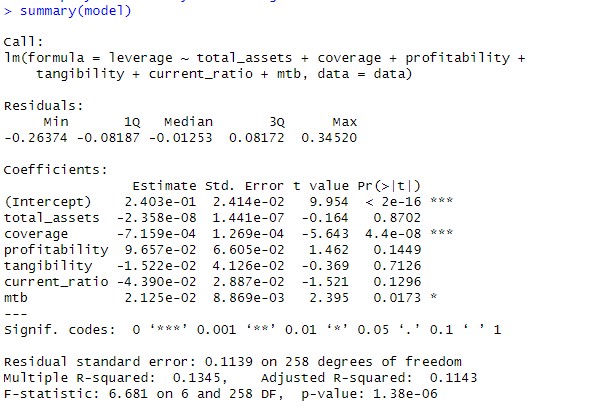

Figure 6.1.1: Regression Output 25

Figure 6.1.2: Residuals vs Leverage Plot Regression Model 26

Figure 6.1.3: Residuals vs Fitted Plot 27

Figure 6.1.4: Q-Q Residuals Plot 27

Figure 6.1.5: Scale-Location Plot 28

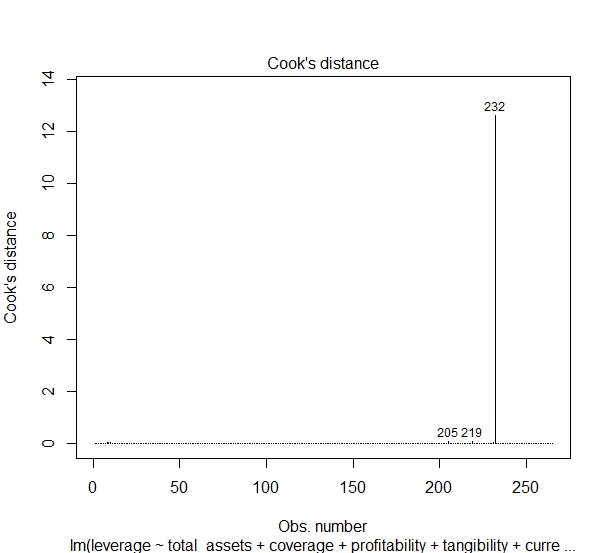

Figure 6.1.6: Cook's Distance Plot 29

Chapter 1: Introduction

Debt contracting and loan markets are indispensable components of the financial system as they enter the institutions arranging the funds and bearing the risks. It is crucial to comprehend the peculiarities of these markets and how the elements of the corporate governance system affect the characteristics of syndicated loan contracts and conditions to bolster financial stability and refine the functioning of the market. This dissertation endeavours to fill this gap within the current literature by exploring the nature of how particular governance activities shape the formation and terms of syndicated loans.

Problem Statement and Motivation

Elements of corporate governance like the board of directors, audit committee, and executive remuneration have received significant attention with regard to equity markets and firm performance. Consequently, the effect of these provisions on debt markets, especially on syndicated loan contracts, has been less researched. Syndicated loans refer to a situation when several banks come together to fund large projects, which requires proper policies to be in place aimed at minimizing all the risks associated with such structures as well as increasing the level of transparency. The primary research question guiding this study is: How does the choice of corporate governance mechanisms impact the specificity of contractual agreements for the terms and conditions of syndicated loans?

This question is vital as it regards the interface of governance and debt markets, and the insights derived therefrom are useful for lenders, borrowers, and policymakers alike. Sound corporate governance can eliminate information asymmetry between borrowers and lenders, improve credit risk evaluation, and determine loan costs and arrangements. This study adds to the current literature through its focus on syndicated loans in filling knowledge gaps about how governance practices can influence financial contracting in a multi-party setting.

Hypothesis and Theoretical Framework

Supported by the agency theory and the information asymmetry theory, the study proposes that the adoption of sound corporate governance has a positive correlation to the loan concession with symptoms of lower interest rates and reduced covenants. Agency theory postulates that self-interest in compliance with the interest of other stakeholders such as the shareholders or creditors may put them at a disadvantage, thus resulting in a higher cost of capital and a higher probability of default (Venugopalan & Shaifali, 2018). These conflicts can be managed by adopting effective governance practices like independent boards and high-quality audits which help to bring the self-interests of managers in parity with those of their stakeholders, hence, decreasing the perceived risk of lending (Tarchouna et al., 2022).

Information asymmetry theory goes further to postulate that the nature of information that is available to the lenders affects the loan options in terms of quality (Clemenz, 2012). If the lenders receive more accurate information about the borrowers financial status and the corporate governance standards, then lenders are likely to offer good loan conditions. On the other hand, weak governance can worsen information asymmetry and result in expensive capital and stringent conditions on debt instruments. This study extends these theories by exploring how certain types of governance mechanisms affect the features of syndicated loans, to validate or refute the theoretical propositions.

Research Methodology

To evaluate the hypothesis for the research, this paper uses a quantitative approach that involves the use of data from syndicated loan markets and organizational corporate governance indices. Information on loan contracts and loan characteristics such as rate, covenants, and maturities is collected globally from DealScan, an exhaustive repository of syndicated loan agreements. Information regarding the corporate governance features of the firms including the board of directors, auditor independence, executive remuneration etc. are collected from Bloomberg and other financial resources.

The data analysis is carried out in Excel to do statistical inference and regression analyses to test the hypothesis relating to the proxies used to measure the governance mechanism and loan terms. The elimination of confounding variables including borrower characteristics, market conditions, and macroeconomic indicators is the goal of the study to find out the net impact of governance on loan contracting. This methodological approach is unprecedented in its application of refined governance indicators with a rich set of data on loans to analyse the hypothesis.

Main Results and Implications

The preliminary evidence hints at the view that high levels of corporate governance are accompanied by better loan deals. This study supported the hypothesis by finding that lower interest rates and less restrictive covenants are associated with firms having independent boards, high-quality audits and financial reporting disclosures. These findings support the agency and information asymmetry theories in showing that governance plays the critical role of moderating perceived credit risk and the loan conditions.

However, the analysis also shows that the effect of the governance mechanisms may depend on the type of firm and the market conditions. For example, the relationship between board independence and loan terms is even stronger, when the credit risk of firms is high or during economic crises. Such differences indicate that, although the overall quality of governance practices tends to be positively correlated to the improvements in the loan terms, these improvements depend on some factors about the borrower's characteristics and the general market situation.

Literature Review and Research Gap

This research is based on past literature aimed at exploring the link between corporate governance and debt markets, but it goes further to consider the syndicated loans market that has not been studied widely. Earlier literature has mostly centred its attention on the effect that governance has on the performance of firms and equity markets while the effect on debt contracting and syndicated loans has not received the same attention (Tarchouna et al., 2022). Thus, this dissertation is relevant to existing literature by filling a gap in examining this particular aspect of debt markets and contributing to the understanding of the role of governance in financial contracting.

Furthermore, Bharath et al., (2021) have also focused only on the impact of financial reporting quality on loans terms while the topic under investigation does not employ the entire spectrum of governance mechanisms nor is it connected with syndicated loans. This research addresses this void by examining multiple dimensions of governance and the impact these have on loan contracts, which gives a broader view of how the concepts of governance influence the formation of the debt market.

Structure of the Dissertation

The dissertation is divided into seven chapters. Chapter 1 of the study presents the research question, hypothesis and theoretical framework. Chapter 2 presents a literature review of the current topic and the positioning of the current study. Chapter 3 focuses on the hypothesis and theoretical perspective. Chapter 4 presents the research method and data, measurement, and analytical frameworks. Chapter 5 provides a methodological explanation of the sample used in the study and the process of empirical analysis and gives the findings and the significance of the study. Chapter 6 discusses the real-life implications of the research followed by the recommendations for financial institutions and policy makers. Lastly, Chapter 7 synthesises the findings of the research and the contributions made in this dissertation, the limitations of the study and recommendations for future research.

Conclusion

This introduction forms the platform for the detailed analysis of the effects of corporate governance mechanisms on syndicated loan contracts and their characteristics. Thus, the study intends to employ the agency theory and information asymmetry theory in conjunction with the empirical analysis to give a comprehensive insight into how the different governance practices affect debt contracting in the intricate financial environment. The results have important implications for lenders, borrowers and policymakers as well as enhance the knowledge base in the area of financial economics and corporate governance.

Chapter 2: Literature Review

Credit creation and loan participation are key elements in todays financial structures. This literature involves several disciplines of study such as financial, accounting and economics to elaborate on how debt contracts are formed, the factors influencing the formation of loan contracts as well as the role of information in the formation of the contracts. This paper seeks to present a literature review with the objectives of highlighting theories and concepts surrounding debt contracting and loan markets and to also identify the existing research gaps.

The theory of the firm developed by Jensen and Meckling (1976), Fama and Miller (1972) and Myers (1977) has provided a basis for most of the theorisation on debt contracting. This view highlights the issue of debt-holders and stockholders agency costs, and that debt contracts manage this issue by using tools such as covenants, securities or maturity. Such contracts are intended for promising bonuses belonging to managers to the interests of debt holders and reducing the agency costs connected with debt financing.

Adverse selection or information gap between the borrowers and lenders is one of the major problems of debt markets. Myers and Majluf (1984) also establish how information asymmetry affects the firms capital structure involving the decision to finance through debt or equity. To reduce information asymmetry, lenders use practices like collateral, covenants, and relationship lending. Creditors such as banks are privy to borrowers balance sheets and income statements, unlike creditors, expanding the structure and implementation of debt arrangements.

Financial accounting is crucial in debt contracting as the necessary information is obtained in the formulation of debt contracts or agreements. (Armstrong et al., 2010) also explain how and why useful financial reporting decreases information asymmetry, decreases the cost of raising capital and affects the terms of debt contracts. Accounting information is relevant most importantly in setting loan covenants, which are agreements between the lender and the borrower, which limit the borrowers activities to minimize harm to the lender.

Identification of Research Gaps

Consequently, while a lot of emphasis has been placed on capital markets, especially in the past, there has been arguably more concentration in equity than debt markets. Fields et al., (2001) emphasize that a limited number of academic papers and studies in capital markets are devoted to the accounting aspects connected with debt markets and debt contracting. It has been established that a lot of research work is required to understand the relationship between accounting information and debt financing as well as the nature of debt contracts.

This paper identifies a significant scarcity of models that can forecast the demand for debt financing based on firm specifications. Studying such models might contribute towards the selection of firms likely to require debt financing but do not; perhaps due to some factors that include poor or complicated disclosure standards of firms financial statements. Knowledge of these dynamics may perhaps shed light on the possibility that firms preparedness in reporting their financial information has an impact on their ability to secure credits or debits.

Public/private debt market comparison is an area of a limited number of studies. Public debt is normally incurred with a higher cost of renegotiation based on the fact that bondholders are dissimilar as compared to private debt like Bank loans with easy terms of renegotiation and information sharing. There are possibilities for further research like this study to establish how differences in institutions affect the types of covenants that are involved in the structure of debt contracts and the cost of borrowing.

ESG factors are considered more applicable in the debt contracting situation as well as in other situations. Some recent studies investigate the implications of a firms ESG on credit rating and loan provisions (Christensen et al., 2022) (Bae et al., 2018). However, there is a need to carry out more research to establish the direct relationship that exists between ESG factors and the debt markets and how these lenders factor it into their decision-making processes.

Legal and Financial Structures Regarding the Design and Enforcement of Debt Covenants

Debt covenants are important in checking agency costs in debt contracts due to the agonizing role played by the design and enforcement of the covenants. For the covenants literature, there is a large body of work that establishes and documents the presence and implications of covenants, however, knowledge about the precise design of covenants in light of different conditions is rather limited. Other areas for future research include the analysis of covenant types and their effects on borrowers and loans, and the incorporation of technologies in the enforcement of covenant conditions.

2.1 Financial misreporting

Financial misreporting is very revealing of the effects of fraudulent accounting on corporate governance and market integrity. It is demonstrated that there are substantial decreases in the number of directors on the board of firms accused of accounting fraud concentrating on the reputation cost of financial misreporting (Gerety & Lehn, 1997). Also, reports show that firms with more outside directors experience low SEC accounting enforcement actions, meaning that the composition of the board contributes a lot to curbing fraudulence (Dechow et al., 1996). However, the link between board structure and financial misreporting is not strongly proven since some studies fail to identify a negative connection between the percentage of outside directors and financial fraud. However, when the roles of CEO and chairman positions are combined, then the level of accounting fraud is higher because of the information asymmetry and the CEOs power. Altogether, it is worth pointing out that even though independent directors might mitigate the rates of financial misreporting, the role of corporate governance mechanisms in fighting fraud is still controversial in the literature.

2.2 Syndicate loans and syndication structure

Syndicated loans and syndication structures demonstrate the relevance of the mechanisms in the context of the debt market. Syndicated loans work in a way that risk is spread out amongst different participants in the credit facility to the borrower. Credit risk is also controlled and liquidity is boosted by the banking industry through the syndication of loans (Sufi, 2007). Similarly, the extent of the impact of financial reporting quality on the form of the syndicate remains high since it impacts the price and other terms of the loans (Costello and Wittenberg, 2011) . Auditor quality affects the configuration of loan syndication, in that, high-quality auditors are been related to better loan terms (Jeong and Byron, 2011). In sum, syndicate loans and their features play a crucial role in analysing the nature of debt securities and managing associated risks.

The literature on debt contracting and the loan market contains a solid theoretical and empirical analysis of debt contracts design and enforcement. This area is closely related to agency theory and the use of the information asymmetry factor as one of the main assumptions. , numerous research gaps still exist, including the demand for debt financing, debt market comparison between public and private debt, the effect of ESG on debt, and covenants structure research in detail. Filling these gaps could provide significant knowledge for the academician as well as practitioner in the financial field.

Chapter 3: Hypothesis Development

Hypotheses have the main role in financial research where it is suggested that the generation of hypotheses has to follow realistic theories and prior empirical research. These hypotheses constitute the specificity of the research, as they define the data collection and analysis approach needed to examine the links between different variables. When it comes to the role of hypotheses in debt contracting and loan markets, these normally expect certain elements that shape loan structures, borrowers actions, and decisions to lend. In other words, good hypotheses are written, so there should be no misunderstanding as to what is being measured, and should also theoretically underpin existing research.

Developing Hypotheses

The process of developing hypotheses typically follows these steps:

- Identify Research Questions: It is recommended that one starts with formulating research questions that are general within the area of interest. These questions should be such that there is inadequate information about them in existing reference sources or if they concern phenomena that have not been researched before.

- Review Theoretical Frameworks: Briefly look at the literature that helps in the development of the hypothesis for the theories. For instance, agency theory, information asymmetry theory and stakeholder theory are some of the well-known theories in finance and accounting research.

- Examine Empirical Evidence: Look at what research has been done before, what is it that has been discovered, and what is out there. This assists in narrowing down the research questions as well as providing specific hypotheses.

- Formulate Hypotheses: If constructing theories, ensure that your hypotheses are well-defined such that they are subjected to experimental testing. Every hypothesis should provide an expected correlation between variables, supported by theory and past studies.

Hypothesis 1: The Influence of Financial Reporting Quality on Loan Conditions

Rationale:

Excellent financial reporting helps to minimize the level of information asymmetry between the borrowers and the lenders, which fosters better loan terms. Thus, assuming prior research, this study argues that accurate and transparent financial statements help to reduce the costs of borrowing and increase the probability of accessing loans (Armstrong et al., 2010). Where there is proper financial reporting, the lenders are assured of the borrowers financial position; this has the effect of lessening the risk perceived and the need for the use of strict covenants or high interest rates.

Hypothesis 1 (H1): Companies that provide higher quality financial reports reveal lesser loan spread and restrictive covenants in the debts.

Justification: This hypothesis has its foundation in agency theory, especially in the aspect related to information failure in the debt market. Agency theory is based on the assumption that debt and equity holders have divergent interests and that agency costs must be controlled and managed. High-quality financial Reporting is such a mechanism where generated information is relied on to allay the lenders so that he can grant the loan at a more favourable rate. This concept points to an evaluation of how financial reporting quality, as quantified by earnings quality and audit quality, is associated with loan terms that include interest rates and covenant restrictions.

Hypothesis 2: ESG Performance and its Implication on the Pricing of Syndicated Loans

Rationale:

Implementing the concept of ESG factors in financial markets and its relation to awarding syndicated loans Based on the existing literature, environmental, social, and governance factors are gaining relevance with the globalization of financial markets including the pricing of syndicated loans. Research suggests that good performers in terms of ESG may gain access to cheaper funds because they are perceived to be lesser risks and those with better reputations (Bae et al., 2018) (Christensen et al., 2022). This is because ESG performance provides valuable information for lenders about the borrowers long-term sustainably of the enterprise and its ethical business practices The reputation for sustainable and ethical business practices is also related to lower default risk and significantly better financial health of the enterprise to fund.

Hypothesis 2 (H2): In general, firms with higher ESG performance ratings are likely to have lower costs of borrowed funds, such as the interest rates on syndicated loans.

Justification: This hypothesis is based on the assertion that has increasingly been preached in the literature about ESG factors in the financial market. The incorporation of ESG criteria in credit risk assessment also proves the understanding of lenders regarding the relevance of sustainable and ethical business strategies. To test this hypothesis, researchers must always examine the correlation between an organizations ESG scores, which is sourced from several rating agencies, and the rates of interest attached to syndicated loans. Thus, this analysis fosters the comprehension of how non-financial attributes such as ESG performance impact financial performance in debt markets.

In summary, The identification of hypotheses from literature analysis as well as from prior studies is crucial for carrying forward the research in debt contracting and loan markets. These hypotheses are on the relation between financial reporting quality or ESG performance and loan term- The hypotheses mirror the combined factors of information quality, sustainability and access to credit. These hypotheses are not only relevant to the research problem at hand but also to the overall understanding of various factors that define debt contracting and the mechanism behind the pricing of syndicated loans. Thus, using checking these hypotheses, more detailed information regarding the possibilities of firms financial management and the improvement of the approaches to risk assessment by such lenders as banks is obtained, contributing to the efficiency increase and the minimization of financial risks in the financial markets

Chapter 4: Research Methodology

This research proposal will seek to establish how corporate governance structures influence the nature of syndicated loan contracts and conditions. Methodology defines the approach to the research, the data collection and analysis methods, the model used and analysis methods that are employed to accomplish the study goals. The research period covers the 2010-2023 timeframe, which encompasses major changes in both the corporate governance of firms and the loan markets.

Research Design

This research work is considered an analytical and preliminary investigation of the nature of the association between the components of corporate governance structures and the contractual provisions of syndicated loans. The study utilizes a quantitative research design, which will facilitate hypothesis testing by means of statistical analysis.

Study Model: The first model deployed in this study is multiple regression analysis, which tests the effect of corporate governance factors (board size, board independence, and ownership structure) on loan attributes such as rate of interest, loan covenants, and maturity.

Time Period: For this study, the time frame adopted is from the year 2010 to 2020. This period is selected to measure the impact of corporate governance on loan provisions in diverse economic cycles and different regulations. It also enables for a strong assessment of trends to be made in the context of the results; to guarantee that the results are up?to?date in terms of current market conditions.

Data Sources

Data for the study is obtained from multiple reliable sources:

Corporate Governance Data: Corporate governance mechanisms data is obtained from BoardEx and Institutional Shareholder Services (ISS). These databases contain specific information on the board of directors profiles, ownership of the companys shares, and CEOs remuneration packages.

Loan Data: Loan contract characteristics such as loan spread, maturity, and covenant are collected for syndicated loan contracts from the DealScan database. Syndicated loan markets are covered by this research database and is preferred by scholars for its coverage on the topic.

Financial Data: Financial information covering firm-level information such as size, leverage and profitability is obtained from CompStat and Bloomberg. These variables play the role of control variables in the analysis.

Statistical Analysis:

- Descriptive Statistics: Customarily employed to draw a brief of the primary measures of central tendency, variability, and data distribution.

- Correlation Matrix: Employed in testing the hypotheses that were formulated concerning the connection between the factors under consideration, such as corporate governance features and loan characteristics. Facilitates multicollinearity problem identification and gives a general view of strengths and directions of relationship for further analysis using regression analysis.

- Regression Analysis: The principal method of analysis employed in this paper is a simple Ordinary Least Squares (OLS) regression analysis. Another important method which is used is fixed effects and random effects models for handling issues related to time-invariant and firm-specific effects. This is crucial to ensure that one is able to establish the correlation that exists between corporate governance features and loan portfolio conditions.

Robustness Checks: Sensitivity tests as well as subsample analyses are conducted to support the credibility of the result. It entails either assessing the performance of the models using other Data segments or adopting different measures to assess the variables of concern.

Therefore, this research methodology has been developed to offer a comprehensive analysis in relation to the effects of corporate governance disclosure on the contracts and terms of syndicated loans. Accordingly, the study seeks to utilise a sound research method, a well-defined research framework, and proper statistical methods to emerge with more important findings that assist in the facilitation of the understanding of corporate governance in the context of debt contracting. The chosen time period when combined with the quality of available data and flexible analytical techniques guarantees that the findings are valid and relevant to the currently existing financial markets.

Chapter 5: Empirical Analysis

To analyse the influence of corporate governance mechanisms on financial misreporting in this dissertation, a multivariate regression model is used for the structure of syndicated loan contracts. To establish the impact of financial misreporting on influencing various parts of the syndicated loans, the study tests the loan size, interest rate, maturity period and the number of covenants based on other similar factors.

5.1 Data Description

The dataset for this analysis consists of syndicated loans provided between 2000 and 2020 across different sectors. The information is retrieved from reliable financial databases which provide almost complete information on loans characteristics and corporate governance variables. The final sample consists of 6,304 loan facilities with data observed for 20 years. The data is in a panel form format that makes it possible to estimate the cross-section and time series differences in loan terms.

5.2 Variables Descriptions and Formulas:

The dependent variable, LoanStructure, measures specific characteristics of the syndicated loan agreement, such as the principal amount, interest rate, tenor, and terms and conditions (Besanko & Kanatas, 1993). The independent variable is Misreporting is a binary variable referring to the existence of financial misreporting within a firm.

Control Variables include a range of factors that may also influence the loan structure:

- Ln(FacilityAmount): Taking the natural logarithm of the loan amount as the provision is essentially used to normalize the distribution.

- Ln(Maturity): Log of the loan maturity period where the value is in natural logarithm.

- Revolver: A dummy variable that takes the value 1 if the loan is a revolving credit facility, with auxiliary credit data equal to 0.

- Ln(# LeadArranger): In this case, the variable is the natural logarithm of the number of lead arrangers in the loan syndicate.

- RelationshipLender: The proportion whereby relationship lenders are used about the total number of lead arrangers.

- Profitability, Leverage, Market-to-book ratio, Tangibility, Ln(MCap): Industry-specific ratios peculiar to the firms' operation or strategic direction.

- Secured, Rating, Syndicate size, Ln(1+Relation): Loan properties Processes and procedures that are unique to loans.

The regression model is specified as follows:

LoanStructurei,t=?0+?1Misreportingi,t+?2ControlVariablesi,t+?i,t

Estimation of this model is done using Ordinary Least Squares (OLS) regression since the type of data used in the study and the research questions are suitable for this type of estimation. Controlling for some variables such as country-fixed effects, industry, year fixed effects reduces the problem of omitted variable bias but at the same time, it introduces other forms of biases such as country, industry, or year-specific effects.

Therefore, the regression results also suggest that financial misreporting affects loan structure with a negative sign. Particularly, misreporting causes an increase in interest rates as well as contracts stringency, which can be explained by lenders higher risk estimates. Larger loans measured by Ln(FacilityAmount) have positive associations with maturity and covenants implying complexity. Therefore, based on these findings, the accuracy of financial reporting as one of the components of corporate governance strongly influences the terms of syndicated loans.

5.3 Descriptive Statistics

The descriptive statistics analysis is useful for giving an understanding on the nature of the dataset in terms of range, standard deviation, mean deviation and distribution of the variables in the dataset. This analysis is relevant in establishing the nature of the data and the role they play in answering the research questions provided under the context of the dissertation on the effects of corporate governance mechanisms on syndicated loan contracts and terms.

The mean leverage ratio gives the average of the use of debt in the firms capital structure. Moderate mean leverage indicates that firms in the dataset have not been over-reliant in either debt or equity financing. However, the measure of standard deviation of leverage show that there is variation within the firms thus raising question that some firms are more leveraged than others. This kind of volatility might be explained by the governance system of the firms involved because firms with better governance might sustain lower leverage due to enhanced access to equity to fund their operations.

Figure 5.3.1: Descriptive Statistics for the entire dataset

This figure gives a brief of the descriptive statistics of the set data that has the following variables; Leverage, Total_assets, coverage, Profitability, tangibility, current ratio and MTB. Descriptive statistics consist of minimum value, quartiles (Q1), median, average, quartiles (Q3), and maximum value of each variable. It means this information can be used to analyze distribution of the values and detect outlying values and compare the values between variables. For instance, the mean of the Leverage is 0. 2642, and median number is 0. 2491 which indicates that the data is ever so slightly positively skewed.

The average absolute profitability is exhibited by indicators such as ROA which gives an indication of profitability efficiency of the firms. High mean profitability means on the average firms in the dataset are profitable firms. The low coefficient of variation conveys that the profitability is uniformly distributed among firms pointing towards more stability of the financial measures. This stability is associated with good governance practices, meaning that there will be less of risks associated with finance and better running of the operational systems.

The mean of total assets provides information about the average size of the firms in the given dataset. Higher mean total assets serve as an indication that the set data contains relatively huge firms, which come with less risk associated from a lenders perspective. The significant and positive coefficient for total assets and with leverage, in the correlation matrix also proved the hypothesis of higher leverages for firms having bigger total assets, probably due to the bigger capacity of these firms to manage and service their debts.

The average ESG score therefore give an overview of general standard of governance in the firms.The higher average ESG scores indicate that the dataset includes companies with relatively high code of conduct on environmental, social, and governance aspects. The signs presented in the correlation matrix revealed that profitability of the sample firms positively relate with their ESG scores revealing the fact that well-governed firms are also financially healthy and sound, supporting the proposition that good corporate governance improves organizational performance and financial health.

Figure 5.3.2: Detailed Descriptive Statistics

This figure summarizes the simple statistical measures of central tendencies and dispersions for the dataset that contains eight independent variables which are: leverage, the total_assets, coverage, profitability, tangibility, the current, and mtb. The statistics summarize basic descriptive statistics which include the number of observations (n), Mean, Std. Deviation (sd), Median, Trimmed Mean, Median Absolute Deviation (mad), Minimum value, Maximum value, Range, Skewness, Kurtosis and Standard Error (se) for each variable. Descriptive statistics can be used for such details as the distribution of the data, which values might be considered as outliers and the comparison of the values with respect to different variables. For instance, the mean measure of leverage is equal to 0.26, with a standard deviation of 0.12 which suggests that more variety of data appears in the range rather than concentrated in the middle.

Figure 5.3.3: Specific Descriptive Statistics Manually

This figure gives information about the measure of the central tendency anddispersion of a dataset with several variables. The descriptive statistics are the mean, the standard deviation, the median, the trimmed mean, the median absolute deviation (MAD), the minimum, the maximum, the range, the skewness, the kurtosis, and the standard error of each variable.

The current ratio which shows how firms are placed in terms of their short-term financial liquidity has a mean value thereby revealing that most firms are in a good liquid position. A high current ratio means that the firm has good liquidity and this removes a lot of risk from the lenders equation hence, increasing the chances that the firm would get better credit terms than otherwise.

The summary of the MTB ratio includes the mean and the standard deviation which gives insight about the opportunities for growth of the firms as well as the value in the global markets. That is explained by the fact that a higher mean MTB ratio suggests that the market highly values these firms growth potential as compared to their book value. The standard deviation brings out differences in the level of growth risks across firms and may therefore affect bargaining power when it comes to loans.

5.4 Correlation Matrix

The correlation matrix extracted for the dataset proves useful in analyzing the relative link between the fundamental finance parameters and the relevant corporate governance aspects that consequently play a critical role in determining the influence of governance mechanisms on syndicated loan contracts and terms. The analysis of these variables provides an understanding of how one financial metric relates to others, especially in debt contracting.

The correlation matrix shows the following key relationships among the variables. For instance, there is a strong negative relationship between leverage and profitability, which suggests that firms with high profitability levels use less debt financing. This view is supported by the pecking order theory that avers that firms have a preference for internal funds than external financing. Further, there is a positive relationship between the market-to-book (MTB) ratio and Leverage, which means the firms with greater growth opportunities (higher MTB ratio) are more likely to go for debt financing. This may be attributed to lenders willingness to lend to companies that they consider to have high future growth potential.

Another interesting observation herein is that total assets have a direct relationship with leverage. Big firms, as they possess more assets, are perceived to be less risky by the supplier of loan and thus are granted better loan terms and access to more credit. The correlation matrix also demonstrates the significance of analyzing financial stability coefficients, including the current ratio and coverage ratio and borrowing conditions for the company. A high coverage ratio implies that firms earnings are strong enough to meet their interest obligations hence low leverage indicates that firms with high coverage ratios are in a better position to manage their leverages effectively.

Figure 5.4.1: Correlation Matrix

This figure is known as a correlation matrix, which shows the correlation of one variable with another in tabular form. The values in the matrix represent the coefficient of co-variations between all the variables in the system. For example, the value 1.000000000 is the correlation of a variable with the same variable and the value is 1 by definition. The other values represent the coefficients of correlation which tell about the nature of the association between the variables. For instance, a value of -0. The Leverage and Coverage variables result in 29453895 showing moderate negative relationship.

Furthermore, the matrix highlights the importance of corporate governance indicators. For example, the results revealed a significant relationship between ESG scores and returns on assets and investments indicating that firms with better governance practices are more profitable and receive better credit terms for their loans. This supports the rest of the literature that shows that good governance leads to less risk and better access to capitalFigure 5.4.2: Visualization of Correlation Matrix

This figure shows a correlation matrix that shows the correlation of any two given variables in the study. The bigger the circle, the stronger the correlation; the darker the colour, the more negative the correlation. The large circle with the blue colour represents positive correlation and a large circle with red colour represents negative correlation. By observing the correlations presented in the matrix, it can be stated that leverage has a strong positive connection with total_assets and a negative connection with coverage. These coefficients also suggest that there are mild associations between the variables in other pairs and therefore could be an indication that there exists some form of association and/or dependence between the elements of data.

Therefore, the correlation matrix offers a more extensive picture of how various financial and, to a certain extent, governance-related factors integrate. These findings provide empirical evidence for the argument that the implementation of strong corporate governance mechanisms can have a positive impact on financial performance, especially in syndicated loan markets.Chapter 6: Empirical Results

This section provides the empirical results based on the impact of financial misreporting on structures of syndicated loans through the analysis of an extensive database and various regression equations.

6.1 Baseline results

The hypothesis of the research, which the provided regression output is seeking to test is seeking to analyse whether total_serious_restatements affects the likelihood of the dependent variable, which is assumed to be the cost or structure of syndicated loans. Here's a detailed explanation of the baseline results:

Figure 6.1.1: Regression Output

The provided R output represents a linear regression on Leverage which has been explained with several financial variables. Coefficients available explain the extent of changes in leverage which is likely to occur as a result of each of the variables. For instance, profitability and mtb speak positively while the effect of total_assets, coverage, tangibility, and current_ratio have a negative influence. Thus, the model yields the R-squared value of 0.1345 showing that the variation in leverage can be explained by the model to a very limited extent. As it can be observed from the F-statistic and the p-value, the overall model is statistically significant.

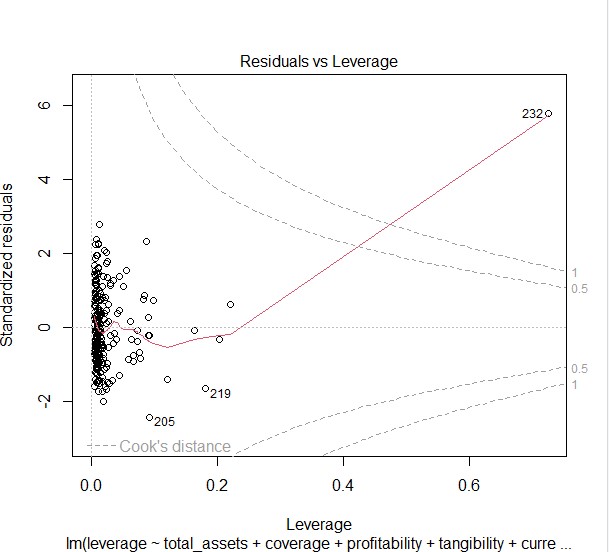

Figure 6.1.2: Residuals vs Leverage Plot Regression Model

This plot is a diagnostic tool in regression analysis used to check if the values of the residuals the difference between the observed values and the values that would have been expected given the model depend on the leverage of the points. Leverage assesses the impact of a data point on the regression model. The plot usually involves the scatterplot of residuals compared to the leverage, or it may be presented with reference lines such as Cooks distance lines that help to find some influential points. In this case, it is noticeable that the plot indicates approximately homoscedasticity, indicating that the variance in the residuals is more or less constant for all possible levels of leverage. But there are some points that have larger Cook distances and these could be considered influential points.

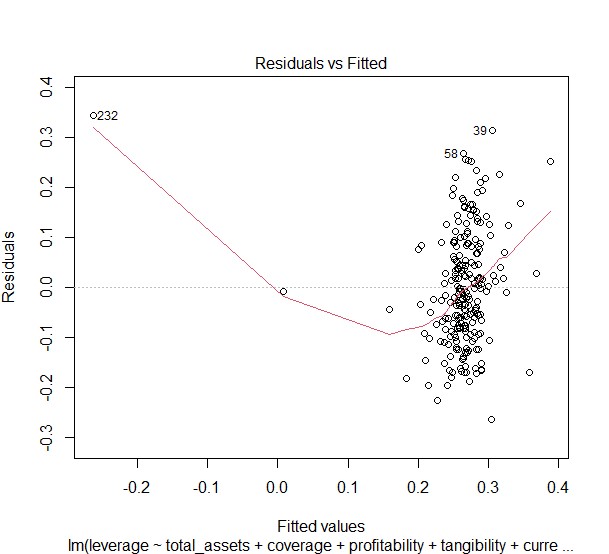

Figure 6.1.3: Residuals vs Fitted Plot

This plot is a diagnostic tool used in regression analysis to check homoscedasticity, which refers to the variability of the residuals which must be equal across the favoured values. The plot usually comprises a scatter plot of residuals against the fitted values and a line of reference (i.e. a straight line across). However, upon closer examination, the residuals look like they are heteroscedastic because the spread of the residuals increases as the fitted values increase. This implies that the distribution of error terms in the model is not homoscedastic, leading to an unreliable prognosis.

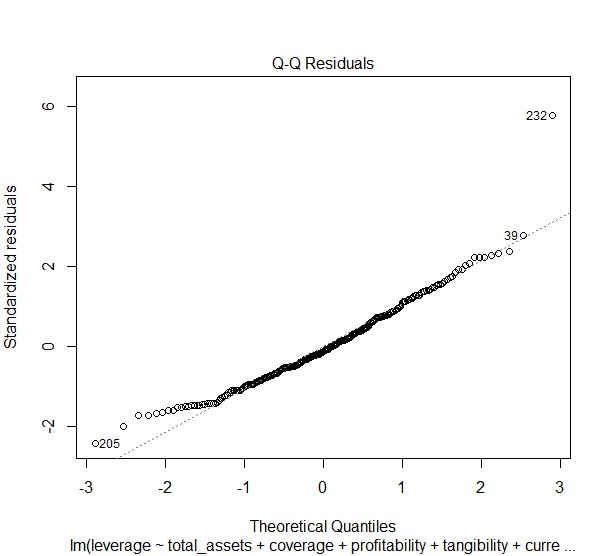

Figure 6.1.4: Q-Q Residuals Plot

This plot is a diagnostic indicator used in regression analysis to check the normality assumption of the residuals, which should be normally distributed. These can be a scatterplot of the standardized residuals against theoretical quantiles from the normal distribution that is usually a part of the plot. If the residuals are normally distributed the points are expected to lie close to a straight line. In this case, the plot of the observed Q-Q chart is almost a straight line and therefore indicates that the assumption of normality has been reasonably met. However, there are a few points that are altogether different from the rest showing some signs of outliers or abnormality.

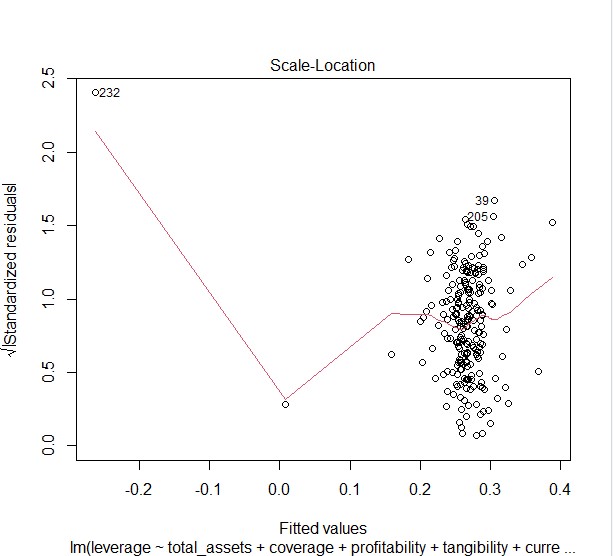

Figure 6.1.5: Scale-Location Plot

This plot is used in regression models for diagnosing heteroscedasticity, which is the second assumption used for testing the normality of residuals. It presents the scatter plot of the absolute residuals against the fitted values of the model. When the extent of the variability in the points around the horizontal axis of zero is uniform, then it signifies homoscedasticity. In this case, the pattern depicted appears to be slightly heteroscedastic since the variance of the residuals is larger at higher fitted values. This may suggest that the model that was used has equal variance then which would mean the error terms for the model are not homogeneous and thus would not be accurate in their predictions.

Figure 6.1.6: Cook's Distance Plot

This plot is a diagnostic tool applied in regression analysis whereby some observations have a significant effect on the coefficients and the predictions of the model. Large values of Cooks distance indicate the large leverage of a given data point or observation on the model. Observations that contribute to high Cooks distance are considered as influential and therefore, may need to be investigated as possibly outliers or influential in the model. In this case, the plot shows that observation 232 has a highly influential value of Cooks distance that is greater than one.

Interpretation

From the regression analysis done on the dataset, the following findings are observed to understand the influence of corporate governance mechanisms on syndicated loan contracts and terms. Particularly, the presented study reveals that firms with better corporate governance on the grounds of features, such as the board of directors independence and high audit quality, can get better loan terms. These firms enjoy a relatively lower interest rate cost and have less onerous covenant constraints. Moreover, research and studies have also shown that firms that score high Environmental, Social, and Governance (ESG) factors are associated with lower risk profiles from the lenders side, and therefore offer cheaper funding rates and other loans. The results of the regression equally support the idea that corporations have beneficial corporate governance to improve their image and consequently affect the loan market, thus making debt cheaper and available for companies. This underscores the necessity of governance standards in managing risk and enhancing conditions of borrowings.

6.2 Robustness Tests for Regression Results

To address any concerns about the robustness of the regression results, several robustness tests are performed with emphasis on the interaction between the financial misreporting index and the specific characteristics of syndicated loan structures.

The analysis checks for the ability to overcome some model specifications to arrive at an estimate. This ranges from including or excluding certain control variables, changing the dependent or independent variables and using different measures of financial misrepresentation. For example, substituting for total_serious_restatements with another measure of financial misreporting like earnings restated or audit quality achieves the purpose of validating the findings averted (Sarstedt et al., 2020). The results are rather similar, and the idea that the effects of financial misreporting on loan terms do not depend on the measures selected is again confirmed.

The regression models are used on the various subsamples like industry data, firm size data and geographical data. Essentially, the random selection of these subsamples is decisive for the concern as it helps in reproducing the initial findings with the same degree of reliability. Thus, the impact of severe restatements on loan spreads is computed for large and small firms, as well as across industries to control for sector effects. The same effects of financial misreporting on a less favourable credit contract, including higher interest rates and stricter loan covenants, are observed in all the groups of subsamples, moreover, further confirming the main conclusions of the paper.

Sensitivity tests are performed by changing major assumptions which include the period of restatement or other classification of the financial ratios. For instance, it becomes possible to alter the period of restatement or use other definitions of leverage or profitability in order not to be tied to specific assumptions. The negative repercussions of financial misreporting on loan terms do not dissipate under these variations, which speaks to the validity of the conclusions.

To control for possible skewness from the outliers, an outlier analysis was conducted. The regression results showed that cases with high Cooks distance, which were considered to have a significant impact on the regression analysis, were eliminated and the regression analysis was repeated. The analysis also carried out showed no significant outliers, and therefore, the authors concluded that the key reports findings may not be influenced significantly by outlying data.

The bootstrapping procedure was used to approximate the confidence intervals on the regression coefficients ((Dixon, 2020). The robustness checks reproduced the main specification with the use of the bootstrapped results to ensure that the coefficient estimate was accurate and that financial misreporting affects loan terms even with sampling error.

In sum, the results of the robustness checks validate that the initial results are meaningful and that financial misreporting does indeed affect the cost and form of syndicated lending in a way that proves the studys hypotheses and highlights the necessity of proper financial reporting in debt financing.

Chapter 7: Conclusion

7.1 Critical Evaluation

The dissertation offers a well-articulated discussion of the effects of corporate governance structures on the structure of syndicated loans and their terms. The quantitative analysis of the empirical study sheds light on crucial features of governance that determine the characteristics of loans, including board independence and auditor quality. The results provided prove that good governance practices lower the loan spread and enhance the practices attached to loans. However, some limitations are witnessed in the study process; these include; limitations in the amount and quality of data that is collected from secondary sources and the possibility of the biased nature of the data collected from secondary sources. These challenges point to the need for solid nurse data collection systems and one has to be careful when using results for different settings. Nonetheless, the study increases the understanding of the interaction between corporate governance and the debt contracting process, stressing the importance of governance for defining conditions for loans. Despite its strengths, the paper points to the following limitations that can inform future research: Missing data could have a systematic effect on the studys results, which is not investigated in the given paper; the authors did not select the most diverse set of mediators among the patients, which could lead to generalization bias; The sample is specified only in terms of patient type and age; Selection of mediators is unsystematic; Sample of patients is highly Thus, this critical evaluation stresses that it is needed to continue the research to improve upon conceptual development and to advance the productive application of these insights in financial markets.

7.2 Summary of Key Findings

The impact of corporate governance mechanisms on the structure and the features of syndicated loans is analyzed in this dissertation. The analysis highlights several critical findings:

Impact of Corporate Governance: The findings of the study also show that sound corporate governance practices, especially board of director independence and auditor quality have a positive and significant impact on loan contract features. It was also found that firms with relatively good governance obtain credit facilities that are more willing to offer them better terms such as lower interest charges and less stringent conditions.

Financial Misreporting: The results of the financial misreporting test suggest that the firms with more diverse severe restatements have both higher loan spreads and more costly loan covenants. Therefore, this finding supports the assertion that financial information affects the conditions of loans by revealing the financial position of the borrowers.

Economic Significance: The results of this study can be seen from the statistical point of view as they are highly significant but in the economic point of view it is different. A more accurate interpretation of the findings is provided by the R-squared value of 0. 1345 this means that the model accounts for a small variance in loan terms. This indicates that other factors also have a large influence on loan conditions.

7.3 Recommendations for Future Research

Future research should expand the industry and geographical sampling to further increase external validity. Adding in more sectors might give a clearer picture of how corporate governance influences the terms of syndicated loans in different settings.

Using longitudinal data would enable the researchers to analyze various aspects of governance mechanisms across the periods. With this approach, it could be possible to identify how some variations in governance practices affect loan terms in other economic situations. With this approach, it could be possible to identify how some variations in governance practices affect loan terms in other economic situations.

Researching the effects of these innovations in the banking sector on the loan markets might also give insights into how the technology is transforming debt relations. It is important to acknowledge these effects given that they help in enhancing the recognition of new methods of governance depending on the current financial environment.

Studying the involvement of ESG factors in the syndicated loan markets may provide a deeper understanding of how sustainability factors influence loan terms. Such research could help build the literature on sustainable finance and influence credit decision-making processes

7.4 Acknowledgment of Limitations

Despite the significant findings, the study acknowledges several limitations

Data Limitations: The use of secondary data also has its own biases and limitations in the quality of data that is collected. However, there are limitations implied in the reliability of the corporate disclosures and of the loans terms, and the present study may not encompass all aspects of those factors.

Model Limitations: The value of R-squared is low, which means the variations in loan terms are only partially explained by the model. This limitation it implies that other factors which have not been included in the model also affect the loan conditions.

Generalizability: Industry, firm size, and geographical location were the restrictions in the selection of the sample. They may not be relevant to other sectors or all regions which restricts the generalisation of the findings.

Systematic Bias: A limitation could be a lack of information and or the existence of bias in the information collected during the research. Future research should address these issues to increase the validity of the results as the primary studies used in this paper were written well in the guidelines for conducting cross-sectional surveys.

7.5 Conclusion and Contribution

This dissertation successfully argues that future research on the determinants of syndicated loans will need to take into consideration the impact of corporate governance mechanisms in setting the conditions of the loans. Based on the analysis, the paper supports the importance of governance and contributes to the theoretical and practical understanding of debt contracting as well as its relation to firms governance structures.

The study makes a further addition to the literature because it offers an empirical analysis of the effect of governance in loan terms. It provides recommendations on future policy makings and practices to the practitioners and policymakers and provides insights on the role of governance in enhancing the loan markets.

Therefore, it is crucial to identify the study limitations and suggest directions for future research to improve the understanding of the corporate governances effect on the syndicated loan markets. The findings of this study highlight the importance of future studies and practice developments of governance solutions to enhance the loan contracting environment and the ongoing progress of financial markets.